Co-authored by Treading Softly

What’s your favorite flavor of ice cream? What’s your favorite food? Do you have a favorite car brand? Maybe a favorite brand for the sneakers you like to buy, or the jeans you prefer? Perhaps you have a favorite electrician or auto body shop? It’s natural to develop a tendency towards having preferences because you have previously had positive experiences, or societal pressure encourages you to believe certain things are superior to others.

Investors often have preferential favorites based on past performance. While we all recognize that past performance doesn’t guarantee future returns, a company with a management team that has proven itself adept in past scenarios is likely to be adept unless it shows signs to the contrary.

When it comes to the financial sector of the market, investors readily feel that higher interest rates benefit the sector more so than lower interest rates. If you are painting with a wide brush, it’s true. However, many sectors within the financial sector can be hurt more by declining rates than others. A mega-bank like Bank of America (BAC) can largely shrug off interest rate movements because of its massive capital reserves. It benefits from rate cuts and increased consumer lending activity, but it also benefits when rates rise with the ability to lend to businesses at a higher cost.

When we come to the more focused subsector within financial services, we find Business Development Companies or BDCs. These are companies that are designed to help support lending and provide liquidity to middle-market companies across America. As such, they benefit when interest rates rise because their earnings will rise. But, if interest rates remain high too long, they can start seeing cracks in their portfolio because of rising default rates. Middle-market companies are often privately held, making it more difficult for them to refinance their debt amidst quantitative tightening. So, if interest rates remain high for too long, they can start defaulting on loans and close shop. The question becomes, “What is your favorite BDC to hold through a recessionary period?” Are there any with proven track records that we can look back on? Today, I want to talk about my favorite BDC to hold through a recession.

Let’s dive in!

Deploying More Capital, Earning More Income

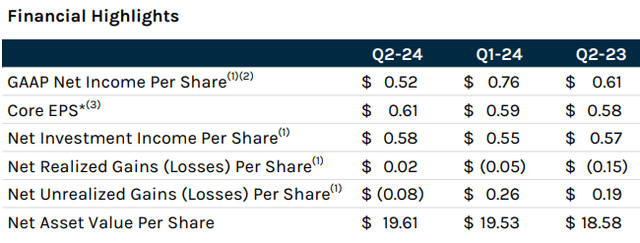

Ares Capital Corporation (NASDAQ:ARCC), yielding 9.4%, is a BDC that focuses primarily on lending to non-publicly traded middle-market companies. ARCC reported a very strong quarter, with Core EPS coming in at $0.61 and NII (Net Investment Income) coming in at $0.58/share – both higher year over year and from last quarter. Source

ARCC Q2 2024 Presentation

The cherry on top is that net asset value increased to $19.61, up 5.5% year over year.

For the past several years, rising interest rates have fueled growth in BDCs. BDCs follow a strategy of lending at floating rates while using fixed-rate debt for their own leverage. As a result, rising interest rates mean higher returns on the same assets.

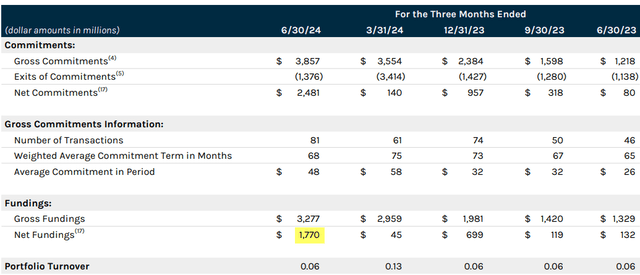

As the Fed stopped hiking, interest rates leveled out over the past year, and earnings have stabilized. Today, quarterly earnings are primarily dependent upon BDCs increasing the amount of assets they invest in. ARCC’s Q2 was strong because it funded a net $1.77 billion in new investments.

ARCC Q2 2024 Presentation

This compared to just $45 million last quarter and $995 million in the prior four quarters combined. $1.77 billion in net funding is a lot more than we’ve seen recently, and that is what drove earnings higher. A larger portfolio produces more cash flow.

ARCC has been achieving this growth by issuing common equity. Last quarter, it ended with 630 million in common shares, an increase of 22 million from the prior quarter and 73 million from the end of Q2 2023.

ARCC can do this because its share price has traded at a premium to NAV. This gives them the green light for growth, as they can invest the new shares at returns that increase per-share earnings for everyone.

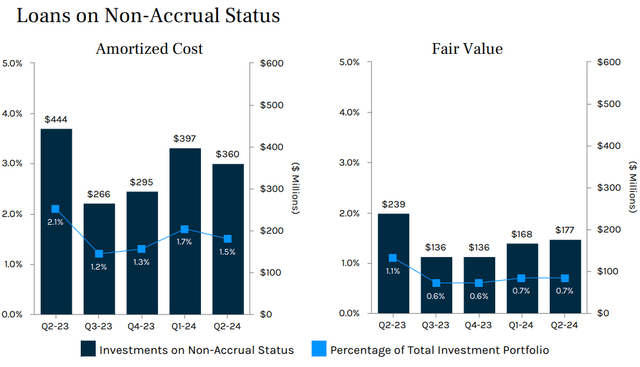

In terms of credit quality, ARCC’s portfolio remained stable, with approximately 4% of its portfolio in the two highest-risk categories. This compares to 4% last quarter and 7% a year ago. Borrowers have seen stress from higher rates, but the headwind of higher rates is front-loaded. Borrowers who are going to struggle, have struggled and either solved their issues or went under.

Non-accruals in ARCC’s portfolio have declined to 1.5% on an amortized cost basis, down from 1.7% last quarter and 2.1% a year ago.

ARCC Q2 2024 Presentation

Looking forward, ARCC’s ability to grow earnings is going to be dependent upon its ability to issue equity at a premium to NAV and/or its willingness to increase leverage. At 1.01x debt to equity net of cash, ARCC definitely has room to leverage up. In the past, we’ve seen ARCC willing to take leverage up to 1.15x-1.20x. A willingness to go that high will obviously be dependent on conditions.

Overall, we expect ARCC’s earnings to be stable to slightly up and for its book value to continue growing as debt markets become more stable, which will be positive for its valuations. ARCC common shares should be able to continue trading at a modest premium to NAV. Currently, ARCC is a bargain trading at a ~5% premium to NAV; based on history, we could see it trade as high as a 15% premium to NAV.

Conclusion

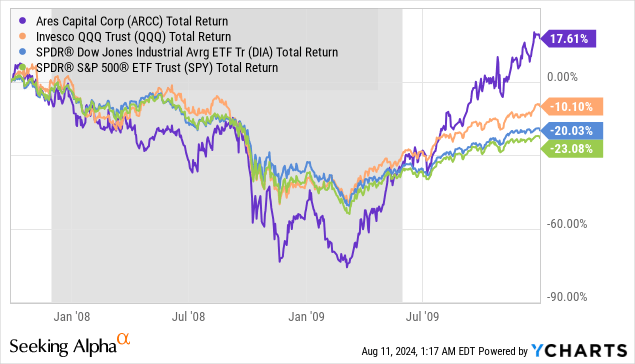

We saw why ARCC is attractive today: you can buy more shares and grow your position for more income. But the question becomes, can we take a snapshot of what occurred in the prior recession? We can. ARCC existed through the Great Financial Crisis. While ARCC was hit hard during the recession, it also recovered exponentially compared to major market indices.

This is one reason why I like to hold ARCC both in strong and weak economic conditions. The management team has proven itself to be adept at managing the situation effectively. We discussed above how they were using fixed-rate debt to originate floating-rate loans. Now, we’re seeing that instead of piling on more debt while interest rates are high, they are effectively issuing out new shares at a premium to book value to grow their asset base and earnings.

When it comes to your retirement, you need to hold companies in your portfolio that can be stalwarts of income regardless of what’s going on. You need people you can trust to show up to work, actively manage the portfolio while managing execution and market risks, generate income, and pay you a strong dividend reliably and consistently. This way, you don’t have to worry about making money; you can simply worry about enjoying your retirement.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here