Note:

I have covered Bristow Group Inc. (NYSE:VTOL) previously, so investors should view this as an update to my earlier articles on the company.

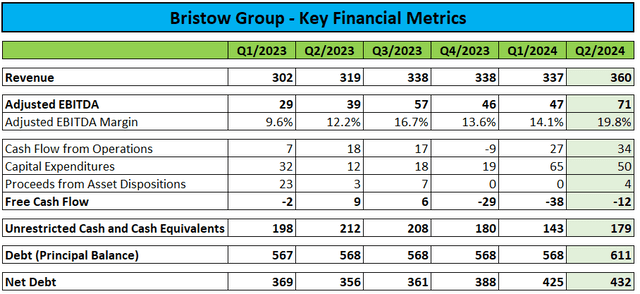

Last week, leading helicopter services provider Bristow Group or “Bristow” reported strong second quarter results, with both top-and bottom line results outperforming consensus expectations:

Company Press Releases / Regulatory Filings

Adjusted EBITDA of $71 million and Adjusted EBITDA margin of 19.8% advanced to new multi-year highs as the company’s core offshore energy services segment outperformed expectations across multiple regions, thus more than offsetting penalties suffered in the company’s government business. In addition, Bristow’s fixed wing business also delivered a strong performance.

However, as outlined by management on the conference call, Q2 results benefited from an aggregate $8.6 million in one-time items:

Of note, there are a few quarter-specific items which benefited our financial results in Q2. These include a seasonal personnel cost benefit in Norway, the transition from cash-basis recognition to an accrual basis of accounting for lease payments from Cougar, an adjustment for tax equalization in Suriname, and the release of an insurance reserve. In aggregate, these items resulted in an $8.6 million benefit to Q2 results.

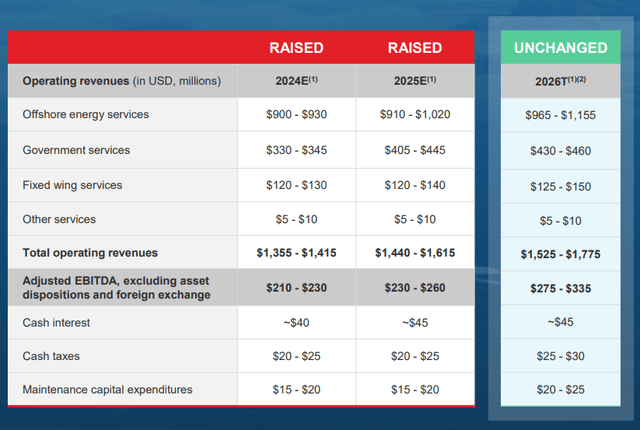

While the company expects some of the Q2 operational tailwinds to abate in the second half, Bristow raised its outlook for both 2024 and 2025 while leaving the recently introduced preliminary 2026 guidance unchanged:

Company Presentation

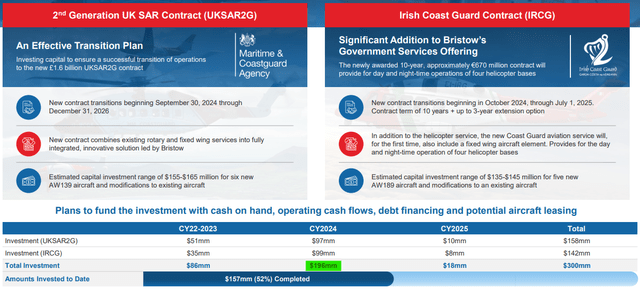

Bristow generated $34 million in cash flow from operations but elevated capex requirements related to the new SAR contracts in the United Kingdom and Ireland resulted in slightly negative free cash flow for the quarter.

Company Presentation

While SAR capex should come down significantly next year, the company expects to take delivery of new helicopters for its offshore energy service operations in 2025 and 2026 with the required investment exceeding $170 million.

However, even when considering Bristow’s fleet expansion efforts, the company should start to generate meaningful free cash flow next year which bodes well for shareholder capital returns in the form of buybacks and/or dividends as also stated by management during the questions-and-answers session of the conference call (emphasis added by author):

Steve Silver

(…) And given the strong performance in Q2, the recent financing now behind you, and now being more than halfway through the contract investments for the new SAR contract. Is there any change in your thinking in terms of potential timing on capital allocation and shareholder returns?

Chris Bradshaw

No material change, Steve. I think it affirms the framework that we have for thinking about capital allocation, namely that we want to ensure that we protect our strong balance sheet. We are, via our significant exposure to the Offshore Energy Services space, exposed to volatility from oil and gas cycles. So we want to make sure that we have a strong balance sheet that can withstand various cycles over time.

We also want to make sure that we have the ability to continue to invest in attractive organic investments, like the ones that are driving our higher guidance ranges. And then we also believe we’ll be in a position, particularly in the latter half of 2025 and beyond, to return capital to shareholders via share buybacks, whether that be programmatic or opportunistic, and potential dividends.

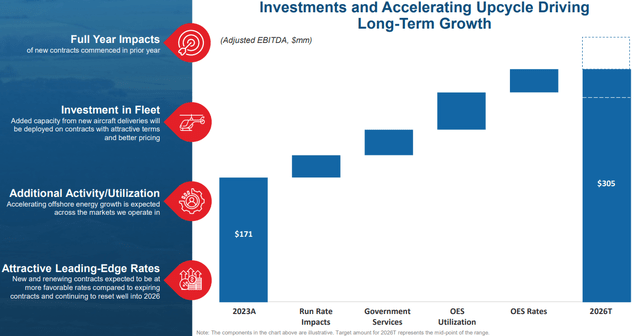

Going forward, the company expects continued increases in profitability from the commencement of new SAR contracts in the United Kingdom and Ireland, as well as a combination of higher rates and improved fleet utilization in the offshore energy services segment:

Company Presentation

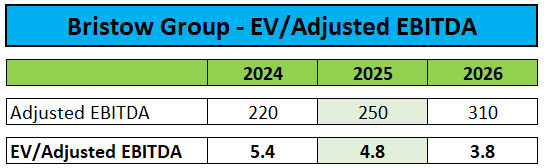

As a result, I have updated my Adjusted EBITDA estimates for Bristow:

Author’s Estimates

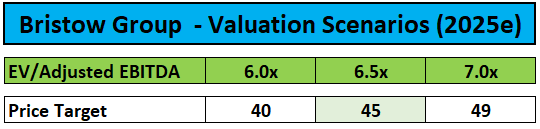

With the government services segment offsetting some of the inherent volatility in the offshore business, assigning a multiple of 6.5x EV/Adjusted EBITDA seems warranted, thus resulting in a $45 price target for the shares:

Author’s Estimates

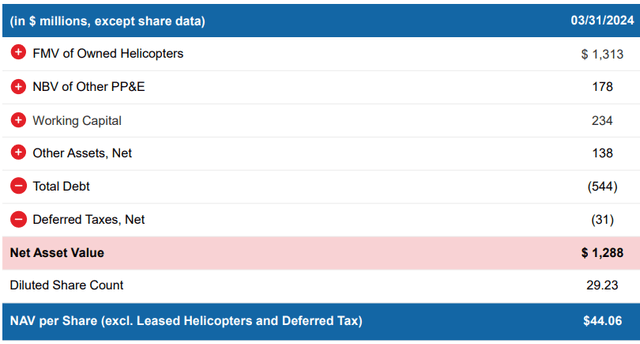

The new price target roughly matches the company’s most recent net asset value (“NAV”) estimate:

Company Presentation

Bottom Line

Bristow Group reported better-than-expected quarterly results, with strong profitability and decent operating cash flows.

However, some of the outperformance was a result of one-time benefits which are not expected to repeat going forward.

With the core offshore energy services segment expected to further improve profitability, the company raised its outlook for both 2024 and 2025.

Starting next year, Bristow will also reap the benefits from its material investments in new large-scale government SAR contracts, which should provide the company with healthy margins and cash flows well into the next decade.

Even after the recent rally, Bristow’s shares are still providing for substantial upside. As a result, I am reiterating my “Buy” rating while raising my price target from $35 to $45.

Read the full article here