Investment overview

I give a buy rating for Insight Enterprises (NASDAQ:NSIT), as it should benefit organizations adopting more complex IT solutions like AI that require more sophisticated expertise. This will also drive a higher mix of software products that are gross margin accretive. In the near term, the PC refreshment cycle and the adoption of AI PCs are growth catalysts.

Business description

NSIT is a global value-added reseller [VAR], where it provides hardware, software, and service solutions, including cloud solutions, to customers. The primary business units (segments) are: product (83% of revenue and 46% of gross profits in FY23); and services (17% of revenue and 54% of gross profits in FY23). Within products, hardware represents 67% of the mix, and software represents 33% of the mix. As for services, it is split between agent services (43% of service revenue) and NSIT-delivered services (57% of service revenue). Breaking down revenue by geography, NSIT derives the majority of its revenue from North America (80.5% in FY23), followed by EMEA (17%) and the rest from APAC (2.5%).

AI is a growth catalyst

NSIT offers investors indirect exposure to benefit from the rising adoption of next-generation technologies. Across the entire spectrum of new technologies, AI is a key growth catalyst that I have identified for NSIT.

AI has become a buzzword for many businesses, and the appeal is that AI can significantly improve productivity, which effectively helps to reduce cost as well. For instance, AI is disrupting the call center industry in that organizations can leverage AI-bots to resolve common issues, thereby reducing the need to station employees to man the phone. At the higher level, AI helps large enterprises discover deeper insights based on the data available, and this helps enterprises gain an edge against peers.

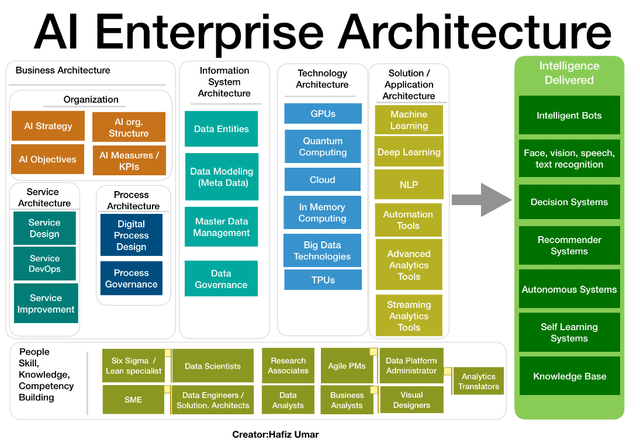

Hafiz Umar

The constraint to adopting AI is that many organizations are not very well versed in setting up the entire required IT infrastructure for AI to work. Underlying the front-end application is a deeply integrated architecture of storage, computing power, edge-computing software programs, database programs, etc. It would take a decent amount of time to hire a full team of experts, conduct a deep dive on what is needed, and implement the entire architecture. Given that time to market is extremely important (the earlier an enterprise adopts AI, the faster it can tap into its capabilities), I believe organizations are going to rely more on VARs (like NSIT) to implement such complex systems for them.

Unlike organizations that have a core business to deal with, vendor selection (procurement), integration, and implementation are the bread and butter for VARs. As such, players like NSIT have more capacity and expertise in this aspect. In particular, VARs have strong connections to OEMs to know what the best available products are to meet the needs of organizations. This trend of outsourcing is becoming more apparent, as seen in a market study done by Equinix, where organizations are now connecting with 30% more business partners in twice as many locations to help implement AI.

Another AI-related near-term growth catalyst is the adoption of AI PCs. The timing of the current PC refresh cycle and the release of AI PC products should provide NSIT with a boost in growth over the coming quarters. According to IDC, the PC refresh cycle is going to start this year, driven by an education refresh cycle of ~30 million PCs (refreshment was delayed due to the pandemic) and a Windows refresh cycle (Microsoft stops supporting Windows 10 in October 2025). The pace of recovery is already evident from TD Synnex Corp. PC gross billings performance, which grew 6.5% sequentially in its 2Q24 results. This refreshment cycle is timely, and NSIT should benefit from it as organizations have an opportunity to upgrade to AI PCs. As per Canalys estimates, worldwide AI PCs will account for around 70% of total PC shipments. Importantly, AI PCs carry higher pricing, and this should further drive top-line growth and gross margin expansion at NSIT.

Overall, to give a better sense of how much the industry is expected to grow ahead, third-party estimates are expecting ~11% CAGR between 2024 and 2030, and I believe NSIT, as one of the leading VARs in the industry (with >$9 billion in revenue), will be able to grow in line with the industry at the bare minimum.

Gross margin has potential to expand

May Investing Ideas

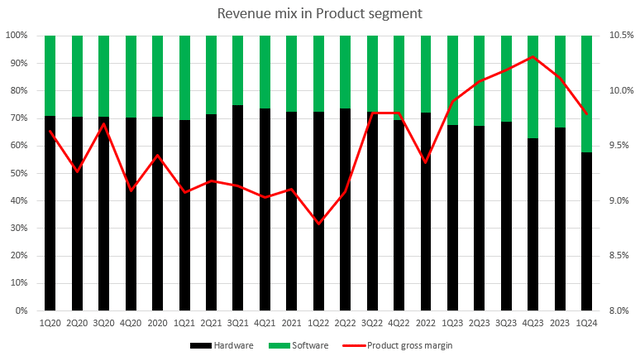

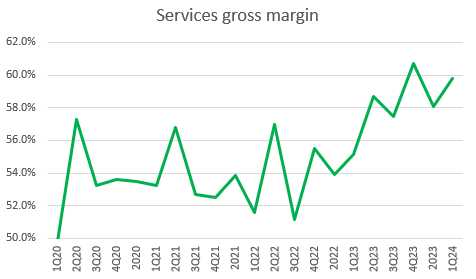

Growing adoption of AI has also shifted the focus from just hardware to both hardware and software, and this is a gross margin expansion tailwind for NSIT as software tends to carry a higher gross margin. As NSIT continues to take on more of such complex projects, the mix of software (within the product segment) has gradually inched upwards, from the high-20% range to 42% in 1Q24. The impact on the segment’s gross margin is apparent, which has expanded from the ~8% range to the 10% range.

May Investing Ideas

In addition, I believe NSIT now has a little bit more pricing power, as the underlying solutions are more complex today than in the past. In the 1Q24 earnings call, management noted that pricing initiatives were part of the reason why gross margins expanded. I would expect NSIT to be able to continue raising prices when organizations become more dependent on VARs to implement and manage complex IT projects and solutions.

Valuation to trade at a premium to peers

May Investing Ideas

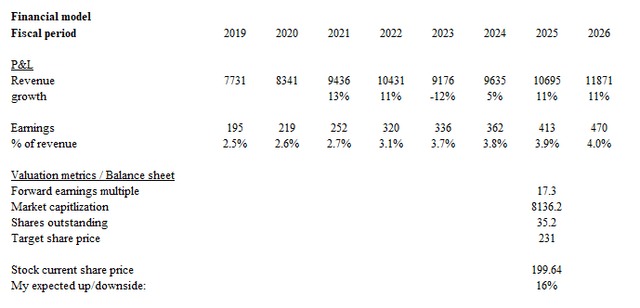

Based on my research and analysis, my expected target price for NSIT is $231.

- Revenue should trend back to industry-level growth of 11%, as I don’t expect organizations to continue pushing out their digitalization timeline (the growth slowdown in FY23 was due to the macro slowdown that pushed out the IT spending timeline). NSIT also appears to be executing a lot better than peers, as it printed positive revenue growth in 1Q24, in contrast to peers such as CDW Corp, which fell by 4.5% and EPAM Systems fell by 3.7% in 1Q24.

- Net margin should continue to expand as NSIT delivers higher-margin solution products and charges more for the complex services required. The expansion is well evident in the historical financials. Over the past 5 years, net margin has expanded by 24bps/year on average. I am assuming at least 10 bps of expansion per year moving forward. For benchmark purposes, CDW Corp, which is a larger peer, has a net margin of ~5.6%, so there is certainly room for NSIT to further expand.

- Among these three players, NSIT has the lower forward PE multiple of 17.3x, and I think this multiple is justified as it has the lowest net margin among them (~3+% vs. EPAM at ~10% and CDW at 5.6%). That said, if NSIT can continue to outgrow peers and expand margins, I see potential for NSIT multiples to trend towards where CDW is trading today.

Risk

The industry is highly fragmented, with many competitors. Increased competition arising from industry consolidation or low demand for certain IT products and services may cause NSIT growth to slow. The past year has shown that a macro slowdown will impact IT spending, regardless of how strong the value proposition is. Hence, a worsening macro backdrop could drive lower demand, which would delay the growth recovery timeline for NSIT.

Conclusion

I give a buy rating for NSIT as I expect it to benefit from organization rising adoption of complex next-generation IT solutions, in particular, AI capabilities. This will also drive a shift towards higher-margin software sales, which is margin accretive. In addition, NSIT should also benefit from the upcoming PC refresh cycle.

Read the full article here