Investment Thesis

Teladoc (NYSE:TDOC) is set to report its Q2 2024 results next week, Wednesday, after hours.

Having been bearish on Teladoc stock for some time, I now no longer believe it makes sense to sustain this bearish outlook. Even as I recognize that Teladoc today operates as a shadow of its former self, I nevertheless contend that this insight has already been priced into its stock.

At approximately 5x next year’s free cash flow, there is a better risk-reward than there’s been in quite some time. Therefore, I now change my mind and upgrade my rating from a sell to a neutral stance. Even as I start to turn optimistic about the future.

Rapid Recap

Back in February, I said,

I want to be clear, that the problem with Teladoc is not that the stock is expensive. Indeed, I make it clear that paying 13x forward free cash flows is not expensive.

Rather, the problem here is that this business’ growth rates have petered out as Teladoc moves to the ex-growth part of its cycle.

Elements that were previously a vexing detraction, such as its elevated stock-based compensation will now gain a life of themselves.

I believe that in the next twelve months, investors will look back to $16 per share as a high price to aspire towards.

All in all, I recommend selling TDOC stock.

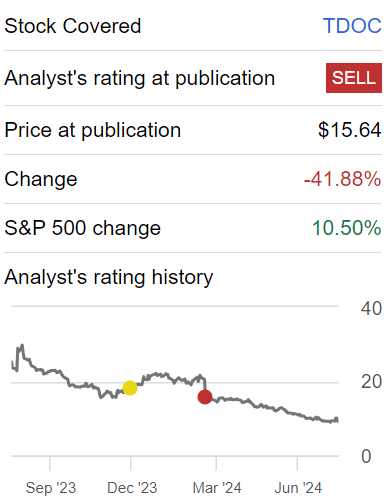

Author’s work on TDOC

Since I issued a sell on TDOC, the stock has dropped 42%, underperforming the S&P500 by nearly 50 percentage points in a few months. A terrific call, I’m confident you’ll agree. And now, here’s why I’ve changed my mind.

Teladoc’s Near-Term Prospects

Teladoc provides virtual healthcare services, connecting patients with healthcare professionals through online platforms. They offer a range of services, including primary care and mental health support, aimed at delivering care without the need for in-person visits. Teladoc seeks to make healthcare more convenient for patients.

However, Teladoc faces challenges, in maintaining growth (more on this soon). What’s more, Teladoc is in a period of transition, under its new CEO while ensuring that strategic initiatives continue without disruption. We will undoubtedly hear more about Teladoc’s CEO’s plans in its upcoming earnings call.

This leadership change comes at a critical time as the company aims to accelerate growth, which requires strong leadership to regain investor confidence.

Additionally, Teladoc must navigate the complexities of integrating new clients and maintaining high enrollment rates in their chronic care programs, all the while managing the operational and strategic shifts that come with a new leadership approach.

Moreover, Teladoc’s BetterHelp segment, which focuses on mental health services, has been under pressure with declining revenues and challenges in user acquisition costs. The company has seen a decline in paying users and has had to adjust its advertising strategies to balance growth and profitability.

Given this context, let’s now delve into the main bearish argument facing Teladoc.

Revenue Growth Rates Moderate to Mid-Single Digits

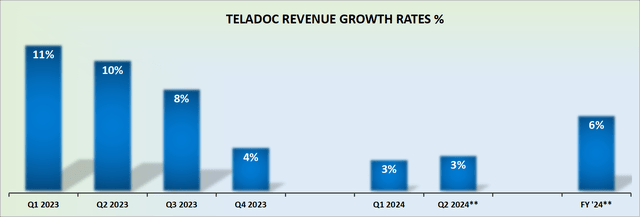

TDOC revenue growth rates

The graphic above depicts the hard truth — Teladoc is no longer a growth company. This is a company that is likely to see some acceleration on its topline in the back half of 2024, but that’s simple since its comparables suddenly ease up.

As it stands, I suspect that Teladoc’s growth rates will moderate to the mid-single digits, in the medium term.

Consequently, I recommend that investors do not overly obsess with the share price chart, and ponder and deliberate over where the share price was last year and price anchor to where it could return in time.

In fact, one of my top bits of advice for my friends and followers is never to look at where the share price was as an indication of where it could go. This plays out in more ways than one. But suffice it to say, ultimately, the share price will approximate the expectations that free cash flow will head towards. And everything else is a distraction. With this in mind, let’s discuss its valuation.

TDOC Stock Valuation — 5x Free Cash Flow

Teladoc makes the case that by 2025, it will be on a path towards approximately $450 million of EBITDA. Of that figure, roughly speaking, $150 million will be plowed back as either capex or capitalized software.

Therefore, in the best case, Teladoc promises investors about $300 million of free cash flow next year. That’s the carrot for investors.

This leaves Teladoc priced at 5x free cash flow. Yes, I acknowledge that Teladoc carries approximately $1.5 billion of convertible notes. And yes, its balance sheet also has other pesky minimal liabilities laying claim to its $1.1 billion of cash and equivalents.

However, when all is said and done, its balance sheet, while far from blemish-free, isn’t in such a bad state that it can’t be repaired with a little time and concrete focus.

Hence, under this consideration, even as I recognize that Teladoc has several obstacles that it must overcome to stabilize its operations, I can no longer keep a sell rating on its stock. Thus, I’m now neutral.

The Bottom Line

In conclusion, paying 5x forward free cash flow for Teladoc is already pricing in a multitude of negative factors, including its moderated growth rates, leadership transitions, and challenges within its BetterHelp segment.

This valuation suggests that the market has already accounted for the company’s current operational hurdles and its journey from a growth stock to a more mature phase.

With Teladoc’s balance sheet being manageable and its future free cash flow projections indicating potential stability, the stock presents a more balanced risk-reward profile than previously. Therefore, maintaining a bearish outlook seems unwarranted at this juncture.

In essence, it appears that Teladoc’s valuation has gone through quite a “check-up” already and is now healthier.

Read the full article here