Investment Thesis

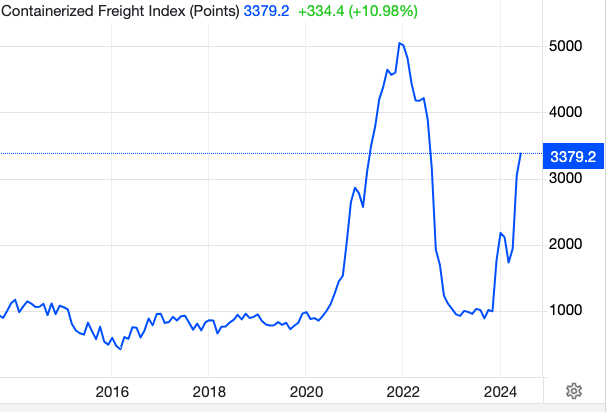

Global freight rates continue to incur volatility and have stretched back towards 2022 highs. The containerized freight index shown in Figure 1, has lifted to 3,379 points from a range of 1,000 leading into the year.

The last time this occurred in 2022, those in the air freight and marine logistics industries saw tremendous repricing And managed to return mouthwatering sons of capital to their shareholders by way of dividends and buyback.

This is a highly competitive industry where everything is priced on the margin and those with either 1) production/pricing advantages (and therefore higher volume) or 2) differentiated business models (and therefore higher margins) are typically the winners.

Figure 1.

Trading Economics

Expeditors International of Washington, Inc. (NYSE:EXPD) is a global logistics services provider that is positioned at strategic points along the logistics value chain. The company’s services include 1) air and ocean freight and 2) customs brokerage. Customers turn to the business as part of their supply chain and movement of sensitive assets/products.

In most transactions the company is an indirect carrier, issuing a house airway bill/house ocean bill of loading, or a house seaway bill. In my view, the company’s non-asset-based model, which utilizes relationships with transportation providers instead, could be a competitive advantage to peers in the freight + logistics industry who carry this tangible capital on their balance sheets. It has operating efficiency without the capital burden of owning a full inventory of transportation assets.

Revenues are booked in the air and ocean freight division by purchasing tendered transportation space in volume directly from asset-based carriers. It then resells that space onto customers. As such, the main risk it faces is to ensure it sells what is “secured/bought” so as not to create a stranded cost.

Revenues and expenses are therefore:

(i) A sell rate – what it bills customers;

(ii) A buy rate – what it pays the carriers for the space.

As with all those in the freight-forwarding domain, the lack of maintenance capital expenditures creates a less benign pricing environment. Margins are consequently razor-thin. As such, being asset-light may not necessarily create economic value itself.

But it does create several attractive economic characteristics:

-

Economies of scale due to EXPD’s substantial volume. This is its major competitive advantage in my view. Invested capital turnover is tremendously high indicating it has pricing advantages that enable it to price its offerings below peers Because this turnover on capital is so high, it can afford a lower gross and operating margin and still throw off >20% returns, minting cash along the way. It has leverage to negotiate favourable rates with transportation providers, so, as forwarding rates spike, this competitive advantage increases – it allows the company to offer lower rates into that strength.

-

Intangible value/economic goodwill due to the customer brokerage division, which is a differentiated – and therefore higher margin – service offering. In my view, this is one critical reason why the company trades at such a high spread of market value to invested capital (6.6x as I write).

-

Defensibility in that, unlike other retail-exposed sectors, its services are less susceptible to disruption from e-commerce giants [think Amazon/Costco/etc – these companies have proven if they enter a market, the rules suddenly change. Look at Costco in the poultry industry for example]. EXPD has 1) deep customer networks that are difficult to replicate, and 2) added value in its customs brokerage, providing a moat against ‘digitalization’ and loss-leading divisions from these giants. I think this is tremendously important to the long-term thesis because these earnings are more “competition-proof” due to these advantages.

The culmination of these factors has me constructive on the company’s prospects. I am buy on EXPD due to 1) bullish outlook on forward rates, 2) attractive economics, and 3) valuation with support for an intrinsic value range of $138–$150 per share

Q1 FY 2024 earnings breakdown

EXPD’s Q1 FY 2024 numbers painted a nuanced picture of challenges and opportunities across its primary service lines. On first look, financials were impacted by shifting demand patterns and residual impacts from previous supply chain disruptions (this includes issues surrounding freight in the Red Sea, which aren’t discussed here). As expected, the company did $2.2 billion of business during the quarter, down 15% year over year and $20 million behind consensus (due to the normalized freight rates), on earnings of $1.17 per share.

Divisional highlights include the following:

- Airfreight services

- Airfreight services saw a 16% year over year decline in revenues and a 19% decrease in expenses. This was due to the sharp reductions in its average sell/buy spread, which fell by 22% and 24% year over year, respectively. Despite this, tonnage increased by ~4%, suggesting a demand recovery following a sluggish Q1 in FY 2023.

- Management said the most significant decreases in sell and buy rates were observed in exports from North America, South Asia, and Europe due to overcapacity.

- Ocean freight + ocean services

- Ocean freight and ocean services revenues were down 18% but expenses were also down 14% year over year. Ocean freight consolidation – the largest component of this segment – accounted for just ~65% of ocean freight and ocean services revenue in Q1 2024, 600 basis points down from 71% in Q1 2023.

- In total, ocean freight consolidation revenues were down 25% year over year, with the avg. buy/sell spread down 26%/20%, respectively.

View of upcoming earnings

With Q2 earnings coming next week, my view is that Wall Street will look at two things: – 1) average freight rates, and what the outlook there is, 2) the obvious changes in EPS etc., and 3) dividend growth + any buybacks. And I would agree. The business economics are well proofed up, and management has shown it is on shareholders side with the spate on annual dividend increases and buying back >$1 billion of stock every 12 months. The potential for analyst revisions stems on these factors in my view. I would also urge investors to keep a close on each of the above.

Catalysts for price change

Several catalysts could drive EXPD’s performance over the next three to five years, enhancing shareholder value and reinforcing the company’s market position.

Growth Catalysts:

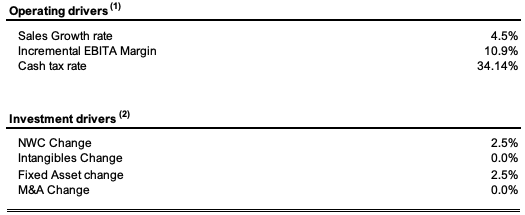

(1). Given the lack of visibility due to volatility in freight prices, this allows me to run with very conservative projections in modelling potential sales, earnings and free cash flows going forward. I’m going to carry a 4.5% revenue growth rate out to FY 2026 (consensus average + aligns with industry growth), on incremental pre-tax margins of 10.9%. This is slightly higher than the current level but is supported by the higher freight prices seen recently.

Management has been shedding from the business rapidly, but this is unrealistic to project forward. I assume that for every new dollar of revenues, this will require a $0.02 investment to net working capital, and a $0.02 investment to fixed assets. This is low intensity but aligns with the company’s asset-light business model. For one, it does not have any fixed assets. Two, basically of the business capital is tied up in receivables and payables, the intensity of which has been decreasing rapidly.

Figure 2. Assumptions for drivers of forward estimates

Author’s estimates

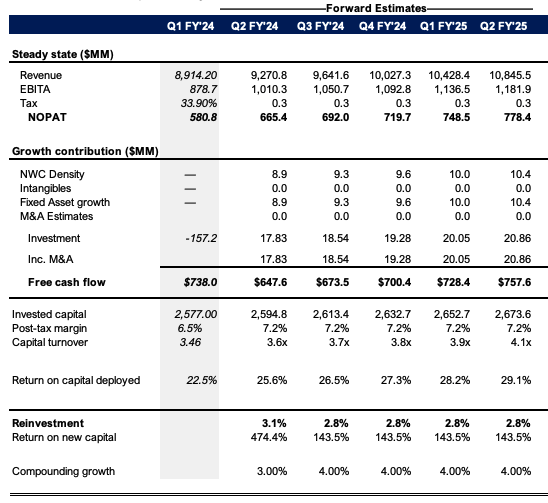

(2). Even at these Conservative assumptions, I get to ~ $10 billion in sales by FY 2025, roughly $300 million ahead of consensus estimates. This could produce anywhere from $700 million-$750 million in thanks to the exceptionally high returns on business capital >25%.

The downside of course is the opportunities to re-deploy funds and grow the business – but that is not the thesis here. These cash flows can 1) fund continued dividend growth, and 2) enable management to maintain the pace of on-market buybacks. Because I believe the stock is undervalued I am in favour of these buybacks tremendously.

Figure 3.

Author’s estimates

Potentially attractive valuation

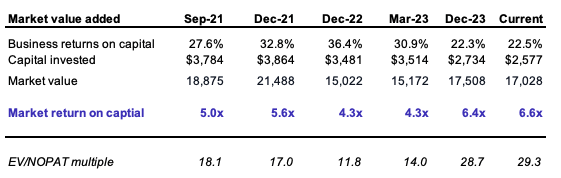

Despite the volatility of freights, I believe that EXPD’s shares are attractively valued. The market has increased the multiple paid on capital invested in the company as it has 1) worked through working capital, and 2) shed capital through dividends + buybacks. It is now paying 6.6x EV/IC as I write (3-year average is 5.5x), whilst increasing the multiple paid to NOPAT from 18x in 2021 to 20x at the time of publication.

Figure 4.

Author

Valuation Insights:

-

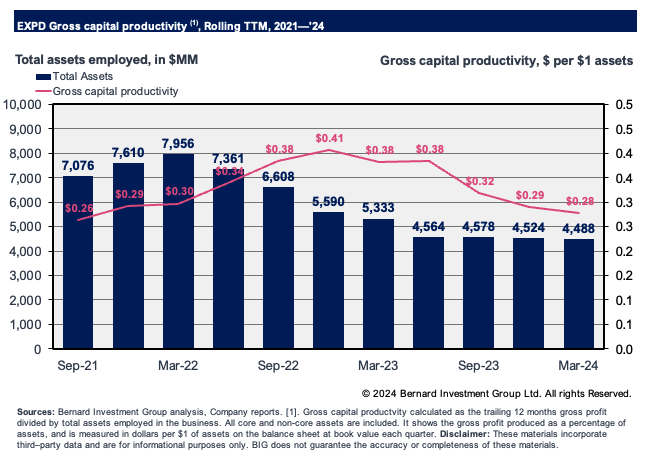

Firstly, a 4-5x market return on capital is excellent market value added, and is a result of 1) the company’s tremendous returns on capital injected into the business, and 2) the return on talent in its business. This talks to my point from earlier: it has highly intangible economic value in its deep customer networks and expertise. Gross capital productivity on total assets (inc. all cash held + invested) is also $0.20 per $1 of assets (Figure 5.a.)

Figure 5.

Company filings, author

Figure 5.a.

Company filings, author

-

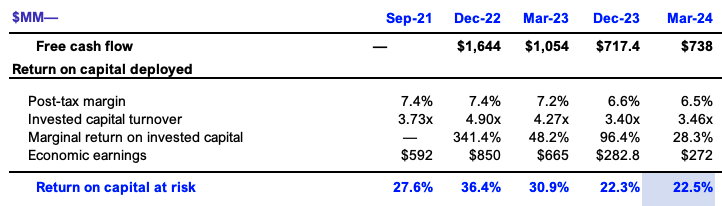

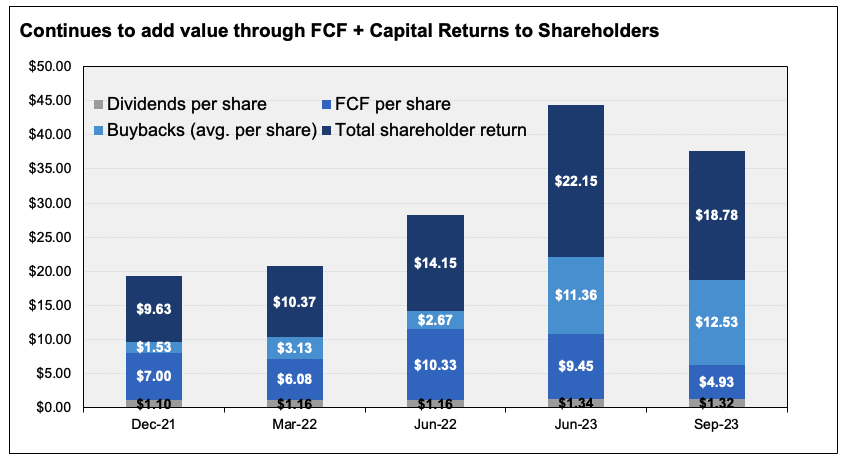

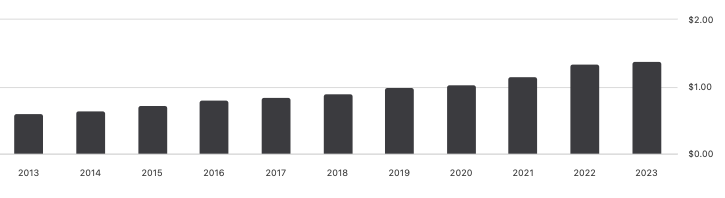

Second, business returns routinely average >20% on a rolling 12-month basis and have shot north of 30% on capital in previous freight-rate cycles. These are mouth-watering economics that fund 1) ongoing dividend growth (see: Figure 7), 2) ~$1.5 billion in buybacks each rolling 12 months, and 3) $700-$1 billion in FCF on the same terms. In total, dividends, buybacks + FCF per share tallied ~$18.80 per share in the TTM (14.8% yield).

Figure 6.

Company filings, author

Figure 7.

Seeking Alpha

-

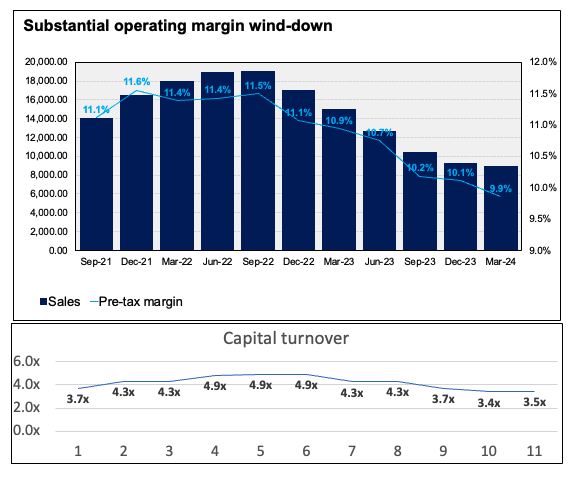

As freight rates have normalized, EXPD’s sales and operating margins have contracted back to the longer-term range. Pre-tax margins hit highs of 11.5% in 2022, and have tightened in to 9.9% in the last 12 months. What hasn’t changed is the turnover on invested capital. This has averaged above 3.5x over this entire period (highs of 4.9x in 2022). Regardless, this signals that every $1 of capital invested in the business is returning at least $3.50 in sales. This is a testament to its capital-light operating model that requires a lower investment to produce the same one dollar of revenues compared to peers.

Figure 8.

Company filings, author

-

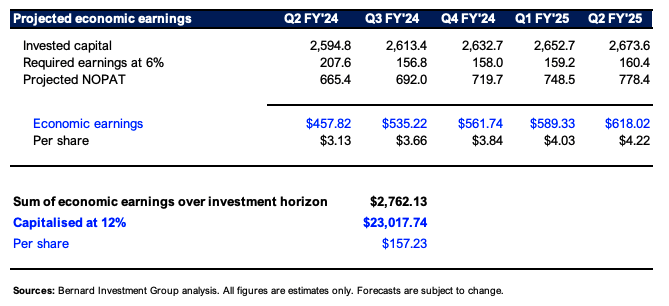

Projected net operating profit after tax in my modelling appears economically valuable when indexed against an 8% capital charge, then discounting any surplus as economic earnings at a 12% hurdle rate. The 8% is a c.6% starting yield on most investment-grade corporates, plus a 200 basis points inflation premium. We could therefore reasonably expect the 6% returned to us in yield. In my view, the company is worth ~$157 per share under these assumptions (26.3x trailing NOPAT). Comparatively, indexed at the capital charge, the opportunity cost is worth $49 per share.

Figure 9.

Author’s estimates

-

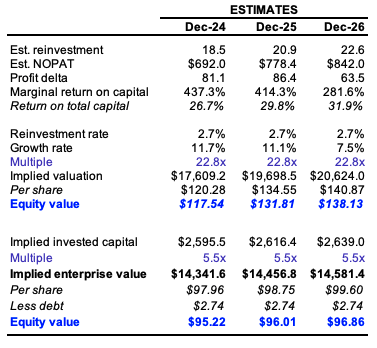

Carrying a more conservative 22x multiple on post-tax earnings forward on my estimates to FY 2026 gets me to a valuation of $138 per share. The downside risk is if investors compress the multiple paid on invested capital of the company. A 5.5x multiple (circa 15% contraction) would imply a valuation of $96 per share on my estimates. The propensity for this contraction to occur is lowered by 1) the excellent spread in business returns to the cost of capital and 2) the intangible economic value I discussed earlier in the niche expertise and deep custom networks.

I would also stress that none of these factors include the intended dividends and buybacks that are expected for distribution to shareholders over this time. Including these factors increases the implied intrinsic valuation drastically, especially considering 1) the dividend growth over such an extended period, and 2) the free cash flow production on such highly productive business assets, which can hold up these payments for many years to come.

Figure 10.

Note: The Multiple on NOPAT is EV/NOPAT, where EV is enterprise value. (Author’s estimates)

-

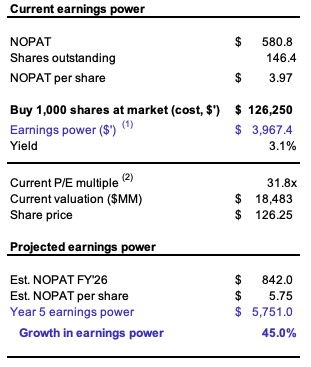

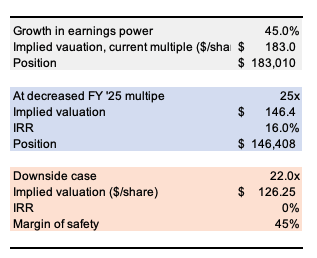

Should we start a position of 1,000 shares in EXPD at market today, our cost base is $126,250, to receive earnings power of $3,960. The return on market capital is ~3.1%. The conservative projections outlined earlier call for a 45% change in earnings power by FY 2026, justifying:

-

A $186 per share valuation at the current multiple (31.8x Price / NOPAT – note: different to EV / NOPAT from earlier), and

-

A $146 per share value at a contracted 25x price. Based on these assumptions the stock could trade as low as 22x and still be fairly valued, providing margin of safety of 45%.

-

Figure 11.

Note: The multiple on NOPAT used here is PRICE/NOPAT, where Price is current share price. (Author’s estimates)

Figure 12.

Note: As above

In short

EXPD is a high-quality operator in one of the most competitive industries on the planet. Its asset-light business model allows it to compete on price and realize high returns on net tangible assets required to operate the company. Given the fact that reinvestment opportunities to re-deploy these funds are low within this industry (excess capacity already exists, and the propensity to create more capacity is highly limited on the supply side – not necessarily demand – this is one of the major reasons why pricing is tipped to remain strong in the industry for years to come) these funds will be used to supply attractive dividend payments to shareholders alongside more than $1 billion in share buybacks every year.

As I mentioned in the report, I believe the stock is undervalued so this use of capital is highly attractive for me – (i) increasing our ownership without laying down any additional capital, and (ii) increasing dividends and free cash flow per share alongside this. My estimates project a valuation range of $138-$157/share depending on the methodology used. These do not include the buyback and dividends I just discussed. Therefore, I am buy on this company based on fundamentals and valuation.

Read the full article here