The verdict, when it finally came at midday on Thursday on the 17th floor of San Francisco’s federal courthouse, was stunning. More than 12 years after being accused of what one US investigator called the biggest fraud ever to hit Silicon Valley, Mike Lynch, once one of the UK’s most prominent tech entrepreneurs, was not guilty on all counts.

The co-founder and former boss of the formerly high-flying UK software company Autonomy briefly put his hands over his face and eyes after the words “not guilty” were read out 15 times, according to a reporter from Law360 who was in the room. Moments later, his wife rushed over to embrace him.

After fighting aggressively and tirelessly in the courts and through the press for years, it was a moment of pure vindication. One of the leading figures to emerge from the “Silicon Fen” tech scene around Cambridge in the 1990s, Lynch had been forced to give up his life as an entrepreneur, start-up investor and prominent figure in the UK science establishment to defend himself. He had endured an ignominious year under house arrest in San Francisco, wearing an ankle bracelet and under 24-hour supervision by security guards he was forced to pay for personally.

But in the campaign by US prosecutors against high-profile white-collar crime, the verdict was little short of a disaster. They had already secured a conviction of Autonomy’s top finance executive, Sushovan Hussain, on similar charges using much the same evidence. They had also fought a successful campaign to extradite Lynch from the UK, where he had argued that any claims involving a British-listed company by executives based in the UK should be heard.

The charges sprang from the $11bn sale of Autonomy to US tech conglomerate Hewlett-Packard in 2011. A year after the deal, Silicon Valley veteran Meg Whitman, then chief executive of HP, accused Lynch and other Autonomy executives of falsely inflating their company’s revenues in the years before the deal, causing HP to overpay by $5bn.

In 2019, in the same courtroom where Lynch was later to stand trial, Hussain was sentenced to five years’ imprisonment. That conviction, however, could not be discussed in front of the latest jury in San Francisco, forcing prosecutors to make their case again from scratch — a convoluted financial argument involving a dizzying variety of allegedly fraudulent contracts and accounting tricks.

Lynch appeared to be facing an uphill battle from the start. As well as seeing his former finance chief convicted, a judge in the UK had ruled against him in a civil fraud case brought by HP. The US company is pursuing damages of $4bn, though the judge has said any award was likely to be much smaller.

Lynch’s defence in the criminal case suffered serious setbacks even before the trial began in mid-March. He had argued for years that the fraud claims were a smokescreen used by HP to hide its own mismanagement of Autonomy after the deal. But Judge Charles Breyer — the bow tie-wearing brother of former US Supreme Court Justice Stephen Breyer, who presided over the case — prevented Lynch making that point to the jury, maintaining that events that occurred after the alleged fraud were irrelevant.

His legal team defined it as a battle against the odds from the start. Yet by the end, the prosecution’s struggles to hit home with its detailed analysis of Autonomy’s finances, and Lynch’s calm and confident performance in his own defence on the witness stand, appeared to have turned things in his favour.

Prosecutors sought to depict Lynch was a domineering and controlling boss who had personally masterminded the alleged fraud. By contrast, the Lynch who appeared on the stand was calm and controlled — and sometimes funny — under cross-examination. Facing questions about increasingly erratic emails from his finance chief about end-of-quarter figures that risked putting Autonomy behind Wall Street estimates, he joked that Hussain “lived the quarters like the coach of a football team”.

Presented with emails he had sent to his own team containing spelling errors or capital letters, he joked that “it does sound like me”. Once when describing how he was “trapped” in San Francisco for months due to a volcano eruption in Iceland in 2010, he hastened to add to the jury of Californians: “It’s very nice here, though I missed the tea.”

Prosecutors also faced challenges in making a clear case that fraud had occurred. During opening arguments, Breyer prodded the prosecution, wondering why it could not pare down the number of detailed examples and get to the point.

Prosecutors spent hours presenting the jury with spreadsheets displaying Autonomy’s financial performance and internal Autonomy emails — without landing any apparent blows. The first day of cross-examination was so meandering that after the judge excused the jury, he lambasted the prosecution, warning them to come to a point and noting that jurors were clearly not following.

“I think I see some of the points you’re trying to make, but they’re lost in the morass,” Breyer said.

Without direct evidence linking Lynch to the contracts and accounting records they claimed were fraudulent, prosecutors fell back on trying to depict Lynch as a demanding and detail-oriented chief who had kept a close hand on all aspects of his company’s business.

That was in keeping with the Lynch who had fought his own defence through the press for years, laboriously arguing over the disputed accounting treatments that had resulted in criminal charges. This included a detailed defence of why Autonomy’s accounting was fine under the international accounting rules, and that it was only the particularities of US accounting that appeared to show a problem.

Yet Lynch repeatedly downplayed his involvement in Autonomy’s financial accounting during the trial, occasionally claiming to not understand detailed spreadsheets prepared by his finance chief of the company’s quarterly sales presented by prosecutors.

“The CEO doesn’t do those things,” he said, speaking directly to the jury. “You don’t do the accounting, you don’t do the customer support. You have a department that does that and you set a culture for what you want them to do.”

He also distanced himself from the transactions that were said to be at the root of the fraud. Many of the witnesses that testified against him, he told the jury, were “people I’d never met, or if I’d met them it was incidental — a handshake”.

“It appears the government believed that because Mike Lynch was the CEO that he knew everything that was going on at the company,” Stephanie Siegmann, a partner at Hinckley Allen and former prosecutor and national security chief in the US attorney’s office in Massachusetts, told the Financial Times. “The evidence appears clearly not to have met the [evidentiary] burden.”

Lynch’s decision to take the stand at his own trial follows that of other erstwhile tech CEOs such as Elizabeth Holmes and Sam Bankman-Fried, who were convicted. But in those cases, the victims were individual investors.

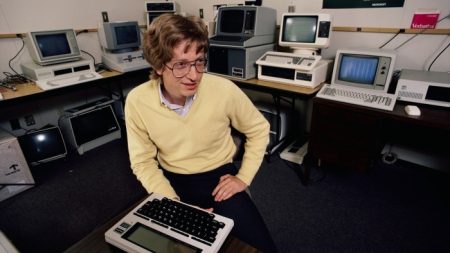

HP, on the other hand, was “far less sympathetic” as an alleged victim, Siegmann said. And the government faced a challenge in convincing a jury beyond a reasonable doubt why Lynch, who had been described as “the Bill Gates of the UK,” had a strong enough financial motive to defraud HP, she added.

The high-risk strategy worked and as the verdict was delivered, the long legal nightmare appeared to have ended. But even as Lynch said he looked forward to going home and getting back to his life as an entrepreneur, he still faced a potentially ruinous civil judgment and difficult struggle to regain his position in the UK tech establishment.

Read the full article here