I rate Panasonic Holdings Corporation (OTCPK:PCRFF) (OTCPK:PCRHY) [6752:JP] stock as a Hold. My rating for Panasonic is lowered from a Buy previously to a Hold now, as the company’s Electric Vehicle or EV battery business’ growth outlook has become less favorable. I have stopped short of assigning a Sell rating to PCRFF, as the stock could witness a positive valuation re-rating in the future upon the achievement of its long-term ROIC targets.

My latest article evaluates the company’s prospects for the near term and the long run. I previously assessed Panasonic’s FY 2024 (YE March 31, 2024) results and the stock’s valuations in my earlier May 15, 2024 update.

Investors can buy or sell Panasonic’s shares traded on the OTC (Over-The-Counter) market and the Tokyo Stock Exchange. The daily trading values for the company’s OTC shares and Japan-listed shares were $1.6 million and $55 million, respectively, for the last 10 trading days according to S&P Capital IQ data. Readers can engage the services of US brokerage firms like Interactive Brokers to deal in Panasonic’s relatively more liquid Japanese shares.

Short-Term Outlook Is Unfavorable Due To Headwinds For EV Battery Business

The sell-side analysts’ consensus full-year FY 2025 operating income estimate for Panasonic was revised downwards by -15% in the past three months to JPY 387 billion, based on S&P Capital IQ data. This means that the company’s operating profit growth is projected to moderate from +25% in FY 2024 to +7% in FY 2025.

PCRFF’s operating profit decreased by -7% YoY to JPY 83,761 million in the most recent Q1 FY 2025, and which was 6% lower than the market’s consensus forecast of JPY 89,216 million as per S&P Capital IQ data. In its first quarter results presentation slides, Panasonic indicated that its Energy segment’s operating income contracted by -8% YoY in the recent quarter due to lower “production in North America.” The Electric Vehicle or EV automotive business falls under the company’s Energy segment.

The weakness associated with Panasonic’s EV battery business is likely to remain as a drag on the company’s operating earnings for the near term.

Dutch bank ING has forecasted that the “EV penetration rate” for the US will increase modestly from 9% last year to 10% this year, as per its August 6, 2024 research article. It is reasonable to assume that affordability issues have resulted in a weaker-than-expected pace of growth in EV adoption. According to Wood Mackenzie’s July 2024 research report, BEVs (Battery Electric Vehicles) in the US are priced at a level representing a premium of around 50% over the mean automobile sales price.

At the company’s 2024 strategic briefing presentation in May this year, PCRFF acknowledged that “the pace of shifting to BEV seems to be slowing down right now.”

Panasonic’s EV battery business will likely expand at a more moderate pace in the short term, and this will in turn hurt the financial performance of the overall business for full-year FY 2025. In that respect, the market’s expectations of significant operating earnings growth deceleration for Panasonic from a mid-twenties percentage in the prior fiscal year to a high-single digit percentage in the current fiscal year appear to be realistic.

But Meeting New Long-Term ROIC Targets Could Help To Narrow Valuation Discount

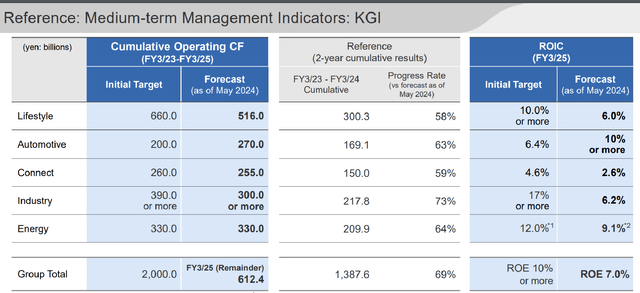

As per the chart presented below, Panasonic had lowered the full-year FY 2025 ROIC (Return On Invested Capital) guidance for four of its five business segments in May this year. As an example, PCRFF has set a goal of achieving a FY 2025 ROIC of 12% for its Energy segment in 2022 as part of its intermediate term targets, but the company revised this segment’s FY 2025 ROIC guidance to 9.1% three months ago.

Downward Revision In ROIC Guidance For Panasonic’s Different Business Segments In FY 2025

Panasonic’s Q1 FY 2025 Results Presentation Slides

This also implies that Panasonic’s expected ROE for the company as a whole will be 7% for fiscal 2025, which is much lower than the initially targeted 10%. Panasonic is now valued by the market at a trailing P/B of 0.57 times as per S&P Capital IQ data, or a -43% discount to book value.

The stock might continue to suffer from a substantial valuation discount, until the company’s overall ROE and the ROICs for its individual business segments improve.

It is encouraging to know that PCRFF is determined to enhance the ROICs for its various businesses in the future. Panasonic revealed at its strategic briefing presentation in May 2024 that the company is targeting to have all of its business segments “reach ROIC levels exceeding its WACC (Weighted Average Cost Of Capital)” by +300 basis points in fiscal 2027.

There are two ways that Panasonic can meet its FY 2027 ROIC target. One way is to improve the ROIC of its existing businesses. The other way is to part ways with low-ROIC businesses. In specific terms, PCRFF stressed that it won’t have any businesses with “negative growth” and ROIC “less than WACC” remaining in its portfolio by March 31, 2027 as indicated in its May 2024 strategic briefing.

In other words, PCRFF is most probably going to step up efforts associated with business performance improvement and portfolio reshaping (i.e. sales of or exit from underperforming businesses) in the coming years.

Conclusion

Panasonic’s current valuations are reasonable, and a Hold rating for the stock is warranted.

The Gordon Growth Model arrives at a fair P/B ratio by dividing [Return on Equity minus Perpetuity Growth Rate] by [Cost of Equity minus Perpetuity Growth Rate]. A fair P/B multiple for Panasonic is 0.57 times or the same as its current P/B metric based on assumptions of a 7% ROE (FY 2025 guidance), a 10% Cost of Equity, and a Perpetuity Growth Rate of +3%.

PCRFF’s depressed P/B valuations are justified based on its FY 2025 ROE guidance of 7% which takes into account the weak performance of the Energy segment or EV battery business. But Panasonic has the potential to command a higher P/B multiple sometime in the future, assuming that it achieves its FY 2027 ROIC goals.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here