Investment Thesis

BlackBerry‘s (NYSE:BB) stock jumps 8% premarket on the back of its fiscal Q1 2024 report.

And yet, I remain bearish on this stock. I contend that this cheer from investors is little more than a relief rally that its earnings results weren’t worse.

Essentially, I argue that this business has too little in the way of prospects. And then, to compound matters, the stock is already priced at 87x this year’s EBITDA.

For bullish investors, their argument is that the stock was once higher and therefore, that I’m too bearish, as this stock is primed to revert higher.

All in all, this quote from Warren Buffett neatly summarizes my opinion:

Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.

Rapid Recap

Back in April, I said,

[…] while BlackBerry’s fiscal Q4 2024 results present a mixed picture, with guidance indicating better prospects than initially perceived, I maintain my bearish stance on the stock.

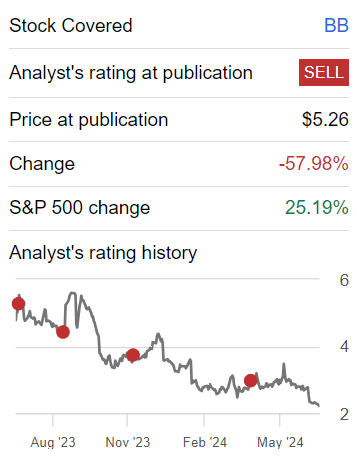

Author’s work on BB

BlackBerry is a stock that I’ve been bearish on for a while. And for its part, the stock continues to slide, and is down about 50% (including the premarket jump), while the S&P 500 is up approximately 25% in the same time frame.

Now, as we look ahead, I reiterate my stance.

BlackBerry’s Near-Term Prospects

BlackBerry today specializes in two main areas: Internet of Things (“IoT”) and cybersecurity.

In the IoT division, BlackBerry’s QNX software is used in automotive and various embedded systems, providing crucial functionalities like digital cockpits and advanced driver assistance systems (“ADAS”).

The cybersecurity division focuses on securing communications and protecting data through solutions like Cylance, which leverages AI to defend against cyber threats, and SecuSmart, which offers encrypted communication solutions for high-security environments.

In the near term, BlackBerry’s prospects are fair. The IoT division is performing satisfactorily, with healthy revenue growth from automotive software solutions and new design wins with major global automakers.

Additionally, the cybersecurity division is gaining traction, particularly in the small and medium-sized enterprise market, through its managed detection and response services.

However, BlackBerry faces challenges too. In the IoT sector, the delay in automotive software development programs due to the industry’s transition to more software-defined vehicles is a significant headwind. The fluctuating demand for electric vehicles and the complexities of integrating new technologies into traditional automaker operations add to these challenges.

In BlackBerry’s cybersecurity division, as has been a pervasive topic throughout 2024 with commentary from CrowdStrike (CRWD), Palo Alto Networks (PANW), and other cyber players too, elongated sales cycles continue to hamper growth in this sector.

Given this balanced background, let’s now discuss its fundamentals.

Revenue Growth Rates Remain Underwhelming

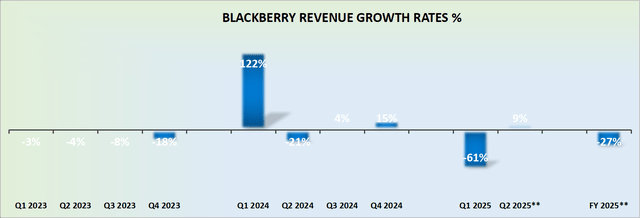

BB revenue growth rates

BlackBerry doesn’t provide a straightforward comparison with the prior year.

However, if we do some rough calculations, we’ll see that by excluding the $218 million from inorganic patent sales in last year’s Q1 2024, its revenue growth rates were less horrendous than the negative 61% y/y revenue growth rates presented in the graphic above.

More specifically, BlackBerry’s revenue growth rates are down 7% y/y, which BlackBerry’s management reiterates on numerous occasions throughout the earnings call, was ahead of their guidance.

This suggests that while the business is struggling, it is still able to survive. Considering the many high-quality businesses available for investment, I have to wonder what the appeal of investing in this lower-quality business is.

But even as I ask this question, I know the answer. It’s the same reason investors have had for years with BlackBerry: the stock is cheap. However, I contend that this is an illusion, which we’ll explore further next.

BB Stock Valuation — 87x This Year’s EBITDA

BlackBerry holds about $230 million in cash, cash equivalents, and marketable securities, and the business has no debt. This is the foundation of the bullish thesis.

However, my argument has been, and continues to be, that BlackBerry’s cash only has value if the business can use it to drive future profitable growth. Otherwise, that cash has no practical value.

BlackBerry has aggressively cut back on its capital expenditures and reduced substantial costs from its operations.

Despite this, the recent narrative is that BlackBerry is pivoting towards investing in its IoT business. Yet, without significant investment, how can its IoT business grow? It can’t. This is why its IoT business was up only 23% y/y, even though it isn’t even generating $250 million in annual revenues.

Meanwhile, Samsara (IOT), a stock I own, is projected to grow 30% this fiscal year and already has $1 billion in revenues. This reinforces that there is strong demand for IoT services, but BlackBerry is struggling to gain significant traction in this highly competitive sector.

Additionally, BlackBerry is projecting an adjusted EBITDA of approximately $10 million for fiscal 2025. This means the business is priced at roughly 87 times forward EBITDA. Is that cheap? I don’t believe so. I believe this stock is overvalued.

The Bottom Line

Paying 87x forward EBITDA for BlackBerry is not an attractive investment because the company faces significant challenges in its key areas of focus, IoT and cybersecurity, while failing to show substantial revenue growth.

Despite having a cash reserve and no debt, BlackBerry’s inability to effectively deploy its cash to drive profitable growth undermines its valuation.

The IoT segment’s modest growth and the competitive pressures in the cybersecurity market further highlight the company’s struggle to gain traction. This inflated valuation, compared to the limited growth prospects and the underwhelming performance relative to industry peers, suggests that the stock is overvalued. Readers can do better elsewhere.

Read the full article here