Although the stock market has recovered nearly all the losses from the recent selloff, and fresh economic data has eased concerns of a recession, a cautious stance remains appropriate in the current environment. This makes investments with a quality approach a simple and efficient alternative at this moment, as they have historically delivered returns in line with the broader but with lower volatility, as evidenced during market downturns like in 2022.

One of the alternatives in this field is the Dimensional US High Profitability ETF (NYSEARCA:DUHP), a fund that, despite its selective approach, has a diversified allocation, including technology, industrials, and more defensive areas such as health care and consumer staples. With total returns roughly in line with the broader market, higher profitability measures and lower volatility, DUHP is certainly a fund to consider when looking to maintain or add exposure to the stock market, while mitigating downside risk in this still vulnerable environment.

ETF Description & Highlights

DUHP is an exchange-traded fund that aims to achieve long-term capital appreciation by investing in large U.S. companies with high profitability relative to other large-capitalization companies within an eligible universe comprising the 1.000 largest U.S. companies.

The fund invests in a portfolio that leans toward higher profitability companies, but may include stocks with smaller capitalization and lower relative price, defined by their price in relation to book value or occasionally price-to-cash flow and price-to-earnings ratios. The emphasis on these companies is carried out by an overweight allocation relative to their market capitalization, based on the profitability and relative price.

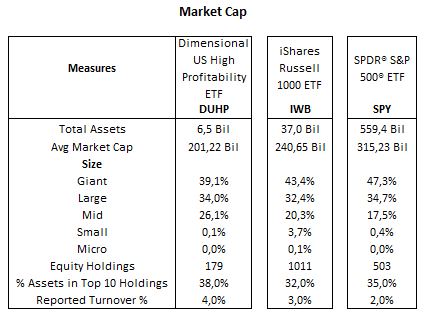

As of August 14, 2024, DUHP is composed of a portfolio with 179 constituents, $6.5 billion in AUM, and an average market cap of $201.2 billion. The allocation across market cap sizes is, for the most part, similar to the benchmark for the largest 1.000 U.S. stocks, the Russell 1000 index, as represented by the iShares Russell 1000 ETF (IWB), except for a slight tilt toward mid caps, with 26% of total assets, compared to 20% in the Russell 1000 index.

DUHP’s top ten holdings: Apple (AAPL) (5.7%), NVIDIA (NVDA) (5.6%), Eli Lilly (LLY) (5.1%), Microsoft (MSFT) (4.7%), Visa (V) (3.75%), AbbVie (ABBV) (3.0%), Mastercard (MA) (2.9%), Johnson & Johnson (JNJ) (2.8%), Home Depot (HD) (2.4%), and PepsiCo (PEP) (2.3%) make up 38% of total assets. This composition includes some of the same tech giants that are also among the Russell 1000 index’s top holdings, such as Apple, NVIDIA, and Microsoft, and primarily large healthcare names and the biggest transaction & payments companies (Visa and Mastercard), underscoring the fund’s bias toward more profitable stocks.

Morningstar, consolidated by the author

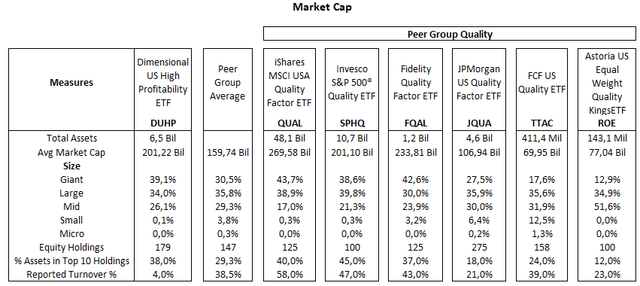

Below is a table that compares DUHP with a peer group of large-cap quality ETFs. The first two are the largest funds in the segment and are weighted on quality measures. FQAL and JQUA are funds with cap-weighted sector allocations, mirroring broader indexes. TTAC is a broad-based fund in terms of market capitalization, covering the largest 3.000 U.S. companies, and ROE is an equally weighted fund that started operations in 2023.

Morningstar, consolidated by the author

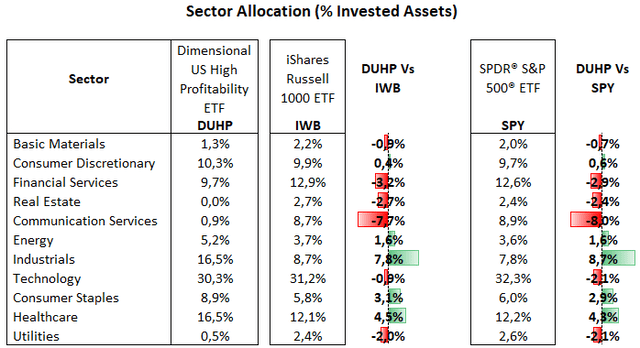

From a sector allocation perspective, DUHP’s largest allocation is to the Technology sector, with 30.3% of total equities, followed by Industrials and Healthcare, both with 16.5%, Consumer Cyclical with 10.3%, Financial Services with 9.7%, Consumer Defensive with 8.9%, Energy with 5.2%, Basic Materials with 1.3%, Communication Services with 0.9%, and Utilities with 0.5%.

When compared to the Russell 1000 index, DUHP has higher allocations to industrials (+9.8%), healthcare (+4.5%), and consumer staples (+3.1%). The overweight allocation to industrials is due to its heavier allocation to a number of companies such as Caterpillar, Union Pacific Honeywell, Lockheed Martin, Deere, and United Rental, more than compensating for holding no shares of GE and RTX. In addition, the fund holds relatively large positions in Eli Lilly, J&J, AbbVie, and consumer staples like Costco, Target, and Colgate, underlining a selective allocation profile.

On the flip side, DUHP is underweight in sectors such as financials, utilities, real estate, and particularly communication services, as the fund has no allocation to mega caps like Alphabet, Meta, and Netflix.

Morningstar, consolidated by the author

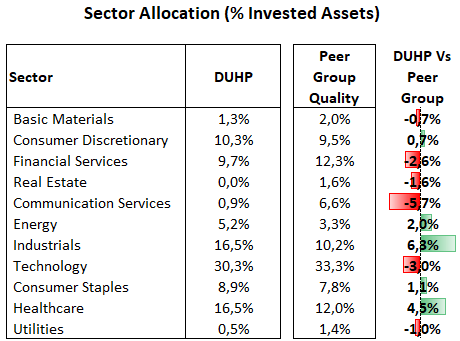

A comparison with the peer group of large-caps quality ETFs shows the same trend, with DUHP primarily overweight in industrials and healthcare, while highly underweight in communication services, followed by lower exposure to technology and financial services.

Morningstar, consolidated by the author

Valuation

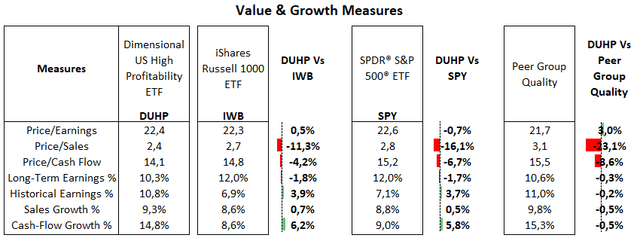

DUHP’s stock allocation approach has improved profitability measures, with EBITDA margin and return on assets increasing by three percentage points, according to my estimations. Meanwhile, DUHP’s price/earnings ratio looks similar to the Russell 1000 index and the peer group of quality ETFs, all roughly at 22x, as DUHP’s no allocation to high multiple names like Amazon and Tesla is offset by overweight allocations in health care and consumer companies like Eli Lilly, Mastercard, and Costco, which also trade above 30x price/earnings. On the other hand, DUHP shows a lower price/sales ratio, driven by its no exposure to high multiple names like Alphabet, Meta, and Broadcom.

Morningstar, consolidated by the author

Performance In Line With The Market

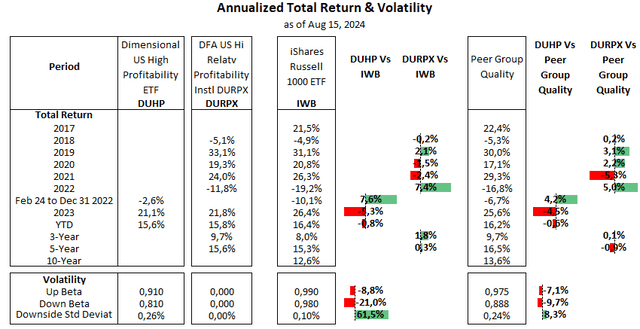

Quality ETFs have been able to keep pace with large caps benchmarks like the Russell 1000 index, with remarkable outperformance during a market correction in 2022, while years 2023 and 2024 have mainly seen mixed results, driven by the narrow market leadership concentrated in a few mega caps.

The following table shows DUHP’s total returns versus the Russell 1000 index and the peer group of quality ETFs. As DUHP is a new ETF, with inception on Feb 23, 2022, I added a column for reference with returns of the U.S. High Relative Profitability Portfolio (DURPX), a mutual fund also managed by Dimensional, which follows a similar strategy.

Morningstar, consolidated by the author

In this scenario, DUHP’s performance since its inception has been relatively in line with the Russell 1000 index and the peer group, as its strong outperformance in 2022 was in large part eroded by stronger returns from broader indexes in the following years. Over longer time frames, using the DURPX mutual fund as a proxy, performance has been mixed, as the mutual fund has slightly surpassed the Russell 1000 index, but underperformed the peer group.

Meanwhile, a silver lining for DUHP is that it has been less volatile than the Russell 1000 and the S&P 500 indexes, as expected for a quality fund, but also compared to the peer group of quality ETFs.

In summary, despite being a new ETF, DUHP has largely met expectations for a quality fund, outperforming during market selloffs, as occurred in 2022, and showing lower volatility than the broader market. In addition, the fund’s investment approach seems competitive with other quality ETFs, given the historical performance of another Dimensional mutual fund with similar strategy. That said, in my view, DUHP is positioned among the alternatives expected to offer returns in line with the broader market, but with relatively lower downside risk.

Read the full article here