By Min Joo Kang

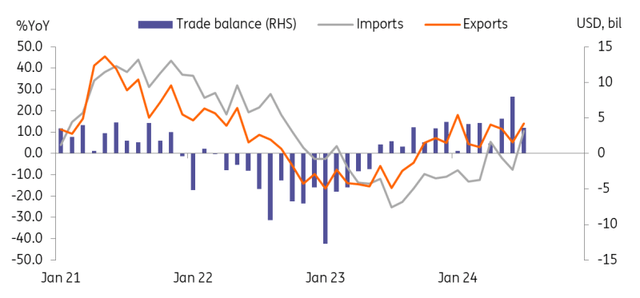

Trade surplus narrowed in July due to a rebound in imports

Export growth accelerated to 13.9% YoY in July (vs 5.1% in June, 18.4% market consensus) mainly due to favourable calendar effects. Adjusting for working days, average daily exports moderated to 7.1% in July from 12.4% in June. By product, 11 out of 15 major exports gained. IT exports were quite solid with computers (61.6%), wireless devices (53.6%), displays (2.4%), and semiconductors (50.4%) increasing. Car exports dropped 9.1%, but this was mainly due to the summer shutdown, while auto parts exports rebounded 9.5% for the first time in three months. By destination, exports gained across the region except to the EU (-1.4%).

Meanwhile, imports rose 10.5% YoY in July (vs -7.5% in June, 13.4% market consensus) as energy imports grew quickly (crude oil 16.1%, gas 23.8%). Due to the import rebound, the trade surplus narrowed to USD 3.6bn in July from USD 7.9bn in June.

Korean exports gained for the tenth consecutive month

Business survey suggests a moderation in manufacturing in the near term

The manufacturing PMI fell to 51.4 in July (vs 52 in June) but remains in expansion for the third consecutive month, with both output and new orders down from the prior month. Local business surveys from last week also showed some weakness in the manufacturing sector.

GDP outlook

Together with today’s weaker-than-expected exports and softened business surveys, we are wary of a possible moderation in exports in the near future. However, export details – by product and by destination – are quite encouraging so far. Thus, it is still too early to conclude that export momentum is trending down. But a narrowed trade surplus clearly clouds our growth outlook for a rebound in 3Q24. We currently expect 3Q24 GDP to rebound to 0.4% QoQ sa from -0.2% QoQ in 2Q24.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Read the full article here