Co-authored with Hidden Opportunities

Do you enjoy traveling? I personally enjoy undertaking new adventures, exploring new places, and immersing myself in new experiences. Soaking up different cultures and trying exotic cuisines are among my favorite aspects of traveling to new regions. Preparing for the vacation itself is a part that brings a lot of excitement to me. From finding the right balance between expense and comfort while booking the travel and accommodation to creating an itinerary of activities I want to pursue at our destination, I love the process of planning.

Things rarely go exactly as planned. Sometimes, there is a large volume of tourists, making it harder to cover all my points of interest, or unexpected weather preventing certain activities. This is why my itinerary serves as a guideline rather than a strict schedule to follow. A good plan with provisions for ad-hoc changes makes it a memorable trip.

In a similar way, when it comes to investing, it is critical to set clear goals and understand your risk tolerance. By identifying promising securities, making investments, and regularly monitoring their performance, we can adjust our approach as unexpected events arise, ensuring we stay on top of our financial objectives. My investment goal is to generate predictable and reliable income from my portfolio, aiming for financial independence today and support for my retirement in the future. With this approach in mind, let’s review my top income picks.

Pick #1: VZ — Yield 6.5%

American telecom giant Verizon Communications Inc. (VZ) reported its second-quarter results on July 22, followed by a bitter reaction from Mr. Market. We’ll discuss the progress and the financials from the report to explain why we think this is a buying opportunity for growing income.

Within the consumer segment, VZ reported 1.8 million postpaid phone adds, a 12% YoY increase, marking the sixth consecutive quarter with YoY growth. Within broadband, VZ delivered 391,000 net additions in Q2, marking the eighth consecutive quarter with over 375K net adds. Within fixed wireless access, the telecom provider delivered 378,000 net adds during the quarter, altogether bringing its base to over 3.8 million subscribers (a 69% YoY growth)

Within the business segment, VZ delivered strongly with a quarterly record 160,000 fixed wireless access net adds and ended Q2 over 11.5 million broadband subscribers (a 17% YoY increase)

Coverage Expansion In Underserved Markets

VZ continues to expand its C-band spectrum in suburban and rural areas, reporting that almost half its network traffic is running on ultra-wideband (up from 36% last year). During the quarter, the company also announced a partnership with AST SpaceMobile (ASTS), a company pioneering a “direct-to-device” technology to provide broadband services to unmodified smartphones via its satellites.

“Our agreements with AT&T and Verizon are essentially eliminating dead zones and empowering remote areas of the country with space-based connectivity.” – Abel Avellan, CEO, AST SpaceMobile.

VZ expects this partnership to provide satellite-to-device connectivity using the 850 MHz spectrum, bringing its 5G network to underserved communities and furthering its goal of achieving 100% coverage from coast to coast. This positions the telecom company to match the capabilities offered by SpaceX’s Starlink without new equipment.

Financial Results Show Surging FCF

VZ’s Q2 wireless service revenue totaled $19.8 billion (a 3.5% YoY growth), driven by the consumer segment. Consumer postpaid Average Revenue Per Account (‘ARPA’) grew 5% YoY. For Q2, VZ reported adj. EBITDA of $12.3 billion (a 2.8% YoY increase) and an adj. EPS of $1.15/share.

As expected, VZ reported $8.1 billion capex for the quarter (down from $10.1 billion in Q2 2023) as the company reports that they have deployed C-band on nearly 60% of the planned sites.

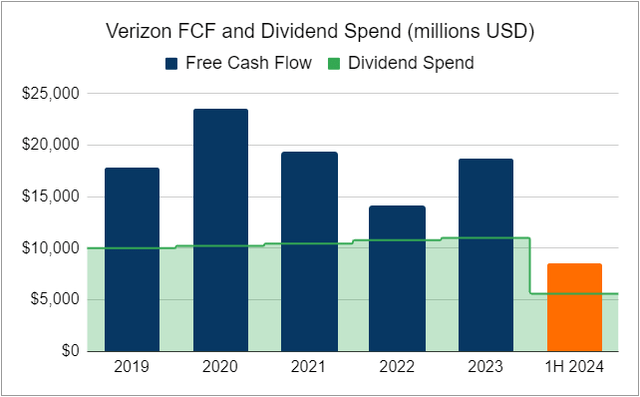

Due to declining Capex, VZ delivered $8.5 billion in FCF (Free Cash Flow) for the first half of 2024, representing a $550 million increase vs. the same period last year, despite higher tax and interest expenses. For 1H 2024, VZ’s FCF placed its dividend at a 65% payout ratio.

Author’s Calculations

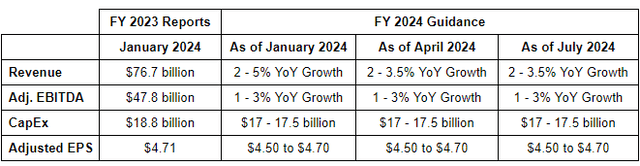

We expect VZ to keep up with its 17-year track record of dividend raises (averaging ~2% in recent years) and deliver another hike in September. VZ successfully reduced $3.4 billion in total debt and ended Q2 at a leverage ratio of 2.5x (vs 2.6x at the end of Q1). The company’s balance of unsecured debt carries an A- rating from Fitch. VZ has reaffirmed its guidance for FY 2024, with 1-3% YoY adj EBITDA growth and adj. EPS between $4.50 to $4.70.

Author’s Calculations

If we assume a 2% dividend raise in September, the payout would be a respectable ~59% at the midpoint of VZ’s adj. EPS guidance.

In VZ, we see a company delivering exactly as it outlined at the beginning of the year. We are seeing debt reduction, capex decline, growing FCF, and higher dividends. The market sell-off because VZ missed analyst revenue expectations by $249 million (which happens to be a rounding error on its $32.8 billion quarterly top line) presents an attractive opportunity to grab this 6.8% qualified yield. We note that the revenue miss was primarily induced by a decline in wireless equipment revenue, as device upgrades were down 13% YoY. Equipment sales and upgrades are a low-margin business for Verizon, often sold at or near cost to attract and retain retail customers. We are encouraged to see strong growth in the company’s core business segments, which are its primary profit drivers.

Pick #2: JPC — Yield 10.5%

Cash returns have been attractive for investors over the past few years in this high interest-rate environment. The Fed is close to slashing rates, and we expect more of this in 2025 if the economy continues to weaken. This will significantly weigh on cash and cash-like investments, such as money-market funds and CDs.

Since it is very important to position yourself for whatever the market may throw at you, we will now discuss a CEF that will experience strong tailwinds from rate cuts.

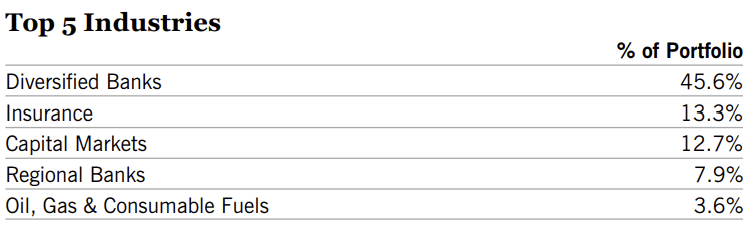

Nuveen Preferred & Income Opportunities Fund (JPC) is a CEF with 83% exposure to cash-flow-rich industries such as banks, insurance firms, capital markets, and oil and gas companies. The fund’s assets are highly diversified across 325 holdings, with ~80% of the portfolio deployed into investment-grade securities (rated BBB and higher). Source

JPC Fact Card

To discuss this further, 88% of the CEF’s assets are institutional preferreds, which are typically thinly traded, require large capital investments, or are simply unavailable to the average investor. In recent months, we have seen several investment-grade companies issue high coupon preferreds with excellent dividend coverage, and JPC has been buying these at bargain prices. As a result, the CEF’s NII has steadily improved, leading to a 40% distribution raise last month. The CEF makes monthly payments, and the current yield is 10.5%.

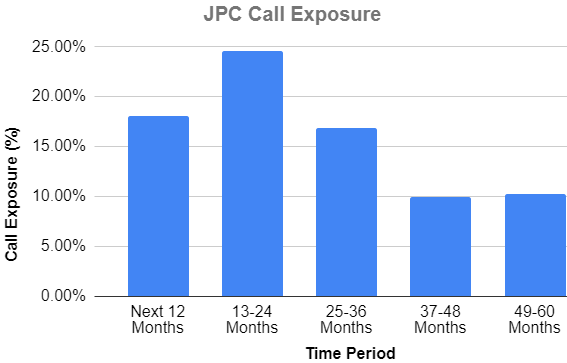

JPC’s call exposure is well-staggered, with a leverage-adjusted effective duration of 4.2 years. This positions its portfolio NII to remain stable through maturities and early redemptions.

Author’s Calculations

The CEF operates with an effective leverage of 37.7% at a weighted average cost of 6.2%. While this is a source of headwinds in the form of higher interest expenses when rates are elevated, it will quickly reflect into greater NII as rates drop. As such, we can expect higher distributions. Moreover, rate cuts will increase the market value of JPC’s holdings, automatically boosting the NAV.

Even if rates stay elevated for longer, we see benefits for JPC. Even the biggest companies need capital to grow and will continue to issue high-coupon securities. JPC will actively manage its portfolio to allocate more to higher-yielding securities and grow its total investment income and NII as a result.

JPC trades at a 5% discount to NAV, making your dollar buy more of the discounted and lower-risk assets it holds. With this CEF, we see a win-win situation for our income stream, no matter what the Fed chooses to do.

Conclusion

In both travel and personal finance, success lies in thoughtful planning while maintaining the flexibility to adapt to unexpected situations. This is particularly important in retirement as there can be unexpected expenses, lifestyle, or personal health changes that have the potential to send an ill-prepared retiree back into the workforce. You need a portfolio that supports your financial needs in retirement, and it should work just as effectively in a bear market as it does in a bull market.

Our Investing Group maintains a meticulously crafted portfolio of over 45 securities, targeting an 8 – 10% overall yield. Some of our holdings pay well below 8%, while others pay significantly over 10%. Some benefit from rising rates, while others thrive when rates decline. Some investments thrive in a booming economy, while others excel during downturns. Altogether, my portfolio ensures that I swim in dividends across all market cycles. Such a portfolio is essential for a happy and healthy retirement, and the Income Method can help you achieve this level of financial stability.

Read the full article here