As many of my loyal followers and readers know, I’m a big fan of the net lease juggernaut known as Realty Income (O).

I’ve been a shareholder in the San Diego-based REIT for over a decade, and I’ve witnessed the evolution of the company – from a small landlord to Taco Bell to a gigantic net lease consolidator with over 15,500 properties in all 50 states and Europe.

Based on fundamentals, there is little doubt that Realty Income deserves space in an intelligent REIT portfolio.

The stalwart REIT has paid and increased its dividend for over 30 years in a row and has achieved 4.3% annualized dividend growth since 1994.

Yet, despite these impressive statistics, Realty Income has become the topic of debate over its size.

Some pundits argue that Realty Income is too big and that the company will not be able to grow at the same impressive rate it has in the past.

While I disagree with this argument, I’ll save that for another article.

Instead, I wanted to focus on two terrific alternatives that I have been allocating my hard-earned capital to.

Realty Income is still my largest REIT holding; however, these two REITs are gaining ground, and you will see why based on the research our team put together below.

Agree Realty (ADC)

Agree Realty is a real estate investment trust (“REIT”) focused on the development and acquisition of freestanding commercial properties that are net leased to leading retailers.

ADC looks to develop and acquire properties used in retail industries that are resistant to e-commerce and resilient against recessions. To that end, the company targets properties used by retailers that sell durable goods, or that provide necessity-based goods & services.

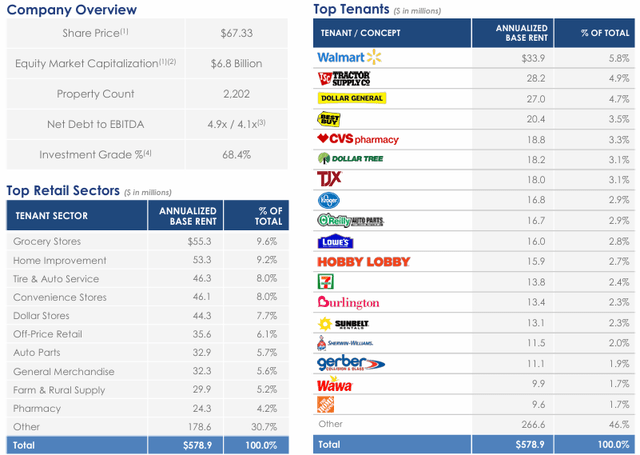

The company’s largest retail sector is grocers, which make up approximately 9.6% of its annualized base rent (“ABR”), followed by home improvement and auto service, which make up 9.2% and 8.0%, respectively.

In addition to targeting defensive retail industries, the company strategically looks for fungible properties that can be used across multiple retail sectors, rather than acquiring single-purpose assets that require a particular type of tenant, such as a bowling alley or car wash.

The company also places a large amount of emphasis on the quality of its properties and its tenants. The vast majority of ADC’s tenants are national or super-regional retailers, and roughly 68% of the company’s ABR is derived from tenants with an investment-grade credit rating.

ADC’s top tenants are well-established and include high-quality companies such as Kroger, TJX, Lowes, Home Depot, Wawa, and 7-Eleven. The company’s largest tenant is Walmart, which makes up 5.8% of its ABR, followed by Tractor Supply and Dollar General, which make up 4.9% and 4.7%, respectively.

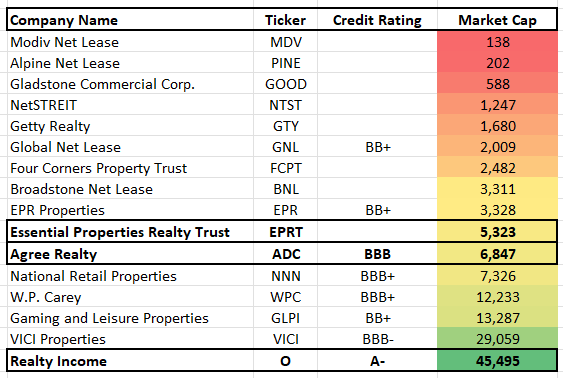

Agree Realty has a market cap of approximately $6.8 billion and a 45.8 million SF portfolio made up of 2,202 retail properties located across 49 states.

At the end of 2Q-24, the company’s portfolio was 99.8% leased and had a weighted average lease term (“WALT”) of approximately 8.1 years.

ADC IR

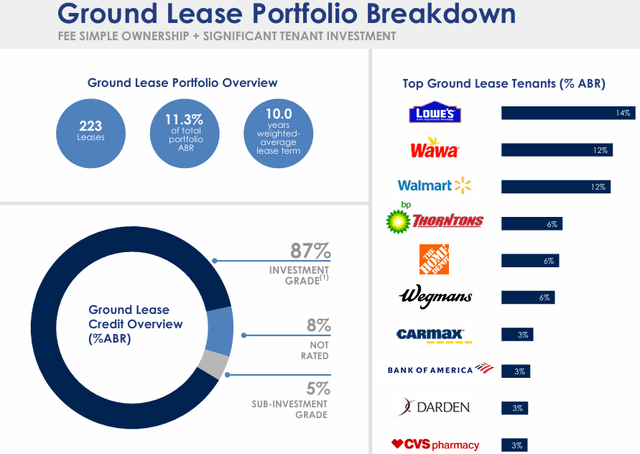

In addition to its net lease portfolio, the company has a ground lease portfolio that consists of 223 leases located in 35 states that cover roughly 6.1 million SF of gross leasable area.

Its ground lease portfolio is 100% occupied, has a WALT of roughly 10 years, and roughly 87.3% of the ground lease ABR is generated by investment grade tenants. At the end of 2Q-24, the company’s ground lease portfolio made up 11.3% of its total portfolio ABR.

ADC IR

The company released its 2Q-24 operating results in July and raised its full-year acquisition guidance to approximately $700.0 million and its 2024 AFFO per share guidance to $4.11 – $4.14.

Total revenue during the quarter was reported at $152.6 million, compared with total revenue of $130.0 million in the second quarter of 2023.

Core FFO during the second quarter was reported at $104.2 million, or $1.03 per share, compared to Core FFO of $91.4 million, or $0.98 per share in 2Q-23. On a per share basis, the change in Core FFO represents a year-over-year increase of 5.7%.

AFFO in 2Q-24 came in at $105.3 million, or $1.04 per share, compared to AFFO of $91.8 million, or $0.98 per share for the comparable period in 2023. On a per share basis, the change in AFFO represents a year-over-year increase of 6.4%.

2Q-24 acquisition volume was roughly $185.8 million and consisted of 47 properties acquired at a weighted average cap rate of 7.7%. The acquisitions made in the second quarter have a WALT of ~9.3 years, and roughly 59% of the ABR acquired in 2Q-24 comes from investment grade tenants.

2Q-24 dispositions include 10 properties sold for roughly $36.9 million at a W.A. cap rate of 6.4%.

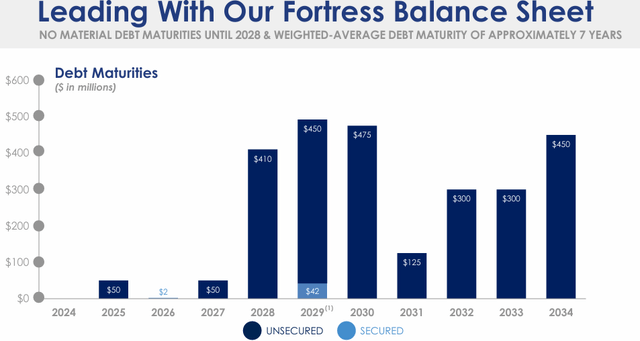

Capital market activities during the second quarter include a $450 million public bond offering the company completed with an effective yield to maturity of 5.779%. ADC also received commitments to increase its credit facility from $1.0 billion to $1.25 billion and entered into forward sale agreements to sell 3.2 million shares of stock for proceeds of $194.5 million.

At the end of 2Q-24, Agree Realty had total liquidity of more than $1.4 billion which consisted of cash, outstanding forward equity, and undrawn capacity under its revolving credit facility.

ADC provided an update on its financial condition and reported net debt to EBITDA of 4.9x and a fixed charge coverage ratio of 4.7x.

Additionally, the company has an investment grade balance sheet with a BBB credit rating and has no significant debt maturities until 2028.

ADC IR

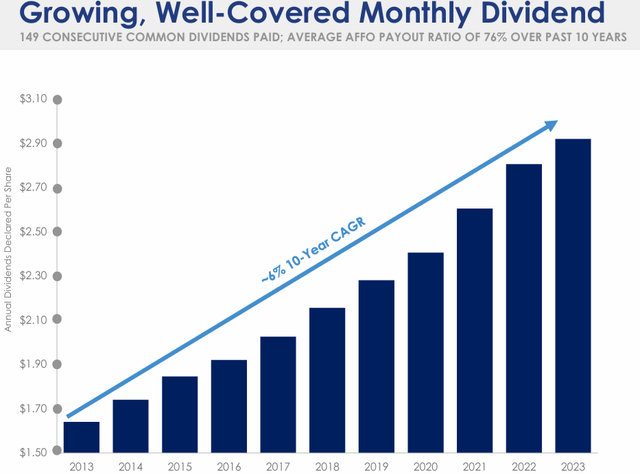

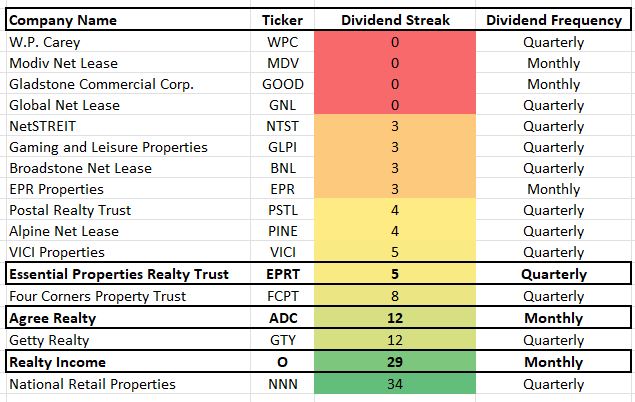

Agree Realty pays a monthly dividend and has an excellent track record of consistency and growth.

From 1994 to 2020 the company paid dividends on a quarterly basis and made 107 consecutive quarterly payments before changing to a monthly dividend.

Since the change, ADC has made 42 consecutive monthly payments for a total of 149 consecutive common dividends paid.

The company increased its dividend each year between 2013 & 2023 and delivered a 10-year compound average dividend growth rate of approximately 6% over this period.

ADC managed to increase its dividend each year over the past decade while maintaining an average AFFO dividend payout ratio of 76%, which is a conservative level and easily covers the dividend.

ADC IR

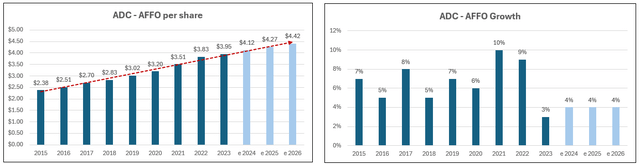

ADC’s dividend is supported by its investment-grade balance sheet and the consistency of its earnings. The company has delivered positive AFFO per share growth in each year between 2015 and 2023 and has achieved a blended average AFFO growth rate of 5.91% over this period.

Analysts expect AFFO per share to increase by 4% in 2024 and then increase by 4% in both 2025 & 2026.

FAST Graphs (compiled by iREIT)

Agree Realty has arguably the highest quality portfolio and tenant base in the net lease space.

The company has an excellent management team with a clear vision and defined strategy of owning and leasing fungible commercial properties to top retailers in defensive industries.

ADC has an investment grade balance sheet with excellent debt metrics, and its monthly dividend is supported by the steady and dependable cash flows generated by over 2,000 properties.

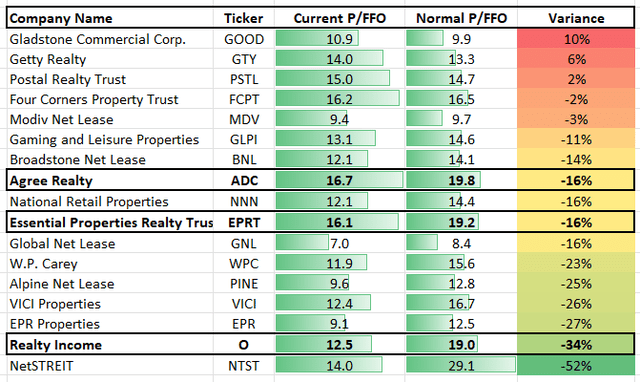

Agree Realty pays a 4.42% dividend yield that is well covered with a 2023 AFFO payout ratio of 73.90% and its stock is currently trading at a P/AFFO of 16.78x, compared to its average AFFO multiple of 18.52x.

We rate Agree Realty a Buy.

FAST Graphs

Essential Properties Realty Trust (EPRT)

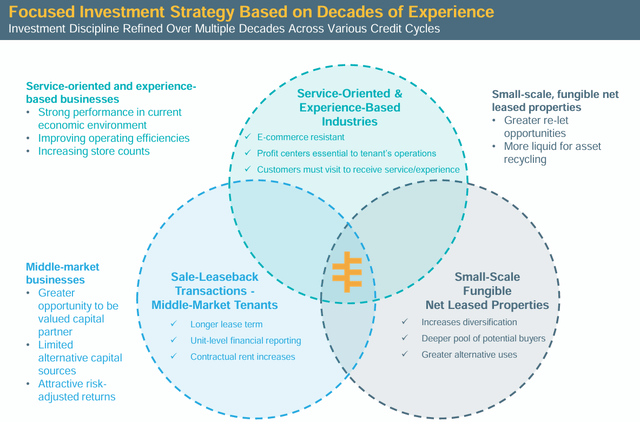

EPRT is a net lease REIT that specializes in the acquisition, ownership, and management of single-tenant commercial properties which are leased to middle-market companies that operate in service-oriented and experienced-based businesses.

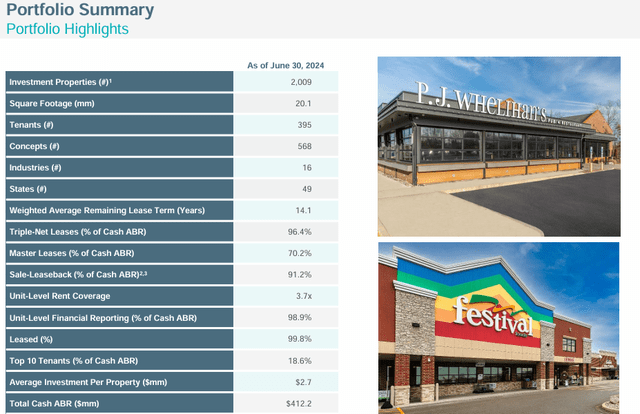

The company has a market cap of approximately $5.3 billion and a 20.1 million SF portfolio made up of 2,009 properties that are leased to 395 tenants operating in 16 industries across 49 states.

EPRT focuses on middle-market companies that provide a service or offer an experience. Some of the industries it targets include restaurants, both quick service and family dining, car washes, medical services, dental services, automotive services, early childhood education, convenience stores, and health & fitness.

The company’s largest industry is car washes which represent 15.1% of its portfolio, followed by early childhood education and medical/dental offices which represent 11.3% and 10.9%, respectively.

The net lease REIT believes that properties leased to service-oriented and experience-based operators are essential for the success and viability of the tenant’s business. A good example of this is a car wash operator. Without real estate, no cars could get washed.

Additionally, by their very nature, service-oriented and experienced-based types of businesses tend to be more insulated from the threat of e-commerce. At the end of 2023, roughly 93% of the company’s ABR was derived from tenants operating in service or experienced-based businesses.

As of the end of the second quarter, the company’s portfolio was 99.8% leased and had a WALT of 14.1 years.

EPRT IR

The majority of EPRT’s investments are acquired through the use of a sale-leaseback structure, rather than entire portfolio purchases or new construction.

The company’s sale-leaseback structure enables it to include favorable terms such as base rent escalation, requirements for unit-level reporting, and in some cases, requirements for corporate-level financial statements.

At the end of 2023, 98.8% of EPRT’s investments were made through a sale-leaseback structure.

Unit-level reporting is critical to mitigate risk, as EPRT’s focus is on middle-market or smaller companies without the same credit or resources as national retailers. By including requirements for unit-level reporting, EPRT is able to better access the health of its tenants.

At the end of 2023, EPRT’s portfolio had a weighted average rent coverage ratio of 3.8x and 98.8% of its leases included the requirement to provide unit-level financial reporting.

EPRT IR

Essential Properties released its 2Q-24 operating results in July and reported total revenue during the quarter of $109.3 million, compared to total revenue of $86.5 million in the second quarter of 2023.

Core FFO during 2Q-24 was reported at $84.2 million, or $0.47 per share, compared to Core FFO of $66.2 million, or $0.44 per share for the comparable period in 2023. On a per share basis, the change in Core FFO represents a year-over-year increase of 7%.

AFFO during the second quarter was reported at $77.1 million, or $0.43 per share, compared to AFFO of $61.9 million, or $0.41 per share in 2Q-23. On a per share basis, the change in AFFO represents a year-over-year increase of 5%.

2Q-24 acquisition volume was roughly $333.9 million and consisted of 83 properties acquired at a weighted average cash cap rate of 8.0%.

The acquisitions made in the second quarter have a weighted average lease escalation of 1.9% and a WALT of 17.8 years.

76% of the 2Q investments are subject to a master lease, 100% of the investments were made through sale-leaseback transactions, and 100% of the 2Q leases require financial reporting.

2Q-24 dispositions include 6 properties sold for roughly $4.8 million at a W.A. cash cap rate of 7.3%.

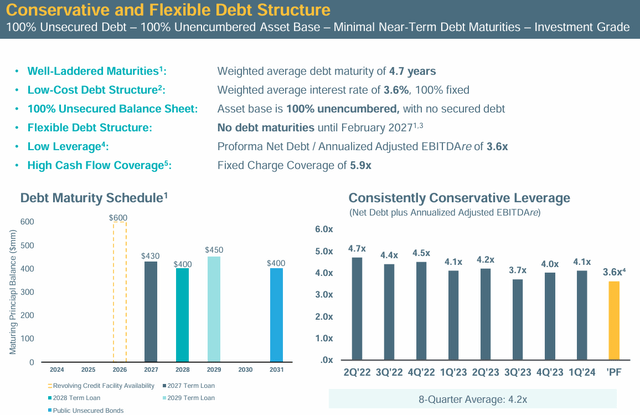

Essential Properties provided an update on its financial position and reported net debt to adjusted EBITDAre of 4.6x, or 3.6x on a pro forma basis, a fixed charge coverage ratio of 5.9x, and total available liquidity of $698.2 million, which includes cash and equivalents, revolver capacity, and unsettled forward equity.

EPRT has an investment grade balance sheet with a BBB- credit rating from S&P Global. The company’s asset base is 100% unencumbered with no secure debt, and all of its debt is fixed rate.

The company’s debt carries a W.A. interest rate of 3.6% and has a W.A. term to maturity of 4.7 years, with no debt maturities until 2027.

EPRT IR

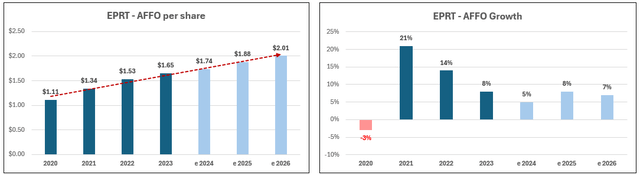

EPRT has delivered a blended average AFFO growth rate of 8.44% and an average dividend growth rate of 6.22% over the past 5 years.

AFFO per share fell by -3% in 2020, but the company generated positive AFFO per share growth each year since. In 2023, the company’s AFFO per share grew by 8% and analysts expect AFFO per share to increase by 5% in 2024, and then by 8% the following year.

FAST Graphs (compiled by iREIT)

EPRT pays a 3.87% dividend yield that is secure with a 2023 AFFO payout ratio of 67.88% and its stock is trading at a P/AFFO of 17.62x, compared to its average AFFO multiple of 18.70x.

We rate Essential Properties Realty Trust a Buy.

FAST Graphs

In Closing

I’m overweight net lease REITs.

Which simply means that I have positions in all of these REITs:

- Realty Income

- Agree Realty

- Essential Properties

- VICI Properties (VICI)

- Getty Realty (GTY)

Indirectly I also own shares in Broadstone Net Lease (BNL), Gaming and Leisure (GLPI), and NNN REIT (NNN) via my stake in my REIT ETF.

Given the highly fragmented orientation within the Net Lease REIT sector, I believe that this popular income alternative will deliver steady investor returns as a result of continued consolidation.

In addition, the larger REITs will capitalize on the abundance of sale-leaseback opportunities that can be sourced off the balance sheets of larger corporations like Tractor Supply (TSCO) and 7-Eleven.

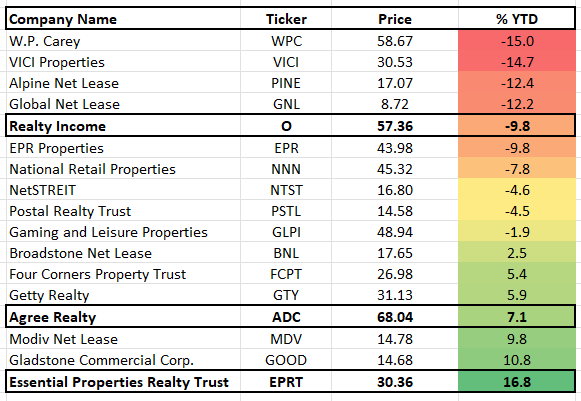

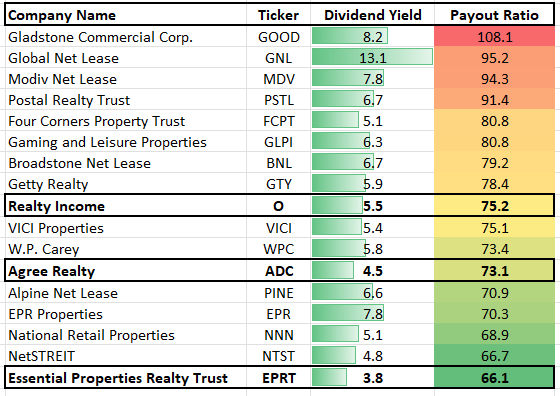

Now let’s examine the Data Duel:

iREIT®

iREIT®

iREIT®

iREIT®

iREIT®

Read the full article here