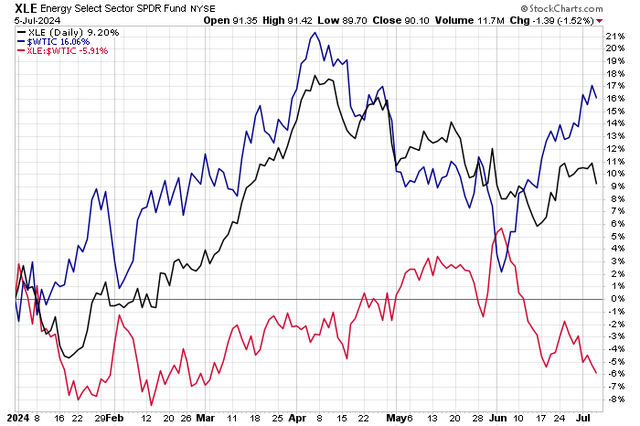

Chevron (NYSE:CVX), like many Energy-sector stocks, has struggled on a relative basis to the S&P 500 so far in 2024. The group is higher, of course, but momentum has not been consistent with resource stocks over the past handful of months. Among the more recent trends that should be a concern to investors in oil and gas plays is that while WTI and Brent oil have been on the rise, closing last week at their best levels since April, the Energy Select Sector SPDR ETF (XLE) remains below where it traded in early Q2. In fact, XLE is now at fresh relative lows dating back to early March when compared to WTI. I always get concerned when Energy shares lose ground while oil itself rises.

But we’ll know a whole lot more in the weeks ahead with monthly reports from both OPEC and the EIA this week and major integrated oil & gas Q2 earnings reports in early August. For now, I reiterate a buy rating on Chevron. I see the $284 billion market cap stalwart as cheap on valuation with high free cash flow, while its dividend yield should attract income-focused investors. Shares have returned 8% since my most recent buy rating, helped by higher oil prices since January.

Energy Stocks Sag Despite Rising Oil

Stockcharts.com

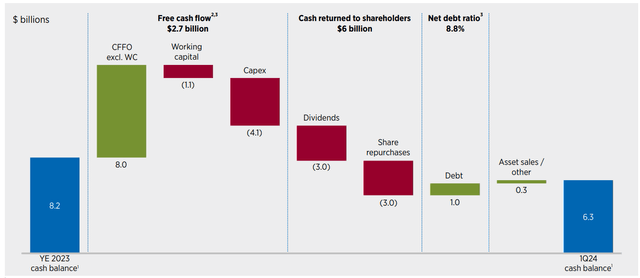

Back in April, Chevron reported a mixed set of quarterly results. Q1 non-GAAP EPS of $2.93 topped the Wall Street consensus forecast of $2.90, but the company’s revenue fell shy of estimates, coming in at $48.7 billion, down 4% from year-ago levels, missing the consensus by $2.0 billion. Still, its worldwide production grew 12% compared to Q2 of 2023 and the firm returned $6 billion in cash to shareholders.

Chevron posted healthy refining and marketing earnings and solid exploration and production profits. Total production of 3,346 million barrels of oil equivalent per day was strong. Away from operational activities, the management team noted that its merger with Hess was pacing well, while its interest in Tengizchevroil (TCO) and the related Wellhead Pressure Management Project paces to start up early next year. So, there are favorable developments with respect to new assets that should be earnings accretive in the years ahead.

While Q2 net income fell to $5.5 billion in the most recent quarter, down from $6.6 billion year-over-year, the firm sports a more than 6% free cash flow yield which should easily support the current dividend policy and a significant stock buyback program. Shares traded fractionally positive following the Q1 report.

Chevron’s Q1 Cash Flow Summary

Chevron IR

What I like is that even with capex ongoing and a major recent merger, the firm remains focused on shareholder returns. Key risks include weakness in global oil and gas prices, which could come about if we see a further slowdown in the US market. Also, there’s the risk that key projects and the Hess integration could encounter challenges, resulting in higher costs and reduced earnings.

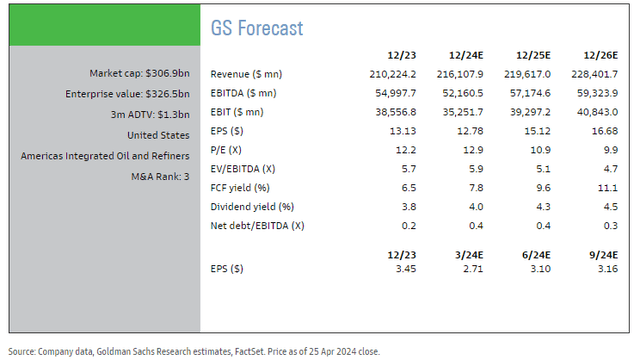

On earnings, analysts at Goldman Sachs see EPS falling 3% this year to $12.78 with a growth inflection in the out year and continued earnings strength through 2026. The current Seeking Alpha consensus figures show a less sanguine EPS trajectory, with non-GAAP per-share profits hitting $14.55 in 2025 and hovering close to that mark in 2026. Sales growth is seen as tepid, holding in the $195 to $200 billion range.

Dividends, meanwhile, are forecast to increase over the next several years, potentially resulting in a dividend yield near 4.5% should the stock price hold current levels, while Chevron’s free cash flow yield could reach double digits if Goldman’s outlook comes to pass.

Chevron: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

Goldman Sachs

What’s my take on the valuation? I see most fundamental conditions as on track. $14 of operating EPS remains doable over the year ahead. Applying a 12x multiple, the sector average per FactSet, and more conservative to my 13.5x P/E applied back in January, then shares should trade near $168, making the stock still materially undervalued today.

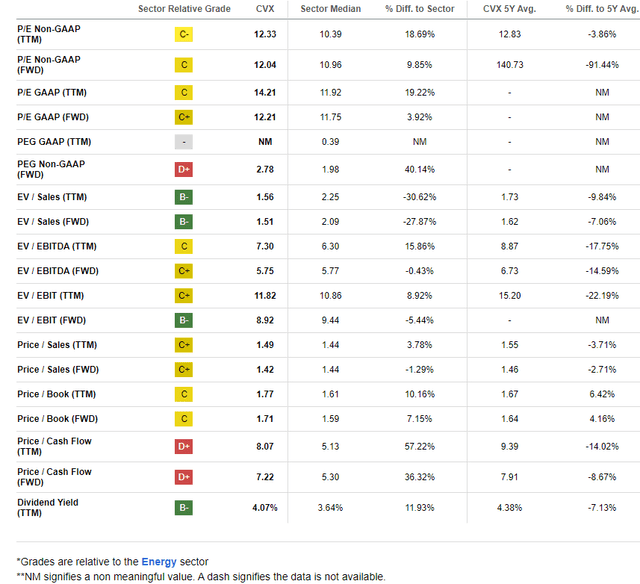

Chevron also trades close to its long-term price-to-sales ratio, so I don’t see the stock as a tremendous deep-value play either.

Chevron: Mixed Valuation Metrics, High Yield

Seeking Alpha

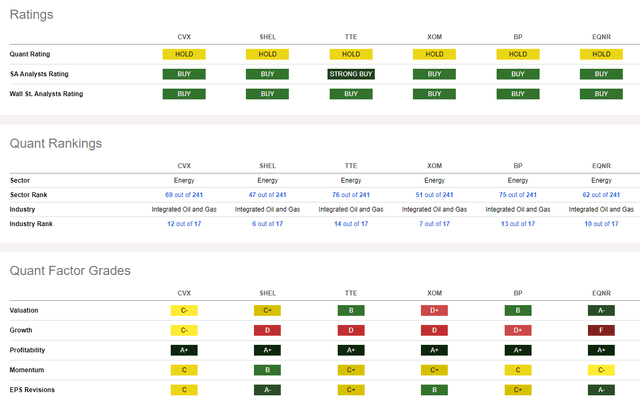

Compared to its peers, CVX features a relatively soft valuation grade, while its growth path is a bit better than its Energy-sector peers. But with very robust profitability trends, the firm continues to produce high operating and free cash flow.

But the sellside has been less than impressed with the Integrated Oil and Gas industry firm – there have been 12 EPS downgrades in the past 90 days, compared with just five upgrades. Finally, share-price momentum has been lacking, and I will detail key price levels on the chart to monitor later in the article.

Competitor Analysis

Seeking Alpha

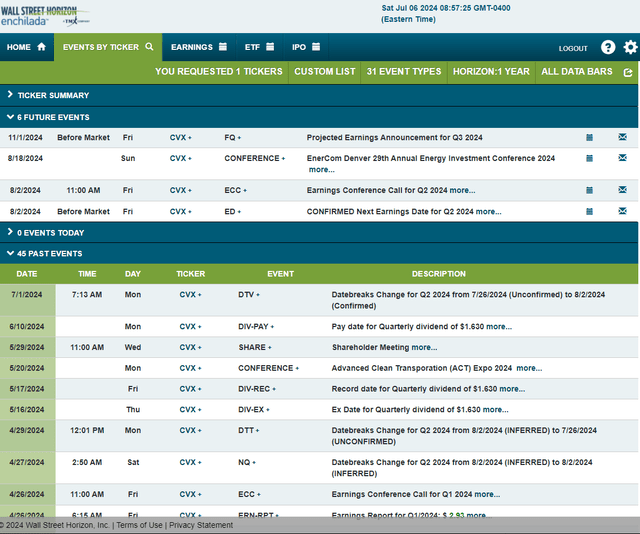

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Friday, August 2 BMO with a conference call later that morning. You can listen live here. The management is then slated to present at the EnerCom Denver 29th Annual Energy Investment Conference on August 18.

Corporate Event Risk Calendar

Wall Street Horizon

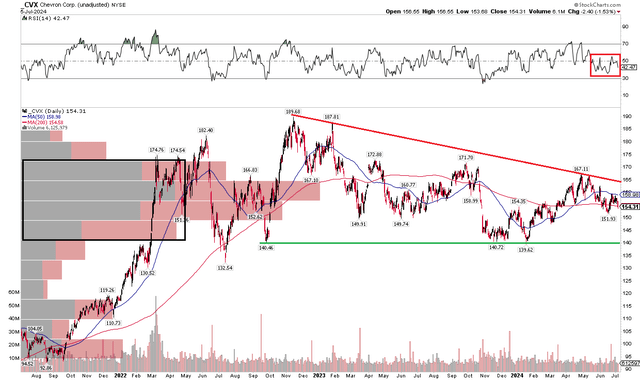

The Technical Take

I highlighted neutral technical signs back in the first quarter. With Q3 now underway, the trend is not much changed. Notice in the chart below that shares remain confined within a consolidation pattern, with key resistance at a downtrend line off the late 2022 high just below the $190 mark. I see support in the $139 to $141 range. What is not so encouraging is that CVX’s long-term 200-day moving average is flat to slightly negative in its slope, suggesting a neutral to modestly bearish primary trend.

Also, take a look at the RSI momentum oscillator at the top of the graph. It has begun to range in a bearish zone between 35 and 55 – I would like to see momentum perk up and for the stock to climb above near-term resistance between $165 and $167. Based on the height of the consolidation pattern, about $50, a bullish upside measured move price objective to $215 would be in play if a breakout from the existing descending triangle pattern occurs.

Overall, CVX has underperformed the S&P 500 as the stock keeps coiling.

CVX: The Consolidation Continues, Softer RSI Trends, $140 Support

Stockcharts.com

The Bottom Line

I have a buy rating on Chevron. The stock trades on the cheap side while free cash flow remains solid. With a more than 4% dividend, the stock should be one owned by yield-focused investors, while momentum players should monitor CVX for a breakout in the second half of 2024.

Read the full article here