Alvopetro Energy (OTCQX:ALVOF, TSXV:ALV:CA) is a Canadian-based oil and gas exploration and production small cap operating in Brazil, with 95% of its revenue derived from natural gas. Some temporary external headwinds have halved the share price over the last year, which is likely a market overreaction due to the dividend decrease combined with the shares’ low liquidity. At a current share price, the 0.09US$ quarterly dividend offers a 9.56% dividend yield, but can potentially return to 16.3% when production recovers.

The company is being run conservatively and has a strong balance sheet with negative net debt of -9.67M USD. Its enterprise value is trading at 2.85 times EBITDA and at 45% of its 2P reserves NPV10 after tax. Alvopetro’s netback margins of 87% and EBITDA margins of 74% are industry leading, making them resilient to a potential energy price collapse. This is possible due to its well-positioned infrastructure which is directly connected to a local distributor, alongside low production costs and a favorable fiscal regime in Brazil.

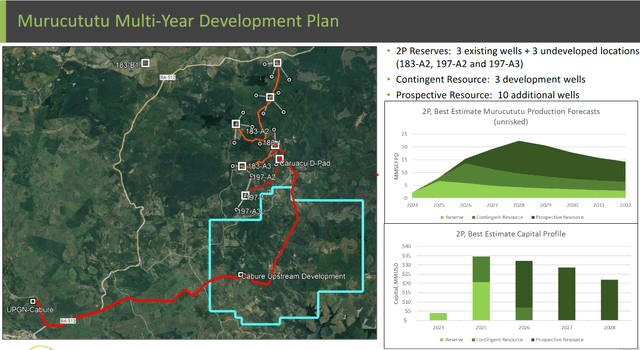

Through the redetermination of the Caburé unit, their stake increased from 49.1% to 56.2%. ALV aims to further expand unit capacity to reach their near-term goal of 18 MMcfepd (3,190 boepd), twice current levels. Concurrently, ALV is independently developing an additional 5,460-acre deep basin gas resource, called the Murucututu field. If successful, this will unlock an additional NPV10BT of $129.2 million, which they aim to develop organically within the next 12-24 months, so they can reach their longer-term production goal of 35 MMcfepd (6,203 boepd), more than four times the current levels.

You get paid a great dividend while waiting for the production to return to normal levels after temporary headwinds pass, which will push the stock back up. In addition, there are many significant direct growth opportunities for this effectively run small cap, which is why I believe the stock is a strong buy.

Production Headwinds

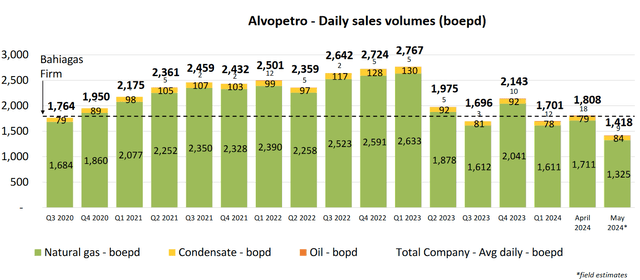

When starting production, ALV aimed for 1,800 boepd, which it quickly exceeded in the following quarters. Now, the situation has reversed and production for the month of May at 1,418, which Alvopetro attributes to two external factors:

- Its gas distributor, Bahiagás couldn’t take on all of Alvopetro’s production because of some demand disruptions with its consumers in the state of Bahia.

- ALV’s partner at the Caburé field wasn’t nominating for gas at the unit before.

After redetermination of the lot, Alvopetro now owns 56.2% of the Caburé field, which is now a majority stake, giving them operational control. This also increases their production plateau up to 2,300 boepd. After the production decrease, management conservatively reduced the dividend temporarily, which the market severely punished.

Daily Sales Volume (Alvopetro Investor Presentation)

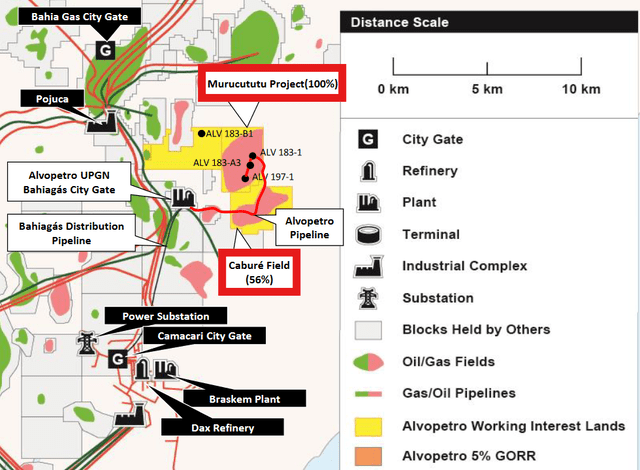

Alvopetro’s Fields

Alvopetro operates in the State of Bahia, in the Reconcavo Basin. It owns a 56% stake in the Caburé field, which consists of eight wells and the production facilities. It’s currently ALV’s core producing asset and after the redetermination is effective, they’ll have operational control. When the redetermination is effective, ALV will be entitled to an additional 5% of the production to recoup historical shortfall, but they’re also expected to owe an additional $1.2 million of past expenditures (2024Q1 MD&A).

Also in their MD&A:

- Alvopetro will be entitled to approximately 393,000 m3/d (13.9 MMcfpd or 2,315 boepd) of natural gas production from the Unit.

- ALV and its partner have agreed to a development plan at the Unit, including drilling and completing an additional five wells in 2024 and 2025.

ALV’s Gas Fields (Alvopetro Investor Presentation)

The Murucututu field is a 5,460-acre deep basin gas resource, adjacent to ALV’s other assets and connected to its midstream infrastructure through independently owned pipelines. Alvopetro had to wait until they had access to the gas sales contract to finally start developing wells on the Murucututu field. ALV has a 100% working interest on this field and many potential growth opportunities, with 2P Reserves estimated at 4.6 MMboe, but potential estimates ranging up to 9.6MMboe. ALV has some additional exploration assets for the future, but doesn’t seem to have any capital plans for them as of now.

Murucututu Development Plan (ALV Investor Presentation)

ALV’s midstream assets are also independently owned and consists of a 11-km transfer pipeline to its gas plant with 18+ MMcfpd capacity, from where it is sold to Bahiagas.

Gas Sales Agreement

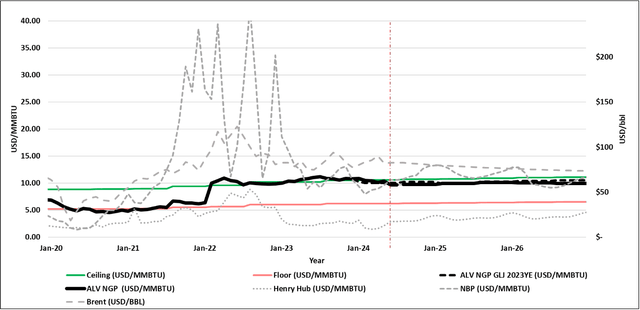

The natural gas price under our long-term GSA with Bahiagas is set semi-annually (as of February 1st and August 1st) based on a trailing weighted average of USD benchmark prices for Brent, Henry Hub and National Balancing Point, incorporating both a floor and ceiling price, which were $6.22 /MMBtu and $10.58/MMBtu as of February 1, 2024 (2024Q1 MD&A).

Per the MD&A:

ALV’s average realized price for natural gas in the first quarter of 2024 was 12.57$/Mcf. Their contract with Bahiagas entails take-or-pay provisions and ship-or-pay penalties based on firm volumes to ensure performance by both parties. It is also CPI adjusted, assuming US inflation of 2% annually, offering a slight inflation hedge.

While this type of contract offers stability, if gas prices were to reach the bottom of the contract, that would still be almost 50% down from the current ceiling prices at which they currently sell their gas.

Gas Sales Agreement (Forward Pricing at 6/14/2024) (ALV Investor Presentation)

Brazil

Operating in Brazil requires a large margin of safety. Aswath Damodaran suggests a 4.40% extra required return for Brazilian equities. Alvopetro is competing against Petrobras (PBR) after all. However, their small size should help them fly under the radar. Besides, they have a direct and independently owned connection to their distributor, which is quite rare in Brazil.

Brazil’s fiscal regime is quite exceptional, they pay an effective royalty rate of 2.7% on unprocessed natural gas and ALV’s income tax rate is just over 15%. The continued industrialization in Brazil will continue to gradually increase gas demand over time, even if there are temporary headwinds currently. The gas industry itself may see more headwinds over the long run, but it still looks better than the oil industry overall.

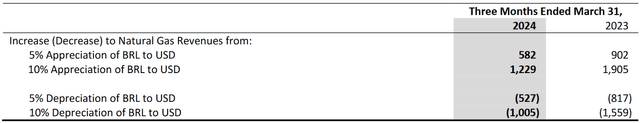

Foreign exchange risks will persist. In Q1 2024, ALV recorded a foreign exchange loss of $0.9 million on due to the depreciation of the BRL relative to the USD, according to their MD&A. Here is a table showing the impact of USD/BRL exchange volatility on AVL’s gas revenues.

FX Risk (2024Q1 MD&A)

Valuation

ALV’s pristine balance sheet, with a working capital surplus was $15.0 million, offers a nice cushion to potential future disruptions. Its 2P NPV10 after tax sits at $260.6 million, so there is definitely value in their assets. Here’s what management answered on a question about buybacks in their Q1 earnings call:

I think this is something that the Board, especially at these valuations, we’ll be looking at as we make decisions on the stakeholder return portion of the pie. And particularly, I think as we increase the cash flow back up, I think it’s a good opportunity to reevaluate that.

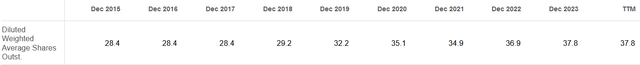

Management’s strategy is to reinvest half of ALV’s cash flows for growth, while returning the other half to stakeholders. Since July 2020, 30% of funds flow from operations have been returned to shareholders (29% through dividends and 1% through repurchases). While there have been some repurchases, ALV has been consistently increasing the share count.

Shares Outstanding ALV (Seeking Alpha)

Valuation Model

To understand the valuation, we have to assess how much cash flow ALV can generate depending on both the annual production (365 * boepd), and on the effective sales price of gas ($/Mcf, 1BOE = 6Mcf). For calculating the potential cash flows, I assume that FX risk is neutral over long run and a relatively conservative 85% netback margin.

Here’s their annual funds from operations, depending on daily production and gas prices:

| 6.50 | 8.00 | 9.50 | 11.00 | 12.50 | $/Mcf | |

| 1,400 | 16.94M | 20.85M | 24.76M | 28.67M | 32.58M | |

| 2,000 | 24.20M | 29.78M | 35.37M | 40.95M | 46.54M | |

| 2,600 | 31.46M | 38.72M | 46.00M | 53.28M | 60.56M | |

| 3,200 | 38.72M | 47.66M | 56.60M | 65.54M | 74.48M | |

| 3,800 | 45.98M | 56.60M | 67.22M | 77.84M | 88.46M | |

| boepd |

Since the gas industry is a capital intensive business, we can conservatively assume that half of their cash flow is used for sustaining capital expenditures.

At current enterprise value of 116.58M, we can then determine P/FCF ratio’s by halving their annual funds from operations.

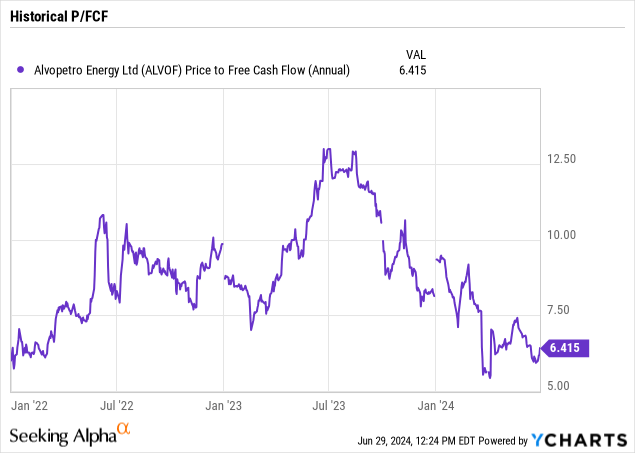

Based on historical levels, I’m assuming a 7.5 P/FCF ratio and a 14% required return for operating in Brazil. If I input this into my DCF model, at current valuations, the market expects 16.1M of annual free cash flow. This corresponds to a 32.2M of free funds flow. Looking at the table above, it shows that if they manage to reach their 3,200 boepd production goal, the stock is expected to double on current valuation multiples. Here’s an overview of the variables used for my DCF model for what I believe to be the market’s estimate. This means that the market assumes a fair value for the stock if it can get an average annual FCF of 16.1 million over the next 10 years. I believe this estimate is very conservative and leaves large upside.

| Initial Free Cash Flow | Required Return | Length | Growth | Terminal Multiple |

| -> 16.1M | 14% | 10 Years | 0% | 7.5 |

Conclusion

Since Alvopetro came on production in July 2020, management stayed true to their capital allocation goals in a disciplined manner. External headwinds may persist in the future, as the gas industry is never without trouble. However, the netback margins of 87% offer a great margin of safety for any downside. While waiting for the productions levels to return to normal levels, you get paid a 9.55% annual dividend yield.

While Alvopetro is a great business, operating in the gas industry always poses several perpetual risks. Clearly, if weak demand for gas in Bahia is prolonged, production will stay depressed. More significantly, gas prices may fall to the floor if its contract with Bahiagas. Thirdly, as its partner in Caburé field is disputing the distribution of working interest, the effective date of the new split may be delayed. For operating in Brazil, continued depreciation of BRL to USD push back on cash flows. As for its growth projects in Murucututu and in Caburé, any failed explorations and developments of future wells can result in more capital expenditures needed than expected, which is likely why they don’t give any capex guidance.

However, if their growth projects turn out successful and Bahiagas can take on its production, the stock is poised to more than double in the next 12-24 months at current valuation multiples.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here