Investment Thesis

I am still unhappy with the share of Four Corners Property Trust’s (NYSE:FCPT) largest tenant in its ABR. However, I appreciate the Company’s efforts to diversify its tenant structure, especially given the positive investment spreads. I am a long-term investor with a buy-and-hold approach (unless material adverse change occurs), so I don’t feel comfortable allocating my resources to FCPT – I prefer some of its competitors. Yes, FCPT has strong business metrics regarding occupancy rate, WALT, and a solid balance sheet featuring a fixed-rated structure, no upcoming debt maturities until November 2025, and solid fixed charge coverage.

However, FCPT is accompanied by elevated risk in the case of its major tenant issues, which I don’t believe is reflected in its valuation. Its peers share FCPT’s strengths and have similar valuations but don’t share its largest weakness, which I believe justifies the fact that I prefer to allocate my capital to FCPT’s peers rather than FCPT. Nevertheless, FCPT may be considered a ‘hold’ for those who believe the diversification of the tenant structure will proceed and are willing to withstand a potential share price volatility resulting from any premise related to the potential tenant issues.

For transparency, once again – FCPT certainly has several strengths and could be considered a “hold” for more risk-tolerant investors who believe in their ongoing diversification attempts. I would not recommend holding a substantial share of the portfolio allocated to FCPT nor buying the Company, especially given the valuation when compared to its peers.

Introduction

Since I last covered FCPT, when I pointed out the high tenant concentration as my major concern, FCPT realized six acquisitions. None was related to their most significant (~51% of ABR as of March 2024) tenant – Darden Restaurants (DRI). I’ve decided to review these transactions and refresh my take on FCPT, as the Company upholds strong business metrics. Its annual rent escalators remain within the typical 1% to 2% range and amount to 1.4%, which is an important growth factor – especially when combined with the triple net lease characteristic, which involves tenants covering the substantial part of the costs related to operating and maintaining the property. As a result, even seemingly low-rent escalators tend to heavily impact the bottom line. FCPT has a high occupancy rate of 99.6%. For reference, the above metric stood at:

FCPT also had a WALT of 7.6 years, which was below the level recorded by its competitors but at a solid level nonetheless. Its credit metrics were generally in line with those of ADC, EPRT, or NNN. With a BBB-rated balance sheet, fixed-rated debt structure, and solid fixed charge coverage, FCPT’s shareholders may sleep sound regarding its credit situation. Its debt maturity schedule is not especially ‘long-term’, but there is no debt maturing until November 2025, so the impact of the high interest rate environment on FCPT remains limited. For details, please review the table below.

| FCPT | ADC | EPRT | NNN | |

|---|---|---|---|---|

| Credit rating | BBB | BBB | BBB | BBB+ |

| Fixed-rated debt share in total debt | 95% | 88.9% | 100% | 97% |

| Fixed charge coverage ratio | 4.3x | 4.9x | 5.9x | 4.3x |

| Weighted avg. debt maturities | 4.5 | 7 | 4.7 | 11.8 |

Its dividends yielding ~5.1% are well-covered, with a forward-looking AFFO payout ratio of ~80.4%. FCPT has recently paid $0.345 DPS for Q2 2024 on July 15, 2024. It was the third dividend in a row of such a level, and given FCPT’s DPS history, I expect another increase coming for Q3 2024.

Investment activity

Since my last coverage of FCPT was published on May 30th, the Company closed six transactions:

- $1.9m investment volume – BluePearl Pet Hospital Property

- $2.0m investment volume – National Veterinary Associates Property

- $2.4m investment volume – Mavis Tire Property

- $3.8m investment volume – Mercy Health Clinic Property

- $3.0m investment volume – MercyOne Outpatient Clinic Property

- $2.5m investment volume – Buffalo Wild Wings Property

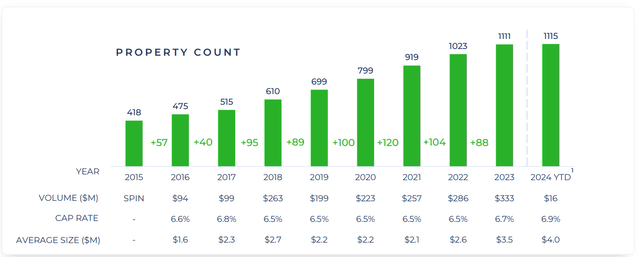

FCTP realized impressive investment volumes in recent years (e.g. $333m in 2023).

FCPT Investor Presentation

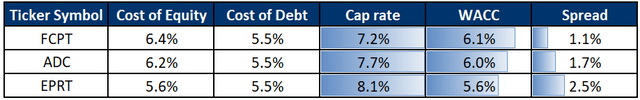

The $16m investment volume regarding 2024 YTD was presented as of March 2024. Considering the acquisitions announced since then, FCPT has so far realized ~$64.3m of investment volume in 2024. Considering that we are in the second half of July, FCPT will probably record its first acquisition volume decline on a year-over-year basis since 2019. However, that is not necessarily a bad thing. FCPT is small enough to remain highly selective in terms of its acquisition targets, as it doesn’t have to realize such extensive investment volumes to keep on growing. Considering the high interest rate environment and, thus, the relatively wide disparity between buyers’ and sellers’ expectations, I am not overly concerned with that. Nevertheless, it’s a factor worth looking out for in the future, as the Company has already proved its capability of sourcing and closing deals under such economic conditions. Also, FCPT has improved its cap rates on acquisitions as the transaction on MercyOne Outpatient Clinic was priced at a 7.2% cap rate, the BluePearl Pet Hospital acquisition had a cap rate of 7.9%, and the Mercy Health Clinic transaction was priced at a 7.1% cap rate. Let’s briefly look at the investment spreads of FCPT compared to ADC and EPRT. FCPT doesn’t publish AFFO per share guidance. Considering the AFFO per share CAGR recorded during the 2019 – 2023 period equal to 4.2% and given its relatively slower growth in 2023 (1.8% on a year-over-year basis), let’s assume a 3% growth for 2024 vs 2023 – therefore AFFO per share of $1.72. By dividing it by FCPT’s stock price, we arrive at the cost of equity of 6.4%. I’ve assumed the cost of debt based on FCPT’s credit rating. Analogically, regarding ADC and EPRT, I used their midpoint 2024 guidance regarding AFFO per share. For details, please review the table below. For FCPT, I’ve also assumed an improved (over its Q1 2024 investment activity) cap rate of 7.2%.

Author based on Seeking Alpha, FCPT, ADC, and EPRT

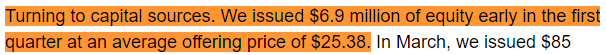

Naturally, the above calculation is for illustrative purposes as it is sensitive to assumptions, especially regarding the cost of equity. Each of the above companies is capable of realising positive spreads on investments. While ADC and EPRT look especially attractive in that regard, I consider FCPT’s spread as solid. Considering the fact that FCPT’s stock price increased, the management may be more eager to use equity to finance its operations. During Q1 2024, FCPT issued $6.9m of equity at an average price of $25.38 per share – with a higher share price, FCPT can gather more proceeds with the same dilution effect. I’m looking forward to their summary of capital sources published upon the Q2 2024 earnings release and moving further – to see how the management approaches tapping into the capital market given a currently higher share price.

FCPT Q1 2024 Earnings Call

Using the opportunity – ideally, I’d like to be able to gather more details of each acquisition (e.g. cap rate), as FCPT sometimes provides this metric and sometimes provides a vague comment:

The transaction was priced at a cap rate in range with previous FCPT transactions.

Valuation Outlook

As an M&A advisor, I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking. Considering that the forward-looking P/FFO multiple stood at:

- 16.2x for FCPT

- 16.3x for ADC

- 16.2x for EPRT

- 13.9x for NNN

I believe that NNN is substantially underappreciated by the market, but that’s a topic for another discussion. Looking at FCPT, ADC, and EPRT – I prefer ADC and EPRT as they share key strengths of FCPT and, at the same time, are not accompanied by its greatest risk regarding the high tenant concentration. I believe there should be a gap between FCPT’s and ADC’s / EPRT’s multiples, which is not currently present. Either way, I believe each of the selected FCPT’s competitors will outperform the Company in the upcoming years and create a valuation gap that, in my opinion, is missing.

Key Takeaways

Strengths & Opportunities

- high occupancy rate

- decent annual rent escalators

- solid WALT

- fixed-rate-oriented debt structure

- solid fixed charge coverage ratio

- impressive investment activity (high volumes) in recent years

- acquisitions oriented for further diversification regarding the tenant structure

- no debt maturities until November 2025

Weaknesses & Risk Factors

- FCPT’s largest weakness and risk factor is related to its high tenant concentration. Any potential issues of the Top 1 tenant would impact FCPT significantly harder than, for example, ADC or EPRT. Therefore, I believe that there’s more price volatility and a valuation gap to be expected

- Should the high interest rate environment be upheld until late 2025, FCPT could be forced to refinance at a higher cost, which would negatively impact its AFFO per share growth

- High valuation when compared to its competitors with a safer business model

- There has been a lower investment volume than in recent years. I don’t consider this a burning issue; however, investors should keep an eye on it—especially given the attempts to diversify the tenant structure. Should the Company lose its ability to realise such significant investment volumes, I believe the key reason for holding FCPT would vanish.

Read the full article here