Intro

We wrote about Huron Consulting Group Inc. (NASDAQ:HURN) in February of this year when we stated that the trajectory of the company’s operating income margins would remain key. Well, Huron managed to report two consecutive bottom-line beats (in Q4 last year & Q1 this year) with core EBIT margins coming in at 9.55% for Q4 & 6.26% for Huron’s most recently reported first quarter (announced on the 30th of April this year). This means the trailing 12-month EBIT margin for Huron comes in just below 10% resulting in a trailing net income margin of approximately 4.8%. Although EBIT margin grew in both the healthcare & commercial segments in Q1 this year, we are maintaining our ‘Hold’ rating in the stock and reiterate that we would not be interested in buying Huron unless shares were to retrace back to long-term support at approximately the $80 level.

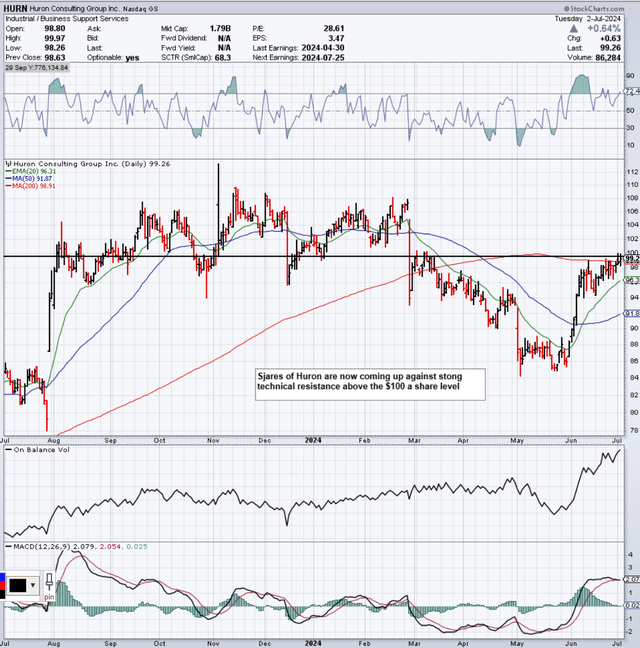

We see on the daily chart below that even if shares manage to convincingly remain above the 200-day moving average (Approximately $99 a share), the stock would immediately come up against more overhead resistance around the $102 mark. Suffice it to say, that we continue to believe that the risk/reward setup in Huron does not justify putting long deltas to work at this present moment in time. Ultimately, our premise boils down to the stock’s valuation, which still is not cheap enough to garner our interest on the long-side here.

Huron Consulting Technical Chart (Stockcharts.com)

Favorable Short-Term Growth Trends

As we see above on Huron’s technical chart, bullish volume trends have seen a noticeable increase over the past six weeks or so. Furthermore, with recent strong growth trends (as demonstrated through revenue growth in healthcare, education, commercial & the integrated digital platform) in the first quarter, it seems evident that more investors are buying into Huron’s growth story. There is plenty of logic to this premise.

Huron’s ‘Healthcare’ & ‘Education’ segments continue to power the company forward, growing revenues by 21% & 7% respectively in the first quarter. The key here is that both of these segments (which make up the lion’s share of annual revenues) are growing, with Healthcare (the largest segment in US Dollar terms), as mentioned, growing by a strong double-digit percentage in Q1. In healthcare, we see management doubling down on what has been working, which is more additional consultant offerings and value-adding digital capabilities.

To this point, the beauty of the consulting industry is that Huron’s Healthcare revenues can continue to increase meaningfully even in the face of growing challenges, which is evident right across the board. Whether these challenges are economic or technology-orientated, Huron essentially gets paid for solving these problems for clients, irrespective of how the general Healthcare industry may be operating at a given point in time.

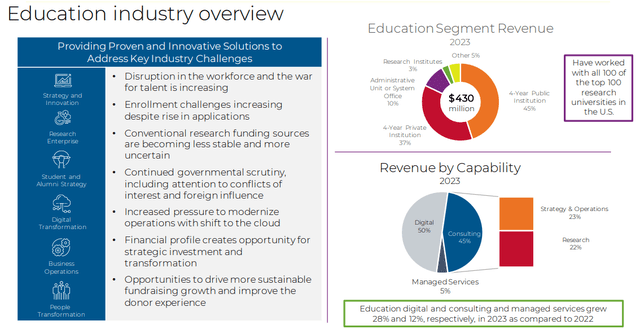

We see the same ‘need for solutions’ in Education with enrollment & fundraising challenges continuing to pressure Huron clients. Again, Huron’s priority is to broaden its offerings & digital capabilities to ensure clients can rectify their issues promptly. Management pointed to the success of its ‘Research Suite Software’ & recent purchase of GC&A on the Q1 earnings call as strong signals on how positive-based client solutions will only grow at Huron.

Huron Education Industry Overview (Q1-2024) (Investor Website)

Balance Sheet Not Being Strengthened

In saying the above, as investors, the principal trends we look for in ‘shareholder-friendly companies’ are rising book value, a well-covered dividend & a reduced share count. Since Huron does not pay a dividend, shareholders must rely solely on share-price gains (which are being helped by ongoing reductions in the share count) for their investing returns. Incidentally, shares have rallied approximately 15% over the past 12 months alone.

Now given Huron’s strong Q1 growth trends alluded to above which culminated in an increase of full-year adjusted EPS guidance from $5.60 per share to $6.10 per share, one would think that the company’s ‘equity’ position would have increased by a meaningful dollar amount over the past 12 months. Well, I’m afraid to say it didn’t. In fact, shareholder equity fell from $529 million in Q1 of fiscal 2023 to come in at $495.6 million in Q1 this year. To add injury to insult, long-term debt rose sequentially from $324 million in Q4 of last year to hit $559 million.

Management pointed to the recent GG&A acquisition along with share buybacks (totaling over $100 million combined) for the debt drawdown, but the real culprit here was the company’s excessive cash bonuses, which continue to drain money out of the coffers every year.

Assets Should Be More Keenly Priced

So let’s run a few numbers to see how Huron’s book multiple has changed over the past 12 months as well as the key debt-to-equity ratio, which is also a strong valuation driver. At the end of Q1 in fiscal 2023, Huron’s trailing book multiple came in at approximately 2.84 whereas the debt-to-equity ratio for the company came in at 0.85. When we fast forward 12 months, to the end of Q1 this year, we see shares are currently trading with a book multiple of 3.55 & a higher debt-to-equity ratio of 1.13.

The moral of the story here is that although shares early last year finally broke out above long-term resistance, the long-term curve regarding shareholder equity (and earnings for that matter) does not demonstrate any growth at all. Suffice it to say, if Huron wants to attract a significant later number of long-term investors, it needs to stop taking significant amounts of capital out of the company every year but rather invest that money to become a bigger, more powerful consulting outfit. Remember, assets are what drive the long-term earnings curve. They are the roots that birth the tree. Start putting down larger roots, otherwise, investors will only be buying on dips (and not holding permanently) when the risk/reward setup stacks up in earnest.

Upcoming Q2 Earnings

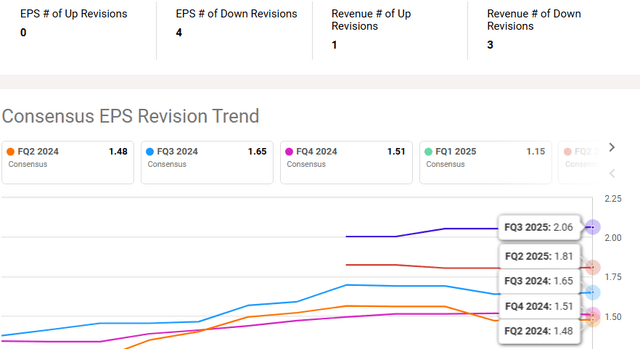

Huron is expected to announce its upcoming Q2 earnings numbers, where the EPS normalized estimate currently comes in at $1.48 for the quarter on revenues of $374.3 million. As we see from the consensus revisions below, there have been four downward revisions over the past 3 months, which demonstrates that achieving management’s guidance number of $5.80+ per share for the full fiscal year may be indeed difficult to attain. We acknowledge that a lower-than-expected tax rate along with a lower share count in general will both act as meaningful tailwinds for Huron’s bottom-line earnings this year.

Huron Consensus EPS Revision Trend (Seeking Alpha)

Therefore, concerning potential share-price gains over the remainder of the year, remember that the near-term trajectory of Huron stock is mostly predicated on forward-looking growth rates. Suffice it to say that Huron has to at least hit its quarterly numbers, otherwise, we do not see sustained traction in the stock over time.

Conclusion

To sum up, we are reiterating our ‘Hold’ position in Huron Consulting despite the group’s encouraging growth trends in its recent first quarter. Rising debt, falling equity & overhead technical resistance have us still waiting on the sidelines for a better entry. We look forward to continued coverage.

Read the full article here