Introduction

As a dividend investor, my two main concerns are reliability & consistency. And if a stock has these two things, it usually means it’s a quality company, and worth considering for someone like myself.

Some investors often search for high-growth dividend stocks and while we all love capital appreciation and dividends, I often find myself buying those that are considered low-growth and boring.

I’ve diversified my portfolio with a few companies that, I think, will deliver high-digit growth over the long term. But again, delivering consistent results while giving some growth is all I ask for.

In this article, I list two stocks that should deliver consistent dividends over the long-term, and also have strong potential for upside in the medium to longer-term.

Chasing Yields

While chasing stocks with super high yields can be considered attractive, I prefer to buy stocks that are considered boring. Those that deliver low, slow growth, but most important of all, they are consistent. And when I buy them, I assume they will continue to pay me for the next 10–15 years. Or forever in come cases.

It’s no guarantee that any company’s past performance will predict their future, but it does play an important role. For example, Coca-Cola (KO), a Dividend King, has paid dividends for more than 60 years and will likely continue for the foreseeable future. On the contrary, a former Dividend King, Leggett & Platt (LEG) slashed their dividend earlier this year after paying dividends for more than half of a century.

A recent high-yielder that cut its dividend by 25% was TriplePoint Venture Growth (TPVG), a BDC that paid a yield upwards of 17% earlier this year. I recently touched on this in an article you can read here.

I say that to say the two stocks I discuss, I foresee paying investors reliable dividends for many years to come, or otherwise I wouldn’t recommend them or have held myself. Without further ado, let’s get into the two companies.

Stock #1: Verizon (VZ)

With the market being considered overvalued, there aren’t many stocks trading at decent valuations. Stocks have rallied now that many think interest rates will come down as soon as next month. But there are some I think still trade at decent valuations that pay safe dividends that are well-covered.

Verizon Communications (VZ) is one of those. The company has a respectable track record as a dividend contender, meaning they have more than a decade of paying dividends. They are also one of the big 3 telecom companies in the U.S., so it’s safe to say they aren’t going anywhere anytime soon.

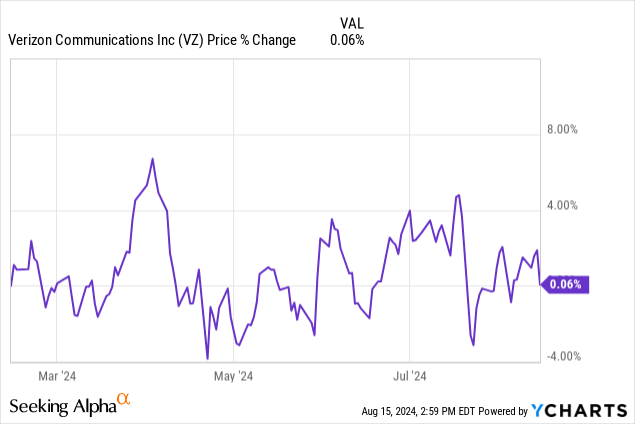

Verizon is also what you consider a boring stock. I mean, their share price reflects this. At a current price of $40 at the time of writing, the stock hasn’t seen much upside in the past 6 months, up just 0.06%.

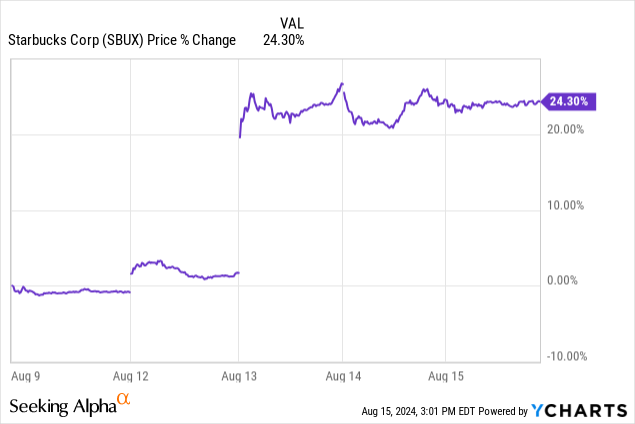

Since July, many stocks have rallied, giving investors some nice capital appreciation along the way. Case in point, Starbucks (SBUX), another dividend stock I own, rallied double-digits on the news of their CEO stepping down.

I was down on my position until that news broke, and sold some shares for a profit as a result. SBUX is considered a high-growth company that has faced its fair share of headwinds over the past 2 years due to high-interest rates. But they’ve seen more price action in the past week than Verizon has over the past year.

But during Verizon’s latest quarter reported in July, the telecom giant delivered solid results. Not world beating, but again I expect it from VZ. Think of these two stocks listed in this article as tortoises. Slow & steady. SBUX is the hare.

EPS declined year-over-year by roughly 5% from $1.21 to $1.15. This was a result of higher taxes and interest expenses as the company put more C-band spectrum into service, as mentioned by management during earnings.

Revenue ticked up slightly by less than 1% from $32.6 billion to $32.8 billion. Slow! But as I’ve mentioned before, some growth is better than no growth. The tortoise is continuing to move towards the finish line.

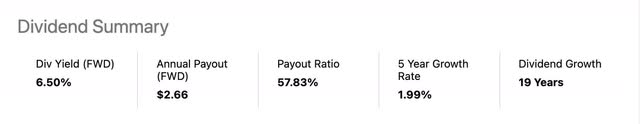

Adjusted EBITDA rose from $12 billion to $12.8 billion, and free cash flow also grew 3% year-over-year. This stood at $8.5 billion during the 1H of 2024 in comparison to $8 billion the year prior, a 7% increase. And with an attractive yield above 6% and a payout ratio of less than 60%, VZ is likely to reward investors with small incremental dividend increases for many years to come.

Seeking Alpha

Aside from improvements year-over-year in cash flow and EBITDA, another reason I think VZ has long-term upside is they’re continuing to chip away at their debt. With high-interest rates currently, I think this along with their sizable debt load is the reason for the stock’s lackluster performance.

Their net unsecured debt declined year-over-year from $126.6 billion to $122.8 billion, improving their debt to EBITDA to 2.5x, down from 2.6x in the prior quarter. So, VZ is on the right track and doing all the right things. And once interest rates come down substantially, I think VZ’s share price will see some strong upside.

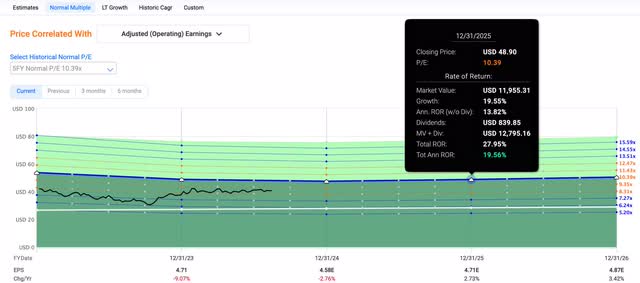

Using their midpoint of guidance, this gives Verizon a forward P/E of just 8.73x, well-below their 5-year historical average of 10.39x. With a P/E that low, it’s no wonder Quant assigns them an A- valuation grade, signaling the stock could be severely undervalued as they trade below the sector median of 12.91x. Even if they return to their historical average, this gives investors upside potential of more than 22%.

Fastgraphs

I do think Verizon could potentially return to its 5-year historical P/E, but this will be highly dependent on where the economy and interest rates will be in the next year/year and a half.

The company would also have to continue improving its cash flows, maintain lower CAPEX spending, and continue making a dent in its debt. And with lower interest rates, I think they could, as this would result in lower interest expenses and lower refinancing.

Stock #2: NNN REIT (NNN)

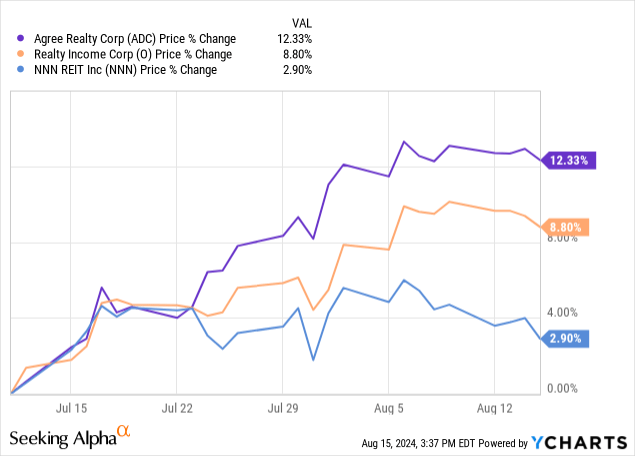

Second on the list is another stock many would consider boring, NNN REIT. The market rallied last month when the CPI report for June was announced on July 11th, and NNN did see their share price increase. But not as dramatically as some of its peers like Agree Realty (ADC) and Realty Income (O).

In the chart below, shortly after the CPI report came out, both peers’ share prices soared in comparison to NNN’s from then until now. ADC leads the pack up double-digits while NNN is up less than 3%.

One reason is I think the REIT’s preference to invest in non-investment rated tenants. Like Agree Realty who focuses on the biggest and best retailers in the country, NNN prefers non-rated tenants as this gives them better leasing terms and bargaining power. This could also lead to better returns for some REITs as well.

With some saying a recession is looming, investors likely prefer to invest in REITs like ADC, who are considered safer due to more stable tenants. But that has not stopped NNN REIT as they have performed solidly this year.

They reported earnings at the beginning of this month, delivering another solid quarter. Consistent as usual for the REIT. FFO came in at $0.83 beating analysts’ estimates by $0.02. Revenue also beat estimates, coming in at $216.81 million. FFO was flat from the prior quarter, but revenue increased less than 1% from $215 million.

By now, investors may be realizing that both of these companies don’t deliver world-beating numbers. As I previously mentioned, they’re tortoises. But every investor should consider at least one tortoise in their portfolio.

A stock that delivers low, slow growth but consistently pays a growing dividend, even if it’s small increases. Every company can’t deliver double-digit earnings or reward massive capital appreciation due to their business models structure, sector, etc.

But these two stocks can give you reliability and consistency. Year-over-year FFO grew from $0.80 while AFFO of $0.84 also increased from $0.80. And this consistency allowed management to increase their FFO guidance for the year. They now expect this in between $3.27 – $3.33, up from $3.25 – $3.31 prior.

Additionally, they still expect to acquire in between $400 – $500 million worth of properties this year. During the quarter they invested $110.5 million acquiring 16 properties at a 7.9% cap rate. That’s more than 100 basis points spread from the 6.7% weighted-average cost of capital, which fellow analyst Cash Flow Venue touched on in an article last month.

YTD NNN sold a total of $85 million worth of properties and recently lifted their disposition guidance to $100 million from $80 million. This gave them $17.6 million in proceeds the REIT can use to reinvest back into existing properties or acquire additional ones to continue growing its portfolio.

Their occupancy did tick down from 99.8% at the end of 2023 to 99.3%, but this is still above their historical average of 98%. Moreover, NNN also pays an attractive yield over 5% protected by a conservative payout ratio of 69%. This is very low for a REIT, as many may know they are required to payout 90% of their distributable income as dividends.

Seeking Alpha

Unlike Verizon, they are also a Dividend Aristocrat with more than 30 years of paying dividends, longer than both Agree Realty and Realty Income. Their balance sheet is also strong with well-staggered debt maturities and a net debt to EBITDA of 5.5x and liquidity of $1.2 billion. Their next debt maturity is not until the last quarter of 2025.

Using the midpoint of guidance, this gives NNN REIT a P/AFFO multiple of 13.56x. Quant assigns them a valuation grade of B- signaling the stock could still offer some upside as they still trade well-below the sector average of 16.05x. If NNN returns to their historical P/AFFO multiple of 16.09x, this gives investors similar upside of roughly 22% like Verizon.

Fastgraphs

Risks & Conclusion

With both of these stocks highly dependent upon debt, their biggest threat is higher for longer interest rates. Especially for VZ as this would continue to increase their interest expenses and make bringing down their huge debt load even more difficult.

Although NNN REIT doesn’t have as much debt, REITs are highly dependent on debt to grow and have faced their fair share of headwinds during the high-interest rate environment.

This has also pushed cap rates up, making acquiring properties slightly more difficult for some in the REIT sector, thus slowing their growth somewhat. Although rates are expected to decline, they will still likely remain above the historical norm for the near to medium-term.

However, both companies have strong business models and long operating histories, which gives them experience when navigating economic uncertainty. Their fundamentals remain strong, and both showed decent growth year-over-year.

They also pay attractive yields above 5% with well-covered dividends that will likely continue growing for the long term. As a result of their slower growth, both have seen their share prices remain stagnant or appreciate slightly since many stocks rallied last month. Both also still trade below their sector averages of 12.91x and 16.05x, indicating they still could offer attractive entry points.

As a result, I think both offer strong upside over the next year and in a market that’s currently overvalued, investors looking for income reliability at attractive valuations should consider these two.

Read the full article here