My top 10 things to watch on Tuesday, July 30

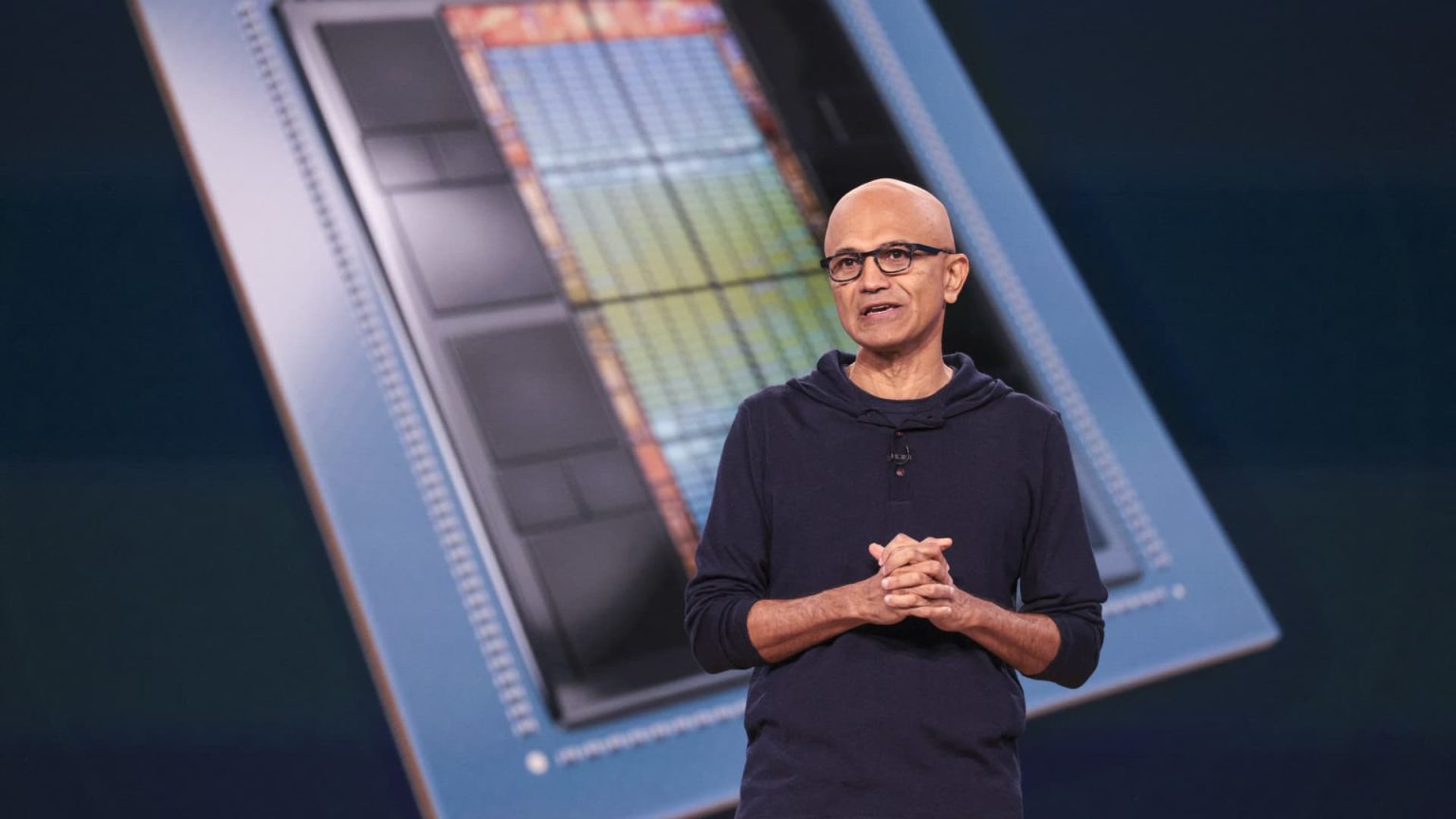

1. Wall Street was mixed Tuesday, heading into the continued onslaught of tech earnings. Microsoft and Advanced Micro Devices are out after the bell. Artificial intelligence spending will be in focus as investors debate whether it is all worth it. Two more portfolio names reported mixed earnings Tuesday morning: Procter & Gamble and Stanley Black & Decker.

2. P&G delivered a really weak forecast. It just figures as the stock was looking way too high. The stock lost 5%. That’s the way P&G does it. Dividend increased by 7%. The consumer products giant beat on quarterly earnings but missed on revenue. Volume did increase for the first time in more than two years.

3. Stanley Black & Decker beat on quarterly earnings and matched on revenue. Big margin expansion. Raised full-year free cash flow and low-end earnings guidance range. The company said its Dewalt brand, outdoor, and aerospace fasteners offset “weak consumer backdrop.” The stock soared more than 7%. We sold some last week into the rally but kept plenty on as Stanley Black & Decker executes a turnaround and stands to benefit from upcoming Fed interest rate cuts. The Fed’s two-day July meeting begins Tuesday. No rate cut is expected this week. September is seen as the first of three possible cuts this year.

4. Diageo had really bad quarterly sales. Premium tequila down huge. Whisky terrible. Time to realize GLP-1 weight loss and diabetes drugs (made by Novo Nordisk and Club name Eli Lilly) are hurting hard alcohol. First down number since Covid. But beer with Guinness up. Will investors differentiate Corona and Modelo maker Constellation Brands, which is killing it in beer? We bought some more Constellation Monday on a decline tied to Heineken’s woes.

5. Barclays cut McDonald’s price target to $300 per share from $320. It doesn’t matter. The fast food giant is committed to value. Will portfolio name Starbucks, which reports earnings after Tuesday’s close, be similarly inclined?

6. Merck beat on quarterly earnings and revenue on strength in blockbuster cancer drug Keytruda. However, Merck’s outlook was regarded as weaker and the stock lost more than 3%.

7. Pfizer delivered beats on quarterly earnings and revenue. It’s the first quarter with topline growth since Q4 2022. The drugmaker benefited Covid antiviral Paxlovid and strong non-Covid product sales. Hiked outlook. The stock was up more than 1%.

8. JetBlue delivered quarterly earnings of 8 cent per share. The Street was looking a 10-cent loss. Revenue also beat. The stock was up 3%. JetBlue bucked an industry trend of troubles as seen in results from Delta, United, Southwest, and American Airlines.

9. Skyworks Solutions price target raised to $115 per share from $85 at Barclays. Skyworks, which provides wireless networking services, is out with earnings after Tuesday’s close. It’s a big supplier to Apple and viewed as a read-through on iPhone demand. Apple reports earnings after Thursday’s close. Apple has fared better in the recent rotation out of tech winners than fellow Club name Nvidia.

10. F5, which provides a ramp to the internet, shows what can happen to non-large cap tech when it delivers a good quarter. The stock soared more than 13%. F5 helps companies secure and optimize their apps on-site and in the cloud.

Sign up for my Top 10 Morning Thoughts on the Market email newsletter for free

(See here for a full list of the stocks at Jim Cramer’s Charitable Trust.)

As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade.

THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, TOGETHER WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Read the full article here