The 50/30/20 rule is a beginner-friendly budget guide you can start following today.

The 50/30/20 rule provides a way to simply break up your after-tax income. With this rule, there are three different “buckets” your money falls into. These buckets are needs, wants and savings.

With this rule, 50% of your income will go toward your needs. This includes things that you absolutely have to pay for, such as your rent/mortgage, transportation costs, food and minimum payments on debt.

ARE YOU SAVING TOO MUCH MONEY? 5 PLACES TO PUT EXTRA CASH

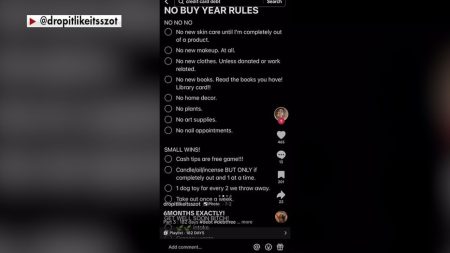

The next category is your wants, which 30% of your income can go toward. This includes things like self-care, vacation, new electronics and other purchases of that nature.

The last category is your savings. Now, one of the most important and first savings goals you should have is an emergency fund.

An emergency fund is complete once you have three to six months of living expenses in that account. If an emergency comes your way, and you need to use some or all of the money in your account, your first savings priority should go back to getting that account funded again.

Other things you can put your 20% toward are a savings account designated for a down payment on a home, investments or even paying your debts down even faster by putting more than the minimum balance due toward them.

HOW TO BUILD BACK YOUR EMERGENCY FUND IN A TIGHT BUDGET

This method of budgeting is favored by many because of how simple and easy it is to incorporate into your day-to-day life.

With this method, you’ll be able to track your month-to-month spending, as well as prioritize saving.

Below is an example of how much money would fall into each account based on a nicely rounded $5,000 monthly take-home pay.

Money for needs (50%): $5,000 x .5 = $2,500

Money for wants (30%): $5,000 x .3 = $1,500

Money for savings (20%): $5,000 x .2 = $1,000

Now, keep in mind that this method is a great base, but if you find, for example, that your needs don’t add up to 50% of your take-home pay, then use that extra money to pay down your debts quicker or fund your savings.

Also, remember that budgeting isn’t one size fits all. This method may work well for some and not for others. It may take trial and error to figure out what method works best for you.

One helpful tactic to keep in mind with this method is automating as much as you can to give you peace of mind.

For example, have 20% of your savings automatically taken out of your account every month and put into savings. That way, you don’t have to worry about doing it manually. You’ll get in the routine of that money being put aside and not spent another way.

Read the full article here