Note:

I have covered Barnes & Noble Education, Inc. or “BNED” (NYSE:BNED) previously, so investors should view this as an update to my earlier article on the company.

Barnes & Noble Education Overview

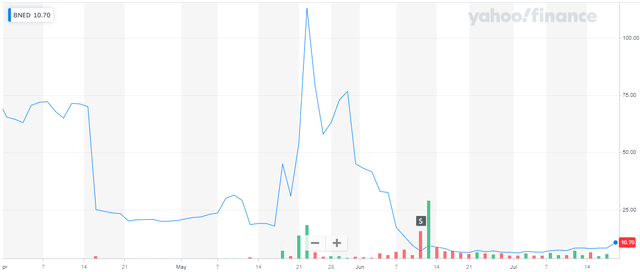

Over the past couple of months, shares of Barnes & Noble Education have been nothing short of a daytrader’s dream, with a recent, heavily dilutive recapitalization transaction and subsequent 1:100 reverse stock split having created plenty of volatility:

Yahoo Finance

While shareholders who decided to take part in the transaction have been rewarded handsomely, selling into the short-lived momentum rally in May would have resulted in even higher gains, particularly as the sale wouldn’t have impacted shareholders’ ability to exercise their subscription rights.

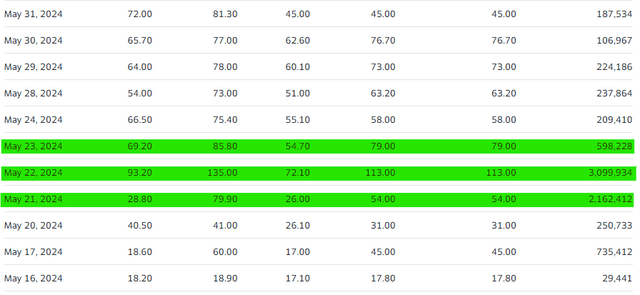

Yahoo Finance

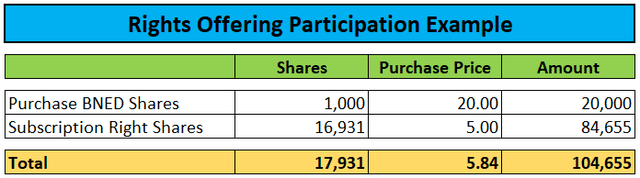

To provide an example (all numbers are on a reverse stock split-adjusted basis):

Purchasing 1,000 shares at $20 in late April would have resulted in the right to subscribe to 16,931 new shares at a price of $5 per share:

Author’s Calculations

Following the May 14 rights offering record date, shareholders were free to sell their original shares without impacting their subscription rights. In fact, they could have tried to hedge gains on their not yet allocated subscription shares by shorting into the momentum rally. However, shares were hard to borrow at that time, so I won’t assume a successful short sale in my example.

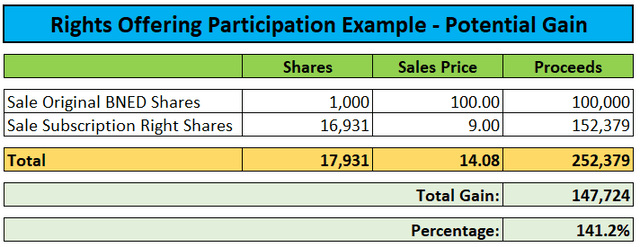

But selling the original 1,000 shares at an assumed price of $100 on May 22 would have resulted in an $80,000 gain alone. Selling the subscription shares on June 13 at an assumed price of $9 would have resulted in an additional $67,700 gain:

Author’s Calculations

In total, purchasing BNED ahead of the record date and opportunistically selling the original position into the momentum rally while disposing of the subscription right shares subsequent to the 1:100 reverse stock split on June 11, could have yielded a 140%+ return.

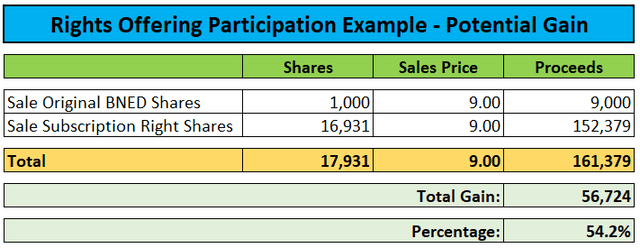

But even without selling the original position into the momentum rally, the potential gain would still calculate to more than 50%:

Author’s Calculations

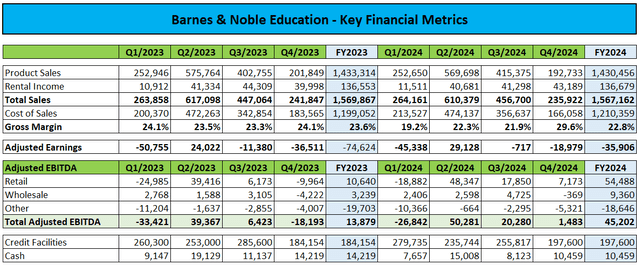

Two weeks ago, the company reported fourth quarter and full fiscal year 2024 results with FY2024 Adjusted EBITDA of $45 million exceeding management’s stated target of $40 million by 12.5%:

Company Press Releases / Regulatory Filings

Revenue generated by the company’s BNC First Day equitable and inclusive access programs increased by $127 million or 37% year-over-year, thus offsetting declines in other parts of the business. Barnes and Noble Education continues to focus on expanding First Day program adoptions and anticipates further growth in FY2025.

After the successful close of the recapitalization transaction, lead investor Immersion Corporation or “Immersion” (IMMR) owns 42.0% of the company’s outstanding common shares while strategic service providers Fanatics Retail Group Fulfillment, LLC and VitalSource Technologies, Inc. own 17.1% and 12.3% respectively following the conversion of $34 million in term loans into new common equity.

Immersion is currently sitting on a $55+ million gain on its stake in BNED, with the total value representing close to 30% of the company’s $385 million market capitalization.

As a result of the recapitalization transaction, cash flows should benefit from substantially lower average debt levels going forward. In combination with further improvements in profitability, free cash flow might turn positive in FY2025.

Pro forma for the recapitalization transaction, current enterprise value calculates to approximately $350 million. Assuming Adjusted EBITDA increasing to $60 million in FY2025, BNED’s forward EV/Adjusted EBITDA multiple of below 6 doesn’t look particularly demanding.

However, the federal government’s recently announced plan to end automatic textbook fees remains a major overhang for the company.

If the current practice will indeed be changed from an “opt-out” to an “opt-in” model, the company’s business model would be in jeopardy.

While the plan is facing strong opposition from publishers and university leaders, the Department of Education is likely to stay the course.

The next step would be for the department to formally propose changes through publication in the Federal Register with a public comment period.

Please note that any regulatory change won’t take effect until July 2025 at the earliest.

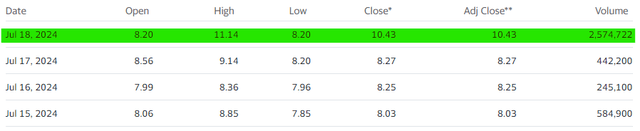

However, with an estimated free float of just 8 million shares, the stock is likely to attract momentum traders from time to time. On Thursday, shares rallied to new post-recapitalization transaction highs on massive volume, with potential follow-through on Friday and going into next week.

Yahoo Finance

While this setup might appeal to speculative investors and traders, the above discussed overhang should keep more conservative investors sidelined.

Bottom Line

Following the recent recapitalization transaction, Barnes & Noble Education has become a financially stronger company with the potential to generate free cash flow in FY2025.

With more than 70% of the company’s outstanding shares now owned by strategic investors, the small free float is likely to attract momentum traders from time to time. Thursday’s break-out to new post-recapitalization highs might very well result in some follow-through on Friday and going into next week.

However, the proposed end to automatic textbook fees remains a major overhang for the company.

Given the potential make-or-break character of the proposed changes, I prefer to remain on the sidelines.

Consequently, I am keeping my “Hold” rating on the shares.

Read the full article here