RLX Technology (NYSE:RLX) stock is still awarded a Hold investment rating. RLX’s second quarter revenue and earnings came in below expectations, but there are bright spots associated with China’s regulatory environment and the company’s R&D (Research & Development) capabilities.

I looked at RLX Technology’s financial performance for the final quarter of last year in my earlier March 19, 2024 write-up. This latest update focuses on RLX’s recent Q2 2024 results.

RLX’s Key Q2 Financial Metrics Came In Below Consensus Forecasts

RLX released its Q2 2024 earnings release at the end of the prior week on Friday, August 16. Its key financial metrics for the recent quarter didn’t meet the sell side’s expectations.

The company’s actual Q2 2024 top line, EBIT margin, and normalized EPS in local currency or RMB terms turned out to be -1.8%, -58 basis points, and -7.3% (source: S&P Capital IQ) below their respective consensus projections.

Revenue for RLX Technology grew strongly by +65.9% YoY to RMB627.2 million, which the company attributed to “international expansion” in its earnings release.

Unfortunately, RLX still suffered from a -1.8% top line miss in the latest quarter, which is likely driven by the weak performance of its Mainland Chinese business operations. At its Q2 2024 earnings briefing, RLX Technology acknowledged that “illegal products still account for a significant majority of sales” for the Chinese market. RLX also disclosed at the recent quarterly earnings call that it recently introduced a new product line referred to as the “mega-sized Phantom series” in China at a “lower price than our (other product offering) Infinity pods.”

Although RLX doesn’t reveal its revenue breakdown by geographical region, it is reasonable to conclude that the company’s top line performance for Mainland China has been negatively impacted by competition from illegal e-cigarettes and lower product pricing.

Separately, RLX Technology’s normalized EPS jumped by +164.5% YoY to RMB0.164 in the second quarter of 2024. RLX indicated at the company’s second quarter result briefing that it has worked hard to increase “supply chain efficiency” and engaged in the “strategic leveraging of our existing workforce during our regional expansion.” The management’s comments imply that RLX Technology has optimized its supply chain to extract cost reductions, and managed to grow in foreign markets without hiring a lot of additional staff.

However, RLX’s EBIT margin and bottom line for the second quarter of 2024 still missed expectations, as highlighted above. Specifically, RLX Technology’s gross margin contracted from 26.1% for Q2 2023 and 25.9% for Q1 2024 to 25.2% for Q2 2024. As such, the decline in gross margin was likely to be the main factor leading to below-expectations operating margin and earnings for RLX in the recent quarter.

In its Q2 2024 earnings call, RLX Technology cited the “changes in our revenue composition, including both channel and product mix” as the reason for the company’s lower gross margin in Q2 2024. In my opinion, the introduction of lower-priced products (mentioned above) in the challenging Chinese e-cigarette market and the establishment of new marketing channels in international markets could have been a drag on its gross profitability.

In a nutshell, RLX’s near-term financial performance might still be impacted by the competitive threat of illicit cigarettes in China and higher costs relating to distribution network expansion in foreign markets.

Certain Positive Takeaways From Second Quarter Disclosures Deserve Attention

In the preceding section, I touched on RLX’s Q2 2024 results miss. But there are specific bright spots relating to RLX Technology’s second quarter disclosures that shouldn’t be ignored.

One favorable takeaway is that the regulatory environment for new e-cigarette product approvals in Mainland China seems to have improved.

An additional nine new flavors for RLX Technology’s China e-cigarette offerings were given the green light by regulators in the first half of 2024 as per the company’s Q2 earnings briefing disclosure. In my prior November 1, 2023 article, I cited RLX’s previous August 2023 management commentary indicating that “China’s compliant e-vapor brands are losing market share to illegal flavored products.” Therefore, the improvement in China’s regulatory environment for e-cigarette approvals will boost RLX’s ability to widen its product range (with a wider variety of flavors) to deal with competition posed by illegal e-cigarettes.

The other positive takeaway is that RLX Technology is strong in R&D (Research & Development) and it is able to bring new products to market in a reasonably short period of time.

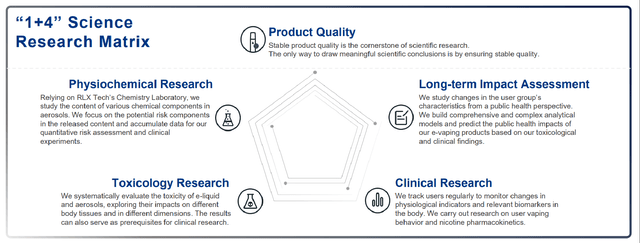

RLX Technology’s Research & Development Approach And Framework

RLX’s Q2 2024 Earnings Presentation Slides

In its earnings presentation slides, RLX shared that it has filed more than a thousand patents worldwide, and the company noted that its entire R&D process for new offerings takes less than three months. These figures provide support for RLX’s assertion that its “leading product development capabilities” will be able to “rapidly develop products that can cater to demand” as per its result briefing commentary.

RLX Technology’s medium-to-long term prospects remain favorable, considering its strengths in R&D and the improvement in China’s regulatory environment. RLX’s financial performance turned for the worse after 2022 (FY 2023 sales dropped -70% to RMB1,586 million), when China imposed a 36% excise tax on e-cigarettes. But the current consensus forecasts (source: S&P Capital IQ) point to RLX’s top line recovering to RMB4,889 million in FY 2026, or just 8% below its 2022 revenue. In other words, a recovery is in sight, although this will take time.

Conclusion

A stock is usually judged to be trading at a fair valuation if its earnings multiple is equal to or close to its future earnings growth rate. This is the case with RLX, as both its P/E ratio and projected bottom line expansion are at the mid-teens level. Specifically, the company’s consensus FY 2023-2026 normalized EPS CAGR forecast is +15.4% (source: S&P Capital IQ), while the stock’s consensus next twelve months’ normalized P/E metric is 15.5 times. Moreover, it will take more time for RLX Technology’s top line to return to 2022 levels.

Read the full article here