Nokian Renkaat (OTCPK:NKRKF) manufactures tires with three segments – Passenger Car Tyres offering summer & winter tires for cars, Heavy Tyres offering tires for machinery for forestry, agricultural, and industrial purposes, and Vianor offering passenger tires.

Since the spring of 2022, Nokian Renkaat has faced significant challenges due to the company’s prior factory in Russia. Nokian Renkaat was forced to exit operations from the company, losing a very significant asset in tire manufacturing. As a result, the stock still only trades at a fraction of historical levels. The stock has started to recover very moderately in recent months.

Stock Chart (TradingView)

Despite high capital expenditures for the company’s new factory in Romania, Nokian Renkaat still prides itself in paying out dividends – currently, the company has an estimated dividend yield of 6.22%.

Rebuilding the Road

In 2022, Nokian Renkaat was forced to pull out its operations from Russia, selling its factory and other assets for around 285 million euros. The factory was a critical component in Nokian Renkaat’s manufacturing capacity, creating a large struggle for the company. Revenues have since taken a large hit with the lower production capacity, also leading to worsening margins – in 2023, revenues decreased by around a third, and the EBIT margin was almost at breakeven after a history of very strong margins.

Nokian Renkaat decided to rebuild the company’s capacity back with a new factory in Oradea, Romania. The new factory is expected to produce around 40% of the company’s total own production, with the other two factories in Finland and the United States accounting for the rest. The investment was announced in 2023 with an estimated total investment of 650 million euros into the new facility. Capital expenditures have already started to scale with 252.1 million euros spent in 2023 – Nokian Renkaat will have a couple of years with highly negative cash flows due to the investment. The company is also ramping up production in its United States & Finland factories to make up for demand.

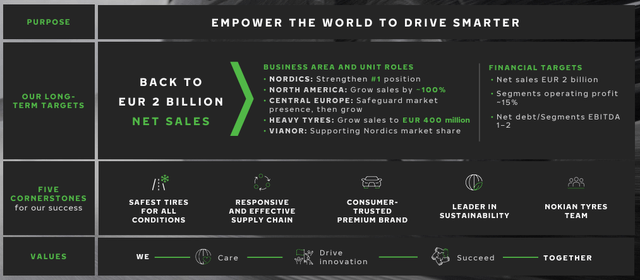

Ambition for a long-term revenue recovery is high. Nokian Renkaat targets to grow its net sales to 2 billion euros from the 2023 net sales of 1173.6 million euros, a bit above the company’s prior revenue level with the factory in Russia. The recovery is going to take time, though – first tires in the Romania factory are planned to be produced in H2/2024 as told in the Q4 presentation, with commercial production starting in 2025 and scaling in following years.

Nokian Renkaat Q3 Presentation

Long-Term Financials

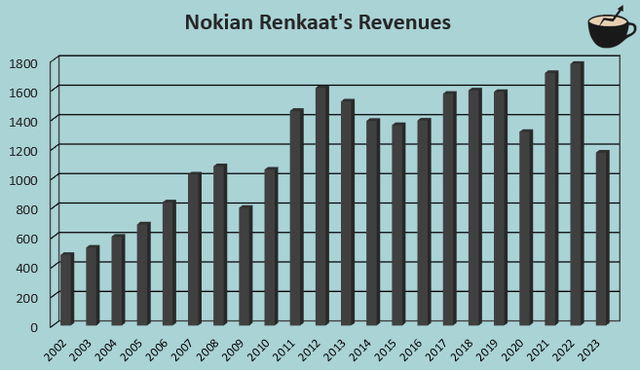

Prior to the company’s catastrophe in Russia, Nokian Renkaat achieved a fair amount of growth with some turbulence. From 2002 to 2019 prior to the Covid pandemic, revenues grew at a CAGR of 7.3%, although the years leading up to 2020 were already showing quite a mediocre growth performance. With the operations being discontinued in Russia in 2023 figures, revenues fell by -33.9%; Nokian Renkaat has a long road ahead in the planned sales recovery.

Author’s Calculation Using TIKR Data

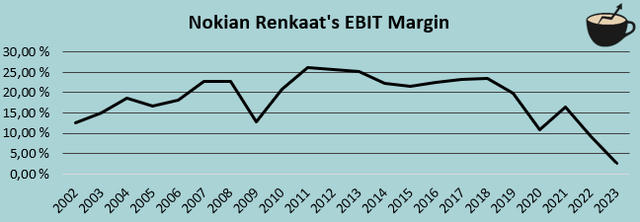

While Nokian Renkaat has achieved very good profitability in the long-term history, the Covid pandemic and the discontinuation of operations in Russia have taken a massive hit on the company’s profitability – in the five years prior to the pandemic from 2015 to 2019, Nokian Renkaat had an average EBIT margin of 22.1%, whereas in 2023 the margin was only 2.7%.

Author’s Calculation Using TIKR Data

Because of low overall costs associated with Russia, Nokian Renkaat’s margins aren’t even targeted to completely recover without the Russia factory. Nokian Renkaat targets a long-term segment operating margin of 15%. In 2023, the company had a segment operating margin of 5.5% and an EBIT margin of 2.7%, 2.8 percentage points below the segment operating margin – in the long term, the target seems to correspond to an EBIT margin slightly above 12%.

A Gradual Recovery

Nokian Renkaat guides for significant growth in net sales and segment operating profit in 2024. The company expects its demand to stay weak in the year, though, as consumer confidence has had and is expected to continue having a negative effect on tire demand. In addition, the Heavy Tires segment’s demand is expected to be hindered from higher interest rates resulting in lower machinery investments.

As such, Nokian Renkaat’s financial recovery is likely to be quite gradual. As the overall macroeconomic sentiment improves, and as Nokian Renkaat is eventually able to grow its capacity in Romania as well as the other factories, sales should start to increase well, also boosting the necessary margin recovery. The company marks 2023-2025 as the investment phase, where the focus is on increasing capacity, and 2026-2027 as the growth phase, as Nokian Renkaat starts to increase market penetration with the newbuilt capacity.

Valuation Leaves Room for More Stock Recovery

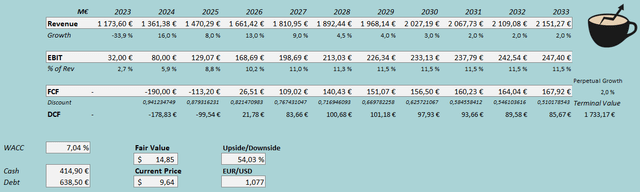

To estimate a fair value for the stock with Nokian Renkaat’s financial recovery, I constructed a discounted cash flow model. In the DCF model, I estimate the company to achieve its long-term sales target of 2 billion euros in 2030, after which the company’s growth slows down into 2% into perpetuity. I expect the growth to vary with Nokian Renkaat’s capacity’s gradual improvement and the improvement of the overall macroeconomic sentiment.

As sales improve, Nokian Renkaat should be able to scale the company’s margins. I estimate the company to achieve an eventual EBIT margin of 11.5% in 2029 with gradual improvements, well below Nokian Renkaat’s long-term level. I believe that the margin estimate is very slightly below a level that corresponds to the company’s segment operating margin target of 15%. Nokian Renkaat will still have a very high amount of investments in the upcoming years, worsening the cash flow conversion well into negative territory in 2024 and 2025 in my estimates. Afterwards, I estimate the conversion to slowly improve into a moderately good level.

With the mentioned estimates along with a cost of capital of 7.04%, the DCF model estimates Nokian Renkaat’s fair value at $14.85, around 54% above the stock price at the time of writing. The stock seems to have a good amount of upside, unless Nokian Renkaat misses its long-term targets quite significantly – at the current price, the investment in Romania seems to provide a good risk-to-reward for investors.

DCF Model (Author’s Calculation)

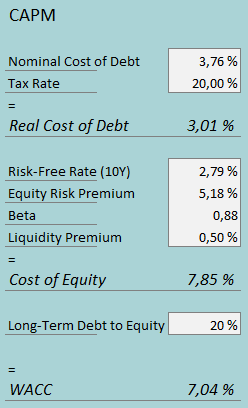

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q4, Nokian Renkaat had $6.0 million in interest expenses. With the company’s current amount of interest-bearing debt, Nokian Renkaat’s annualized interest rate comes up to 3.76%. The company has leveraged quite a large amount of debt to finance the new factory in Romania, and while I believe that the debt-to-equity ratio will lower in the long term, I still estimate a long-term debt-to-equity ratio of 20%.

For the risk-free rate on the cost of equity side, I use Finland’s 10-year government bonds’ yield of 2.79% at the time of writing. The equity risk premium of 5.18% is Professor Aswath Damodaran’s latest estimate for Finland, made on the 5th of January. Yahoo Finance estimates Nokian Renkaat’s primary Helsinki listing’s beta at a figure of 0.88. Finally, I add a small liquidity premium of 0.5%, crafting a cost of equity of 7.85% and a WACC of 7.04%.

A Notice from the European Commission

Along with many other companies in the industry, Nokian Renkaat received a notice from the European Commission on the 30th of January. The European Commission has initiated an inspection in Nokian Renkaat’s headquarters due to concerns about EU antitrust rules against cartels. The extent of Nokian Renkaat’s involvement, and the severity of the breach itself is unknown.

The European Commission could potentially fine Nokian Renkaat up to 10% of the company’s revenues in the year prior to the commission’s decision, as per European Union’s guidelines – for Nokian Renkaat, the amount could potentially be up to around 147 million euros with my 2025 revenue estimate, also depending on realized revenues and the timeline of the commission’s decision. While the maximum sum is potentially quite significant, I don’t believe the fine would deteriorate the currently favorable valuation.

Takeaway

After Nokian Renkaat divested its valuable assets in Russia in 2022, the company’s earnings have completely deteriorated. To recover from the financial hit, Nokian Renkaat is currently investing into a new factory in Romania and expanding the manufacturing capacity in the United States and Finland factories, with plans to open up commercial production in 2025 in Romania. The financial recovery looks to be very gradual, as a poor macroeconomic sentiment and a slowly progressing new factory weigh on financials and the given 2024 guidance. If the company’s long-term targets are nearly met, though, the stock currently seems to have a good amount of upside – my DCF model estimates a very good upside of 54% from the current price. As the risk-to-reward seems favorable, I have a buy rating for the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here