Co-authored by Treading Softly.

When you decide to give somebody a gift, you can often choose between two categories. The first category includes tangible items such as a book, a set of skis, or a television. The second category includes experiences such as an annual pass to your local zoo, free movie tickets, or a membership to a ski resort.

When it comes to owning real estate, there are two major types of properties that can exist. There’s the real estate that is based around tangible items – retail stores, office space, and warehouses, and there is real estate that’s designed to provide the experiences – casinos, ski resorts, amusement parks, and movie theaters. Typically, what we fail to remember within this experiential realm is also places to go work out, schools and educational facilities, and at times, medical facilities – although those aren’t usually experiences you typically desire to have, but ones you’re forced into.

Our unique method of approaching the market for income is called the Income Method, a driving force that fulfills my desire to get paid for everything that I do. This is one reason why I own my local utility, so that way anytime someone flips a switch in my neighborhood, I’m getting my cut. For this reason, I have exposure to fuel retailers, so this way every time you fill up your car with gas, I get my cut. This is why I refused to neglect the experiential side of property ownership because when you go out to have fun, I want to get my cut. People continue to flock to movie theaters, even though many believed it was dead when streaming and COVID-19 was a double whammy against them. Yet still see high-quality movies like Deadpool and Wolverine are drawing massive audiences.

Today, I would like to look deeper at a company that owns experiential real estate and pays monthly.

Let’s dive in!

Big Experiences, Paying You Monthly

EPR Properties (NYSE:EPR), yielding 7.8%, is a REIT that focuses on experiential properties. It started as a REIT dedicated to being a landlord for movie theaters, a sector that until COVID was strong and known for being very consistent with rent. Theaters have plenty of attractive features for a landlord: The sector is dominated by a handful of large corporations, the real estate is an essential portion of their business, and substantially all the cash flow from the business flows through the real estate. Even with the popularity of going out to the movies diminished, EPR benefited from master leases so that even when a particular location closed, rent remained unchanged.

Recently, EPR has focused on diversifying but is still focused on properties that have similar benefits. Namely, EPR wants to own real estate that is rented to businesses that are highly dependent upon that particular real estate. Places where customers go to, where the property level cash flow accounts for most of the tenant revenues, and where rent is ultimately a rather insignificant portion of expenses. This led to properties like water parks, amusement parks, ski resorts, and golf attractions. These are places where people go to have fun, and can’t be moved, and the real estate is an integral part of the business. It isn’t like an amusement park operator is going to take apart their millions in equipment and move it across the street because someone offered them a lower rent.

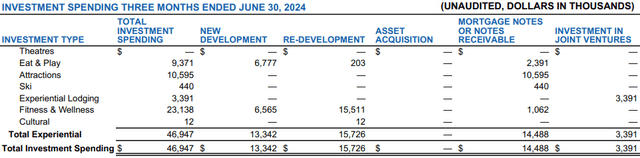

In Q2, we saw EPR continue to execute their plan, selling $10 million in real estate leased to theaters, and investing just under $47 million in their other categories. Source.

EPR Properties Q2 2024 Supplement

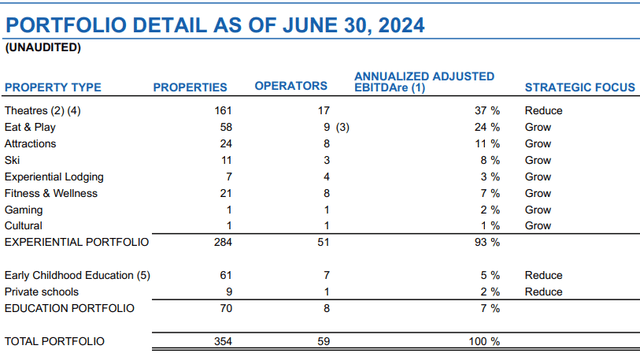

EPR has been gradually making this transition, reducing its theaters from 171 properties in Q2 of last year to 161 properties today. EPR wants to diversify, but they are only disposing of properties when it can be done at attractive prices.

EPR Properties Q2 2024 Supplement

Management has outlined its long-term plan, but instead of forcing it, they are content to watch the market and take advantage of opportunities as they arrive.

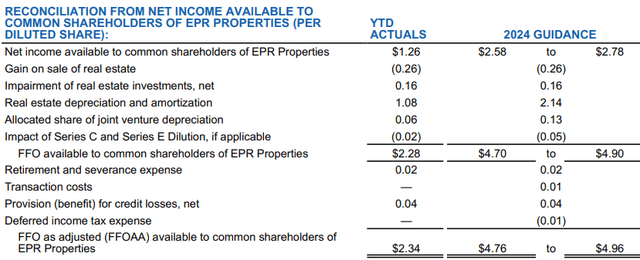

FFOAA (Funds From Operations As Adjusted), came in at $1.22/share in Q2. This was down from $1.28/share in Q2 2023. However, we need to remember that in 2023, EPR was still receiving rent payments that were deferred in 2020. Those obligations are now paid in full, so those extra payments are no longer a factor.

Turning to guidance, EPR reaffirmed its 2024 guidance, which implies growth of approximately 3% year-over-year excluding the impact of the 2020 rent deferral payments.

EPR Properties Q2 2024 Supplement

EPR’s guidance at the midpoint suggests that FFOAA will be $2.52 in the second half, compared to the $2.34 earned in the first half.

With long-term interest rates starting to come down, it is likely that EPR will have the opportunity to be more aggressive in 2025 than it has been in 2024. We expect that growth will accelerate in the second-half as management guidance suggests, and we expect that in 2025 EPR will be able to trend closer to a growth rate of around 5%/year.

EPR pays us a monthly dividend with an annualized yield of over 7.5%. We expect that dividend growth can be sustainable at a 3-5%/year pace. That makes for a very interesting investment profile, with a reasonably high yield right now, and moderate income growth looking forward.

Conclusion

EPR is effectively reducing its exposure and reliance on movie theaters and expanding into multiple other avenues of experiential properties. I think this is the perfect course of action for them because while movie theaters are still showing strength, other categories of experiential properties will continue to provide them with better revenue in the future, even through recessionary periods.

The management team overseeing EPR has been through the wringer when it comes to recessions or COVID shutting down much of the entertainment and experiential sector for properties. However, they have shown the ability to adeptly manage EPR to the success of its shareholders. Today, you can collect a massive 7.8% yield paid out to you in monthly installments throughout the year.

I love receiving monthly income. For many, it makes it simpler to budget when they receive money every single month. If both recur monthly, it’s easy to match a bill to the dividends.

When it comes to retirement, finances should be made as simple and straightforward as possible. You would rather not spend your golden years shackled to a desk with your checkbook, trying to figure out how to squeeze as many dollars as you can out of your fixed income budget so that you cannot just feed yourself and your family, but also pay your bills and see if you have two shekels to rub together for hobbies and experiences. Instead, you should be able to streamline your finances so that your expenses and your necessities are readily covered, and you have an abundance of additional income to enjoy your favorite hobbies. Not every hobby or experience is expensive. You can walk in a park next to a beautiful stream for very little cost. However, occasionally, you may want to take those expensive experiences, and your retirement portfolio should be able to provide you the income you need to do so when you want to do so. If it isn’t, perhaps it’s time to change how you invest and set up your retirement portfolio. Turn down the distractions, turn up the income.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here