Investment thesis

Construction Partners, Inc. (NASDAQ:ROAD) is a civil infrastructure company specializing in the building and maintenance of transportation networks. Its strategically located HMA plants and select material deposits provide construction products and services to both public and private infrastructure projects. It is in the business of building and maintaining highways, roads, bridges, airports, and commercial and residential sites in the southeast US.

ROAD has benefitted immensely from the Infrastructure Investment and Jobs Act (2021), which provided ~$550Bn to transportation and infrastructure spending. This was compounded by the Inflation Reduction Act (2022) which outlined ~$520Bn of funding programs, many of which were direct infrastructure. Signed in to the legislature in August ’22, funds were also provided to the Federal Highway Administration (“FHWA”) among other transportation networks in conjunction with the EPA. ROAD’s exposure to the IIJA funds in particular, and its ~$1.8Bn current backlog “continue[s] to benefit from strong public investment across a variety of infrastructure types, which includes not only highways and bridges, but also airports, railroads and military bases“, per the CEO on the Q2 earnings call.

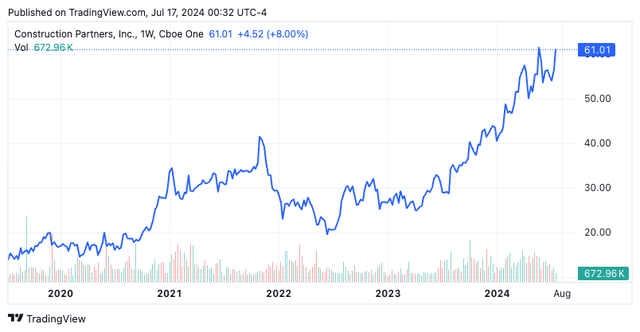

I am a hold on ROAD due to – 1) tailwinds are industry-related, not idiosyncratic [economics lag higher quality peers with <10% ROICs, <5% NOPAT margins, <2x capital turns], 2) the company’s ‘ROAD-map 2027’ (herein: Roadmap) goals which call for (a) +15% to 20% annualized sales growth and (b) 13-14% pre-tax margins by 2027, and 3) valuations that look highly stretched [>3.5x EV/IC and still >45x NOPAT], thus the calculus is skewed away from our favour in my view.

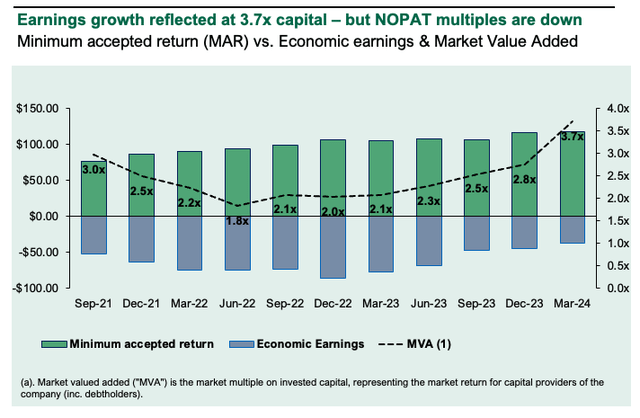

Note: You can see the uptick in market value coinciding with the IIJA’s

TradingView

Business economics

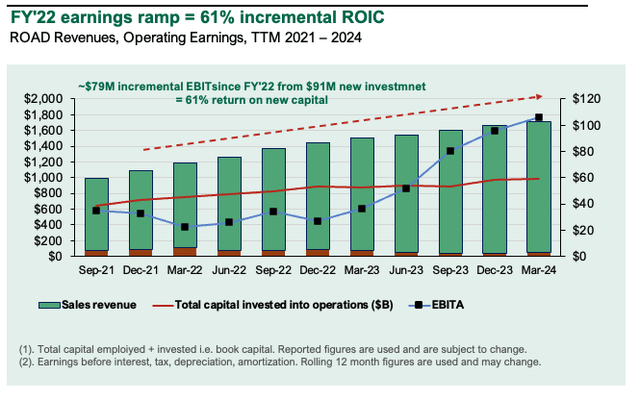

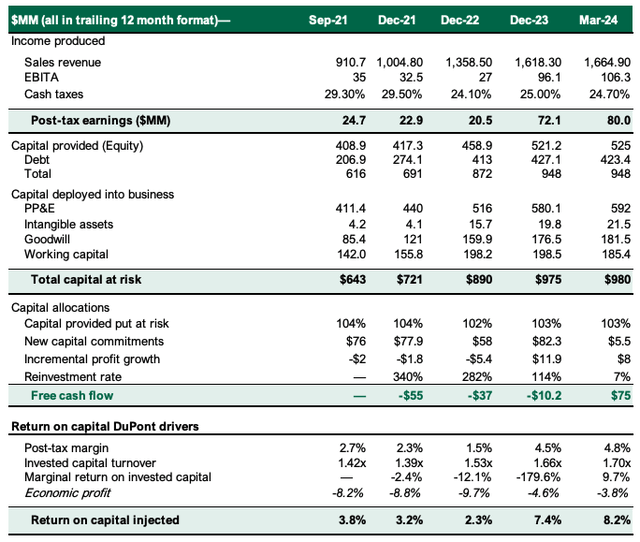

Since December ’22, ROAD’s EBIT is +$79mm from just $91mm incremental investment and sales are +$300mm to $1.66Bn in the trailing 12 months (Figure 1). This ties in directly to the IIJA which has produced ~61% incremental ROIC from FY’22-date (inc. FY’22 numbers). The fact returns on new capital are so high is a major standout that supports the +40% growth in ROAD stock this YTD with earnings growth + multiples expansion. Management said that it sees “the IIJA funding translating to work in the field”.

Figure 1.

Company filings

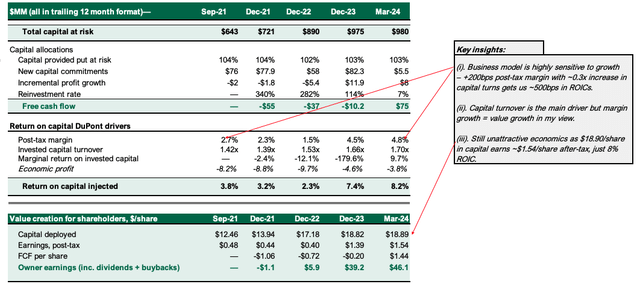

As it relates to the company’s value drivers:

- The business model is highly sensitive to margin growth [post-tax margins are +200bps with ~0.3x increase in capital turns since FY’21]. This gets us ~500bps in ROICs. Despite this, capital turnover is the main driver at ~1.7x [implying $1 capital rotates ~$1.70 in sales]. As such, margin growth = value growth for ROAD in my view.

- Still, the economics are unattractive as $18.90/share of capital put to work in the business earns ~$1.54/share after-tax, just 8% ROIC (Figure 2). If passive benchmarks are expected to return ~10-12% pre-tax and this is the opportunity cost, ROAD is eroding ~400bps value p.a. under these assumptions. Therefore, despite 1) IIJA tailwinds, 2) more extensive runway to deploy funds, and 3) realizing higher margins on the earnings produced by these reinvestments, my opinion is there is no idiosyncratic competitive advantage period. The baton must be passed to multiples to drive the stock to outsized returns from FY’24 onwards, in my view.

Figure 3.

Company filings

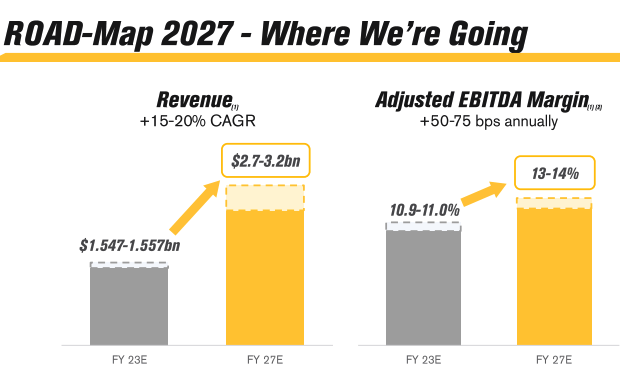

Potential catalysts

- The company’s Roadmap 2027 goals, announced in FY’23, project ~15-20% annualized sales growth in the next 3yrs – this may be a tailwind. ROAD books revenues from both public and private infrastructure projects. Its public exposures are funded by federal, state, and local governments. It’s within the performance band – Q2 FY’24 TTM sales are $1.6Bn vs. $1.44Bn in ’23 (+15.5% YoY growth) and consensus eyes ~17% sales growth this year. Q2 FY’24 sales were +14.3% to $371.4mm. The breakdown included 1) $25.1mm growth from recent acquisitions and 2) ~$21.4mm growth from its existing from existing markets. It booked ~3.3x gross leverage on this with gross profit +47.6% to ~$38mm. Management deserves high marks if it hits these growth targets.

- ROAD’s contract backlog stands at $1.8Bn as a reflection of 1) its current runway to deploy funds and 2) IIJA tailwinds mentioned earlier [it inc. ~$1.4Bn of uncompleted work and ~$0.4Bn of low bid/no contract projects]. Thus, the revenue ramp is strong along with visibility. Management projects $1.8-$1.9Bn in sales this year on adj. EBITDA margins of ~12%. As such, management’s job is to convert on the backlog, as the market is absolutely expecting the 15-20% sales growth moving forward.

Figure 3a.

Construction Partners Website

Fairly valued with downside risks

With the combination of 1) +500bps ROICs since ’21, 2) +61% incremental ROICs [indicating its newer investments are >valuable than its legacy work] and 3 the tailwinds mentioned, I question if the market has captured these drivers with the stock at 3.7x EV/IC and ~45x NOPAT (Figure 4). My view is, the hurdle is set tremendously high and investors absolute bank on the Roadmap 2027 figures at current values. To trade beyond here at above-market rates we need ROAD >48x NOPAT in my opinion, quite the ask with <5% NOPAT margins, <2x capital turnover and <10% ROICs.

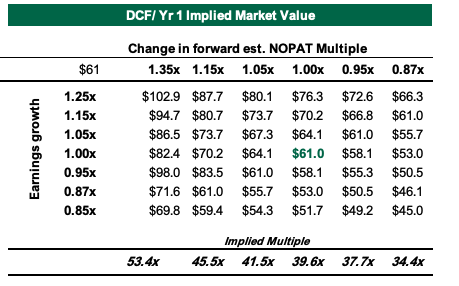

Figure 4.

Company filings

Valuation insights

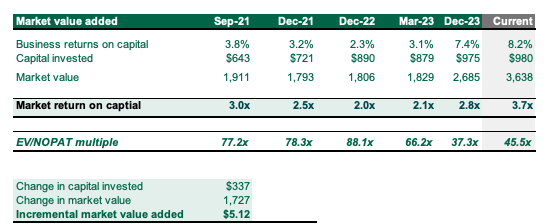

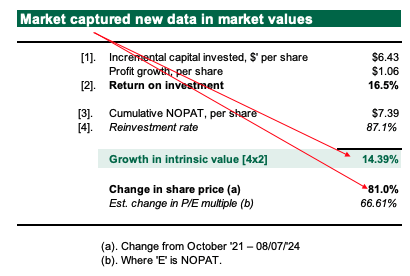

- Investors have reflected 1) the +$100mm incremental capital and 2) $80mm EBIT since FY’22 valuing the company at 3.7x EV/IC vs. 2x back then (Figure 5). Interestingly, as earnings have lifted multiples of NOPAT compressed from ~88x to lows of 37x in FY’23. Each $1 of capital management threw back in the business from FY’21-’24 produced ~$5.10 in market value but just $1.06/share [investors placed a 4.8x multiple on these earnings, i.e. $5.10/$1.06 = 4.8x]. Management reinvested ~87% of earnings [corroborates the IIJA tailwind] thus producing ~15% growth in the business (Figure 5) leading me to believe P/NOPAT expansion explained ~2/3 of the price change. As said, embedded expectations are tremendously high.

Figure 4.

Company filings, author

Figure 5.

Company filings

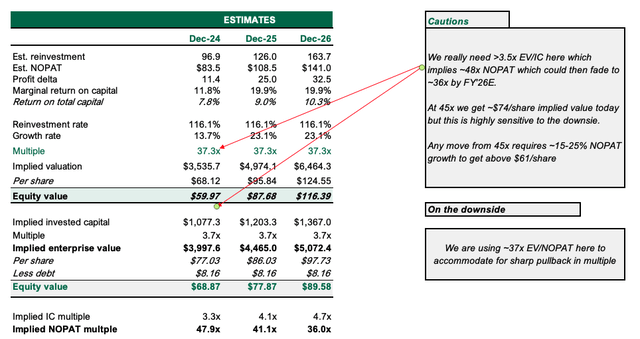

- We really need ROAD >3.5x EV/IC to trade off its current range which = ~48x NOPAT and thus more expansion from here – the question is how feasible this is. The stock has traded well beyond this range before as mentioned but ~13% capital-adjusted NOPAT growth in FY’24 gets us to ~37x implied, suggesting the stock is fairly valued (Figure 6). At 45x my FY’24 estimates [see: Appendix 1, Appendix 2], this gets me to ~$74/share today. My concerns are 1) if the multiple contracts >5% on either earnings growth or revised sentiment, we 2) need >25% earnings growth to accommodate this (Figure 7). I place an even-weight probability of this occurring. Hence, the risk/reward calculus is heavily skewed away from our favour – I want names where multiples contraction has a negligible outcome on the probabilities.

Figure 6.

Author

Figure 7.

Author’s estimates

Based on these factors, my view is the market has fully captured 1) the IIJA tailwinds, 2) ROAD’s margin growth, 3) the Roadmap 2027 plans, and 4) the +500bps ROICs well in its current market values. This supports a hold.

Risks to thesis

Downside risks to the thesis include 1) not hitting the 15% min. sales growth as part of its plan, 2) sharp slowdown in infrastructure spending, 3) ROICs compressing down to 7% or less, and 4) multiples contraction below 37x NOPAT.

On the upside, I’ve modelled 14% avg. sales growth to FY’26 with 4.5% pre-tax margins, so anything above these figures could make my valuation seem overly pessimistic.

Investors must know these risks in full.

In short

ROAD has benefitted immensely from industry-wide tailwinds that have driven ROICs +500bps since FY’21 and resulted in +40% gains in share price this YTD. Problem is, this isn’t idiosyncratic to the company and its fundamental economics haven’t improved to the extent where it deserves to trade >45x NOPAT in my view. There is no sensible way I could label myself paying those multiples with the lack of economic substance behind them (i.e.: ROICs, high margins or capital turnover, high FCF, and so on). As such, my view is the market has fully captured these upsides and the risk/reward calculus is heavily skewed out of our favour based on starting valuations. Rate hold.

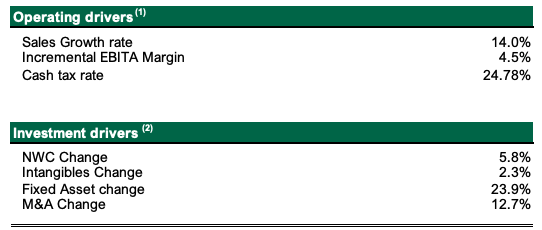

Appendix 1.

Author

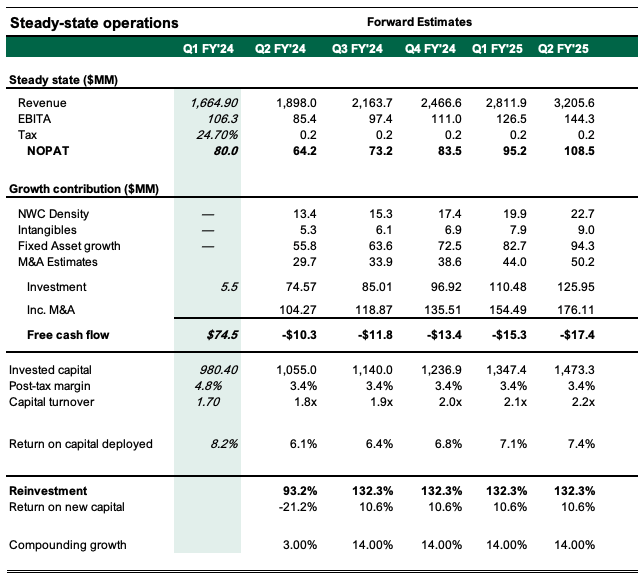

Appendix 2.

Author

Appendix 3.

Company filings

Read the full article here