Note:

MIND Technology, Inc. (NASDAQ:MIND, NASDAQ:MINDP) has been covered by me previously, so investors should view this article as an update to my earlier work on the company.

MIND Technology or “MIND”, formerly known as Mitcham Industries, is a micro-cap provider of technology and solutions for exploration, survey, and defense applications in oceanographic, hydrographic, defense, seismic and maritime security industries.

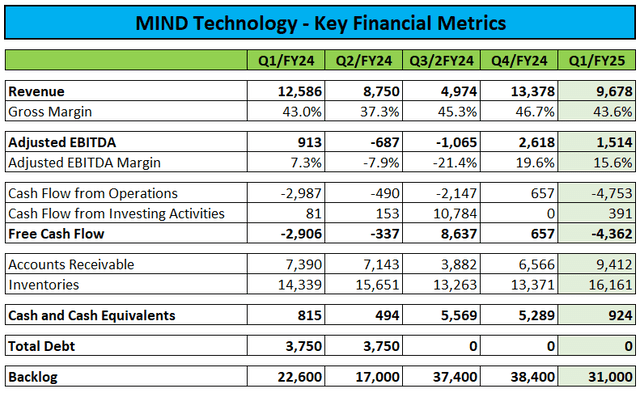

Last week, the company reported uninspiring Q1/FY25 results with revenues and backlog down sequentially as well as materially negative free cash flow:

Company Press Releases / Regulatory Filings

Since Q1/FY24, the company has used almost $10 million in cash from operating activities, which was financed by the $11.5 million divestment of its Klein Marine Systems subsidiary last year.

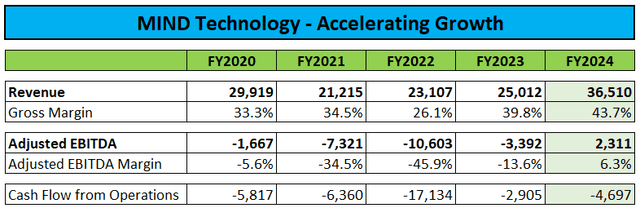

However, demand for MIND Technology’s products has been picking up in recent quarters, thus resulting in accelerating year-over-year revenue growth and vastly improved profitability in fiscal year 2024:

Regulatory Filings

The company expects fiscal year 2025 to be a year of continued growth and increased profitability.

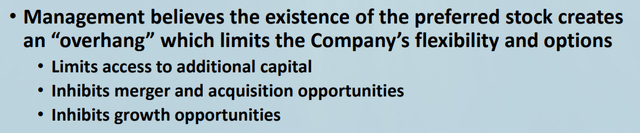

Unfortunately, MIND Technology’s lack of cash generation has been an issue for a number of years already, which resulted in the decision to defer dividend payments on the company’s 9.00% Series A Cumulative Preferred Stock (“Series A Preferred Stock”) in July 2022.

With the exception of Q4/FY23, MIND has abstained from declaring preferred stock dividends, as also outlined in the company’s quarterly report on form 10-Q (emphasis added by author):

As of April 30, 2024, there are approximately 1,683,000 shares of Preferred Stock outstanding with an aggregate liquidation preference of approximately $48.7 million, which amount includes approximately $6.6 million in undeclared cumulative dividends.

Holders of our Preferred Stock are entitled to receive, when and as declared by the Board out of funds of the Company available for the payment of distributions, quarterly cumulative preferential cash dividends of $0.5625 per share of the $25.00 per share stated liquidation preference on our Preferred Stock. (…)

The Company has deferred payment of quarterly dividends for seven fiscal quarters including the first quarter of fiscal 2025. (…)

Management does not believe that current operations can simultaneously fund the capital requirements of the ongoing business (…) as well as ongoing or accumulated dividends related to the Preferred Stock. Accordingly, although no firm decisions have been made, management currently believes it is unlikely that the Company will declare dividends on the Preferred Stock for the foreseeable future.

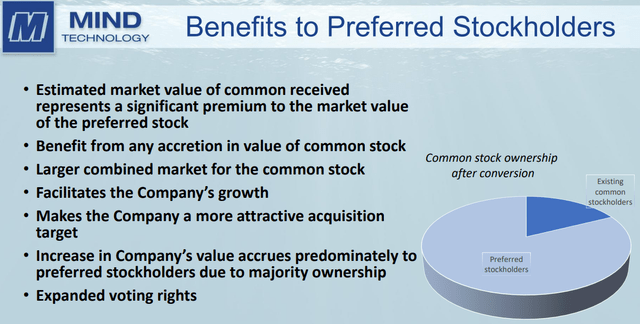

To address the issue, MIND Technology has proposed to convert the Series A Preferred Shares into new common shares at a conversion ratio of 1:3.9.

The proposed conversion would result in current preferred shareholders owning approximately 82% of the company’s common equity:

Company Presentation

However, the proposal requires approval of 2/3 of MIND’s outstanding preferred stock, thus representing a massive obstacle as already evidenced by the requirements to

- significantly increase the exchange ratio from an initial 1:2.7 to the current 1:3.9 and

- adjourn last week’s virtual special meeting of preferred shareholders due to a lack of sufficient votes for the proposal

The virtual special meeting will be reconvened on June 27.

MIND strongly encourages any eligible preferred stockholder that has not yet voted their shares or provided voting instructions to their broker or other record holder, to do so promptly. No action is required by any preferred stockholder who has previously delivered a proxy and who does not wish to revoke or change that proxy.

Rob Capps, President and CEO of MIND, stated, “We are pleased with the response we have received to date to the Preferred Stock Proposal. However, given the diverse holdings of the preferred stock and the requirement to obtain the affirmative vote of two-thirds of the outstanding shares, we think it appropriate to adjourn the virtual special meeting and provide additional time to solicit proxies.”

At least in my opinion, preferred shareholders should consider voting for the proposal in order to clean up the capital structure and remove a long-standing overhang:

Company Presentation

At prevailing market prices, the exchange offer represents a calculated value of approximately $17 per share, thus representing a theoretical 30% gain for preferred shareholders.

The most apparent way to capitalize on the arbitrage opportunity, would be a pair trade “long MINDP/short MIND”. However, the very real risk of the proposal not gaining sufficient traction with preferred shareholders makes this a highly speculative endeavour.

Should the proposal fall through, preferred shares are likely to return to their previous trading range, well below $10.

Yahoo Finance

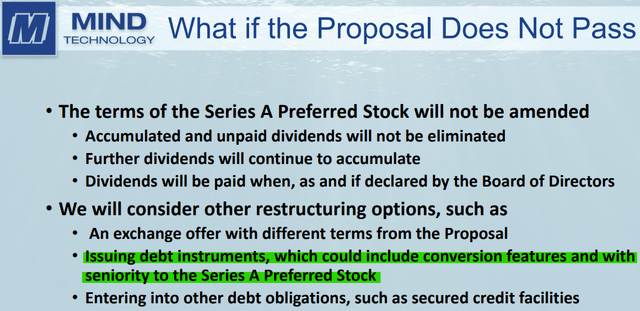

While an exchange into common shares would result in the forfeiture of all accumulated and any future dividends as well as the $25 liquidation preference per preferred share, a non-approval could have dire consequences:

Company Presentation

Hold-outs might still bet on the exchange ratio being increased a second time, but the company might very well abstain from further exchange efforts and rather opt for the issuance of convertible debt which would rank senior to preferred shareholders and likely result in limited or even no recovery in case of bankruptcy or liquidation.

In my opinion, preferred shareholders are stuck between a rock and a hard place as non-approval might not only result in an instant and pretty severe preferred share price drop but also in the potential issuance of debt ranking senior in the capital structure while approval might put intense selling pressure on the company’s common shares.

At the current price of $13.00 for the preferred shares, break-even for preferred shareholders would calculate to $3.33 per common share.

However, considering the proposed issuance of approximately 6.6 million new common shares in combination with the stock’s anemic average daily trading volume, things could get ugly within just a couple of sessions following the registration of the exchange shares and perhaps even before as preferred shareholders try to hedge upcoming common stock exposure.

Bottom Line

While MIND Technology’s business has been picking up in recent quarters, the ongoing lack of cash generation has resulted in some tough choices for the company’s preferred stockholders.

Either pushing for an even higher exchange rate at the risk of the company turning to senior convertible debt instead, or approving the current exchange proposal with a lower margin of safety regarding a potential selloff in the common shares.

At least in my opinion, preferred shareholders should consider voting for the proposal in order to clean up the capital structure and remove a long-standing overhang.

In combination with improved business prospects, the company’s common shares might withstand initial selling pressure and even move higher over time. However, this would require management executing flawlessly, which hasn’t always been the case in recent history.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here