In this article I use AAII’s A+ Investor Stock Grades to give you insights into three semiconductor stocks benefiting from high demand across numerous industries. For investors focused on companies that supply key components for vehicles, 5G and the Internet of Things (IoT), consider the three semiconductor stocks of Advanced Micro Devices (AMD), Jabil (JBL) and Texas Instruments (TXN).

Semiconductor Industry Has a Promising Start to 2023

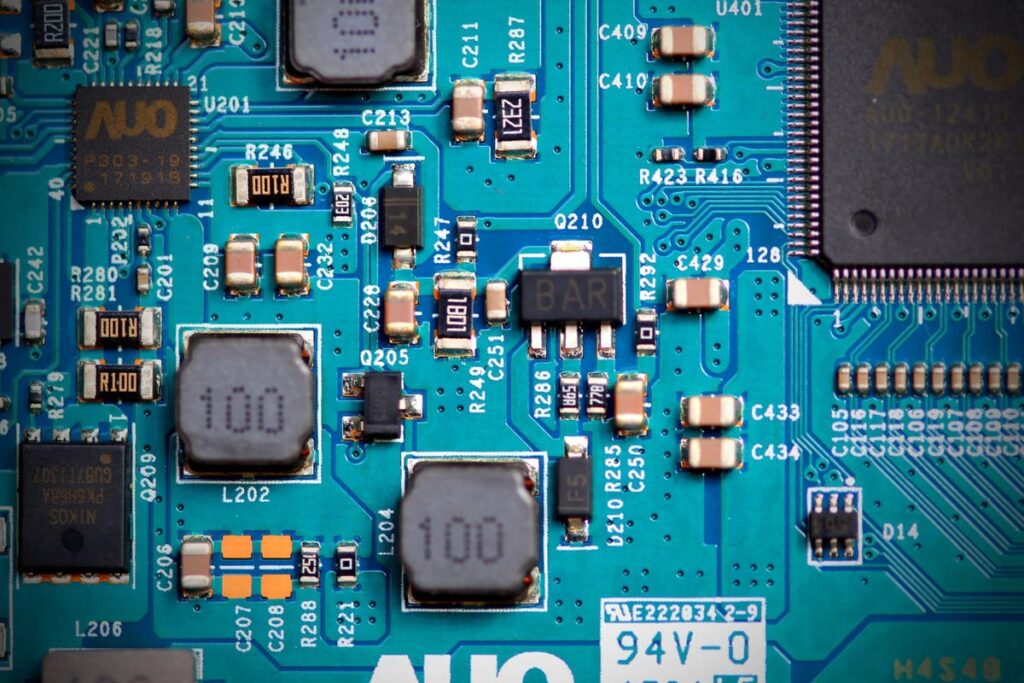

Semiconductors are used in the manufacturing of various kinds of electronic devices, including diodes, transistors and integrated circuits. These devices have found wide application in most electronic appliances, from refrigerators and rice cookers to laptops and fighter jets. What makes semiconductors attractive is their compactness, power efficiency and low cost. Most importantly, they are integrated into complex circuits. Semiconductors are, and will be in the foreseeable future, the key element for electronic systems, communications, signal processing, computing and control applications in consumer and industrial markets.

Over the past few years, the supply of raw materials to build semiconductors has been constrained. This is due to increasing demand for electronic devices because of the coronavirus pandemic. More people working from home requires more devices to be produced. Consequently, automobile manufacturers had to compete with other chip companies because their products are becoming more electronically reliant, especially with the move toward electric vehicles (EVs).

Asia is the world’s largest producer and exporter of semiconductors. Taiwan, South Korea, Japan and China all rank in the top five countries with the highest output. Finding a market balance will take time, as semiconductors are not produced quickly—26 weeks is the industry norm. The logistics of shipping semiconductors from Asia increases the time for American manufacturers to receive the components needed in production. A key factor to restoring balance will be a rebuild of domestic chip manufacturing, which is a primary focus of the U.S. government. In August 2022, the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act was signed, providing $50 billion for domestic semiconductor research, development and manufacturing.

The supply chain has recovered slightly in 2023, with raw materials becoming more reliably priced and increased global production due to fewer pandemic-related restrictions. Automobile production has started to grow compared to 2022, and short-term supply constraints are being eliminated. If the industry continues to grow, semiconductor stocks are positioned to benefit in the long term.

Grading Semiconductor Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is useful to have an objective framework that allows you to compare companies in the same way. This is one reason why AAII created the A+ Stock Grades, which evaluate companies across five factors that have been shown to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three semiconductor stocks—Advanced Micro Devices, Jabil and Texas Instruments—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Semiconductor Stocks

What The A+ Stock Grades Reveal

Advanced Micro Devices (AMD) designs and sells digital integrated circuits (ICs), including x86 microprocessors and chipsets for computers, embedded microprocessors for commercial and consumer applications and graphics processors. It operates through the following segments: computing and graphics; and enterprise, embedded and semi-custom. The computing and graphics segment includes desktop and notebook processors and chipsets, discrete and integrated graphics processing units (GPUs), data center and professional GPUs and development services. The enterprise, embedded and semi-custom segment includes server and embedded processors, semi-custom system-on-chip products, development services and technology for game consoles.

GPUs are used in computers to increase the speed of rendering images and to improve image resolution and color definition. Embedded microprocessors are used in applications, such as industrial controls, point of sale/self-service kiosks and casino gaming machines, among others. The accelerated processing unit (APU) combines a central processing unit (CPU) and a GPU onto a single piece of silicon. This architecture can provide a substantial improvement in user experience, performance and energy efficiency.

The microprocessor market is a critical part of the semiconductor industry and is dominated by two companies, Intel Corp. (INTC) and Advanced Micro Devices. The two competitors have battled for preeminence in the segment for decades. Advanced Micro Devices accounts for less than 20% of the microprocessor market and has made many changes over the years to build a sustainable business model.

Earnings estimate revisions offer an indication of what analysts are thinking about the short-term prospects of a firm. Advanced Micro Devices has an Earnings Estimate Revisions Grade of B, which is considered positive. The grade is based on the statistical significance of its last two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months.

Advanced Micro Devices has posted a positive earnings surprise for the last two fiscal quarters. Over the last month, the consensus earnings estimate for the fiscal year ending December 2023 has increased nearly 1% from $2.829 per share to $2.857 per share despite the majority of revisions being downward.

The company has a Momentum Grade of A, based on its Momentum Score of 89, and a very strong Growth Grade of A. Advanced Micro Devices does not currently pay a dividend.

Jabil (JBL) is a provider of manufacturing services and solutions. The company provides comprehensive electronics design, production and product management services to companies in various industries and end markets. The company has two segments: electronics manufacturing services (EMS) and diversified manufacturing services (DMS). The EMS segment is focused on leveraging information technology (IT), supply chain design and engineering, technologies centered on core electronics, sharing of its manufacturing infrastructure and the ability to serve a range of markets. The EMS segment produces products to the customers primarily in the fifth generation, wireless and cloud, digital print and retail, industrial and semi-cap and networking and storage industries. The DMS segment is focused on providing engineering solutions, with a focus on material sciences, technologies and health care. The DMS segment includes customers primarily in the automotive and transportation, connected devices and other industries.

Jabil has a Value Grade of B, based on its score of 67, which is considered to be good value. The company’s Value Score ranking is good across several traditional valuation metrics, with a rank of 57 for the price-to-free-cash-flow (P/FCF) ratio, 15 for the price-to-sales (P/S) ratio and 23 for the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA) (lower ranks indicate more attractive valuations). Successful stock investing involves buying low and selling high, so stock valuation is an important consideration for stock selection. The Value Grade is the percentile rank of the average of the percentile ranks of the valuation metrics mentioned above along with the price-earnings (P/E) ratio, price-to-book-value (P/B) ratio and shareholder yield.

Jabil has a Momentum Grade of A, based on its Momentum Score of 89. This means that it ranks in the top tier of all exchange-listed stocks in terms of its weighted relative strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters.

Texas Instruments (TXN) is a semiconductor design and manufacturing company. With design, manufacturing or sales operations in more than 30 countries, Texas Instruments is a global supplier of chips to electronics designers and manufacturers. The company has a focus on analog and embedded processing products. It operates in two primary segments: analog and embedded processing. The company’s “other” segment includes digital light processing (DLP) projectors, calculators, custom application-specific integrated circuits (ASICs) and royalties.

Texas Instruments is the world’s largest maker of analog chips. Analog semiconductors are used to condition, amplify or convert signals such as sound, temperature, pressure or images to data that can be processed by other semiconductors. Analog semiconductors are also used to manage power in every electronic device. Embedded processing products are the digital brains of many types of electronic equipment. They are designed to handle specific tasks and can be optimized for various combinations of performance, power and cost, depending on the application.

An important factor in analog’s attractiveness is its relatively steady and profitable business model. Analog companies tend to have thousands of products and a very broad customer base, which lends stability to the revenue stream. Analog markets are also appealing because these are not commodity products.

Texas Instruments has a very strong Growth Grade of A with a score of 90. This is based on sales increases in each of the last five years, and positive cash from operations in four out of the last five years. Its five-year average annual sales growth is 6.0%, translating to a rank of 87. The five‐year sales growth rank awards higher weightings for five‐year sales growth that ranks in the middle 60% of all exchange-listed stocks, while lower weightings are awarded to those companies at the extremes—either too high or too low. The weightings for all companies in the stock universe are then ranked.

A higher-quality stock possesses traits associated with upside potential and reduced downside risk. Backtesting of the Quality Grade shows that stocks with higher Quality Grades, on average, outperformed stocks with lower grades over the period from 1998 through 2019. Texas Instruments has a Quality Grade of A, putting it in the top tier among all U.S.-listed stocks.

The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross profit to assets, buyback yield, change in total liabilities to assets, accruals, Z double prime bankruptcy risk (Z) score and F-Score. The score is variable, meaning it can consider all eight measures or, should any of the eight measures not be valid, the valid remaining measures. To be assigned a Quality Score, though, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

The company ranks highly in terms of its return on assets and return on invested capital, ranking in the 98th and 87th percentile of all U.S.-listed stocks, respectively. However, it ranks poorly in terms of its change in total liabilities to assets, in the 23rd percentile.

___

The stocks meeting the criteria of the approach do not represent a “recommended” or “buy” list. It is important to perform due diligence.

If you want an edge throughout this market volatility, become an AAII member.

Read the full article here