When it comes to investing, it’s imperative to see companies for what they truly are. Back in 2020, amid a notable rise in the global interest in sustainable energy solutions, I thought Exxon Mobil Corporation (NYSE:XOM) should be accepted for what it truly is, a great investment candidate for income investors. When Moody’s downgraded the rating on Exxon’s debt in March 2021, I remained bullish as the company showed an unwillingness to reduce shareholder distributions even if it meant it had to take on more debt.

When activist investor Engine No.1 secured three Exxon Board seats in May 2021, I booked my gains from XOM stock and never looked back. I thought Exxon would be forced to invest in climate change and other ESG initiatives aggressively, which was not the kind of exposure I was expecting from my investment in XOM. I already had exposure to these social values through other investments, so I did not hesitate to part ways with Exxon. XOM stock has almost doubled since then, but no regrets on my part as I know that the decision was taken to stick to my investment objectives.

Today, more than three years later, I am revisiting the oil giant to assess how the company has planned its investments during this period to determine whether Exxon’s fundamental values are changing.

Exxon’s Carbon Capture Investments In Brief

Exxon Mobil, just as I expected, has made several aggressive investment commitments to reach green energy goals since I divested my shares in 2021. Below are some of the noteworthy developments.

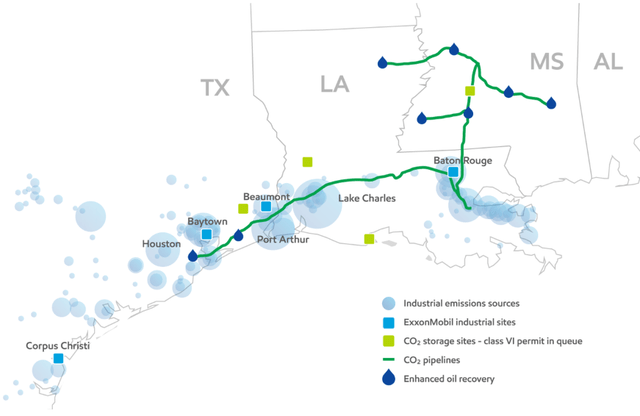

- In 2021, Exxon pledged to invest $15 billion to reduce greenhouse gas emissions through 2027. Later, the company boosted the investment budget to $17 billion, or nearly $3 billion annually.

- The company established Low Carbon Solutions in 2021, a business segment focused on carbon capture technologies.

- Exxon expanded its CCS network to 1,500+ miles of CO2 pipelines, with the potential to reduce emissions by 100 million metric tons per year.

- The company reiterated the goal of achieving net-zero emissions by 2050.

Exhibit 1: Exxon Mobil’s carbon capture and storage map (U.S.)

Exxon Mobil

Although these developments do not point toward a major win for Engine No. 1 and other climate investors, I believe Exxon’s strategic direction has been altered meaningfully to focus on green initiatives, which was something Exxon lacked compared to other oil giants back in 2021.

Exxon Still Remains True To Its Core; Good News For Investors

Despite activist pressures and changing investor expectations, Exxon seems committed to its core values while embracing the need to focus on environmental impact.

Scientists, environmental activists, and even analysts have questioned the true impact of Exxon’s green investments in the recent past. The company faced serious allegations of greenwashing, an unethical business practice where a company uses green investments for good PR instead of focusing on making a real impact. These allegations were centered around the company’s carbon capture initiative at the Fawley refinery in Hampshire, United Kingdom. These allegations came to light when openDemocracy claimed that Esso’s (Exxon’s UK arm) net-zero emission claims, which include completing the first phase of construction of a blue hydrogen plant by 2030, are not realistic given that the company is not committing meaningful investments out of its CapEx budget to build this.

Exhibit 2: The six sins of greenwashing

Blanc

Greenwashing is a poor, unethical business practice, and there’s no justifying that. Amid these allegations, Exxon continues to focus on growing its carbon capture business, but what caught my eye is the company’s continued commitment to fossil fuel exploration.

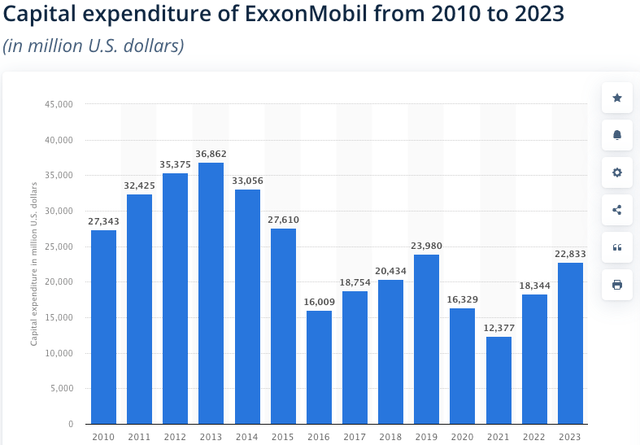

A closer look at Exxon’s capital expenditure patterns reveals the company is strongly committed to growing its fossil fuel business. As noted earlier, Exxon aims to invest approximately $3 billion in its low-carbon business annually through 2027. Although this is an impressive number in isolation, compared to Exxon’s total CapEx spending in recent years, this represents a fraction of the company’s total investments.

Exhibit: 3: Exxon Mobil capital expenditure

Statista

On average, the company has spent nearly $19 billion in capex annually over the last five years, and investments will remain above this average in the next five years as the company focuses on striking a balance between green investments and fossil fuel exploration. The company, last December, guided for annual project investments of $22-27 billion between 2025 and 2027. The bulk of these investments, however, will still be focused on its fossil fuel operations.

Exxon, in the second quarter, reached a net production rate of 4.4 million oil-equivalent barrels per day, registering a 15% growth compared to Q1, aided by the acquisition and integration of Pioneer and volume growth in Guyana and the Permian. Two years ago, Exxon was planning to hit an oil production target of 4.2 million barrels of oil equivalent per day only by 2027, which highlights how the company has used the profit windfall from higher oil prices in the last couple of years to accelerate the growth in production through acquisitions and project investments.

A further evaluation of Exxon’s investment strategy reveals more concrete data to support the premise that the company’s energy transition story will likely take more time than I initially thought in 2021, which leaves ample room for Exxon to reward shareholders handsomely and even support green investments.

- The acquisition of Pioneer has meaningfully expanded Exxon’s presence in the all-important Permian Basin, with the company now expecting to produce 2 million barrels of oil equivalent per day by 2027, up from around 1.3 million barrels today.

- Exxon Mobil is aggressively investing in growing its offshore production capacity. The company announced a $12.7 billion investment in the sixth project on the Stabroek block, Whiptail, last April. This investment will increase the production capacity by 250,000 barrels of oil per day, bringing the total Stabroek block capacity to over 1 million barrels per day. Experts estimate that the Stabroek block has a total resource of 11 billion oil barrels.

Exxon has doubled down on LNG investments as well, with the company now expecting to produce 40 million tons of LNG annually by 2030, more than double its current production. LNG is a transitional energy source that is expected to play a crucial role in the global energy transition but is a fossil fuel, nonetheless, which has led to heated debates among environmental activists.

Exxon’s aggressive investments in fossil fuel may fail to win environmental activists for now, but I believe this strategy will help set the stage for handsome rewards for shareholders in the next decade while enabling the company to boost its clean energy investments without having a negative impact on the capital structure.

I reached this conclusion after evaluating the economic rationale behind Exxon’s fossil fuel investments.

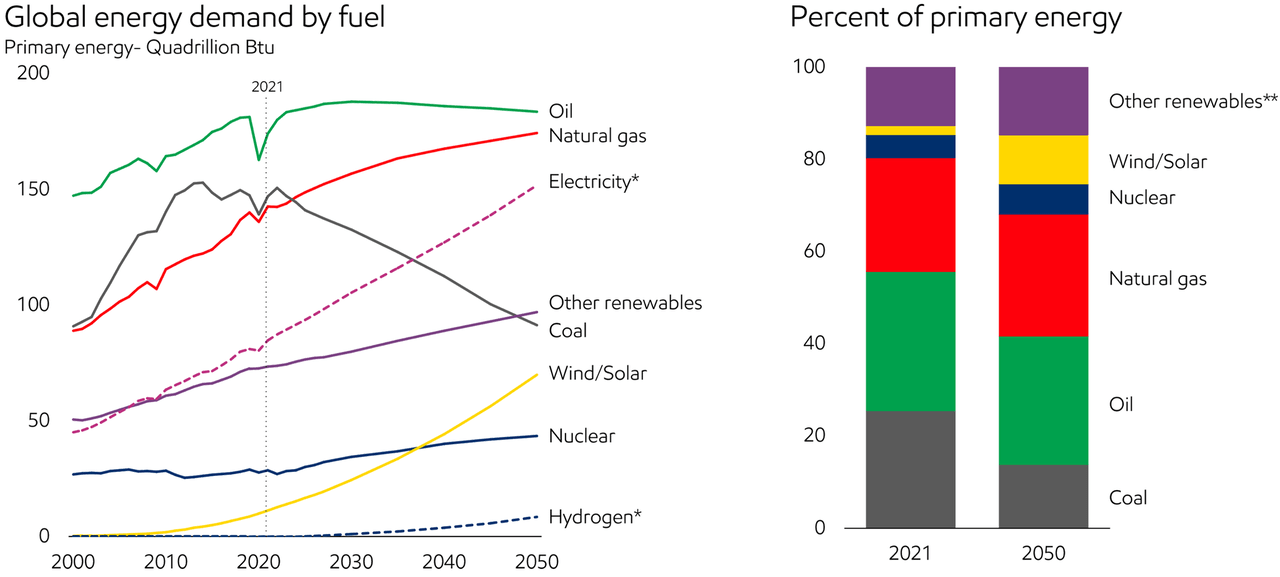

Exxon believes 54% of the global demand for energy by 2050 will still be fulfilled by oil and natural gas. In contrast, the International Energy Agency projects oil demand to peak by 2030. However, a closer look at the IEA’s projections reveals that to achieve the net-zero scenario by 2050, global clean energy investments should triple to more than $4 trillion by 2030, which seems a stretch. Exxon’s investments in fossil fuels are based on the assumption that oil and LNG will account for the bulk of global energy demand even by 2050, which gives an economic rationale for these investments.

Exhibit 4: Global energy demand by fuel

Exxon Mobil

Overall, I believe it makes sense for Exxon to invest in expanding its oil production capacity, leading to strong earnings and cash flow growth in the next decade. The company, which is already one of the biggest shareholder wealth distributors in the nation, is set to reward shareholders handsomely in the foreseeable future.

Exxon’s Net-Zero Pledge Will Attract Criticism

So far in this analysis, I presented opinions and facts as an analyst. My job as an analyst is to predict future stock prices based on an analysis of company and industry fundamentals. As an analyst, I believe Exxon is certainly following a prudent strategy that should help the company add value to its long-term shareholders.

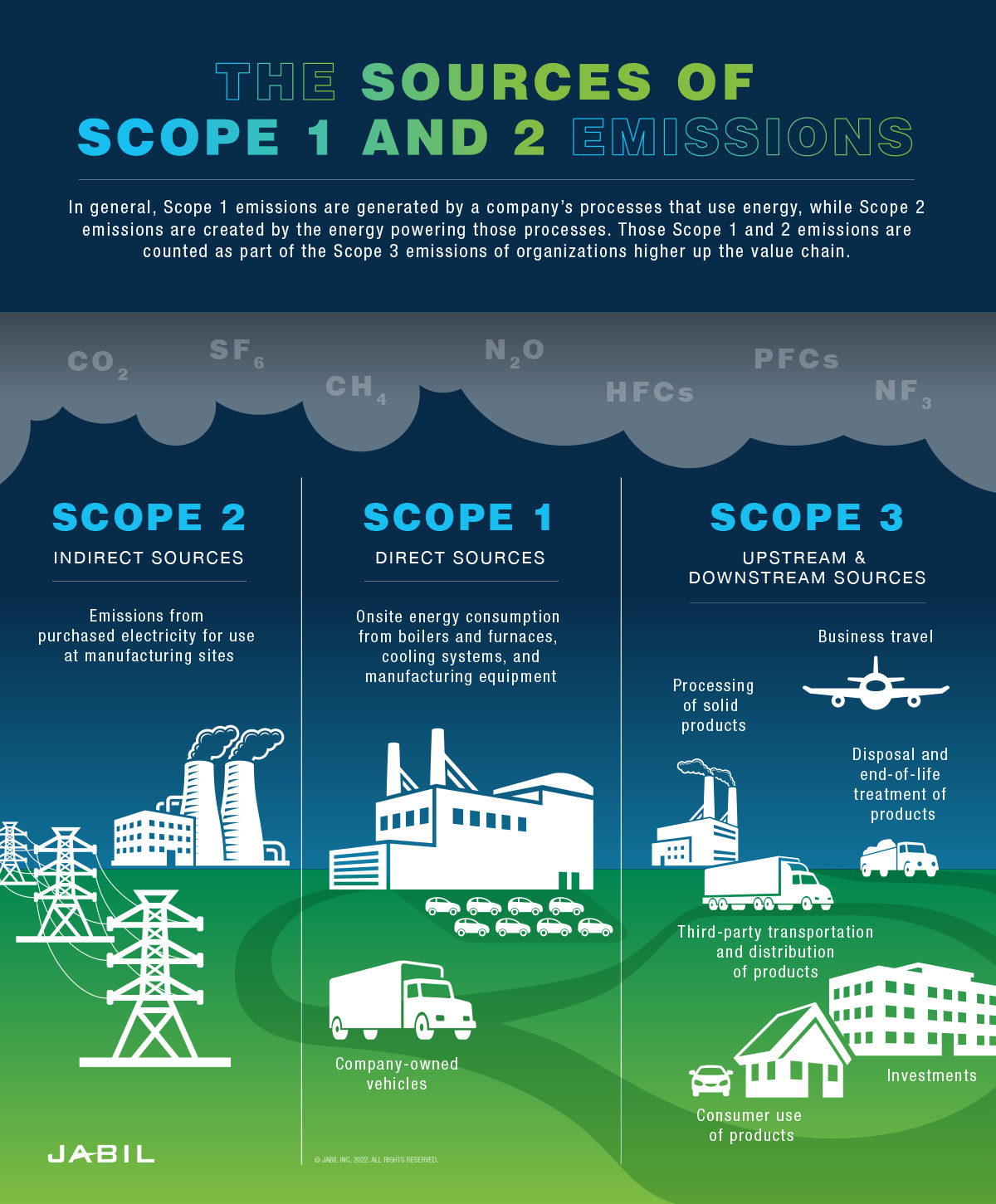

When I remove my analyst hat, I realize that Exxon has a lot to do to ensure it contributes positively to society in the long run. The company, with its net-zero policy, is focused on addressing Scope 1 and Scope 2 emissions, which is technically not a poor choice given that these types of emissions need to be eliminated to ensure normal business operations follow NZE guidelines. However, when it comes to Exxon and other oil giants, the absolute majority of emissions (more than 90%) fall into the Scope 3 bracket, which accounts for the emissions that result from the use of their products. In other words, indirect emissions.

Exhibit 5: Emission types

Jabil

Exxon has not set Scope 3 targets, which the company has publicly acknowledged. The below excerpt from the 2023 progress report summarizes Exxon’s stance and the rationale behind this stance.

We do not set Scope 3 targets. As we discuss in the Life Cycle Approach module, using the GHG Protocol to understand how societal activities drive emissions is appropriate and useful; using it to measure and manage company or sector-wide emissions is flawed and counterproductive. It also ignores growing energy demand, enabling no comparison of alternative ways to meet that demand. To meet a net-zero goal, it is essential that companies fully understand their net emissions and have a means of comparing themselves against others in their industry. Most importantly, the approach needs to equip and incentivize companies to make investments that will reduce their emissions – not simply encourage companies to back away from meeting society’s needs and pass portions of their carbon footprint to someone else.

Although Exxon is making progress with Scope 1 and 2 emissions, its lack of interest in addressing Scope 3 emissions – which is based on a clear rationale – will attract continued criticism from activists and maybe even government agencies.

Risks To The Thesis

The biggest risk to my bullish thesis is if Exxon fails to transform its business in time to become a major player in the clean energy space. As discussed earlier, I believe Exxon has decades, not years, to complete this transition. Although I appreciate Exxon’s decision to stay true to oil, in the long term, the company will have to play catch up to transform the business to embrace clean energy. I believe Exxon has what it takes to pull this off, but I am keeping an eye on this risk nonetheless.

The other obvious risk to the thesis is a prolonged period of low oil prices. This will not only limit Exxon’s short-term growth but will also hinder its investments in new energy. With global economic growth expected to gather some pace in the next few years, I am not worried about a catastrophic decline in oil prices, but I will monitor oil markets carefully to identify potential inflection points.

Takeaway

Exxon Mobil should be seen for what it truly is; a low-cost oil producer that does not hide its ambitious growth projections in the fossil fuels business. The company’s massive fossil fuel investments, which have spooked activists, will lead to lucrative long-term returns. If I were looking for exposure to oil and gas, Exxon Mobil would be my number one choice as things stand today.

Read the full article here