Intro

Waldencast plc (NASDAQ:WALD) (incorporated in 2020) is a provider of independent brands in the beauty & wellness industry. It provides the ‘Milk Makeup’ & ‘Obagi’ brands which are tailored to a host of clientele in the makeup & skincare categories. Both brands underwent a successful business combination with Waldencast back in 2022.

In any prospective investment, we look at the company’s technicals, profitability & growth trends, plus valuation to see if there is value in the stock. To this point, valuing growing companies can be tricky in the best of times especially when bottom-line profitability remains negative (as is the case of Waldencast at present).

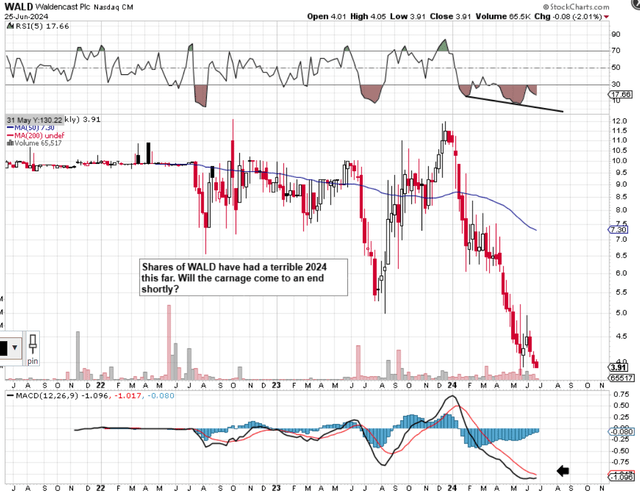

As we see from Waldencast’s technicals, for example, shares have consistently been making lower lows since the latter stages of last year. Although the collapse of the share price in recent times has resulted in a very oversold MACD reading (which looks like a bullish crossover may be imminent), the absence of a bullish divergence in the popular RSI momentum reading may be demonstrating that a convincing bottom may indeed be not at hand at all. Therefore, let’s go to Waldencast’s recent first-quarter earnings report & associated profitability and valuation trends to see if there is any justification for buying the New York-based company at just under $4 a share.

Waldencast Intermediate Technical Chart (Stockcharts.com)

Q1 2024 Financial Results

Net revenues excluding the China business reached $67.9 million in Q1, a 21% top-line increase over the same period of 12 months prior. Obagi Skincare (Sales of $33.4 million) & Milk Makeup (Sales of $34.5 million) both grew sales by approximately 21% which is encouraging from a forward-looking perspective.

Profitability was greatly enhanced in the quarter with adjusted gross profit surpassing $52 million (33% increase) principally due to much-improved e-commerce activity and a pivot to more a direct route to the customer on Amazon. Furthermore, the company’s improved profitability in the first quarter made its way down the income statement resulting in a net loss of -$3.9 million. This was a much-improved result given the -$13.2 million net loss comparable to the same period of 12 months prior and the fact that net earnings are still being adversely affected by non-cash amortization & 2022 restatement changes.

Furthermore, growth is particularly evident in the company’s adjusted EBITDA figure for Q1 ($11.4 million) which already makes up 47% of the adjusted EBITDA Waldencast reported in full-year fiscal 2023 ($24.4 million). Company profitability concerning Net profit & EBITDA multiples are used widely in valuation exercises to value stocks although we must remember Waldencast (although trends have been improving) continues to report negative GAAP earnings alongside an adjusted number for overall company EBITDA.

Fiscal 2024 Guidance

Although the CFO projected more growth on the recent Q1 earnings call (Announced on the 21st of May last), guidance was vague, making valuation tough to decipher. Top-line growth for full-year fiscal 2024 is expected to outpace the 21% growth rate we witnessed in Q1 but management failed to present a specific target. E-commerce activity, growing international sales & stronger dermatological evidence of authority in the US are expected to grow sales of Obagi over the remainder of the year. Furthermore, management is confident that eventually, Southeast Asia will bounce back strongly and that the brand’s omnichannel performance will continue to go from strength to strength as we see from the CEO’s comments below.

In the case of Obagi, our U.S. physician dispense channel continues to be the bedrock of our brand. It’s growing strongly. We’re building from strength to strength, recommitting to the brand DNA and recommitting to the core, but also omnichannel performance has been an important part of the growth, both obagi.com as well as other online retailers. International is starting to add to our growth quite substantially outside of Southeast Asia

On the ‘Milk Makeup’ side, innovation & fresh brand partnerships (which should augment brand awareness) are expected to drive sales forward in fiscal 2024. Management is set to ramp up marketing in ‘Milk’ for the remainder of the year in the hope that these marketing dollars will stick over time resulting in a considerable increase in repeat customers. Innovation concerning the introduction of multiple new products along with international growth (where encouraging signs have been evident concerning growing sales from existing distributors) is also expected to grow sales of the ‘Milk Makeup brand going forward.

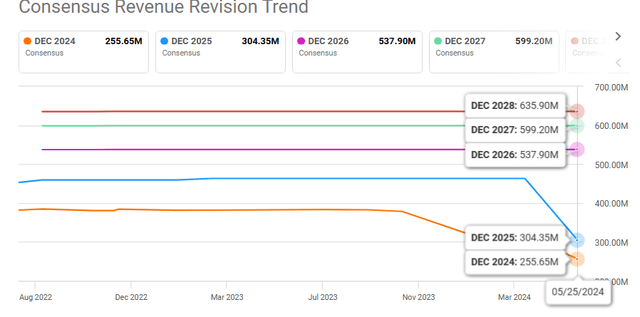

Interestingly, consensus however is only projecting approximately 17% top-line growth this year (Expected sales of $255 million) which is below what management earmarked just over one month ago. Suffice it to say, that top-line revision trends have not been favorable in Waldencast as we see below.

Waldencast Consensus Revenue Revision Trend (Seeking Alpha)

Valuation

Although the company’s trailing EV / Sales multiple of 3.57 comes in well ahead of the sector median of 1.69, Waldencast’s assets look relatively cheap, currently reporting a trailing book multiple of 0.76 (Sector median of 2.36). Long-term debt however comes in north of $150 million which is a sizable number considering the company remains unprofitable. Another trend of note on Waldencast’s balance sheet is the amount of goodwill ($334+ million) & intangible assets ($582+ million). The fact that the sum of these line items outweighs shareholder equity ($769 million) is worrying, to say the least, especially if growth targets were not met going forward (resulting in possible impairment charges). Suffice it to say, that it is the company’s balance sheet that brings risk to the stock’s present valuation which means both sales & earnings revisions need to be watched closely going forward.

Conclusion

To sum up, we maintain that Waldencast plc is a ‘Hold’ at present although recent revision trends as mentioned have been putting the share price under pressure. The stock may appear cheap due to the sizable pullback in 2024 but the company remains unprofitable which means further dilution looks likely given the lack of hard-assets on the balance sheet, currently reporting only a mere $21+ million in cash. Let’s see what the second quarter numbers bring regarding growth. We look forward to continued coverage.

Read the full article here