I am initiating coverage on DexCom, Inc. (NASDAQ:DXCM) following its Q2 2024 earnings release on Thursday, July 25th.

DexCom, Inc. is a medical device company focused on insulin monitoring, specifically continuous glucose monitors that help track insulin levels throughout the day. The company’s revenue is generated primarily from sales of the devices and services supporting them.

After a strong run in late 2023 and early 2024, DexCom dropped 33% following Q2 earnings when they lowered guidance for 2024. This puts the stock down 38% over the past year.

DXCM Price Trend (TrendSpider)

DexCom’s guidance was definitely unfavorable and could not support the share price over $110. That said, I believe this is a classic overreaction to bad news, and the stock has now been pushed well below fair value.

DexCom may have reduced growth guidance, but the business is still growing. In addition, demographic tailwinds are too strong to ignore, and health insurers will become increasingly motivated to promote this technology. Even at the lowered guidance, a conservative DCF analysis based on business and market trends suggests a price target of $94.30, a 26% upside to today’s pricing.

I rate DexCom a buy and believe the market overreaction is providing a great opportunity for long-term investors to enter the stock.

Q2 Earnings Recap

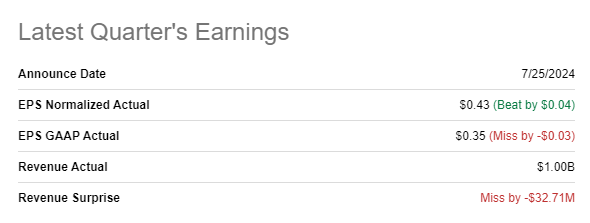

DexCom reported Q2 EPS of $0.43, beating consensus by $0.04, and revenue of $1.00 billion, missing consensus by $33 million.

Q2 Earnings Summary (Seeking Alpha)

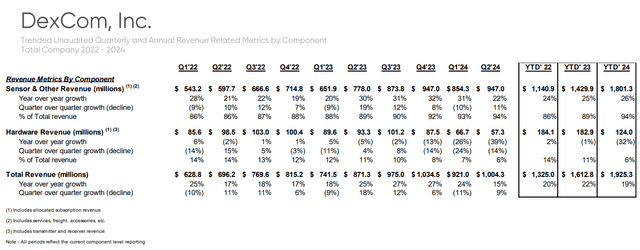

Revenue growth slowed, especially in hardware revenue, with total revenue growth returning to 2022 levels. Important to note that costs were well managed and this had minimal impact on profitability.

Revenue Trend (DXCM Investor Relations)

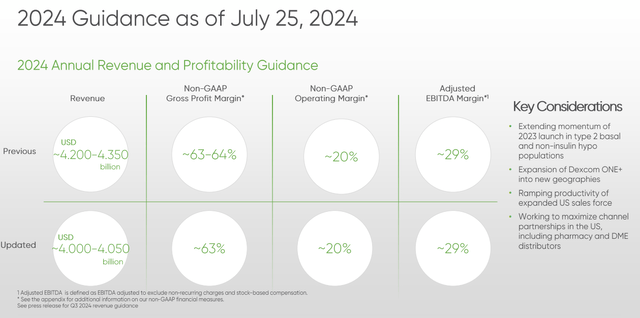

Management expects the slower revenue growth to continue and lowered revenue guidance for the year sending the stock plunging.

DXCM 2024 Guidance (DXCM Investor Relations)

And this is where the market overreacted. Certainly, they deserved a lower price target; I would have lowered it, too. However, the updated guidance still reflects double-digit growth and no change in profitability. This is still a very valuable business.

Valuation

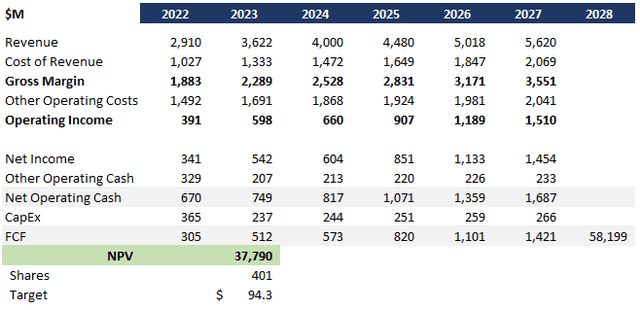

I ran a DCF analysis incorporating the new guidance and market trends. Here are the assumptions I used:

- 12% near-term revenue growth based on near-term market CAGR, low-end of management guidance, and historical performance

- 6.5% long-run growth rate heading back market CAGR to account for competition, cost growth, and diminishing returns as the business scales

- 9.1% discount rate based on estimated WACC

This DCF analysis yields a price target of $94.30, 26% upside to today’s prices.

DexCom DCF (Data: SA; Analysis: Mike Dion)

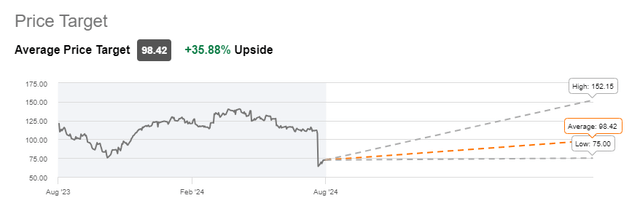

Wall Street analysts actually land in a similar range with an average price target of $98.42 and a range of $75 to $152. Note that the low end of their range is essentially flat to current pricing.

DXCM Wall Street Rating (Seeking Alpha)

Demographic Tailwinds Too Strong To Ignore

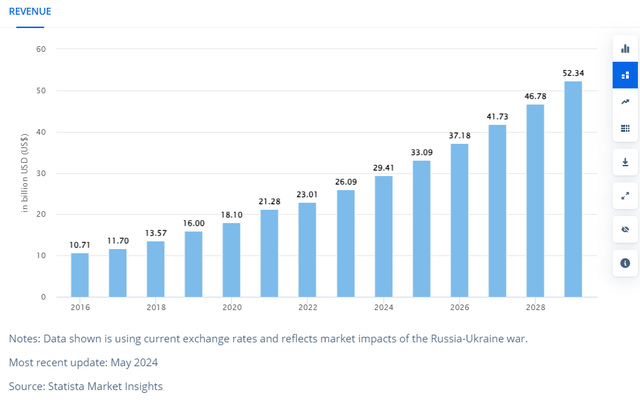

DexCom is a leader in a rapidly growing market with highly favorable demographic tailwinds. Starting with diabetes care devices in isolation, the market is expected to grow at a CAGR of 12.22% through at least 2029.

Diabetes Care Device Market (Statista)

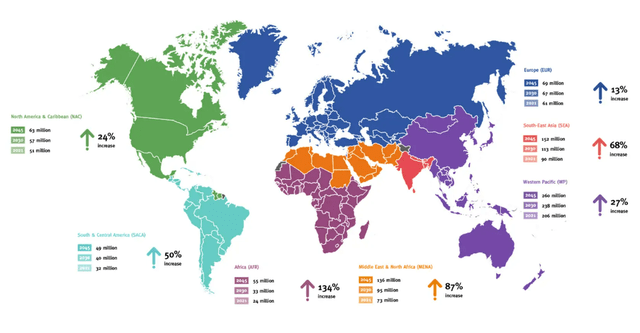

Beyond the current expectations for diabetes care devices, the eligible population is expected to grow rapidly. Mature markets such as North America and Europe will continue to see double-digit growth, while developing regions such as South America, Africa, and Asia will see anywhere from 50% to 134% in diabetes prevalence.

Diabetes Prevalence (International Diabetes Federation)

And this only reflects diabetes prevalence. DexCom is also working on tools and devices for prediabetes and diabetes prevention. This over-the-counter market is expected to grow to over $5 billion over the next 10 years, a billion more than DexCom’s total revenue last year.

Health Insurers Need CGM

Beyond the demographic trends, health insurers are going to become more and more motivated to support continuous glucose monitoring.

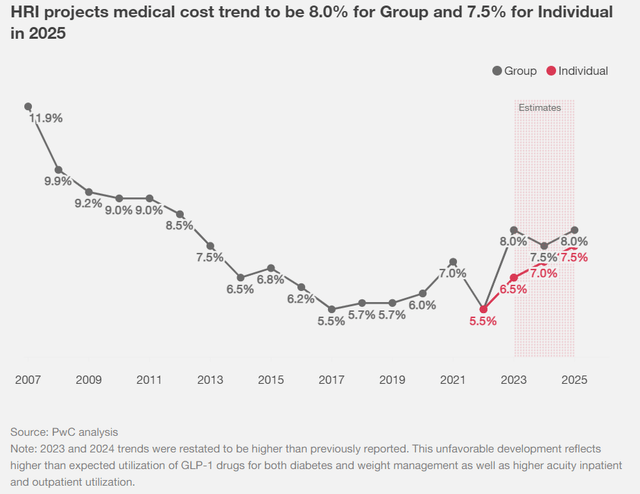

Health insurers medical costs are expected to grow at the highest rate since the early 2010s driven by GLP-1 drugs and acute inpatient/outpatient utilization.

Medical Cost Trend (PwC)

This trend benefits DexCom in two ways. First, GLP-1 drugs for treating diabetes are being approved for weight loss rapidly driving up costs. This spending nearly doubled from 2021 to 2022 alone. DexCom reduces the need for GLP-1 and insulin over time through monitoring and supporting lifestyle changes.

Second, continuous glucose monitors have been proven to reduce overall medical costs for managing diabetes by lowering the rate of inpatient and outpatient acute care, the troubling trend noted above.

Downside Risk

The downside risk is primarily execution on the part of DexCom’s management. CEO Kevin Sayer noted throughout the earnings call that issues with distributor relationships had come up materially impacting sales.

U.S. customer growth has remained strong in our pharmacy business as we expand our reach into primary care and type 2 diabetes more broadly. However, our growth in the DME channel has trailed our plan. The DME distributors remain important partners for us in our business, and we’ve not executed well this quarter against these partnerships. We need to refocus on those relationships.

DexCom drives higher profitability via distributors than pharmacies and needs to quickly rectify this relationship.

The second downside risk is competition. Upside requires pacing with or just behind the market over-time and DexCom needs to be careful not to give up too much share.

Verdict

Q2 earnings were definitely a challenge for DexCom and the revised guidance couldn’t support the $110 plus share price. However, demographic trends along with cost pressures on the insurance industry all bode well for future growth. DCF analysis even at the low end of guidance and market trends supports a price target of $94, 26% upside from today’s pricing. While there is downside risk from execution, especially on the sales side, management is aware and taking steps to mitigate.

Based on all of the above, I firmly believe the market overreacted to the guidance change. I rate DexCom a buy with the current downturn being a great opportunity to enter the stock.

Read the full article here