Performance Summary

|

Cumulative |

Annualized |

|||||

|

3 Month |

YTD |

1 Year |

3 Year |

5 Year |

10 Year/ LOF 1 |

|

|

Fidelity Freedom 2065 Fund (MUTF:FFSFX) Gross Expense Ratio: 0.76% 2 |

1.81% |

10.20% |

17.90% |

3.82% |

10.23% |

10.23% |

|

S&P 500 Index (SP500, SPX) |

4.28% |

15.29% |

24.56% |

10.01% |

15.05% |

15.05% |

|

Fidelity Freedom 2065 Composite Index |

2.04% |

9.08% |

16.46% |

3.87% |

9.54% |

9.54% |

|

Morningstar Fund Target-Date 2065+ |

1.71% |

9.60% |

17.07% |

4.14% |

9.80% |

— |

|

% Rank in Morningstar Category (1% = Best) |

— |

— |

18% |

56% |

31% |

— |

|

# of Funds in Morningstar Category |

— |

— |

195 |

137 |

29 |

— |

|

1 Life of Fund (LOF) if performance is less than 10 years. Fund inception date: 06/28/2019. 2 This expense ratio is from the most recent prospectus and generally is based on amounts incurred during the most recent fiscal year, or estimated amounts for the current fiscal year in the case of a newly launched fund. It does not include any fee waivers or reimbursements, which would be reflected in the fund’s net expense ratio. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares. Current performance may be higher or lower than the performance stated. Performance shown is that of the fund’s Retail Class shares (if multiclass). You may own another share class of the fund with a different expense structure and, thus, have different returns. To learn more or to obtain the most recent month-end or other share-class performance, visit Fidelity Funds | Mutual Funds from Fidelity Investments, Financial Professionals | Fidelity Institutional, or Fidelity NetBenefits | Employee Benefits. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative total returns are reported as of the period indicated. For definitions and other important information, please see the Definitions and Important Information section of this Fund Review. Not FDIC Insured • May Lose Value • No Bank Guarantee |

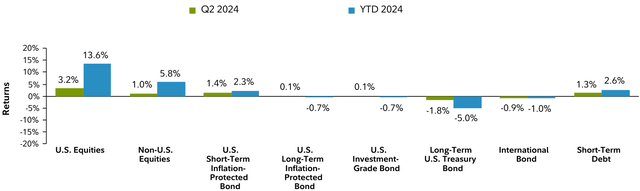

Market Update and Portfolio Review

The inflation outlook and its effect on expected Fed rate cuts were important drivers of investor sentiment in Q2. At its June meeting, the Fed reduced its outlook from three rate cuts to one in 2024. While inflation exceeded the central bank’s 2% target in April, the figures reported in May and June softened. Treasury yields moved higher in April before retreating to end the quarter roughly where they began in April. Against this backdrop, U.S. stocks gained 3.24% for the quarter. Non-U.S. equities also advanced, with diverging results in emerging markets (+4.99%) and developed markets (-0.30%). Interest rates were volatile, and investment-grade bonds gained 0.07%.

Total Return of Strategic Asset Classes Period Ending June 30, 2024

|

You cannot invest directly in an index. Past performance is no guarantee of future results. U.S. Equities – Dow Jones U.S. Total Stock Market Index, Non-U.S. Equities – MSCI All Country World ex USA Index (Net MA), U.S. Short-Term Inflation- Protected Bond – Bloomberg U.S. TIPS 0-5 Years Index, U.S. Long-Term Inflation- Protected Bond – Bloomberg U.S. Treasury Inflation Notes: 5+ Years Index, U.S. Investment- Grade Bond – Bloomberg U.S. Aggregate Bond Index, Long-Term U.S. Treasury Bond – Bloomberg U.S. Long Treasury Index, International Bond – Bloomberg Global Agg Treasury ex USD, ex EM, RIC Capped, Float Adjusted USD H Index , Short-Term Debt – Bloomberg U.S. 3-6 Month Treasury Bill Index |

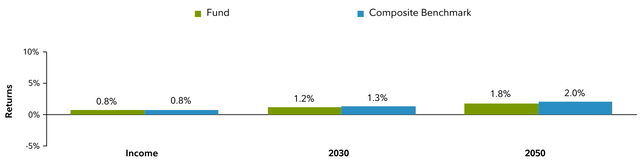

Fidelity’s target-date strategies all achieved a gain in Q2, as displayed below (net of fees)*.

Quarterly Performance for Representative Funds Period Ending June 30, 2024

| See the Performance Summary table in this review for performance reporting on all vintages. Funds shown in this chart are representative samples of where a target-date investor might be at various stages of their life. |

Performance Attribution Summary

Underlying portfolio managers’ investment performance contributed to the Fund’s results versus Composite indexes, whereas active asset allocation decisions detracted. Among the underlying portfolios, U.S. equity managers, in aggregate, produced a positive excess return, along with managers of investment-grade bonds and emerging-markets equities.

Relative Contributors (representative across vintages):

Most underlying building-block managers across all asset classes outperformed or performed roughly in line with their respective benchmarks for the quarter. The largest individual contributors included:

- Fidelity® Series Opportunistic Insights Fund outperformed its benchmark, the Russell 3000® Index. The fund is managed by Will Danoff, who employs an opportunistic, diversified process to choose companies poised for sustained, above-average earnings growth that is not accurately reflected in current valuations. For the quarter, security selection and an overweight in semiconductor-related stocks meaningfully contributed, as did the pharmaceutical, biotechnology & life sciences industry. Within these segments, an overweight in chipmaker Nvidia (NVDA) helped most, followed by pharma companies Eli Lilly (LLY), Vertex Pharmaceuticals (VRTX) and Regeneron Pharmaceuticals (REGN). An overweight in the media & entertainment group also contributed.

- Fidelity® Series Growth Company Fund outperformed its benchmark, the Russell 3000® Growth Index. The fund is managed by Steve Wymer, who invests across a spectrum of companies, from blue chip to aggressive growth. The manager is focused on firms operating in well-positioned industries and niches that Steve considers capable of delivering persistent sales and earnings growth. Security selection within information technology, particularly an overweight in Nvidia, was a notable contributor to relative performance. Other top contributors included security selection and an underweight in the industrials sector, as well as an underweight in financials.

- Fidelity® Series Investment Grade Bond Fund outperformed its benchmark, the Bloomberg U.S. Aggregate Bond Index. The portfolio managers of this core U.S. fixed-income strategy focus on mispriced securities across sectors (corporate bonds, agency mortgage-backed securities and government-related issuers, and others). Strong security selection was a primary contributor to relative returns in Q2. Specifically, security selection within corporates, namely financials and industrials, as well as within the mortgage-backed and asset-backed securities sectors, helped the fund’s relative return.

Relative Detractors (representative across vintages):

Most underlying building-block managers across all asset classes outperformed or performed about in line with their respective benchmarks for the quarter. The largest individual detractors included:

- Fidelity® Series Value Discovery Fund, which trailed its benchmark, the Russell 3000® Value Index. The fund’s manager, Sean Gavin, focuses on companies with an above-average return on invested capital, strong barriers to entry and significant price dislocation. Security selection in the communication services, consumer staples and information technology sectors notably detracted in Q2. In health care, Centene (CNC) and CVS Health (CVS) were notable individual relative detractors, as was media giant Disney (DIS) and biopharmaceutical company Bristol- Myers Squibb (BMY).

- Fidelity® Series International Growth Fund underperformed its benchmark, the MSCI EAFE Growth Index. The fund’s manager, Jed Weiss, targets companies with multiyear structural growth prospects, high barriers to entry and an attractive valuation based on his proprietary earnings forecasts. Security selection in financials, industrials and materials were the primary relative detractors. Semiconductor equipment company Lasertec (OTCPK:LSRCF), along with biotech firm AstraZeneca (AZN) and aerospace leader Airbus (OTCPK:EADSF), were the fund’s largest individual relative detractors.

Active Asset Allocation

Overall, active asset allocation positioning detracted from the Fund’s relative return this quarter. An underweight position in U.S. equities notably hurt, as did an overweight allocation to investment-grade bonds.

Outlook and Positioning

The Fund’s glide path and strategic asset allocation reflect our long-term views and insights on participant needs, diversification and capital markets. Our investment process is focused on selecting strategic asset classes that provide compelling long-term returns, independent sources of return and risk, and favorable implementation attributes. Our view is that long-term trends in economic and policy conditions may imply a regime change for financial markets. High debt, aging demographics, peak globalization and geopolitics are likely to create uncertainty in the path of inflation, policy and profits.

With this in mind, strategic asset allocation decisions continue to emphasize diversification to help target-date investors navigate different risks that emerge throughout their lifetimes. Over long periods, equities are a powerful asset for building wealth, in our view, while our fixed-income portfolio provides balance during periods of inflationary and deflationary stress. Active allocation positioning reflects intermediate-term views on assets that are mispriced relative to our view of fair value. We expect a soft landing of the U.S. economy, and we have moved to an overweight position in equities. While the fundamental story for the U.S. is strong as of midyear, we believe it is fully priced, and we remain underweight U.S. equities. Near-term growth and inflation may be underestimated, and we are monitoring the risk of persistent inflationary pressure and an inverted yield curve. Narrow market leadership by a handful of U.S. large-cap growth stocks presents risk and opportunity for investors. Extremes in market concentration may indicate weakness in the broader economy. This environment may also lead to a repricing of areas that have been range-bound for many years, including small-cap, value and international equities. This may also be a favorable backdrop for security selectors to express views based on bottom-up research. Non-U.S. developed and emerging-market equities have low expectations and ample opportunity for rerating, as we see it, leading to an overweight position in our strategies. A critical issue is whether China’s significant monetary and fiscal policy response can improve sentiment and growth. The U.S. Treasury market represents a good value relative to the prior decade, and can provide a degree of relative protection against a growth shock or Fed policy error. Real yields provide a buffer if inflation surges. An inflation surprise remains a risk, and stimulus in China may lead to increased demand for commodities. We are watching measures that would give us confidence to increase the Fund’s exposure to commodities. We believe heightened volatility and the persistence of uncertainty in the capital markets reinforce the importance of a disciplined investment process. Our target-date strategies are managed with a long-term investment horizon and provide investors with a diversified portfolio that seeks to balance their need for total returns with their sensitivity to many risks – longevity, market, inflation and deflation. In the 27 years we have managed target-date funds, this approach has proven to be a prudent and time-tested strategy. Since inception, Fidelity’s target-date strategies have achieved successful outcomes, as measured by total return, as well as by investors’ tendency to remain invested throughout periods of volatility. We remain focused on researching the key drivers of participant outcomes, including capital markets, diversification and future expectations of retirement participant attributes.

Read the full article here