Thesis

My analysis points out that Ituran Location and Control Ltd. (NASDAQ:ITRN) had solid Q2 2024 numbers, with a GAAP EPS of $0.66 and $84.9 million in revenue. Despite that, the stock isn’t hitting the marks people expected. Even though Ituran announced a $0.39 dividend, showing strong profits, investors might be spooked by currency swings and geopolitical risks. The analysis digs into why, even with a positive outlook for the telematics industry, Ituran’s stock is still undervalued and whether this could be a good chance for value investors.

About Ituran

Ituran Location and Control Ltd. is an Israeli company that provides location-based services – mainly for the auto industry. It was founded in 1995 and currently based in Azor, Israel. While Ituran started by offering vehicle theft prevention services, it has since expanded. The company runs two main segments: Telematics Services and Telematics Products. (Btw, telematics is a term that combines “telecommunications” and “informatics.”)

In Telematics Services, they handle stolen vehicle recovery (SVR), fleet management, and other services (like distribution & logistics) for both businesses and individuals. Client-wise, their products are popular with insurance companies, fleet operators, car rental agencies, and private vehicle owners. They also provide machine-to-machine (M2M) communication products that boost their telematics services.

Ituran Company Website

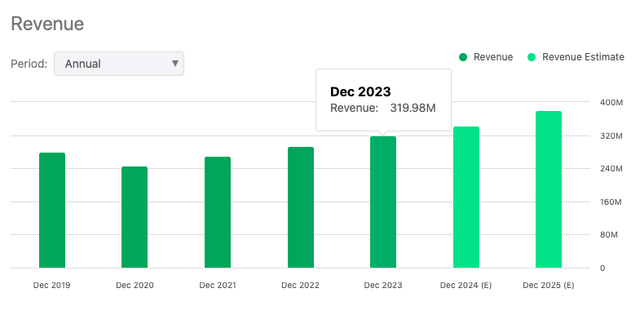

Ituran operates globally, with a presence in Israel, Brazil, Argentina, the U.S., and more. In 2023, they reported about $320 million in revenue.

Seeking Alpha

Why Is Ituran Lagging?

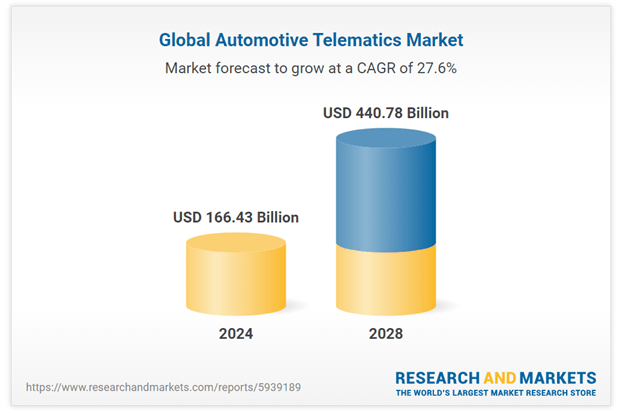

The telematics industry in the automotive sector is expected to grow rapidly over the next ten years. In 2024, the worldwide automotive telematics market is worth around $166.43 billion, but it’s headed for a projected $440.78 billion by 2028, growing at a 27.6% CAGR. Driving the trend? Soaring demand for vehicles fitted with connected tech, the ongoing expansion of telematics tech itself, and the rapid electric vehicle (EV) adoption of the automotive industry, which relies on telematics for real-time status and diagnostic data.

Research and Markets

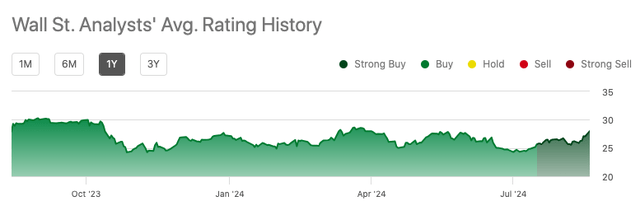

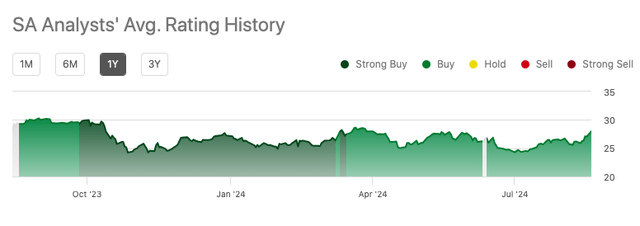

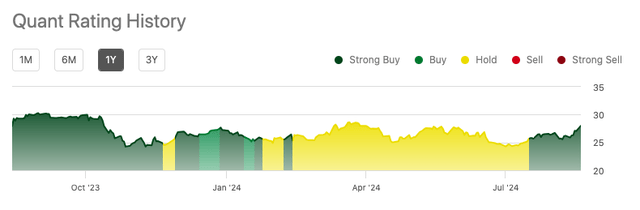

When looking into ITRN, two things stood out right away: First, Wall Street…

Seeking Alpha

Seeking Alpha Analysts…

Seeking Alpha

…and Quant rankings have been on the bullish-side for the past year:

Seeking Alpha

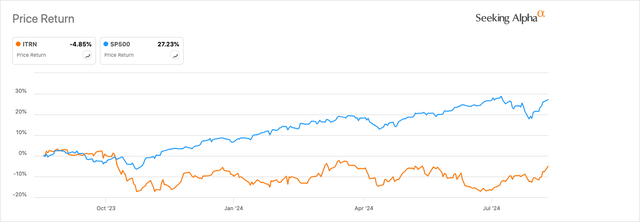

But the stock is negative compared to the broader market…

Seeking Alpha

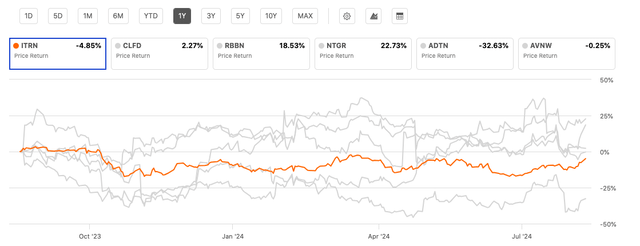

And some of its peers…

Seeking Alpha

Given the positive growth projections for the telematics industry and the bullish attitude of many analysts, are there elements that warrant a closer look? Why has Ituran’s stock underperformed the broader market, and its peers, given the positive outlook for the industry?

Ituran Q2 2024 Highlights: Revenue Growth, Strategic Wins, and Future Outlook

Looking at Ituran’s Q2 2024 results show strong performance and strategic progress. Revenue hit $84.9 million, up 4% from Q2 2023’s $81.6 million. Adjusted for currency swings, the growth jumps to 6%, proving the business’s resilience.

A significant contributor to the boost came from 38,000 new subscribers, pushing the total to 2,329,000, right at the top of projections (they were expecting between 35,000 and 40,000). According to the transcripts, the Q2 revenue breakdown was 51% from Israel, 24% from Brazil, and 25% from the “rest of the world”.

And on pricing, when CEO Eyal Sheratzky was asked about any pressures or changes in any of the regions given the current macro environment, his response was straightforward and confident:

No. The answer is no. We have to, again to remember that it runs the main revenue source is the subscriber’s fees. We have to understand that the average ARPU is about $10. So the sensitivity among the end user, as much as I can say, is quite low. Regard the hardware itself, if you look on our historical numbers, the margin that we are sell are very low in order to get more and more subscribers and in that case our prices are quite low by definition and we don’t see pressure in this field as well.

Product revenues rose 9% to $24.5 million, with a 10% boost in local currencies. A big chunk of this came from DRM, Ituran’s main supplier. DRM focuses mainly on hardware, and they had a solid quarter. Sheratzky added that since they mostly sell hardware, their sales can be a bit volatile, depending on different customers worldwide.

Ituran’s profits are looking solid. EBITDA went up 6% to $23.1 million, making up 27.2% of revenue. In local currencies, it grew even more, by 9%. Net income also jumped 7% to $13.1 million, or $0.66 per diluted share, compared to $12.2 million, or $0.61 per share, from the same quarter last year.

The company’s finances got a boost with net cash hitting $63.1 million by June 30, 2024, up from $53 million at the end of 2023. Thanks to strong profits, Ituran announced an $8 million quarterly dividend, up 60% from last year, with an annual yield over 6%.

In terms of geographic growth initiatives, ITRN’s rolling out proven pilots to other markets. Having won a high-profile deal with Santander Bank last year (for enhanced vehicle recovery services and real-time location tracking), they’re now exporting the solution to new markets and finance customers, as well as providing their SaaS tech to fleet owners of shared cars, helping to match unused cars with demand. The company has fielded interest and begun rolling this out in Israel and the US, where shared car schemes are becoming more popular among rental companies, leasing firms, and corporate fleets.

In addition, they formed strategic partnerships with Porsche and Microsoft for the Porsche Carrera Cup in Brazil, showcasing their tech skills and ability to attract big OEMs. And putting the icing on the cake, ITRN confirmed its full-year EBITDA guidance of $90 million to $95 million, with a goal of reaching $100 million by 2025, showing they’re moving forward with confidence and eyeing future profits.

Valuation

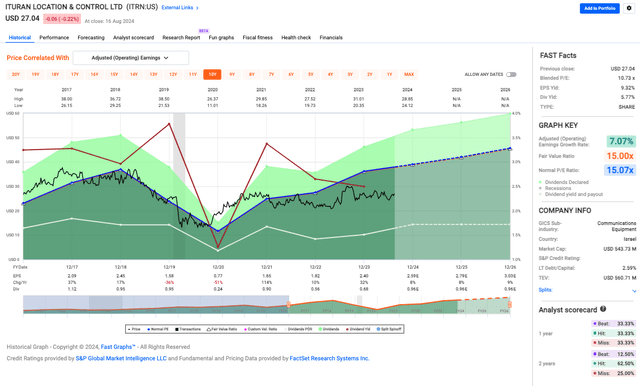

When looking at a blended P/E ratio of 10.73x, the stock seems undervalued to me, especially when compared to its fair value ratio of 15.00x and normal P/E of 15.07x. The market might not fully see Ituran’s earnings potential, which could be a good spot for value investors.

Fast Graphs

Also, the earnings yield sits strong at 9.32%, much higher than the 5.77% dividend yield, and with an earnings growth rate of 7.07%, Ituran is getting stronger, supporting the idea that the stock is undervalued.

Seeking Alpha

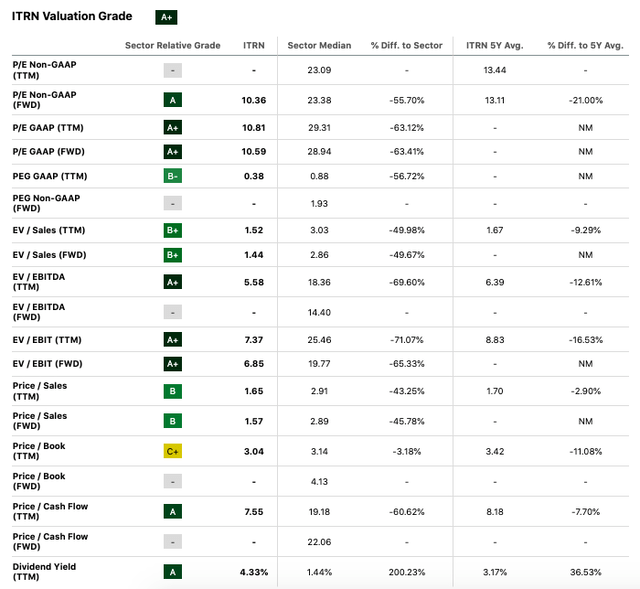

Seeking Alpha’s valuation metrics also confirm ITRN might be (seriously) undervalued, showing big discounts across key financial ratios compared to its peers. The forward P/E ratios are over 60% lower, hinting the market might be sleeping on the company’s earnings potential. Low EV/EBITDA and EV/EBIT multiples back up this undervaluation. With a solid dividend yield and strong cash flow, ITRN looks like a good pick for value investors. The market might be too down on it, possibly opening up a chance to cash in on the mispricing.

Factors Cooling the Optimism

But some negative factors dampened the optimism. The sharp drop in local currencies against the U.S. dollar created big challenges, cutting into revenue growth when converted to dollars. Israel’s ongoing conflict and internal challenges are accelerating capital outflows, further depreciating the shekel. And remember, the company’s revenue also remains geographically concentrated, with 51% derived from Israel and 24% from Brazil, exposing it to potential risks if economic or political conditions in these regions were to deteriorate even further. Yes, subscription revenue went up to $60.4 million, but for some half-glass-empty investors, it represents only growth of 2% year-over-year, or 5% in local currencies, which might seem disappointing.

Also, the EBITDA margin barely budged, going from 26.7% to 27.2%. In my opinion, Ituran’s subscriber growth looks pretty modest, with 35,000 to 40,000 new subscribers expected each quarter, without any major acceleration in the forecast. The company has rolled out some new strategies, but it’s still up in the air if they’ll take off, and expanding them across regions won’t be easy. I think a more impressive growth number would be around 50,000 new subscribers per quarter, about a 25% jump from the high end of the current range, which might show stronger momentum.

Rating: Buy

Geopolitical and currency risks aside, I think the stock’s a ‘buy.’ Ituran has strong fundamentals. Q2 2024 results were good, the dividend yield is high, and the stock is cheap relative to peers. With growth potential in the telematics industry, resilient revenue and strategic initiatives, I think it’s a good pick for value investors.

Read the full article here