This article was co-produced with Leo Nelissen.

When it comes to investing in retail real estate, we often cover some of our favorites, including Realty Income (O), Agree Realty (ADC), and NNN REIT (NNN), all of which are great examples of net lease giants in the consumer-focused retail space.

One area that’s often overlooked is strip mall operators.

That makes sense, as some of the nation’s largest strip mall operators haven’t done so well.

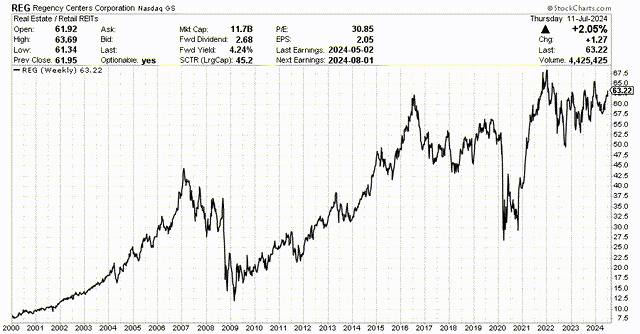

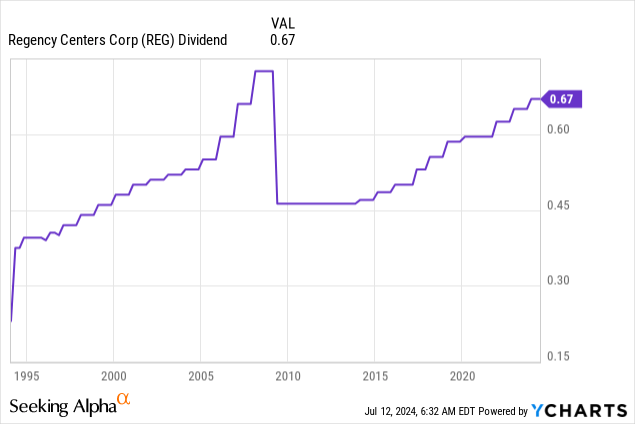

Regency Centers (NASDAQ:REG), for example, is trading at 2016 levels – including dividends. If you were unlucky enough to buy the highs before the Great Financial Crisis, you would be up less than 70%. That’s not a great performance, to put it mildly.

StockCharts

Strip malls were overlooked because it’s hard to focus on investment-grade tenants, competition is fierce, and after the Great Financial Crisis, investors wanted downtown real estate due to the return of the consumer and global travel.

The good news is that strip malls are back!

In this article, we’ll discuss the return of strip malls and why this bodes so well for Regency Centers, a stock that – we believe – deserves a lot more attention.

So, let’s dive right in!

The Return of Strip Malls

“Foot Traffic Keeps Retail Market Moving” is the headline Globest went with on July 5, when it explained the somewhat surprising resilience of retail in an environment of elevated inflation and poor consumer sentiment.

We added emphasis to the quote below:

“The retail sector is performing strongly as consumer resiliency and a strong labor market fuel increases in foot traffic while inflation begins to ease, according to Marcus & Millichap’s second-quarter Retail National Report. In fact, retail was the only major commercial real estate property type to record vacancy compression for the year ending in March as restaurants, supermarkets, discount stores, and fitness centers all noted 5% to 9% year-over-year growth in foot traffic.” – Globest

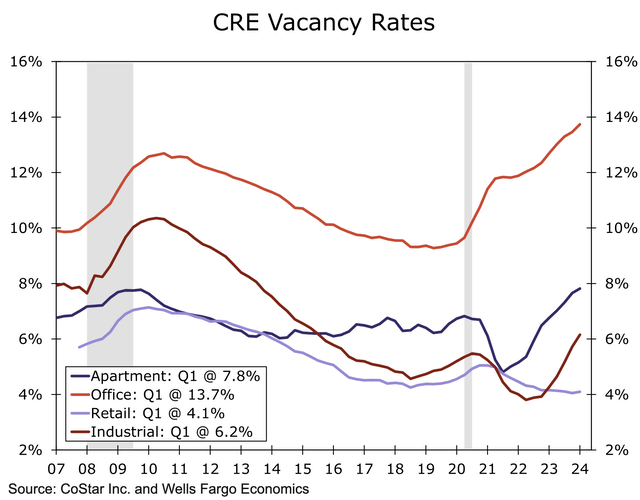

Wells Fargo data confirms this, as retail real estate stands out with a subdued average vacancy rate close to 4%. Not only is this below its long-term average, but it also ignores the vacancy rise in other real estate segments.

Wells Fargo

Even better, although some drug stores, big-box retailers, and restaurants are closing, demand is strong enough to pressure vacancy rates.

Another benefit is that owners are now in a good spot to replace weaker tenants with stronger ones.

On top of this, supply growth isn’t the major risk it used to be in the past, when strip malls were subject to elevated supply risks.

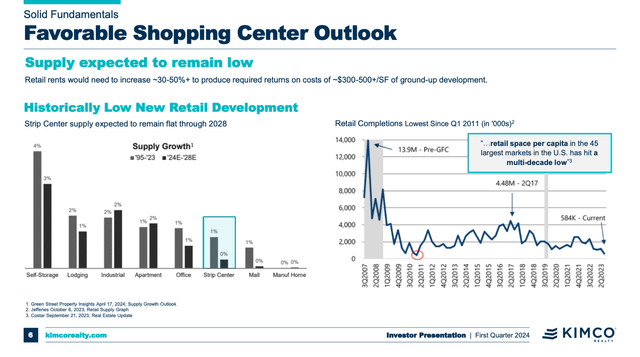

Using data from Regency Centers’ peer Kimco (KIM), we are seeing “historically low new retail development.”

Kimco

In fact, strip centers, malls, and manufactured homes are expected to have the lowest supply risk through 2028.

As one can imagine, this bodes well for Regency Centers.

A Closer Look at Regency Centers

Regency Centers was founded in 1963.

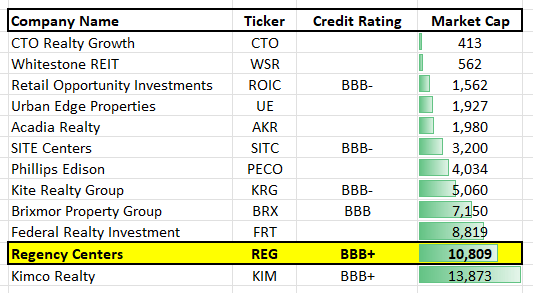

With a current market cap of $12 billion, it is one of the biggest retail REITs on the market. In 2017, it was added to the S&P 500.

Just like most of its peers, the company aims to own and manage high-quality shopping centers, mainly leased to market-leading grocers in desirable suburban areas.

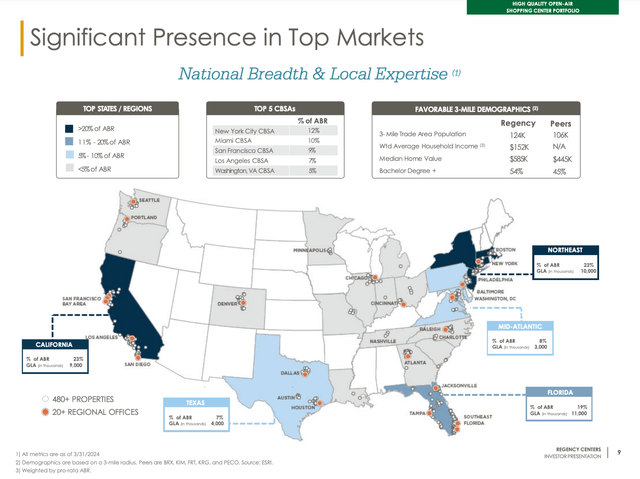

The company, which is highly diversified, generates roughly 12% of its annual rent in New York, followed by Miami (10%), San Francisco (9%), Los Angeles (7%), and Washington (5%).

In its areas, it benefits from above-average population density, higher home values, and a more “educated” population, which tends to boost spendable income.

Regency Centers

Going into this year, the company held an interest in 482 properties, covering roughly 57 million square feet of gross leasable area. This included the acquisition of Urstadt Biddle Properties last year.

Moreover:

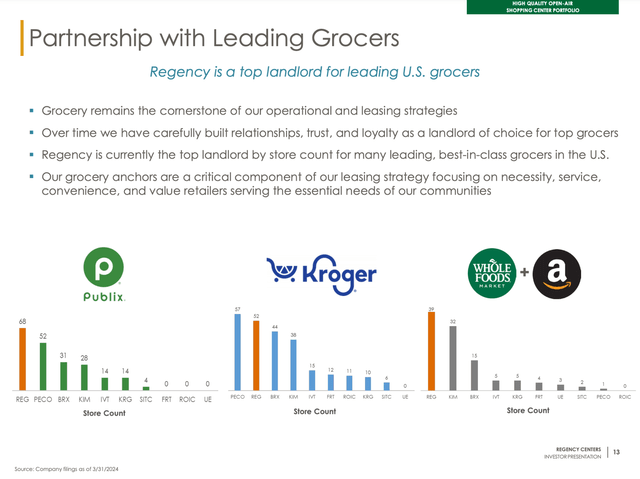

- More than 80% of the company’s portfolio is grocery-anchored, which means a major grocery store is the largest tenant with a number of smaller ships close to its vicinity.

- The company’s grocers are either #1 or #2 in their respective markets – or specialty grocers.

- The company is the biggest public real estate partner of major players like Publix, Kroger, and Whole Foods (Amazon).

Regency Centers

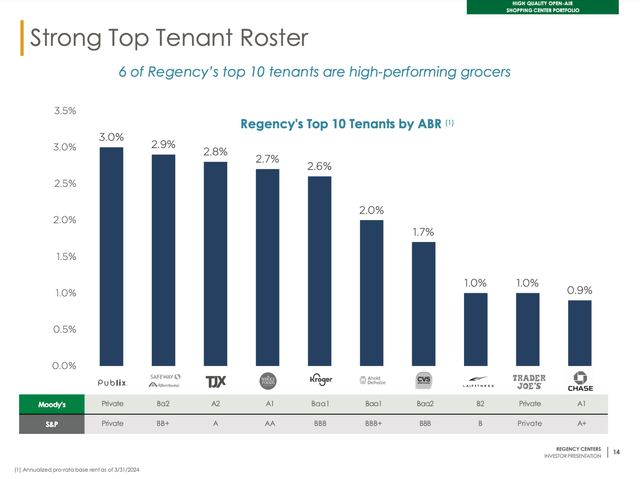

Looking at its top 10 tenants, six of them are leading grocers, with most companies having investment-grade balance sheets and great reputations.

Regency Centers

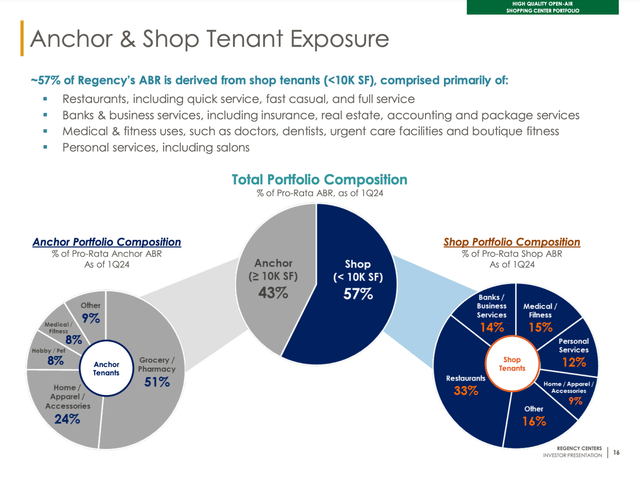

That said, there are some risks, as strip malls cater to a wide range of smaller tenants as well to maintain elevated occupancy and develop desirable shopping experiences.

After all, unlike single-tenant net lease companies, strip mall owners need to build attractive “ecosystems” for consumers to spend money at multiple tenants. Essentially, they want to build a one-stop experience for customers.

This also explains why restaurants have almost as much exposure as grocers in REG’s tenant portfolio. It also has exposure to banks, medical services, hobby/sport, and personal services.

Regency Centers

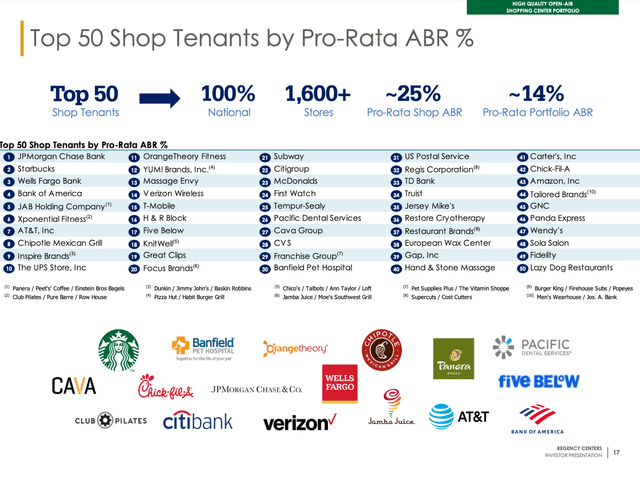

The good news is that the shops surrounding its anchor grocers are often from high-quality operators, including Starbucks, Bank of America, Chipotle Mexican Grill, T-Mobile, Subway, and many others.

In other words, your common corporate fast-food chains, banks, financial/telecom services, and drug stores.

Regency Centers

Just 22% of its annual base rent is derived from local tenants with fewer than three locations. While some of them may come with above-average risks, they add value to the local shopping experience.

There’s Value in Regency Centers

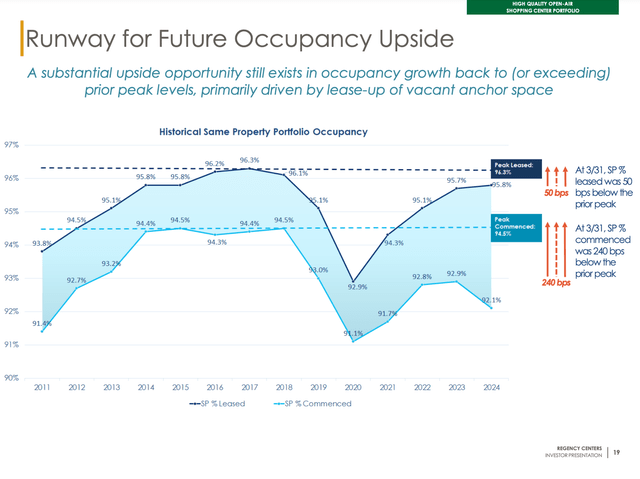

During last month’s Nareit REIT conference, Regency Centers noted that over the past three years, it has exceeded previous high occupancy rates.

In the first quarter, the company achieved a same-store occupancy rate of 95.8% (+20 basis points), benefitting from strong demand, which also allowed same-store net operating income (“NOI”) to rise by 2.1%.

Regency Centers

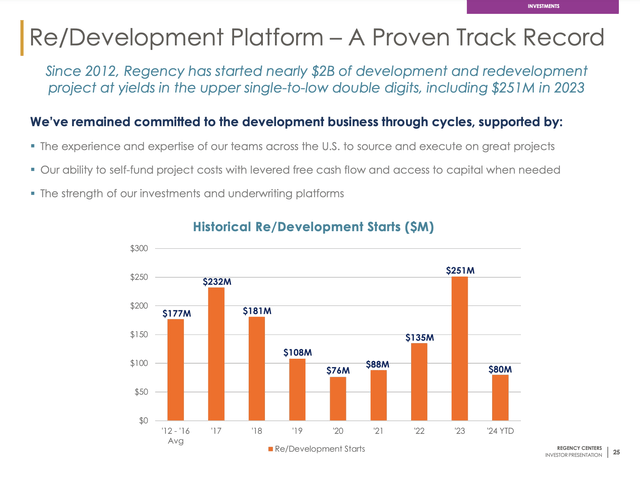

Moreover, due to favorable demand drivers, the company is consistently expanding through developments and redevelopments.

In 2023, for example, the company initiated over $250 million in development and redevelopment projects, and it expects to maintain a similar level of activity in 2024.

Regency Centers

The company currently has more than $500 million in process, with a high leasing rate of nearly 90% and blended returns of 9%.

These projects include a $67 million ground-up development of the shops at Stone Bridge in Cheshire, Connecticut. These shops are anchored by Whole Foods and T.J. Maxx.

Regency Centers

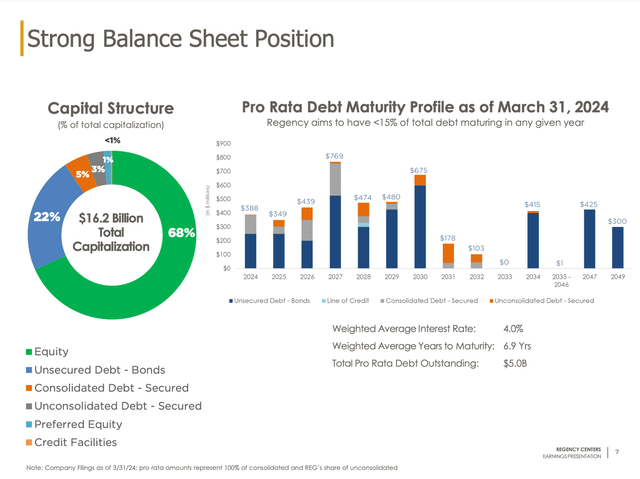

In this case, it helps that Regency has a very healthy balance sheet, protecting it against elevated rates and providing fertile ground for investments in growth.

Currently, it has an A3 credit rating from Moody’s, making it the only strip mall with an A rating.

This balance sheet comes with a weighted average interest rate of just 4.0%, a weighted average duration to maturity of almost 7 years, and a well-laddered maturity schedule.

Regency Centers

On top of that, it has a net leverage ratio of 5.2x and $1.5 billion in available liquidity.

It also benefits from a strong pipeline of leases, with more than $50 million of annual base rent expected to commence by the end of this year.

This is one of the reasons why the company is expected to consistently accelerate its earnings.

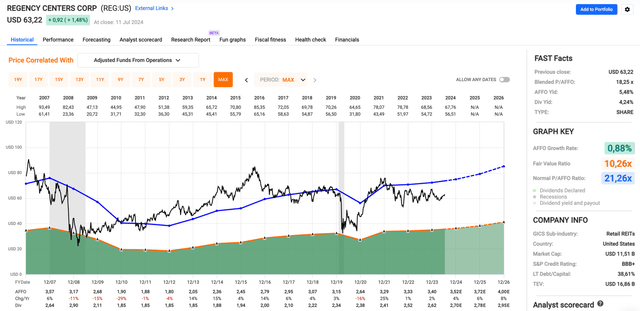

Using the FactSet data in the chart below, the company is expected to grow its per-share adjusted funds from operations (“AFFO”) by 4% this year, potentially followed by an acceleration to 6% and 8% in 2025 and 2026, respectively.

FAST Graphs

This bodes well for its valuation and dividend.

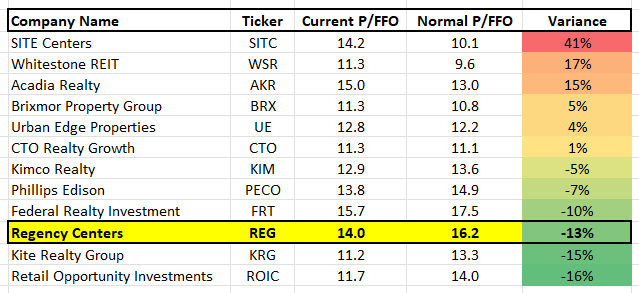

Valuation-wise, REG trades at a blended P/AFFO ratio of 18.3x, a few points below its long-term normalized 21.3x multiple.

While it will require a path to lower interest rates to unlock a higher multiple (this applies to REITs, in general), the company is potentially 34% undervalued.

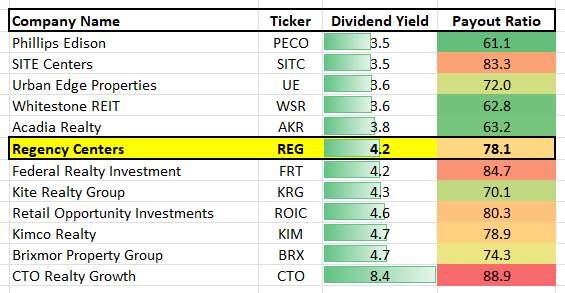

When including its 4.2% dividend, we get a high probability of double-digit annual returns in the years ahead.

With regard to the dividend, it has a 76% AFFO coverage ratio and a three-year CAGR of 3.8%.

yCharts

Although Regency Centers does not have the pristine dividend track record a company like Realty Income has, we believe it offers good value, especially because the market is slowly finding out that strip malls are now in a totally different spot compared to pre-pandemic years.

This will slowly be reflected in its earnings growth and valuation multiple, providing a good risk/reward for long-term REIT investors.

In Closing

We believe Regency Centers is poised for a strong comeback as strip malls regain their significance in the retail real estate sector.

Despite historical underperformance, current trends show significant resilience and growth potential.

Regency Centers, with its high-quality grocery-anchored properties and diversified tenant mix, benefits from low vacancy rates and improving consumer foot traffic.

The company’s solid financial health and strategic developments further enhance its outlook.

Furthermore, trading below its historical valuation, Regency Centers offers a compelling opportunity for long-term investors seeking both growth and reliable dividends.

Major risks to the thesis are the potential for economic downturns that could reduce consumer spending and foot traffic, increased competition from e-commerce, and potential challenges in replacing weaker tenants with stronger ones.

Data Duel

Check out the “data duel” feature below. Please let us know your feedback.

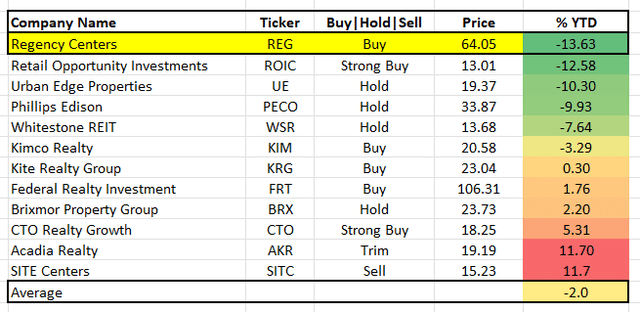

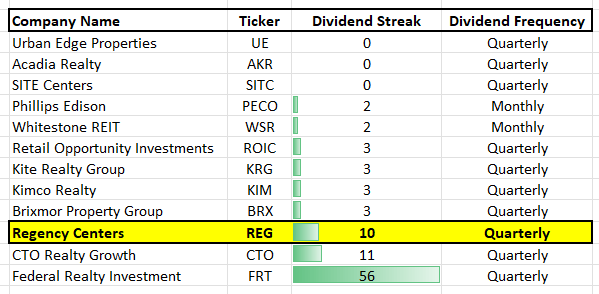

iREIT® iREIT® iREIT® iREIT® iREIT®

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here