Introduction

I get surprised that whenever I talk to someone about investing, very few know about Real Estate Investment Trusts or Business Development Companies. But maybe that’s just in my circle of friends, which so happens to be very small.

If you’re an income investor, I think these two sectors should be staples in your portfolio. And that’s because by law they’re required to pay out 90% of their taxable income in the form of dividends. In this article, I discuss why BDCs & REITs should be staples in an income-focused portfolio.

What Makes Them So Attractive?

I’m sure many readers here on Seeking Alpha are familiar with BDCs and REITs, but for those who aren’t, these two sectors are known for paying huge dividends. For BDCs, it’s not unusual to find higher-quality ones paying yields upwards of 10% or more.

For REITs, I think it’s a little less common to find the higher-quality ones paying yields of more than 7%. However, until recently, there were some in the 6% to 7% range due to the beat down many took as a result of higher interest rates.

A good rule of thumb for myself is finding those with a yield in the 4% – 6% range. Most know the lower the share price, the higher the yield and vice versa. So, now that REITs have rallied, many of the higher-quality ones are sporting yields in the 3% – 5% range.

And over the next year many will likely be lower thanks to anticipated lower interest rates. However, I still think income-focused investors should look to these two sectors for income, especially in BDCs.

Lower Interest Rates

Reason being is lower interest rates. And as investor sentiment continues to shift, many investors will likely rotate from higher-yielding investments (BDCs) into lower yielding investments (REITs).

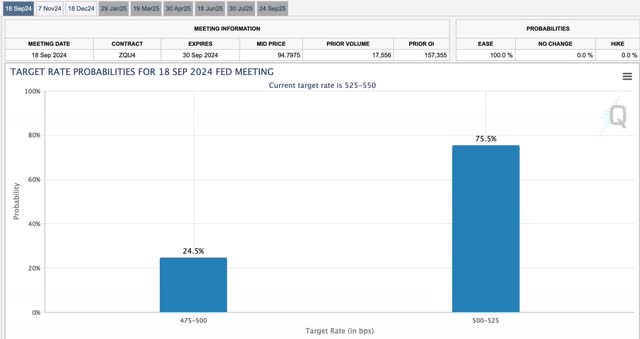

This is because both sectors are highly sensitive to interest rates. Rates in one direction impact one sector positively, while rates in the opposite direction impact the other positively. The first rate cut is still anticipated for next month, with more than 75% expecting a 25 basis points cut.

CME FedWatch

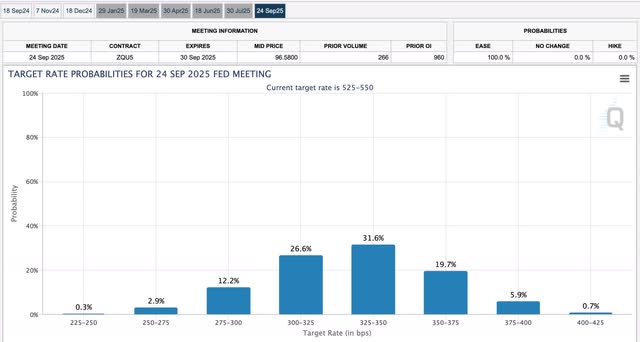

A year later, they are expected to be significantly lower, with nearly 32% expecting interest rates in a range of 325-350 basis points. Of course, this is subject to change depending on how stubborn inflation wants to be. But I think we can all agree that interest rates will be much lower from the point where they are today.

CME FedWatch

And if so, business development companies’ share prices will be likely much lower than they are today, while REIT share prices will be much higher.

Superior Total Returns

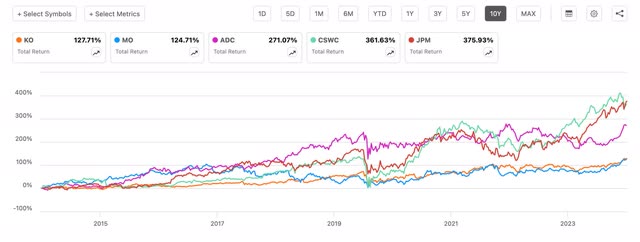

If you’re a dividend investor, total returns are something you often probably look at or should. Although these two sectors are often considered riskier and less attractive, they have beat some of the most popular, well-known dividend stocks in total returns.

In the chart below, you can see how Agree Realty (ADC) has beat popular dividend paying companies like Altria (MO), Coca-Cola (KO), but trailing behind JPMorgan (JPM) when it comes to total returns over the last 10 years.

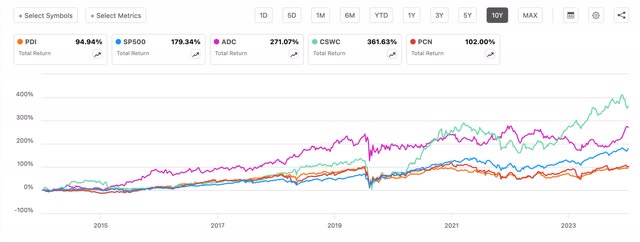

Altria, one of the most popular dividend stocks of all time, returned 127.71% over the past decade, while Agree Realty and Capital Southwest (CSWC) both returned 271.07% and 361.63% respectively.

Seeking Alpha

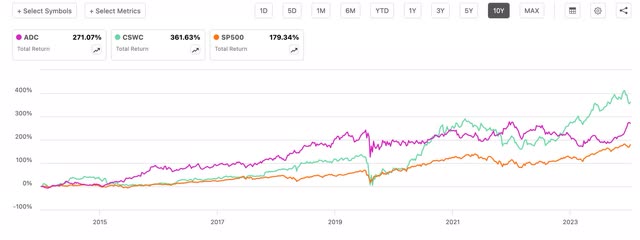

Below is how both stack up against the index S&P over the past decade. Both have returned averages of 27% and 36% respectively annually, while the index has returned an average of roughly 18% annually.

Seeking Alpha

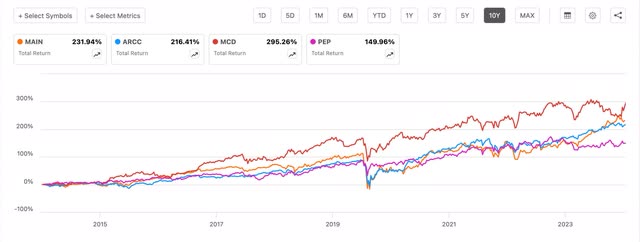

Here I use two other popular BDCs Main Street Capital (MAIN) and Ares Capital (ARCC) against McDonald’s (MCD) and PepsiCo (PEP), two companies known for high dividend growth. Both BDCs stack up well against MCD while besting Pepsi over a 10-year period.

Seeking Alpha

Even Better Than Funds…

Here is how ADC & CSWC do in total returns over a 10-year period vs retiree favorites, bond funds PIMCO Dynamic Income Fund (PDI) and PIMCO Corporate & Income Strategy Fund (PCN). Furthermore, both funds charge expense ratios of 2.18% and 0.85%, respectively. And while this does not seem like much, these can eat into your returns over time.

Seeking Alpha

That’s why when investors say: “just put your money into an S&P fund”, I’d rather invest in individual stocks like BDCs and REITs that can offer superior returns in comparison to the index.

Who Are They For?

These two sectors are for investors of all ages, but in my opinion, they are great for seniors. The reason being is they may not offer as much growth and capital appreciation as stocks like Microsoft (MSFT) or Apple (AAPL), but they offer more bang for your buck over a shorter period of time.

As a senior in your 60s, your time is limited. And you may not have the time or patience to wait for your holdings to give you great capital appreciation. Most at that age are retired and want to supplement their income in retirement. BDCs and REITs can offer that.

For younger investors in their 20s, 30s, or even 40s, growth stocks like MSFT, AAPL, or even Meta Platforms (META) may be better due to an anticipated longer investment time span.

An additional reason is their dividends are considered qualified, thus offering less tax advantages than seniors have as a result of them being able to collect income from ROTH IRA’s, etc. But even still, these two sectors should be staples in your portfolio if you’re an income investor.

Synthetic Dividends

Some investors like to create synthetic dividends by selling shares. And while this may work for some, I think this is an inferior strategy. Here’s why: Let’s say you have 10,000 shares of Apple, a dividend stock with an annual estimated dividend of $0.99. But for this scenario, let’s just use $1.

If you own 10,000 shares, you collect a quarterly dividend of $0.25, or $2500 a quarter. Let’s say you sell 2,000 shares a quarter for $500 because you need $3,000 to cover your expenses.

After one year, you’re left with only 2,000 shares. If you run 10 companies that make $1 million every year, and you sell half of them, your annual profits will be slashed by half due to having less companies.

So, not a successful income strategy for the long term. Yes, you can sell them for more than you bought them for, but you’re still left with less annual income.

Over the past three years AAPL has increased the dividend by a penny from $0.22 to $0.23 in 2022, $0.23 to $0.24 in 2023, and to $0.25 this past May. So, it’s safe to say the quarterly dividend will be $0.26 for 2025.

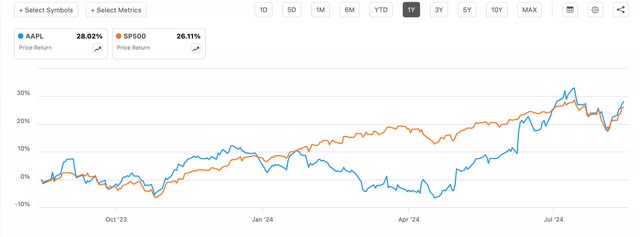

So, now your annual dividend income is only $520. Sure, you can account for capital appreciation, but it is no guarantee a stock’s share price will go up. In the past year, AAPL’s share price has beat the index, up 28% to 26% for the index.

Seeking Alpha

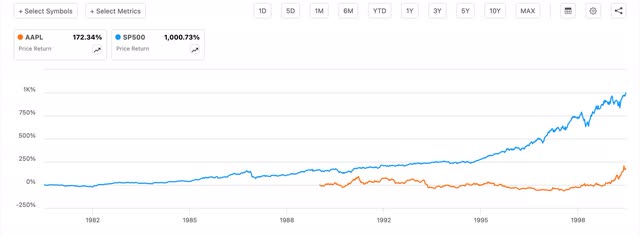

And over the past decade, their share price is up nicely, with nearly 800% share price appreciation. But no matter how popular or great a stock may be, they will have times of share price underperformance.

Seeking Alpha

In a 10-year period from 1990 to 2000 you can see AAPL severely underperformed the S&P. I decided to use Apple because the stock doesn’t offer high dividend growth like companies, Costco (COST) or McDonald’s, but does offer strong capital appreciation.

Seeking Alpha

They Can Offer Strong Price Appreciation

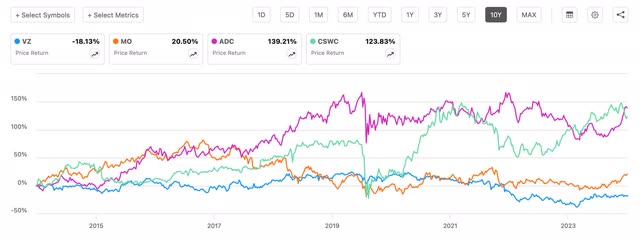

In the chart below, I compare ADC & CSWC’s share price performance over the past 10 years to that of Verizon Communications (VZ) and Altria, two popular dividend stocks known for their high yields. Over the past decade, VZ is down while MO is only up 20%. Both Agree Realty and Capital Southwest are up handsomely compared to the two.

Seeking Alpha

If you would have been selling shares in your Verizon position, you would have sold at a loss, as the stock is down over the past 5 and 10-year periods. So, yes, you can create synthetic dividends, but your investment could be worth less over time. If you elect to keep your shares and reinvest your dividends, your dividend snowball will only grow larger over time.

Conclusion

Although BDCs and REITs are often considered risky and less attractive due to BDCs lending to financially distressed or smaller companies and REITs offering lower-yields, both offer income reliability & superior total returns at times.

Higher-yielding stocks like Verizon and Altria may offer more income at the moment, but over time, REITs and BDCs can outperform in terms of share price appreciation. So, both are great staples for any dividend investor’s portfolio.

Read the full article here