Here at the Lab, we have a long beneficial position in the shares of Unilever PLC (NYSE:UL) (OTCPK:UNLYF). That said, it has been a while since our last coverage. In the meantime, our team has continued investigating the EU Consumer Staple sector with comments on Nestle and Danone and follow-up notes in the beverage segment (Diageo, Heineken, and Campari). The company is one of the largest global fast-moving consumer goods players and operates with five business units: 1) Beauty & Wellbeing, 2) Personal Care, 3) Home Care, 4) Nutrition and 5) Ice Cream. The company’s products are available in more than 190 countries, with supportive sales generation coming from emerging markets and Power Brands. Unilever’s portfolio includes well-known brands like Lipton, Dove, Cif, Knorr, Ben & Jerry’s, and Dove.

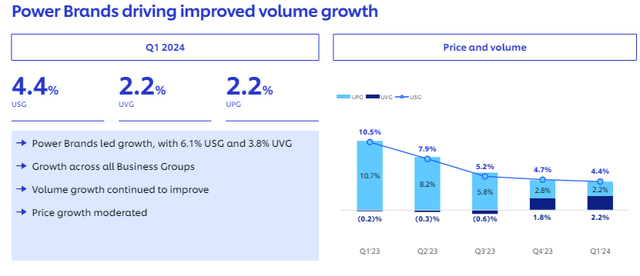

Aside from our new estimates, on a high-level comment, we deep-dive into Unilever’s potential upside shortly. Unilever’s Q1 trading update was particularly encouraging. The company’s Underlying Sales Growth came in nicely ahead of expectations (4.4% compared to a consensus estimate of 3.0%), with most regions and divisions achieving better than forecasted volume growth. This performance has bolstered our optimism for Unilever’s future.

Why are we positive?

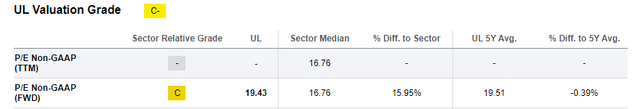

- Starting with a top-down approach, we should report Unilever’s underperformance related to the consumer staples sector. The company currently trades at a P/E of 17x compared to the S&P 500 Consumer Staples average at 20.06x and the MSCI Worldwide Consumer Staples at 18.18x. Our team favors higher-quality companies across a globally developed universe with a low beta, and Unilever is a perfect match. The company’s beta is at 0.18, with a core operating profit margin of 17.5% and an ROIC > 24%, which nicely demonstrates Unilever’s economic moat;

- In the last twelve months, a new leadership team has embedded a new plan across the entire organization. This addresses ongoing concerns related to the previous corporate governance;

- Unilever recently lifted the lid on its 6P strategy. 6P means Pricing, Packaging, Place, Promotion, Pack and Product. On a high level, we understood that the company has more than 20 continuously monitored KPIs. This reminds us that P&G’s strategy dates back a decade ago, and it is critical to know where Unilever’s gaps are and how to close the downside versus its direct competition. At the latest industry conference, Unilever’s CFO and CEO set out a compelling vision of how the company can become a higher-margin and faster-growing player;

- The company is focusing its resources on the 30 Power Brands, and we see already promising signs. Volume growth has accelerated from 2.7% in H2 2023 to 3.8% in Q1 2024 (Fig 1). As a reminder, the Power Brands represent 70% of the total company’s turnover, and we estimate a superior gross margin evolution compared to the group average. That said, the company is not decreasing investment on the non Power Brands products and seeks to recover gross profit margin with new investments;

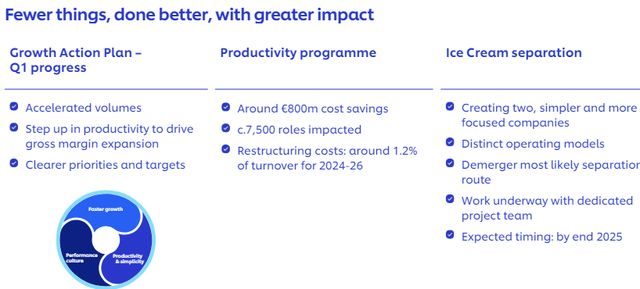

- Unilever’s productivity and ongoing savings are stepping up. Unilever’s new CFO is obsessed with volume growth, product MIX, and gross margins. Aside from the €800 million cost savings projection (Fig 2), in the latest Consumer Staples conference, the CFO added more color to the company’s savings program and quantified €300 million in cost reduction through value chain intervention, such as better procurement and lower supply chain complexity. In number, he emphasized a 2% reduction in logistics costs through network optimization and business waste reduction. This message was in line with our view of a 44% gross margin projection for 2024;

- Looking at the segment, we see support from the Cosmetics and Health and Wellbeing units. These two segments have accounted for an average growth of 6% over the last four years. We anticipate volume growth acceleration in Q2 by an additional 3%. In Q2, we also see a sequential improvement in Ice Cream and Nutrition. Lastly, we see support from portfolio disposals such as DSC, Elida, Suave, and the planned Ice

cream exit. In 2023, the Ice Cream division had disappointing results in profitability with a declining market share. According to our estimates, the division is approximately 90bps dilutive to the group margin;

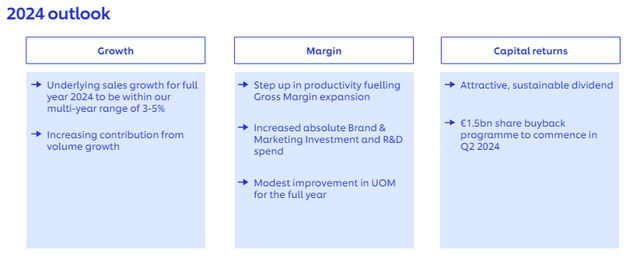

- Regarding capital allocation priorities, we report an ongoing €1.5 billion share buyback program (Fig 3) combined with tactical bolt-on M&A. Considering the current operating cash flow generation and the ongoing dividend, Unilever has a deleverage potential of approximately €3 billion per year, which offers solid downside protection.

Unilever Power Brands Higher Growth

Source: Unilever Q1 results presentation – Fig 1

Unilever Saving Plan

Fig 2

Adjusting Estimates and Valuation

Reporting the CEO’s words, Unilever expects underlying sales growth in 2024 to be within the 3% to 5% range, with more balance between volume and price. It also anticipates a modest improvement in the underlying operating margin. Unilever’s outlook was unchanged (Fig 3); however, we see support from an earnings recovery trajectory. Our view remains above Wall Street’s expectations and relies on better execution than the past operational performance. Disposals and savings will likely support the portfolio with higher growth / and higher gross margin categories. The announced separation of the group’s ice cream business goes in the right direction. Unilever has delivered two consecutive quarters of above-peer volume growth, and we expect positive results in 2024. In numbers, we forecast a volume/mix to reach 3% in the Fiscal Year 2024. This represents a performance improvement from our previous forecast, which was set at plus 2%. Compared to a volume/mix CAGR of +0.5% in the period 2019-2023, the company will likely achieve a volume growth of +2.5%. Here at the Lab, we anticipate sales of €61.4 billion with a core operating profit margin of 17.5%. After a €6.5bn net material inflation in the last years, the company has guided a normalization in cost pressures. Therefore, we anticipate the price will remain resilient. Our support is mainly achieved at the gross margin level with an improvement of 180 basis points. This should help Unilever recover gross margins to 2019 level of 44.0%. Aside from the disposals, this performance is also led by Power Brands’ volume growth and product premiumisation. Compared to Wall Street, we are, on average, 40 bps ahead of the core operating profit margin.

Going down to the P&L, Unilever has an unchanged CAPEX policy. We assume a tax rate of 25% aligned with the company’s historical average (last five years’ average) and a lower interest rate due to deleverage progression. We reached a net income projection of €6.75 billion with an EPS of €2.88. The company trades at 17x. Therefore, there is an 18% valuation gap vs. the S&P consumer staple segment. Applying an average sector P/E of 19x, we derive a valuation of €55 per share (£46) and decide to maintain our buy rating estimates. This target P/E also aligns with Unilever’s year historical average of 19.51x (Fig 4).

Unilever 2024 Outlook

Fig 3

Unilever SA Valuation Data

Fig 4

Risk Section

Downside risks include 1) variances in consumer income and confidence, 2) value destruction M&A, and 3) lower-than-expected Ice Cream exit. Given that Unilever’s sales exposure is related to EM, there are FX risks to consider. Leadership team changes are another risk; the CEO of Prestige Beauty recently exited the company. In addition, lower-than-expected volume and higher interest rates might impact the company’s P&L.

Conclusion

Here at the Lab, we acknowledge Unilever’s new action plan is already yielding early benefits, and we are more constructive at this stage. Although we continue to worry about several of the subgroup’s categories, such as dressings and skin cleansing, we expect a margin recovery supported by Power Brands and ongoing savings. Therefore, we continue to see an unjustified discount compared to the European Staples sector, potential further upgrades, and rerating ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here