Introduction

Things aren’t going so well anymore. The AI-fueled tech rally has stalled, and all eyes are now on the “real” economy, which is showing some serious cracks.

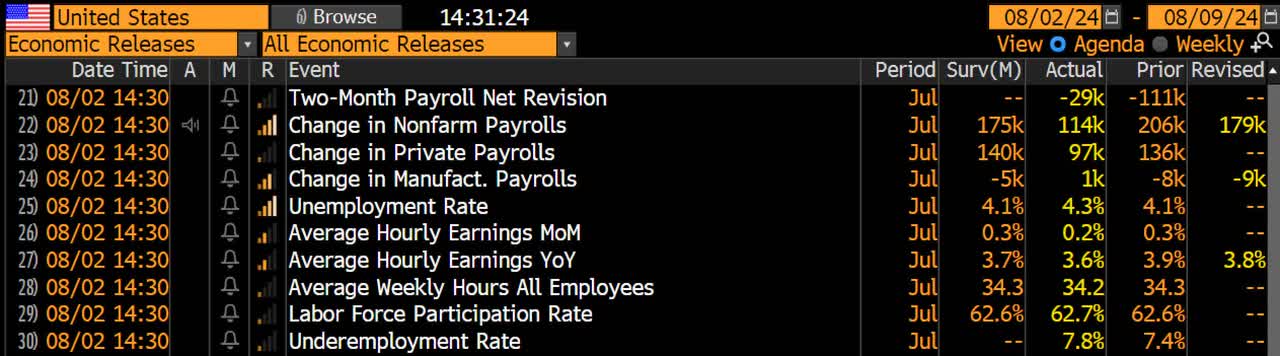

The just-released unemployment numbers, for example, came in much lower than expected, with nonfarm payrolls indicating just 114 thousand new jobs in July. The prior month’s gain was revised from 206 thousand to 179 thousand.

The unemployment rate rose to 4.3%, 20 basis points higher than expected.

Bloomberg

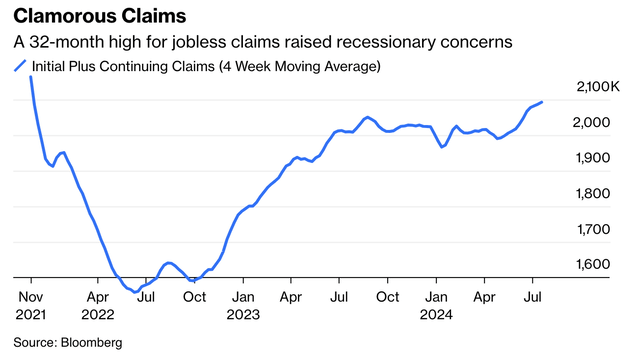

These numbers come a day after continuing unemployment claims rose to the highest level in 32 months, supported by strong momentum since the start of summer.

Bloomberg

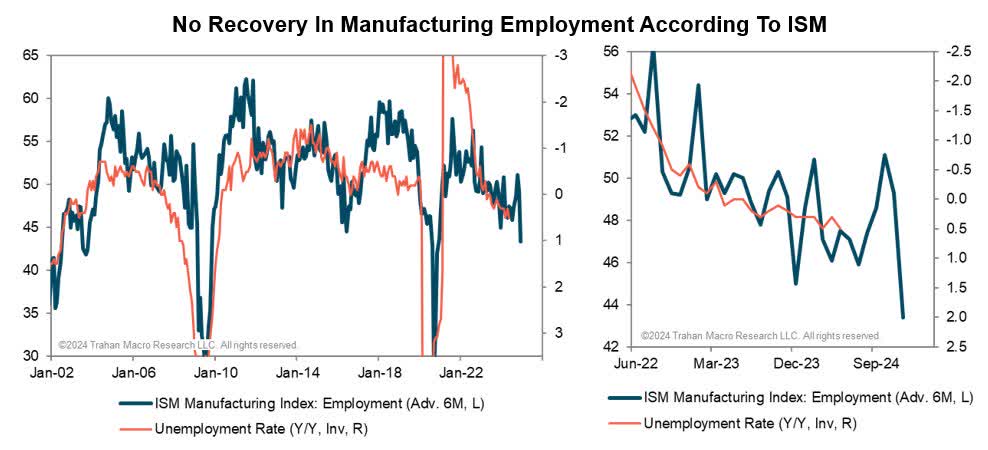

Even worse is that forward-looking indicators like the employment component of the ISM Manufacturing Index are now screaming “recession.” Ignoring the pandemic and the Great Financial Crisis, the employment component is trading at a 20-year low.

X (@FrancoisTrahan)

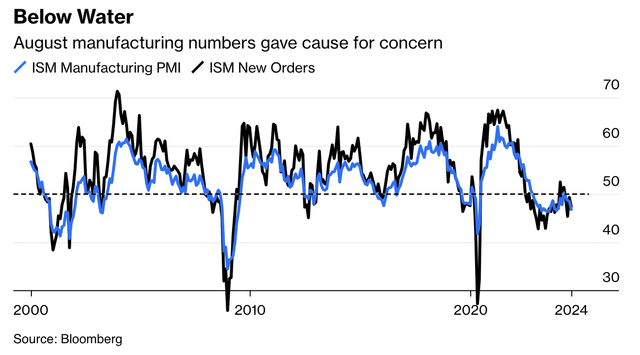

The ISM Manufacturing Index (including all components) and its new orders components are also below 50, suggesting contraction. In fact, since the end of 2022, we have seen a consistent contraction in manufacturing expectations, which also explains why “big tech” has been the only game in town for a while.

Bloomberg

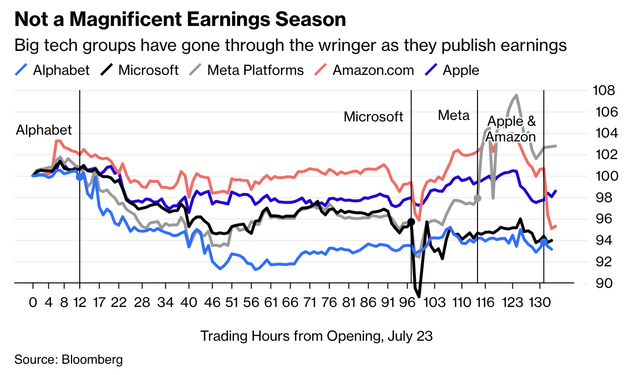

Speaking of big tech, the nation’s tech giants aren’t coming to the rescue, as their earnings have been lackluster, as supported by a chart used by Bloomberg’s John Authers.

Bloomberg

In his article, he quoted Jordan Irving from Glenmede Investment Management (emphasis added):

Economic reality appears to be impacting the mega-cap companies as their growth ramp apparently isn’t to infinity and the astronomical capex budgets aren’t yielding immediate results. None of this is to say that the Mag 7 aren’t good businesses, but rather that the investor fever with which they were adored has begun to break, which means that things like valuation might start to matter again. In that case, the small-cap side of the ledger has a much lower bar to clear and now has a potential tailwind from a declining rate environment. – Via Bloomberg

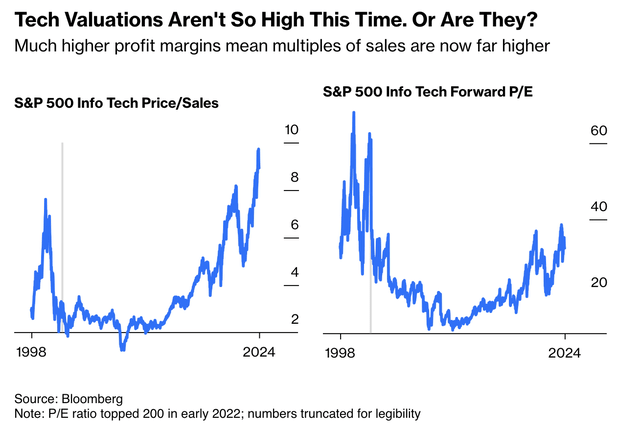

The valuation part in the quote above is key for many reasons. Especially as we are now in an environment of elevated recession odds, it is extremely hard for long-only investors to make money.

When I was still an active trader (many, many years ago), I used to balance long and short positions. I don’t do that anymore. I now dedicate my entire career to finding great long-term investments, even if it means going through some nasty downturns.

However, this does not mean we just need to accept “misery.” Especially in an environment where broadening earnings growth and a shifting focus from “growth” to “value” has started, we can buy great investments at great prices.

I expect that shift to accelerate when margins in information technology start to decline. Right now, high margins justify a sky-high price/sales ratio in this sector. Any headwinds could lead to more tech unwinding.

Bloomberg

In this article, I’ll present three high-yield stocks that I love for the next few years (and beyond). I own all three and have been buying most of them for family accounts as well.

I decided to focus on income (high-yield), as we could face a prolonged sideways trend in the market if recession odds continue to rise. If that happens, a bigger part of the total return (capital gains + dividends) will likely consist of dividends.

Hence, the picks in this article all have:

- Healthy balance sheets (in light of recession risks and elevated rates).

- Stellar business models that are capable of long-term growth.

- Great valuations.

- Wide Moats.

Antero Midstream (AM): 6.4% Yield

I just wrote an in-depth article on this company on August 2, as it recently reported its 2Q24 earnings. In that article, I called it my favorite high-yield stock, which is based on a wide number of tailwinds.

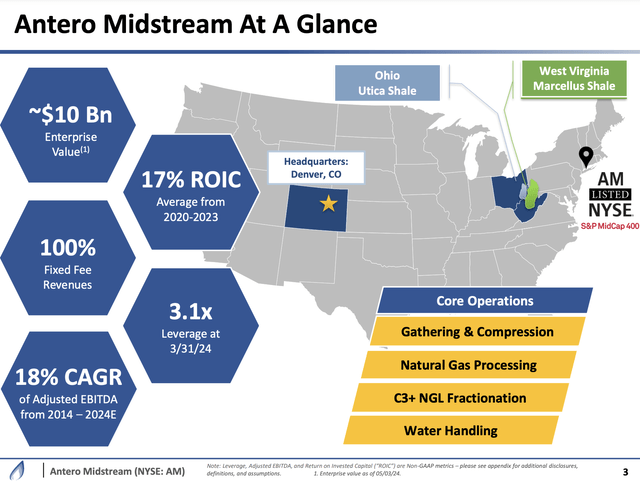

One of them is its relationship with Antero Resources (AR). As its name already suggests, Antero Midstream is a midstream company that owns the infrastructure needed to produce natural gas and natural gas liquids.

This includes more than 600 miles of low-pressure and high-pressure pipelines, 4.5 billion cubic feet of daily compression capacity and 380 miles of water pipelines.

Antero Midstream

These assets support the operations of Antero Resources, one of North America’s largest natural gas producers with a terrific production profile.

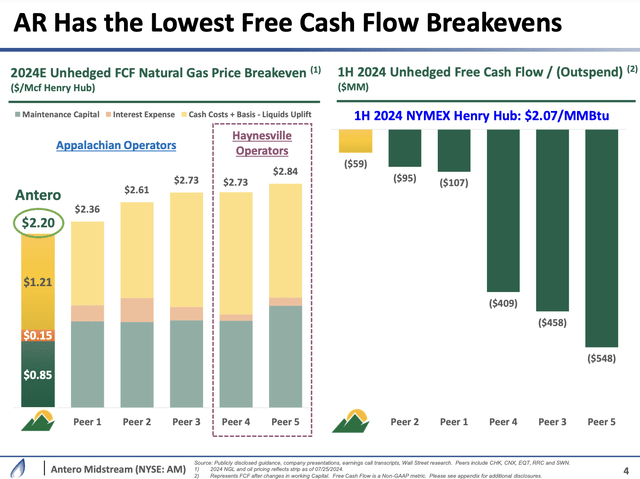

The company’s operations are profitable as low as $2.20 per Mcf Henry Hub, which makes it the most efficient producer in Appalachia. This allows it to produce natural gas when others are forced to reduce production.

Even better, because others are forced to shut production before AR becomes unprofitable, it is often shielded against steep declines, as natural gas prices tend to bottom when other producers take production offline.

Antero Midstream

This bodes well for Antero Midstream, as its business is 100% dependent on fees, meaning even when natural gas prices are low, it still benefits from steady throughput.

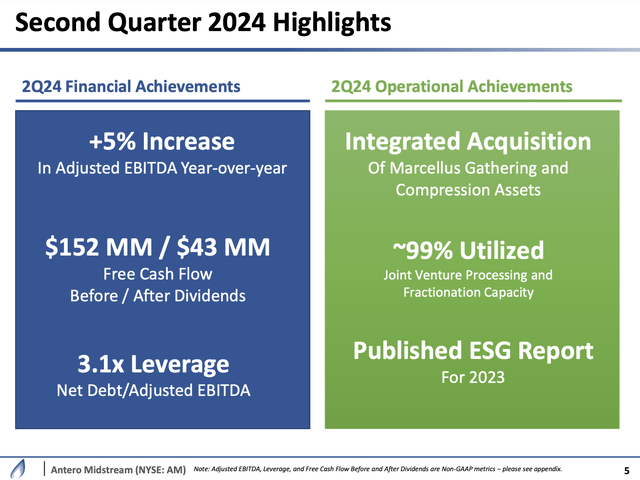

For example, in the second quarter, the company grew EBITDA by 5% despite a decline in throughput and water sales.

Antero Midstream

It also executed a $70 million bolt-on acquisition that immediately added to free cash flow, allowing it to maintain a 3.1x net leverage ratio.

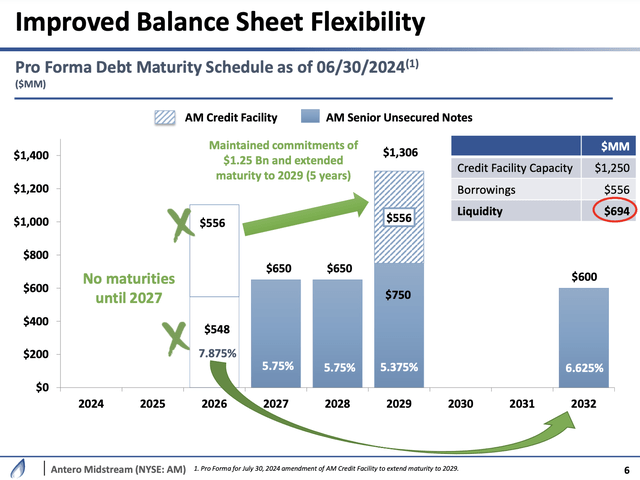

While the company does not have an investment-grade balance sheet, its rating has been upgraded four times since 2020, the most recent hike being to BB+ in May of this year.

It also reduced its near-term maturities, as it currently has no debt maturities until 2027.

Antero Midstream

While its balance sheet has a “junk” rating, it’s actually very healthy and perfectly capable of protecting the business against elevated rates on a long-term basis.

Even better, going into next year, the company is expected to reach its desired leverage target of 2.8-2.9x EBITDA. Once that happens, it will accelerate buybacks and dividend growth.

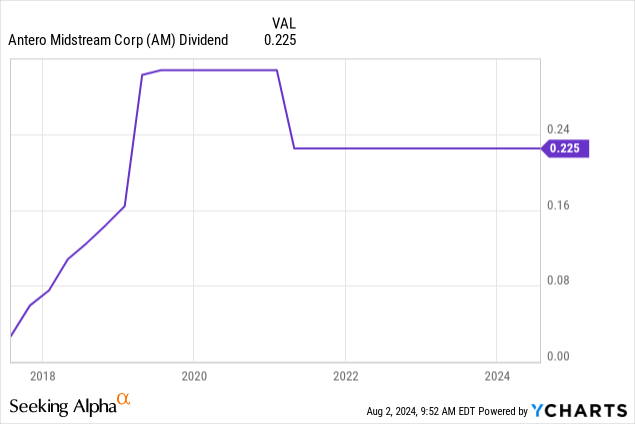

After keeping its dividend unchanged since 2021, it is in a great spot to generate a >10% free cash flow yield, allowing it to protect and grow its 6.4% dividend on top of buying back stock.

Currently, buybacks are preferred because the company believes its equity is undervalued. I agree with that.

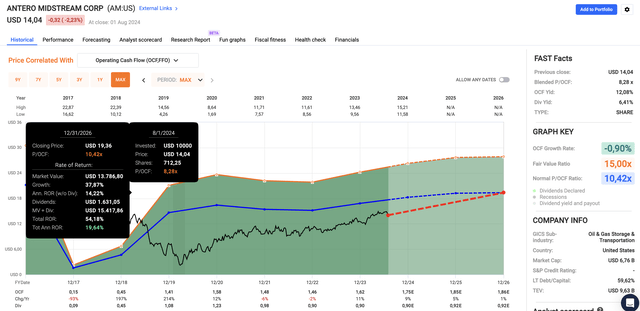

Not only does AM come with a 6.4% yield and an implied 10% free cash flow yield, but it also trades at a blended P/OCF (operating cash flow) ratio of just 8.3x, roughly 2 points below its long-term average.

FAST Graphs

Including 16% cumulative expected per-share OCF growth through 2026, I give the stock a target of $19-$20, 36% above the current price.

Given my long-term bullish outlook on natural gas and the important place of the Appalachian Basin in America’s natural gas production, I’m very upbeat about AM’s future.

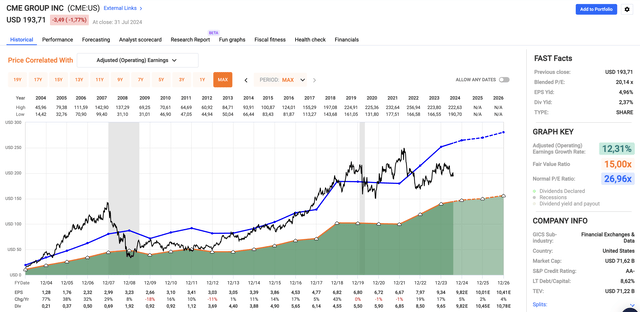

CME Group (CME): >5% Yield (Special Dividend)

I may seem a bit lazy, but CME Group is another company I just covered in an in-depth article.

The title of that article was “Down But Not Out: Why CME Group Remains One Of My Favorite Dividend Stocks.”

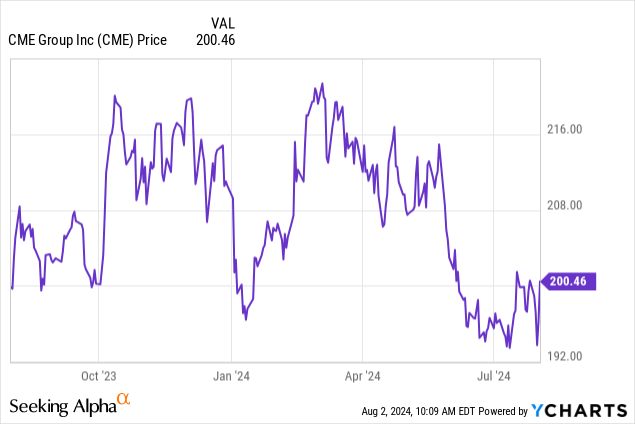

CME Group’s stock price hasn’t been doing too well recently, which allowed me to consistently add to my position.

Now, the stock is making a comeback, fueled by the rotation growth to value stocks.

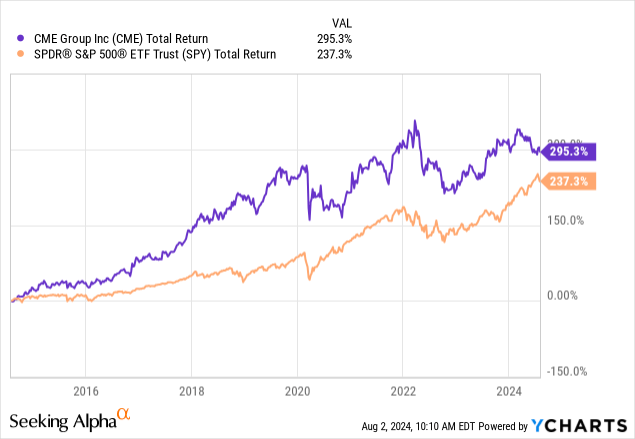

Moreover, over the past ten years, shares have returned close to 300%, beating the S&P 500 by a substantial margin.

What makes CME Group so special is the fact that it owns some of the world’s biggest exchanges, including the Chicago Mercantile Exchange (where it gets its name), CBOT, NYMEX, and COMEX.

These exchanges host some of the most liquid futures and options, including the famous S&P 500 e-mini, NYMEX WTI and Henry Hub, COMEX gold, CBOT corn, and countless others.

In addition to that, the company owns interest-rate products and a wide range of products aimed at emerging segments like cryptocurrencies.

Moreover, the company has exclusive licensing agreements for derivatives with S&P Dow Jones Indices that add to its wide-moat business profile. On top of that, CME has a 27% ownership in that company.

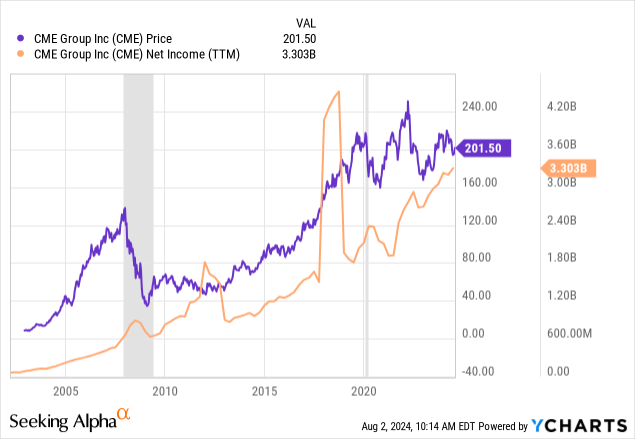

The biggest benefit of this transaction-based business model is that whenever volatility spikes, the company’s revenues/earnings improve. While its stock price is behaving cyclically, all major stock market sell-offs in the past caused earnings to accelerate.

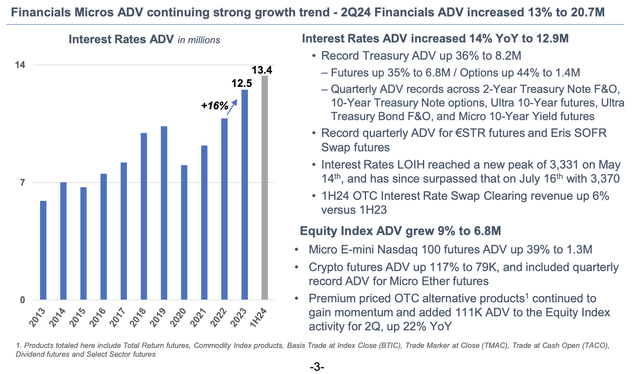

While some people are rightfully making the case that CME has not diversified its business enough by focusing on non-transaction business segments, CME is hitting it out of the park, reporting record daily volumes in July despite subdued volatility.

Personally, I’m absolutely impressed by the way CME is benefitting from successful products in energy, metals, currencies, rates, and others.

CME Group

It also has a deal with Google Cloud to transform its platform and roll out a whole new range of services for people to improve their trading/hedging operations.

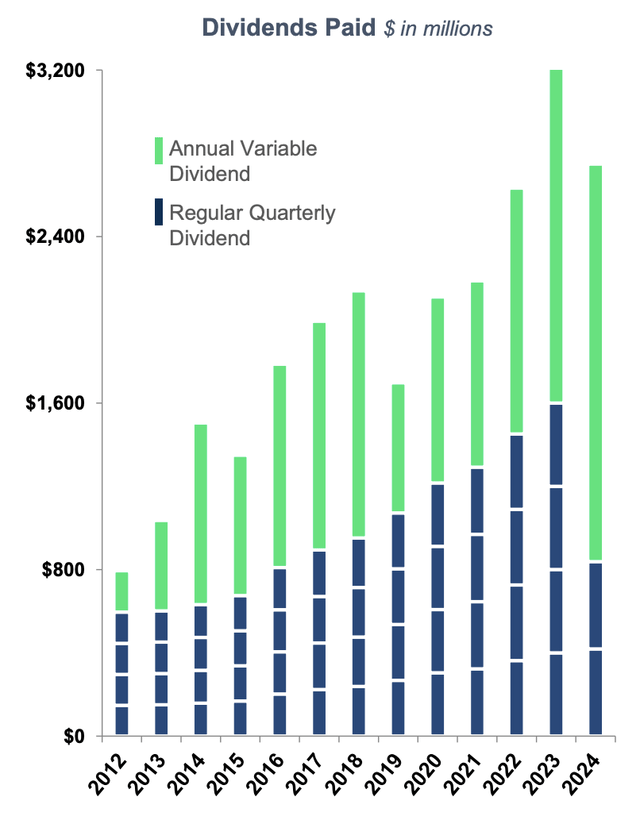

With regard to its dividend, the company has a habit of distributing all of its free cash flow to shareholders. It does this through four quarterly dividends with a yield of 2.4% and one special annual dividend to distribute the rest of its free cash flow.

CME Group

Right now, as I discussed in my in-depth article, free cash flow expectations imply a 5.4% annual yield, which is what I expect the company to pay this year.

Given the current upswing in volatility, I believe that number could be even higher.

In general, the company is attractively valued.

As I wrote in my in-depth article, currently trading at a blended P/E ratio of 20.1x, CME trades below its normal P/E ratio of 27.0x. While this may look like an elevated multiple, we need to be aware that we’re dealing with a company with a net income margin of more than 60% and a favorable business model.

FAST Graphs

In fact, the company has one of the highest-margin profiles on the market with an implied fair stock price of $280, 44% above its current price.

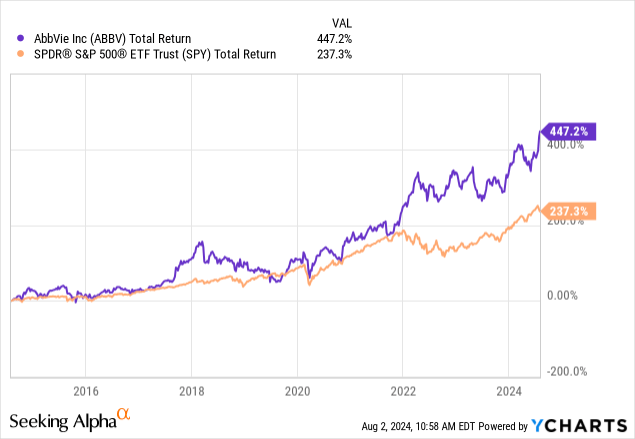

AbbVie (ABBV): 3.3% Anti-Cyclical Income

AbbVie is two of my healthcare investments and one of my few high-yield investments. My most recent in-depth article on this biotech giant was written on May 29, when I went with the title “Looking For Both Income And Growth? 4%-Yielding AbbVie Has You Covered.”

Since then, shares have returned 23%, beating the S&P 500 by 22 points. Currently trading at a new all-time high, the giant has returned 447% over the past ten years.

As I have often written, the patent loss of Humira has been absorbed by the company and the market, as it is firing on all cylinders.

In the second quarter, total net revenues reached almost $14.5 billion. This translates to a 5.6% increase on an operational basis.

This growth is mainly driven by the company’s “ex-Humira” platform, which covers more than 80% of its total sales and is expected to exceed initial full-year sales guidance by more than $1 billion.

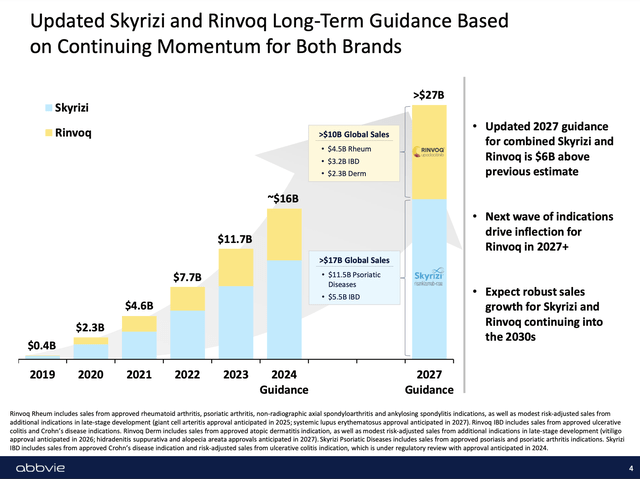

As we can see below, its blockbuster drugs, Skyrizi and Rinvoq, are expected to generate more than $27 billion in revenue by 2027, almost $10 billion more than this year.

AbbVie

According to the company, in the second quarter, Skyrizi and Rinvoq generated sales of more than $4.1 billion, which marks a 50% operational growth rate.

Both drugs benefitted from new approvals and market share growth.

Hence, in addition to other tailwinds, the company raised its full-year adjusted earnings per share guidance to between $10.71 and $10.91. The prior range was $10.61 to $10.81.

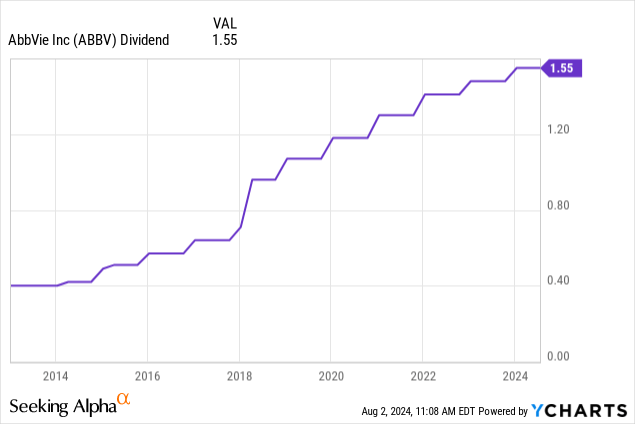

With regard to its dividend, yielding 3.3%, the dividend has a 57% payout ratio and a five-year CAGR of 8.0%. The company has hiked its dividend every single year since its spin-off from Abbott Laboratories (ABT).

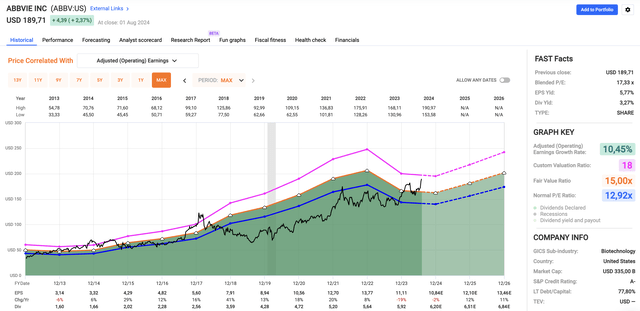

Valuation-wise, we’re dealing with a company trading at 17.3x earnings, a few points above its long-term average of 12.9x. However, the company is expected to accelerate growth.

Using the FactSet data in the chart below, analysts are looking for 12% and 11% EPS growth in 2025 and 2026, respectively.

Given the lower risk of patent losses and its successful products, long-term double-digit EPS growth is likely.

FAST Graphs

I believe this warrants a 17-18x multiple, implying a $242 price target, 27% above the current price.

As such, I continue to buy ABBV on dips, as it offers a perfect mix of growth and value with a fantastic, anti-cyclical business model.

Takeaway

The tech rally’s stall and poor economic indicators suggest we’re in for a bumpy ride. However, that doesn’t mean we have to sit back and accept the downturn.

While high-growth stocks face headwinds, shifting focus to high-yield investments can offer stability and potential gains.

My top picks, Antero Midstream, CME Group, and AbbVie, each enjoy strong balance sheets, resilient business models, and attractive valuations.

In a market where dividends might dominate the total return picture, these stocks stand out for their income potential and long-term growth opportunities.

Even better, all three picks have a wide-moat business model and partially anti-cyclical demand.

Although I have no idea how bad things may or may not get, I feel great adding to these stocks at very attractive prices.

Read the full article here