By Tracy Chen, CFA, CAIA

The world watched expectantly as China completed its Third Plenum of the 20th Party Congress, looking for signs of a potential end to exported deflation and weak domestic growth. However, unlike the Third Plenums of 1978 and 2013, which ushered in new chapters of economic reforms, this much-awaited meeting disappointed asset markets and left skepticism in its wake. Admittedly, the low-hanging fruits of reforms are behind China. Now, President Xi must tackle the “hard-to-chew bones,” including property market woes, local government debt crisis, stubbornly low consumer confidence, lack of domestic demand, and looming tariff wars on cheap Chinese exports.

Since Third Plenums, which are held every five years, revolve around long-term strategic planning, it was no surprise that the recent meeting was devoid of any massive stimulus packages. While markets may have been disappointed by the lack of near-term interventions, we still believe there are some important messages signaling gradual reforms that may change China’s growth path if implemented well. There is a five-year timeline to complete the planned reforms, but success is still uncertain as implementation will not be easy. This Third Plenum focused on balancing dichotomies and managing risks:

- Balancing competing dichotomies:

- New vs. old growth drivers: China’s growth is characterized by a “two-speed” economy with outperformance in industrial production, exports, and manufacturing investment offset by a persistent drag from property market and housing-related consumption. This dual economic construct is by design to transition from old growth drivers to new growth drivers. These “new quality productive forces” refer to technological innovation, green industry, and manufacturing upgrading. The goal is to build technological self-sufficiency and supply chain resilience to combat potential future blockades and sanctions. However, excess capacity has developed in areas like solar panels and EVs. Meanwhile, the government’s control of property market prices has prolonged the correction of property market excesses, and the new growth drivers have not yet offset the drag on growth. Policymakers subsequently reiterated the property market’s systemic importance, but recent easing measures have yet to arrest the sector’s woes, which will continue to be a drag for the next several years.

- Central vs. local: The local governments’ massive debt problem is the main risk. This Third Plenum calls for fiscal reform that focuses on shifting more revenue from the central to local governments, including gradually allowing local governments to receive a larger share of the consumption tax. In addition, the central government will shoulder more fiscal responsibilities. This fiscal transfer from central to local governments should help optimize the division of shared taxes and spending between central and local governments. In the meantime, a new, less centralized housing system will be established that allows each city autonomy in regulating its own real estate market. Finally, policymakers also will facilitate a unified national market to combat local protectionism and streamline national supply chains.

- State-owned-enterprises (SOE) vs. private-owned-enterprises (POEs): The Third Plenum aims to level the playing field, treating all ownership equally and removing market entry barriers. It narrows SOE’s role to key sectors related to national security, public welfare, and strategic emerging sectors. Further SOE reforms are possible in energy, rail, telecom, water conservancy, and utilities. POEs are strongly encouraged to participate in key infrastructure, construction, and technology projects and sectors.

- Market vs. government: The meeting reiterated the “decisive role of the market” and government’s responsibility to exert control on the market to avoid market failures. This balance in the allocation of various factors of production is critical for both development and risk management.

- Urban vs. rural: The Plenum pledged to “improve basic public services to urban migrants who lack the “hukou” and narrow the urban-rural gap.” Protecting the residency status of migrant workers, including land and other property rights, may hopefully release some spending power.

- National security vs. growth: There has been a shift from growth to national security in recent years. During the Third Plenum, President Xi emphasized that national security is a prominent issue, but that China must strive to “achieve positive interactions between security and growth.” This aim for balance is not surprising, as one goal of growth is to safeguard national security.

- Risk management: Driven by the economic slowdown, the unemployment situation has deteriorated along with steep pay cuts. Social fabrics are unravelling with more mental health issues, violent crimes, protests, and suicides. At the Plenum, policymakers’ tone sounded more urgent on preventing and resolving risks in key areas mentioned above. Facing the disappointing second quarter gross domestic product (GDP) data, they also remain firmly committed to achieving the 5% growth target in 2024 and expanding domestic demand. We expect to see some follow-up easing measures, such as tapping special government bond proceeds to boost more “equipment upgrades and trade-in of consumer goods.”

Conclusions and Investment Implications

As U.S. Federal Reserve rate cuts become more certain, we believe the pace of the People’s Bank of China’s (PBOC’s) monetary easing could pick up in response with more rate cuts and announcements of further easing measures. However, Chinese policymakers likely want to save their dry powder in the event of a Trump election win and additional U.S. tariffs. If the proposed 60% tariffs materialize, a Pandora’s box may be opened, releasing a surge of symbolic retaliatory measures from China while reshuffling global supply chains and accelerating Chinese companies’ move to “Go overseas.”

-

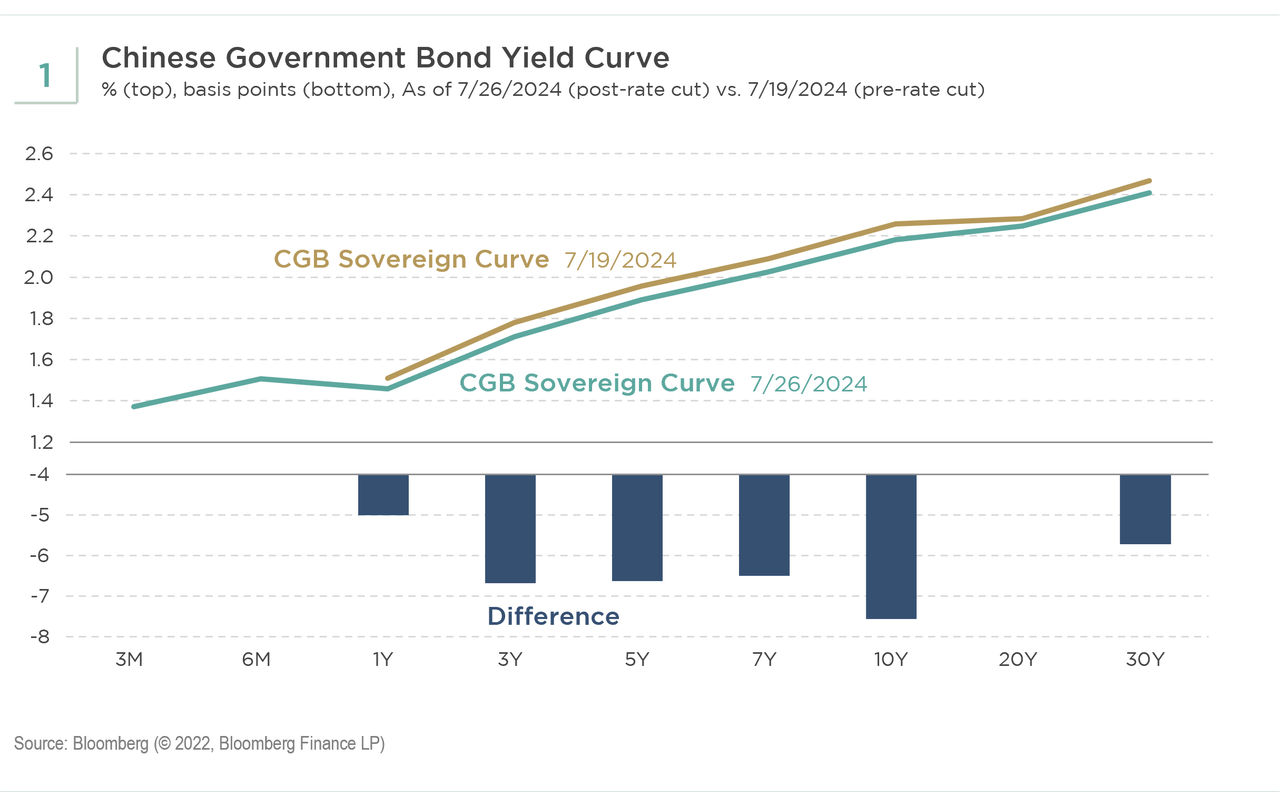

- Chinese government bonds (CGB): Despite the PBOC’s intention to manage an upward-sloped yield curve and control the pace of CGB yield rallying, the rate cuts shifted the entire yield curve down in parallel (see Exhibit 1). With the strong gravitational pull of the long-suffering property market on the economy, growth will be slow for longer, and CGB yields should stay low for longer. We have been seeing a pickup in foreign inflows in the onshore CGB market. The PBOC rate cuts should bode well for the rate rally. We are still constructive on CGB rates.

-

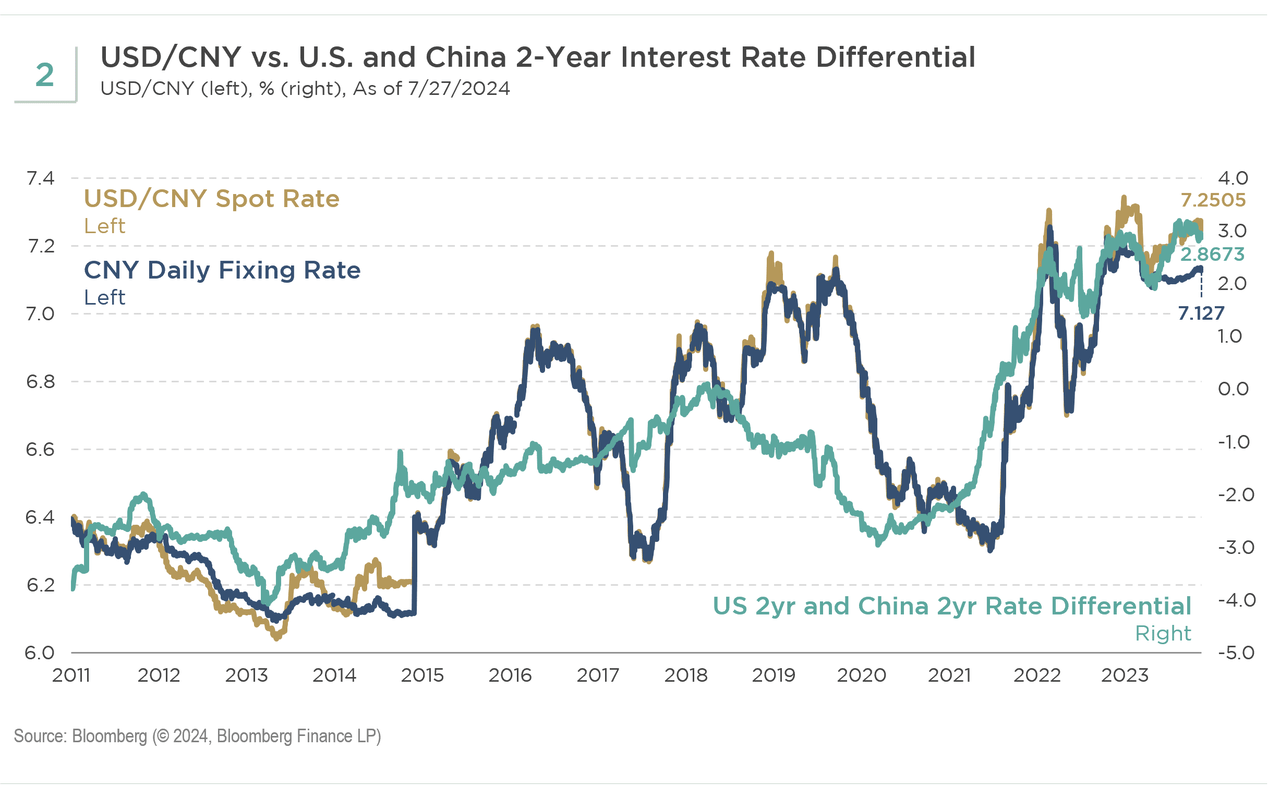

- Chinese yuan (CNY): The unfavorable interest rate differential of CGBs versus U.S. Treasuries along with slow growth, an adverse geopolitical environment, and upcoming tariffs all bode ill for CNY. The only near-term support for CNY is the PBOC’s CNY fixing support as it aims to control the pace of depreciation to prevent sharp capital outflows. The decoupling of the CNY spot rate from CNY fixing indicates the PBOC’s intention to fight against the pace of CNY depreciation (see Exhibit 2). In addition, the trajectory of CNY also will depend on the direction of the U.S. dollar (USD) and Japanese yen (JPY). If USD weakens due to intervention or JPY strengthens, CNY will strengthen accordingly. We are still bearish on CNY but will be mindful of the PBOC intervention and movement of USD and JPY.

- Impact on global growth: The message from the Third Plenum is moderately pro-growth. However, all these reforms, which balance many competing dichotomies, are targeted for the medium to longer term. China needs more forceful measures to stave off the drag from its property market, the backlash from global trading partners, and the upcoming tariffs. We believe we will see more easing measures, but their efficacy hinges on restoring confidence in the private sectors.

The above measures that aim to balance competing dichotomies in the domestic economy and address risks are all the right medicines to cure China’s economic malaise and help release the country’s growth potential. However, the devil is in the implementation. We will continue to monitor the progress and adjust our investment accordingly.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here