Nova (NASDAQ:NVMI) is one of the top mid cap growth stocks available in the market today for investors. The company is one of the innovators in process control for semiconductor equipment applications – an area becoming more and more important in the AI driven world. Nova will continue to benefit from the proliferation of advanced packaging and metrology required for the next generation of AI products. As you may have expected, Nova’s stock has seen significant appreciation so far in 2024, making it a hold for now as fundamentals try to catch up to expectations. The shares currently sit at $241, good for a gain of 77% year to date. The market is pricing in significant growth in the semiconductor space for the rest of 2024 and 2025, with tremendous long term potential. The company has outperformed the wafer front end (WFE) market over the long term, with strong margins and earnings to boot. Memory strength is returning for Nova with high bandwidth memory and DDR5 providing a significant boost as we move through 2024.

Strong Q2 guidance

Novi continued strength into Q1 this year with an impressive Q2 guidance to boot. Revenue is returning to growth, lapping a weak 2023 with $141.8 million of revenue up 7.6% over last year. Margins continue to sit near record highs, as the services business continues to grow significantly. Services grew 13% y/y with maintenance and tool life extensions adding significant revenue, up to $120m in the past 12 months. This is an area for continued improvement over time, with Overall GAAP gross margin was 56.7% with the operating margin at 26.2%, both sitting near all time highs as scale efficiencies continue to help push these higher. Long term CAGR for Nova has been 16% revenue growth over time with outsized growth during periods of industry expansion like expected in 2025. Free cash generation continues to improve, with $57 million a record supporting potential buybacks and investments in growth. The company has been ahead of the curve, with tools adapted for different use cases by NVMI allowing for more flexibility for customers.

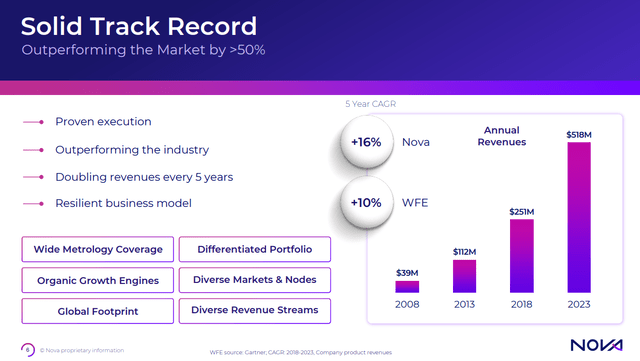

Nova Track Record (NVMI IR)

Increased complexity of applications is leading to over 30% additional processes per node driving higher metrology usage. Data center processor chip sizes have increased 5x in the past few years greatly increasing the need for process control The company is leaning into this with significant research and development spending of 15-18% of revenue over the long term. This is necessary to stay on the cutting edge of applications such as high bandwidth memory, gate-all-around and hybrid bonding of wafers. These are more complex and require precise processes including NVMI metrology. Nova has an edge here with its strong combination of hardware as well as software solutions for Gate-all-around. Operating margins are 30% for the company, meaning a significant amount of revenue growth is going to the bottom line. Nova also has a significant war chest of $689 million of cash and securities for pursuing growth acquisitions. Management has been quiet on this front for some time, so a 2024 acquisition in a high growth area is quite possible for the coming up cycle. Chemical analysis is called out as an area where they may want to add further capabilities to their metrology portfolio. They have been quiet on this front and called out 10 to 20% of their $1 Billion target from M & A, showing we may see a significant acquisition or two in the coming years.

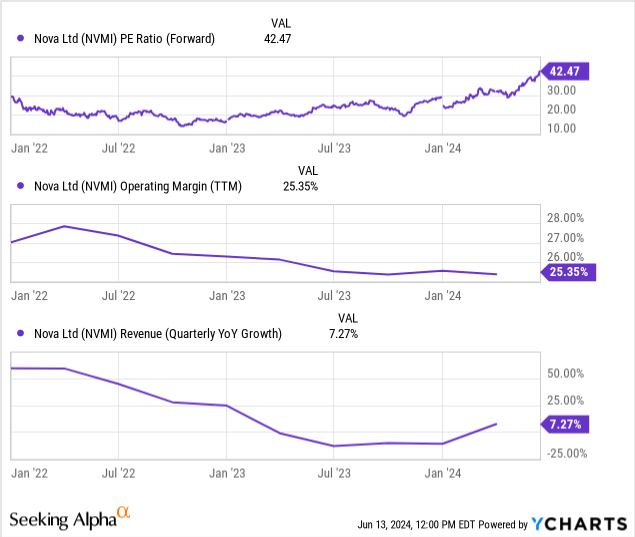

Forward earnings multiple continues to rise for Nova, as the market looks towards a significant rebound for the WFE market in 2025. Operating margins and revenue growth are improving now, with growth to accelerate into 2025 against easy comparisons. 2 nanometer applications will ramp in 2026, but tools from NVMI will ramp prior to that as deployments increase in 2025. Nova continues to have new customers test and evaluate systems such as Elipson and Metrion for widespread additions. The company sees the ramp starting in the next 12 months here, with two of the top three memory customers trialing and the third already starting to ramp capacity. As the market is forward looking this commentary is leading to significant gains this year, combined with improving advanced packaging revenues. 10% of revenue is coming from advanced packaging, which is an area of focus for AI applications demonstrated by its 50% growth rate expected this year. This will increase in revenue and importance over time for Nova.

Nosebleed valuation, strong 2025 growth priced in

NVMI is a high risk, high reward stock with potential for continued outsized share appreciation over the coming years. The cyclicality of its industry means large fits and starts like the one we are seeing now, making it risky for investors without high risk tolerance. As of now estimates for 16% growth for 2024 and 2025 make shares at 42x forward earnings seem extremely expensive. However, continued upside to revenue and earnings numbers is likely as AI applications for semiconductors proliferates. We saw this with Nvidia and others as estimates for growth proved to be far too low. This is going to be the case for NVMI and others into 2025 as they gain from the next leg of AI growth. Large semiconductor players continue to add more tools per fab giving them a stronger position over time to continue to grow revenues. Those looking to put new money to work would be best to buy in pieces on any pullbacks as the stock will be volatile over the coming years with these high expectations.

Read the full article here