Investment Thesis

GigaCloud Technology (NASDAQ:GCT) is a battleground stock. In the same way, as many stocks become battlegrounds at some point in time, this battleground business is being unjustifiably sold off.

Here I want to address the top 3 arguments that bears put forth against GigaCloud. More specifically, I address the question of it being a fraud, the insider selling, and that the business has no moat.

Here’s why I’m super bullish on GCT and continue to believe that this stock’s price target is $60 per share by summer 2025.

Rapid Recap

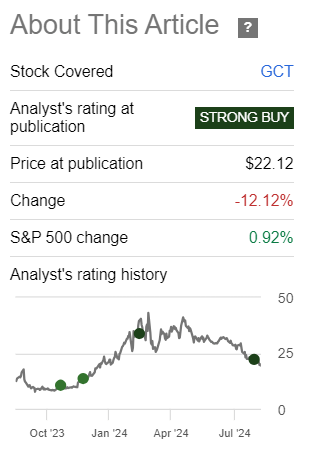

GigaCloud Technology is a stock that I’m very bullish on. And even though I strongly believe in its prospects, the stock has continued to sell off since my recent article. And commensurate with its sell-off, the comments have continued to surface.

Author’s work on GCT

Here I put to rest the top 3 recurring comments.

1) The Company is a Fraud

When people say the company is a fraud, they often simply mean that the share price is down a lot since they bought it. But fear builds on itself, and people keep selling at first, and then capitulating. And this is how markets have worked since the dawn of time.

On top of that, it didn’t help matters that this is for the most part a Chinese company. And if that wasn’t enough, the CFO abruptly left. What a perfect storm. Oh, and did I mention that GCT’s auditor is Chinese? Yes, a perfect short, or so it seems.

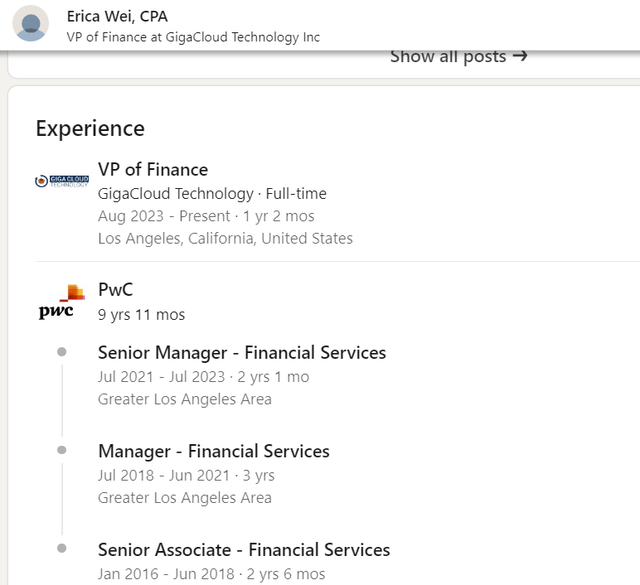

The new CFO, who spent nearly a decade at PwC, hasn’t helped matters, at least from the market’s perspective, as the stock has continued to sell-off.

LinkedIn

Here I refute the claims of GCT being a fraud with three facts.

- SA and their team literally went over to GigaCloud’s main warehouse. And took the picture.

- GCT spent approximately $88 million buying up Noble House and Wondersign in 2023. Unless GCT figured out how to fake cash to buy these two businesses, these acquisitions are proof that GCT is in a strong position to buy up businesses. After all, there are legal aspects to making sure that a business has the means to support its acquisition.

- GigaCloud has no debt on its balance sheet. It’s difficult to run a business that “makes no money” without taking on debt. Common sense, really.

2) Insider Selling

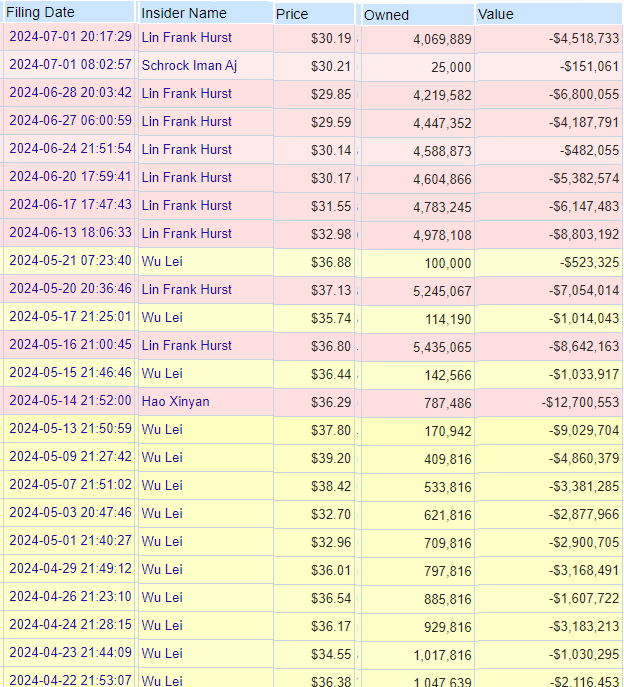

The insider selling of GCT has been intense. There’s no denying this consideration.

Openinsider

But context matters.

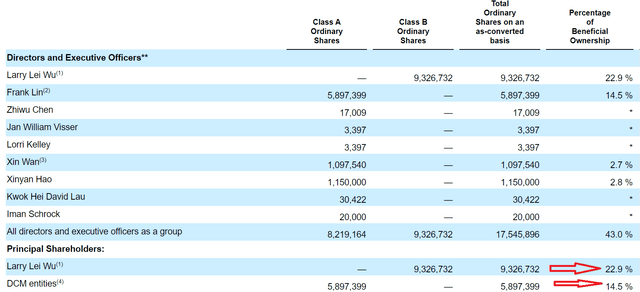

There have been two main people selling out of GigaCloud Technology. These are the CEO Larry Wu and Frank Lin.

Let’s shed some further light on this matter. Frank Lin is a director at GCT, and general partner of DCM, a technology venture capital firm. Venture capital firms are not the sort of investors that stick around with a company for the long-term prospects of the company.

Venture capital firms invest in many early-stage companies, knowing that not all will succeed. They make informed decisions by researching companies with strong growth potential. As these companies grow and increase in value, the VC firms sell their shares. This strategy allows them to earn money even if some investments don’t work out.

If you go on DCM’s website, you can see other investments that DCM has made.

DCM website

For instance, Matterport (MTTR). And you can go on the proxy statement of Matterport and see that DCM is indeed a key shareholder of Matterport.

Moving on, even after all the selling, DCM still holds about 4 million shares or roughly speaking, 10% of GCT. That is about $80 million worth of stock after selling for all these months, and after the stock hit a recent low on Friday.

GCT proxy

To repeat, look at DCM’s website, you can see many other familiar names, for instance, Hims & Hers (HIMS), and other high-growth names. DCM invests in high growth and untested businesses. That’s their setup.

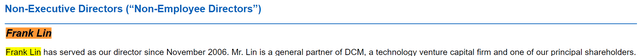

What’s more, keep in mind that Frank Lin has been with GCT for longer than most people have been investing in companies. Not to mention GCT.

GCT proxy statement

As you can see above, Frank Lin has been with GCT since 2006. Can you imagine how much of an upside his firm has benefitted from GCT when it was selling at $30 per share? GigaCloud was most likely DCM’s biggest home run. And if DCM did not sell out and diversify its portfolio, why would they charge their LPs anything?

That’s not their business model. I hope this clarifies matters slightly.

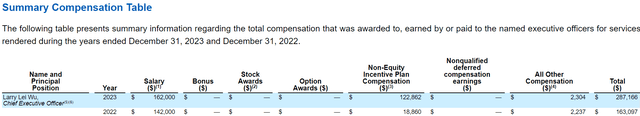

Similar arguments could be made about CEO Larry Wu. I don’t know how many companies you regularly follow, but take it from me, there are not many companies I know where the CEO isn’t even making $300K per year in compensation.

GCT proxy statement

I know of 3 outlier CEOs, but those are just people like Warren Buffett, who are in the richest people in the world, and it’s more of a statement than anything else.

If Larry Wu doesn’t sell any stock in his company, then he doesn’t get rewarded. Is that what shareholders want? A CEO that doesn’t get correctly incentivized?

3) The Business Has No Moat

This final point I don’t have much retort against. This is true. GCT is a mail-order house. It is an online marketplace designed for businesses that deal with large, non-standard, and bulky products. There are countless similar businesses around the world that do just that.

It’s like saying that Amazon (AMZN) is a retailer, and therefore it has no value. Although, to be clear, people made such arguments about Amazon for many years. And yet, I’m not saying that GCT is the next Amazon. But simply to remark that it is difficult to grow a profitable business.

Here’s how the last 3 quarters of GCT’s free cash flow profile have progressed:

- Q4 2023: $47 million

- Q1 2024: $20 million

- Q2 2024: $18 million

The market didn’t like that Q4 saw its free cash flow so strong, and that the next several quarters saw GigaCloud’s free cash flow shrink. This obviously demonstrates how cyclical the business is.

And to further echo this statement, this is what GigaCloud’s 10-K states:

We believe that sales of home furniture and other large parcel items are subject to modest seasonality. We expect the last quarter of the year to be the most active.

Retail business is cyclical. Just like Amazon. And yet, the business is clearly highly profitable.

While most US-based businesses chase growth, with profitability as an afterthought, the main question in my mind is how much free cash flow will GCT make in 2024?

For my part, I expect to see at least $90 to $100 million of free cash flow this year.

In the first half of 2024, GCT made $67 million, which is impressive given it’s not their peak period. If we project that Q3 2024 will earn 15% more than the $43 million it made last year, that would be around $50 million. For Q4 2024, if it also grows by 15%, it would be about $54 million. That totals roughly $142 million for the year.

Now, to leave me a large margin of safety, we can assume GCT might earn less than this estimate. So, it’s possible to expect its free cash flow in 2024 to be around $90 million and $100 million.

This puts the debt-free business, with approximately 25% of its market cap made up of cash and marketable securities, priced at about 8x clean free cash flow.

All in all, I believe that paying close to 20x next year’s free cash flow to be a more reasonable multiple for GCT, or around $2.5 billion or $60 per share.

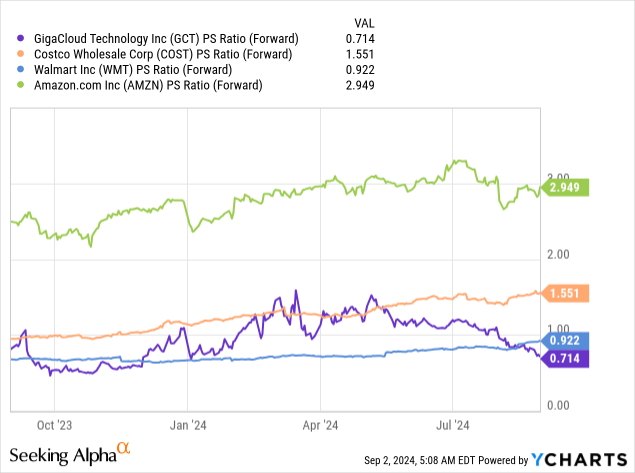

Now, as we look around, this is a large discount to most other established retail businesses.

You’d expect GCT to trade at a large discount to other companies, such as Costco (COST). But when you consider the tremendous growth rates of GCT, with Q3 2024 expecting around 60% revenue growth rates, I find it rather surprising how cheap its stock is.

Investment Risks to Consider

GigaCloud operates in the competitive e-commerce sector and will continue to face challenges as it tries to carve out its place in the market.

With numerous established players dominating the landscape, GigaCloud may struggle to differentiate itself and maintain its very strong growth. After all, some of its biggest customers, such as Walmart (WMT), Amazon, and Wayfair (W), have plenty of alternatives to choose from, leaving GigaCloud Technology without much in the way of pricing power.

I would counter this contention by stating that its active buyers have clearly increased in the past trailing twelve-month period.

- Q1 2023: 13%

- Q2 2023: 7%

- Q3 2023: 10%

- Q4 2023: 21%

- Q1 2024: 29%

- Q2 2024: 67%.

And yet, its buyers will always chase the cheapest price and have limited loyalty to any e-commerce platform.

The Bottom Line

In summary, my confidence in GigaCloud’s potential stems from three key points.

First, despite accusations of fraud, the company has demonstrated its legitimacy through substantial acquisitions and a debt-free balance sheet, which are not characteristics of a fraudulent business.

Second, insider selling, particularly by venture capital investors, is not a sign of weakness but a typical strategy for such firms to realize profits and diversify their portfolios.

Finally, while GigaCloud lacks a traditional moat, its strong cash flow and increasing number of active buyers indicate a solid and growing business. Given these factors, I firmly believe that GigaCloud is undervalued, justifying a price target of $60 per share by summer 2025.

Read the full article here