We recently noticed that Moncler’s stock price (OTCPK:MONRF) has underperformed the market (Fig 1), and this was due to a few sell-side analysts who started cutting the company’s target price. The group has strong market positions in outerwear and a top-performing team that has successfully implemented product diversification to reduce seasonality. As a reminder, Moncler was established in 1952 with a focus on winter items. For this reason, looking at the past stock price performance, Moncler has usually suffered in the summertime. We should also report that Golden Goose postponed its €1.7 billion IPO last Tuesday, blaming dicey market conditions and EU political uncertainty. This was seen as a cold shower from the EU luxury market. That said, Golden Goose has a lower growth rate and a higher debt than Moncler.

Here at the Lab, we believe this is not relevant. We anticipate Moncler will be immune to the overall sector slowdown. Still, considering a physiological slowdown in turnover in Q2, the company remains our favorite stock within the sector. This is based on 1) a supportive equity story, 2) impressive margins, 3) a strong brand position, particularly with Chinese customers, and 4) growth drivers due to tourism exposure.

Mare Ev. Lab Rating Update

Fig 1

Why are we still positive?

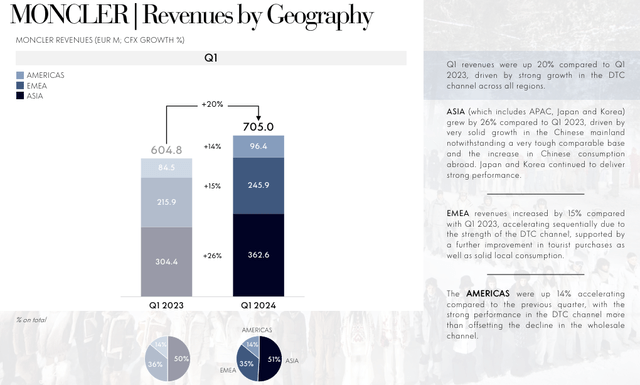

- (Solid results ahead). Firstly, Moncler is one of the few luxury companies with a retail expansion strategy and the internalization of a direct e-commerce business. Even if we assume a weaker store traffic impact, we expect the company to report a Q2 with sales at +6% at the brand level. This follows a +20% in Q1 2024. During the analyst call, Moncler’s top management noted a more normalized sales trend with strong brand momentum in April. According to the latest rumors, the EU luxury companies have started applying unprecedented discounts to the Asian market, focusing on re-gaining Chinese clientele. Looking at the press release, the Kering group decided to discount items by an average of 40%; this strategy was followed by other brands such as Capri Holding (Versace) and Burberry. This might reflect a growing concern about unsold merchandise and a negative sign that Chinese clients are cutting back on luxury expenses. In our Moncler numbers, we anticipated APAC growth up by 6% at constant FX compared to a +26% achieved in Q1 2023, driven by substantial growth in China. Aside from the APAC forecast, Moncler is set to grow by a single digit in all regions, with a plus 3% in America and a plus 7% in the EMEA region;

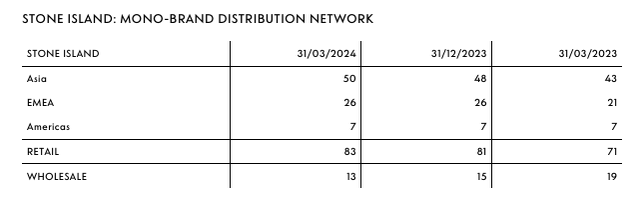

- (Transitions towards an all-year-round brand). Still related to sales growth, we already account for a negative perfomance by Stone Island. Our numbers show a 5% top-line sales decline in Q2, reflecting lower-than-expected development of retail exposure and wholesale rationalization (Fig 3). Given a lower brand perception, Stone Island might also suffer a weaker macro environment. As a reminder, Moncler announced Stone Island’s acquisition in December 2020, and we still see a potential turnaround story on sales and profitability thanks to an ongoing brand transformation. With Milan’s men’s fashion launch, the industry is focused on new fashion proposals. There will be a return of content and innovations, and Stone Island might see support in volume acceleration. Here at the Lab, we are not a fashion expert; however, Stone Island will use leather organza and rubberized satin for a new urban collection. This fabric comprises an ultra-thin layer of leather coupled with a super-light polyester, which gives strength and a crispy finish. Returning to the overall group performance, Q2 sales traditionally represent less than 15% of the group’s annual turnover and around 10% of profit. Therefore, Q2 is not indicative of the brand’s appeal. On the other hand, our team now sees Moncler as an all-year brand, and Stone Island, with the new partnership, is a positive confirmation of this strategy;

- (Margin growth in H1). Compared to the sell-side average, we still see room for margin improvement in H1. After an outstanding Q1, Moncler will likely achieve operating profit margin growth. This is based on a favorable phasing of higher pricing and related operating leverage.

Moncler GEO sales update

Source: Moncler Q1 results presentation – Fig 2

Stone Island Store Evolution

Source: Moncler Q1 press release – Fig 3

Earnings changes and valuation

In our previous estimates, we anticipated a mid-single digit price increase in H1 while a more muted growth in H2. Q1 sales results fully confirmed our financial forecast, and considering the Q2 account (the smaller quarter for Moncler), we decided to have a wait-and-see approach. We are already above Wall Street estimates in our financials estimates. We arrived at 2024 sales of €3.22 billion, and due to a higher CAPEX plan, we have a lower EBIT margin than 2023. That said, Moncler is cash-positive, with a 30% core operating profit margin. On the bottom line, we arrive at a net income of €632 million with an EPS of €2.41.

Looking at the luxury sector, the index trades at a 58% premium compared to the MSCI Europe. This is below the five-year average of 79%. Therefore, the industry remains structurally attractive. That said, EPS growth momentum matters, so Moncler’s valuation has room for growth. In our view, the company is undervalued on a 12-month forward-thinking valuation; given the fact that we anticipate double-digit EPS growth until 2026. The company has lost its premium valuation compared to the industry. At the moment, Moncler trades at 24x P/E. Looking at peers such as Ferragamo, Cuccinelli, and Prada, we arrive at a normalized P/E of 30x. This supports a buy rating of €73 per share. Therefore, we maintain our overweight rating as we think 1) Moncler could outperform the sector this year, 2) a good execution translates into solid earnings, and 3) Stone Island’s successful wholesale-to-retail transition will lead to profit growth.

Risks

Downside risks to Moncler include FX changes given the company’s international exposure (65% of sales are outside the Euro area), 2) pricing pressure from competition, 3) lower brand value, 4) lower perception in equity markets about long-term luxury growth, 5) a slowdown in volume, 6) higher duties on luxury goods, and 6) external influences on consumption. Related to the last point, as reported by several news sources, the Chinese government launched a new campaign on wealth-flaunting influencers. This aims to reduce the showcase of “a lavish lifestyle built on wealth” on social media platforms. This news bans influencers from overly showing off their luxury goods purchases. Currently, we cannot estimate the P&L repercussions, but this will likely impact consumer sentiment, which has already been subdued.

Conclusion

Post Q1 results, although the usual debate around the company’s business seasonality on near-term investor sentiment, these results are, to some extent, already weighing on the current share price. Here at the Lab, we believe Moncler will outgrow its sector peers with the Spring/Summer collection, which now represents approximately 25% of the total company’s sales. There are additional upsides that Moncler might capitalize on, and for this reason, we are maintaining a buy rating status.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here