Dear readers/followers,

Covering formerly Russian-supplied companies like Nokian Renkaat (OTCPK:NKRKF) (OTCPK:NKRKY) is tricky. The company/companies obviously crashed down quite significantly when access to Russian input collapsed. In some cases, with companies that actually had their manufacturing and sourcing capacity in Russian locations, the hit was far worse. Such was the case for Nokian Tyres, which essentially faced an existential situation where they were forced to rebuild part of their manufacturing base.

This is also the situation and the process in which they currently are. The company is slowly improving its fortunes and has made progress in rebuilding its manufacturing and sourcing capacities. Despite its current challenges, Nokian Renkaat has maintained its dividend and shows potential for improvement in the future. The fact that the dividend is maintained, and the company is driving things upward seems to be a clear case of potential undervaluation and investment upside.

However, we need to continue to be aware of the potential downside as well. Since my last article, which you can find here, the company has done fairly well for itself, being up almost 16%. However, it has not beaten the market, as you can see below.

Seeking Alpha Nokian RoR (Seeking Alpha Nokian RoR)

In this article, we’ll see what upside for Nokian we can see after 1Q, and if the company still can be considered an attractive investment.

Nokian – What upside exists after 1Q24?

So, first of all, this company makes excellent tyres. I recently bought 8 new tires for two cars – those tyres went to Nokian and Michelin respectively. When it comes to tyres I only buy quality, and some of the highest quality to my mind are these two businesses.

Nokian as an investment remains a fundamental play – both on a high level and on a granular level. It’s also rife with fundamental warnings and signs of distress, though these are slowly abating as the company once again slowly starts to improve its fortunes. And these signs have been clearer and clearer for the past two quarters.

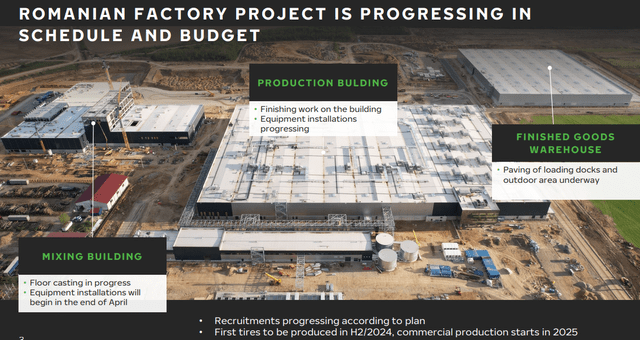

Things have clearly recovered from the worst lows. This is also something that we have been able to see from the company’s results. The last results came in during April of 2024, and this quarterly set of news came with the message that the company is about to start production of its tyres in the new Romanian factory.

Nokian IR (Nokian IR)

The company still focuses much of its presentation and results on the sustainability and ESG of the matter – which tells me that financial results are still not in line (otherwise, they’d probably highlight those), and indeed that is the case for 1Q24. However, the results improved far more than I expected.

Nokian Tyres managed net sales of €236.6 million, which is a growth YoY (albeit a very small one), and a segment EBITDA of €12.5. We know that Tyre company margins are fairly horrible, so the low margins here are not a surprise. Also, and perhaps more telling, continued segment operating profit at a negative level of €15.1M, and actually more negative than during the past year.

The company’s balance sheet is still solid. Gearing is less than 30%, so don’t interpret this result as meaning the company is in trouble. It’s not. The new factory has meant a different debt load – it’s up to almost €400M now, compared to €50M about a year ago – and CapEx has almost doubled. But this is not a fair snapshot for the long term, more for the current term.

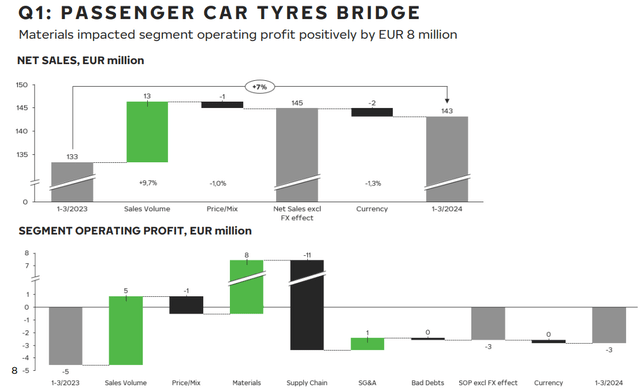

For sales, passenger tyres show higher sales and better profitability, confirming the appeal of Nokian products and good demand. The ASP is comparable to YoY, and margin improvements are driven both by volumes, which are higher, and costs, which are lower for input. So that is all positive.

Nokian IR (Nokian IR)

The company is still in the middle of the downturn here, which troughed during 2023, with an operating profit of €0.09 adjusted. This is set to significantly improve as of this year, but not close to covering the company’s €0.55/share dividend at this time. The dividend, forecasting for this dividend level, at this time is still over 7%. My own YoC is closer to 9% for my small speculative position, and to say that you should have an iron stomach for this investment might be a bit of an understatement.

However, I believe the company is out of the worst of it, and the upside case has mostly been confirmed.

Still, heavy tyres didn’t do so well. The company recorded weak product sales during a weak overall market, impacting overall profitability, with an 18% decline in net sales – although still an operationally profitable quarter. The company’s Vianor segment did not do well either, with negative operating profit and only slightly improved net sales. FX was a big reason here, but it’s worth remembering also that 1Q tends to be a very seasonally slow quarter for Vianor – and this is likely to improve going forward.

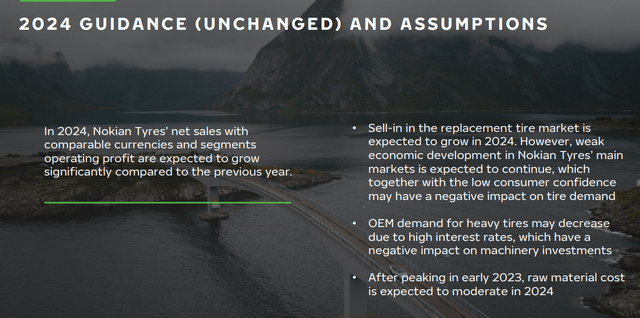

The company is very clear about one thing. 2024E is the year where the company goes back to EPS growth, and it’s not going to be a small amount on a comparable basis. Estimates at the current time are between 150-250% improvement, though this is again from a very low level. However, improvements are expected to be sequential here for 2025E and 2026E as Romania comes online and as this company goes back to being “good” in terms of both earnings and sales to where they were before.

Here is the current 2024E estimate and guidance from the company.

Nokian IR (Nokian IR)

The company has made an official target of €2B in net sales in 2026-2027, which Nokian expects as its growth phase due to among other things, new products, and increased capacity on the production and operational front. Heavy tyres especially are expected to be a sales driver, and Vianor is expected to drive distribution in the Nordics.

The company is still working on diversifying its debt portfolio, which is currently fairly front-loaded, with most maturities either in 2024 or 2026 in terms of the loans. This is worth keeping an eye on, for the interest rates will be indicative of how the market views the company.

, I consider an upside here to be a given from a YoY perspective. I also consider it likely that 2025E is the first year we’ll see the company cover its dividend with the earnings, the dividend remaining at €0.55 that is, and 2026E is the first year of a potential “very good” EPS; meaning recovery to pre-2023 levels.

Based on that, I say that Nokian is still an investable company from a spec perspective. The current valuation specifics are incredibly inflated on a normalized basis – but that’s just it – they’re only inflated if we look at 2023-2024. Anything beyond that, the company could potentially be called “cheap” even now.

Let’s see what we have in terms of valuation here.

Nokian – An upside in the double digits, provided you’re willing to wait here.

Nokian trades at a price of €7.8 at this time. My last price target for the company was a speculative “BUY” at €12.5, and as of this article, I am not changing this target estimate.

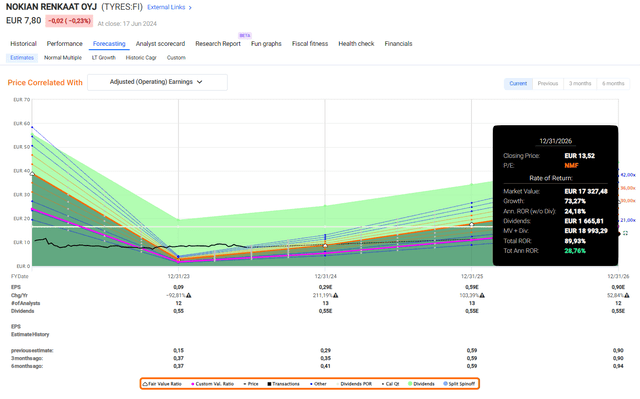

My base target is very simple. I believe Nokian Tyres, native ticker TYRES on the Finnish market, to be worth 15x P/E for the 2025-2026E Period. That 15x P/E comes to between €12-€14/share at that time, and that means that the upside here, even with the increase we’ve seen, is between 21-28% per year, which comes to close to triple digits RoR in that particular time.

Nokian Tyres F.A.S.T graphs Upside (Nokian Tyres F.A.S.T graphs Upside)

As you can see, various valuation methods want to put this company far higher in terms of valuation given the growth rate that is expected. If we go by the 20-year average, we find Nokian trading at around 19x P/E, where we instead see a potential annualized upside of almost 40% per year, or almost 170% total for a 3-4 year basis.

This is possible, but it also highlights the very speculative nature of this investment. We’re talking about a low-margin tyre company that is expecting significant earnings and sales growth. The company is still at low debt – but they’re also a comparatively small player at almost just €1B worth of market cap at this particular time.

This needs to be taken into consideration if you’re interested in such an investment here.

While we’re no longer in a “horror show” in terms of margins and results, as I said in my last two articles on Nokian, I would still argue that the company fails in some ways to hold up in a comparative appeal to many other attractive investments today.

There would be a far stronger argument to be made if we could see 200-400% RoR from a trough – but this is not the case from a conservative perspective. 100-150% is what we can expect here – at least as I would forecast the company. Unless you say the company should revert to over €30/share in less than 2 years, then we’re talking around 250-300% ROR – but I continue to view this as extremely unlikely in this environment, and even a dangerous assumption to work from.

Because of this, I look at where other analysts price Nokian at this time. S&P Global analysts go from a low of €6.6 to a high of €11/share. That’s slightly below mine, and the average PT of €8/share is definitely more conservative than my own (Paywalled TIKR.com link). But it’s still, as of today, an upside. However, the vast majority of analysts are at a “HOLD” or even “SELL” Here. Only 2 out of 11 are at “BUY” or similar. This reflects a very conservative and even negative view of the company managing what it has set out to do, and given the macro environment and what else is available at a far lower risk, I can understand the sentiment.

However, for the 15% speculative or growth-oriented portion of my portfolio, I say that this company is actually worth more than the market is pricing it at. And for that reason, I continue to say “BUY”, and give the company the following thesis in June of 2024 before 2Q.

Thesis

- Nokian, to me, is the textbook definition of a turnaround play where the turnaround actually has pretty good visibility despite all of the risks. The main problem with this is that there are so many alternatives on the market that are not only somewhat better but also come with higher overall safety.

- Due to this, Nokian is of marginal interest even to a native investor in the Nordics like me. I own a stake in Nokian, but I have no immediate plan to increase my stake – even less now as of June 2024, because of the many better alternatives out there today.

- I view Nokian as a “BUY”, but it’s speculative, and I go as high as €12.5/share for the native in the near term here. But again, it’s speculative and shouldn’t be considered unless this is within your risk tolerance parameters – and even then, look at what’s available.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

The company does fulfill 3 of my 5 criteria, but given the recent trends, I can’t call it qualitative or fundamentally safe – yet. For that reason, the “BUY” remains speculative, and I actually would say that it’s now less attractive than other plays – because of their relative safety here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here