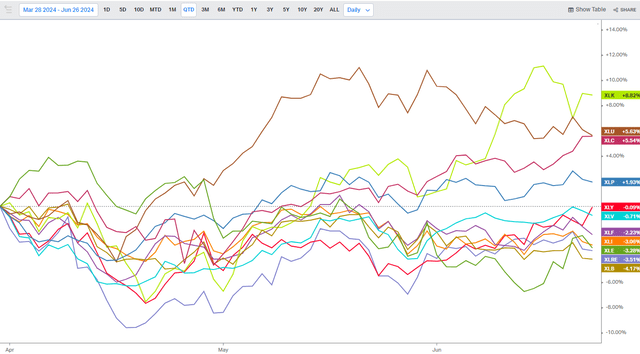

Consumer Staples stocks have quietly produced gains so far this quarter, nearly keeping pace with the tech-dominated S&P 500. While there has been an uptick just recently in Consumer Discretionary stocks, namely a fresh high in shares of Amazon (AMZN), many blue-chip Staples continue to trade at premium valuation multiples in the face of a booming broader market. I believe that will generally persist.

I am upgrading The Procter & Gamble Company (NYSE:PG) from a sell to a hold. I questioned its valuation and pointed out technical risks early last year, but failed to appreciate the durability of the company and its management’s execution. While I do not see the stock as a bargain today, risks appear balanced. Shares have returned 23% since the original analysis compared to a 35% S&P 500 performance.

QTD S&P 500 Sector Performances: Staples Holding Up Well

Koyfin Charts

According to Bank of America Global Research, Procter & Gamble, one of the world’s largest consumer products companies, operates under five segments: Beauty, Grooming, Health Care, Fabric & Home Care, and Baby & Family Care. Brands include Pampers, Tide, Bounty, Charmin, Gillette, Oral B, Crest, Olay, Pantene, Head & Shoulders, Ariel, Gain, Always, Tampax, Downy, and Dawn.

Back in April, PG reported a mixed set of quarterly results. Q3 non-GAAP EPS of $1.52 beat the Wall Street consensus forecast of $1.41 while sales of $20.2 billion, up just 0.6% from year-ago levels, was a $240 million miss. But the company raised its FY 2024 diluted net EPS growth rate from a range of –1% to flat to +1% to +2% compared with the previous year’s $5.90 total. Core net EPS growth was also increased to the 10% to 11% range y/y. The firm expects to reward shareholders with more than $9 billion in dividends while it buys back $5 to $6 billion in stock this year.

After registering 3% y/y organic revenue growth in Q3, all eyes are on the upcoming quarter which featured a higher US Dollar Index and likely more soft numbers out of China and the Middle East. North America sales may be steady in the low-to-mid single-digit range and another strong showing from Europe, which was +7% in the previous quarter, would be a significant tailwind.

Commodities have been held in check for the most part this year, but any further rise in the price of oil, perhaps toward the $90 mark later this summer, would be a challenge for PG. Ahead of the July 30 Q4 report, the options market has priced in a small 2.2% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the report, according to data from Option Research & Technology Services.

Key risks for the company include weaker-than-expected sales growth in the quarters ahead, potentially due to increased competition from private label brands and a broader market upturn which may result in more cyclical areas of the market outperforming. Furthermore, additional strength in the US dollar would be at least a temporary hit to earnings.

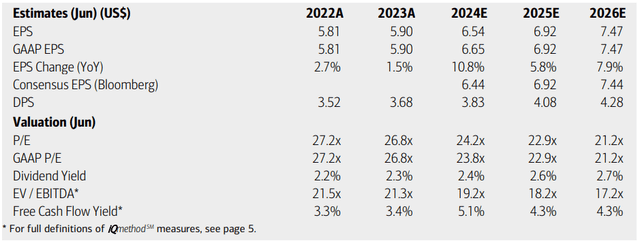

On earnings, analysts at BofA see operating EPS rising sharply this year with continued robust growth through the out year and 2026. The current Seeking Alpha consensus forecast shows comparable non-GAAP per-share earnings advancement in the coming years while PG’s top line is seen rising at a steady pace between 2.9% and 3.9%.

Dividends, meanwhile, are expected to increase from $3.83 this year to potentially above $4.25 by year-end 2026, resulting in a dividend yield that could grow to be more than twice that of the S&P 500. While the company’s free cash flow yield is not extremely high, the firm is executing well after shedding some non-core businesses in recent years.

PG: Earnings, Valuation, Dividend Yield, Free Cash Flow Yield Forecasts

BofA Global Research

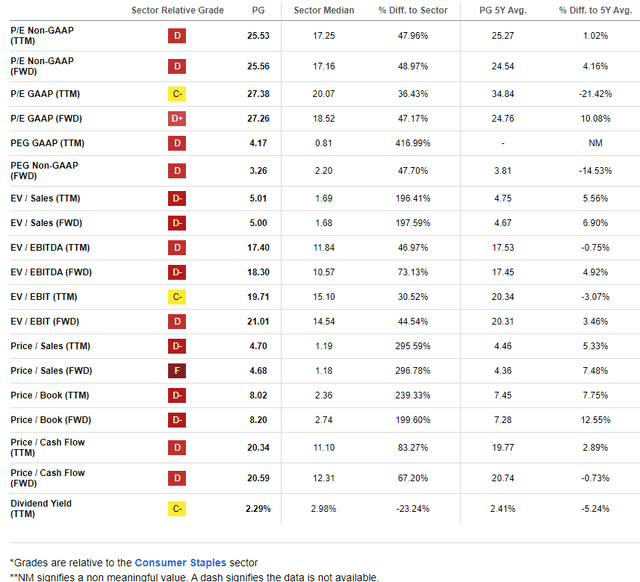

On valuation, PG has historically traded with a significant P/E premium due to its stability even during periods of economic stress. Still, the current earnings multiple is a full turn above its 5-year average. If we assume normalized non-GAAP EPS of $6.70 over the next 12 months, very close to the current consensus, and apply a 5-year average forward P/E, then shares should trade near $164, putting the stock about fairly valued. PG shares are also modestly expensive on a price-to-sales basis.

PG: Shares Trade Near the Historic P/E, Slightly Elevated P/S

Seeking Alpha

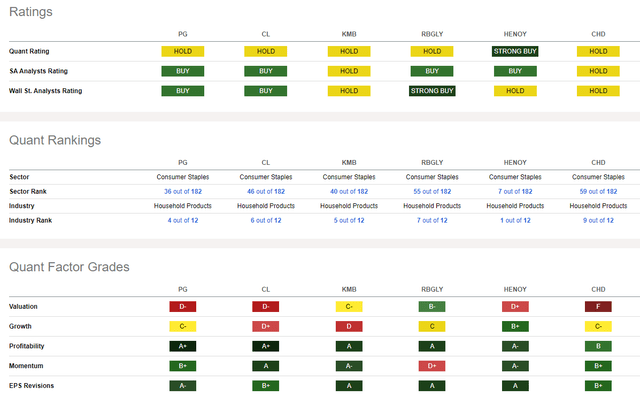

Compared to its peers, PG features a weak valuation rating, but that is common among the steadiest large-cap Staples stocks. With a lukewarm growth trajectory, PG’s profitability metrics are about the best you’ll find across the sector. What’s more, PG has topped EPS estimates time and again, leading to strong sellside EPS revisions over the past 90 days. Finally, share-price momentum continues to run strong with the stock near all-time highs.

Competitor Analysis

Seeking Alpha

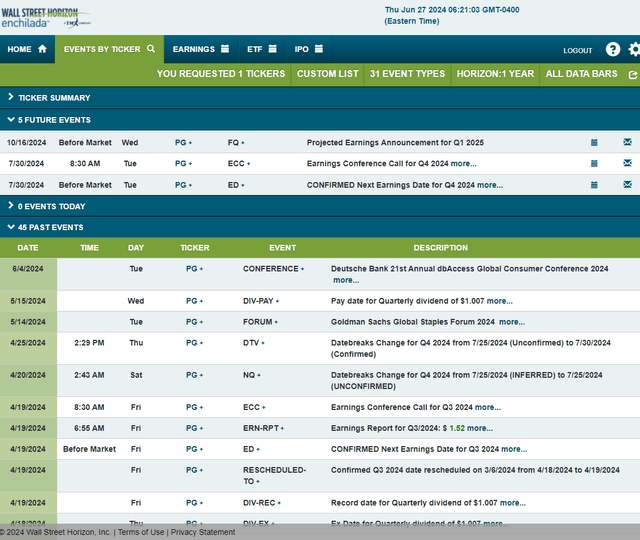

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2024 earnings date of Tuesday, July 30 BMO with a conference call immediately after the numbers hit the tape. You can listen live here. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

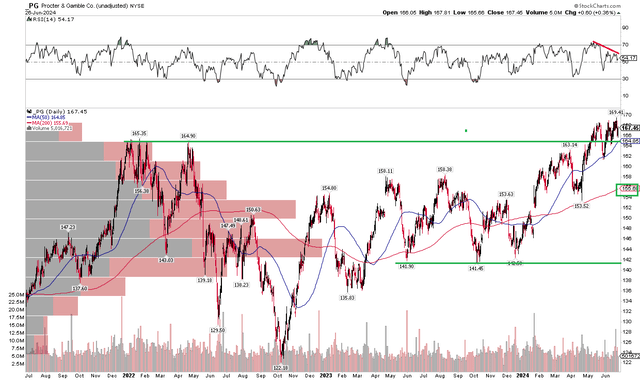

The Technical Take

I was bearish on PG early last year at precisely the wrong time. Mea culpa. Shares had been consolidating after moving lower from a January 2023 peak near $155. Despite a dip under the 200-day moving average, the bulls took charge and a broad uptrend was underway. Jump ahead to today, and the stock is very close to all-time highs, rising above the January 2022 previous peak above $165. Moreover, the 200dma remains upward-sloping, suggesting that the bulls control the primary trend.

I am mildly concerned that shares are not moving decisively above the previous all-time high amid negative RSI divergence. Still, given a previous range between $141 and $158, there is a near-term upside target to $175 based on the $17 height of that past range. I see current support at the 200dma around $156 and the Q2 low of $153.52. Finally, there is now a high amount of volume by price from $165 down to $140 given the congestion zone over the past few years, which should offer cushion on any significant downside moves.

Overall, PG’s chart is healthy with shares hovering near all-time highs.

PG: Bullish Advance to All-Time Highs

Stockcharts.com

The Bottom Line

I am upgrading PG from a sell to a hold. I was too bearish on the valuation last year while bulls defended the stock during an early 2023 pullback. Going forward, solid sales growth, strong margins, and stabilizing commodity prices should be supportive of future earnings increases.

Read the full article here