The following segment was excerpted from this fund letter.

In our Q3 2023 commentary, we featured a section on our investment in Danaher (DHR) entitled “Purity in the Crown Jewel of Bioprocessing.” Specifically, we were speaking to Cytiva, Danaher’s bioprocessing business formed by the merger of PALL Corp and GE‘s bioprocessing division.

We will not repeat the features that attract us to bioprocessing in general, nor the elements of timeliness, though we will emphasize that our confidence in timeliness has actually increased since writing that piece. While Danaher has performed admirably ever since, its peer Sartorius, which was referenced by labeling bioprocessing “an oligopolistic market, with a small number of critical players and extremely high barriers to entry.”

Although Danaher owns the crown jewel of the industry, only Sartorious amongst these peers is what can be described as a “pure play.” At Sartorius and its Sartorius Stedim (OTCPK:SDMHF, publicly listed in France as a stub company) subsidiary, bioprocessing is essentially the business. Sartorius boasts a comprehensive portfolio for bioprocessing, covering the upstream, downstream and media; however, its largest and most lucrative business is in the “upstream” flow.

Upstream is where a small a cell line is taken, scaled from very small quantities to much larger ones and then harvested, before they are purified, separated and isolated into the “end product” downstream. Sartorius is a world leader in single-use bioreactors. These are smaller-scale bioreactors than the traditional steel ones that use replaceable plastic bags, within which the scaling takes place. Sartorius dominates single-use from the research phase through the commercial phase.

For example, the AMBR is an industry-leading offering at the smaller end of the spectrum, which helps Sartorius gain critical share in the research stages and in Cell and Gene Therapy applications. This dominance in research phases helps secure spec’d in placements come time for commercialization, while the CGT placement supports the more demanding, but smaller scale needs of the next frontier of the biotech industry.

Beyond the share capture of single-use, we want to highlight a few unique qualitative traits. We have spoken to numerous customers who have emphasized Sartorius’ unique relationship with their customers. Several even went as far as using the word “partner” as a result of the level of service Sartorius’ field team delivers. They have an “Innovative Differentiated Solutions” team who help customers from process design and equipment placement to clean room designs. These services are offered in pursuit of equipment sales and go above and beyond any peer in the industry who customers view favorably, though in a more mercenarial way.

Moreover, even during the tight supply chain environment of COVID, Sartorius was viewed as the most reliably on-time and consistent solutions provider. While others in the industry have tried to copy Sartorius’ service-first mentality, none have come close to delivering on it or fostering the kind of relationship that Sartorius has with their customers. We think this mentality, beyond the share gains of single-use generally, has resulted in impressive share gains over the past decade and provides the right to win further share (and grow faster than this fast-growth industry) over the next decade.

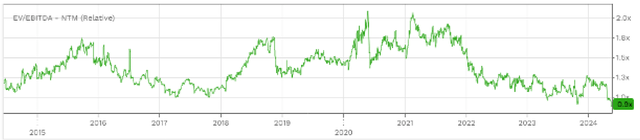

Typically, Sartorius trades at a decent premium to Danaher due to its pure play status in the highest growth area of the industry and its relatively higher growth rate given the share single use bioreactors are taking from stainless steel. Despite relative growth remaining favorable during the downturn and looking to continue so on the way out, Danaher’s meaningful outperformance has created a unique valuation spread:

We started buying Sartorius in the first quarter and will note that we purchased even more recently as Sartorius’ valuation dropped beneath that of Danaher’s (equal valuation would be 1.0x in the chart above, with any number above 1.0 representing Sartorius’ boasting a higher valuation and less than 1.0x representing Danaher with a higher valuation). Sartorius trades at a mid-teens EBITDA multiple on our 2025 estimate and our now average price.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here