Seven GOP-led states have filed a lawsuit challenging the Biden administration’s most recent student debt forgiveness plan, accusing the U.S. Department of Education (DOE) of taking steps to cancel loans beginning as early as this week.

The lawsuit comes nearly a week after the Supreme Court denied the Biden administration’s request to lift a block on the Saving on a Valuable Education (SAVE) plan, which is designed to ease the burden of student loan debt for millions of borrowers.

In a lawsuit filed Tuesday in a Brunswick, Georgia, federal court, attorneys general from Republican-led states, including Georgia and Missouri, took aim at a rule by the DOE proposed in April, which would provide for a waiver of federal student loan debts for about 27.6 million borrowers.

The attorneys claim in the lawsuit that they recently obtained documents showing the DOE instructed federal loan servicers to begin canceling hundreds of billions of dollars of loans as early as Tuesday or Saturday before the rule was finalized.

The order could possibly lead to the overnight cancellation of at least $73 billion in loans, the attorneys said, followed by billions more in debt relief.

The attorneys argue the DOE does not have the authority to cancel the student loan debt.

“We successfully halted their first two illegal student loan cancelation schemes; I have no doubt we will secure yet another win to block the third one,” Missouri Attorney General Andrew Bailey said in a statement.

Joining Missouri and Georgia in the lawsuit are Alabama, Arkansas, Florida, North Dakota and Ohio.

FOX Business has reached out to the White House and DOE.

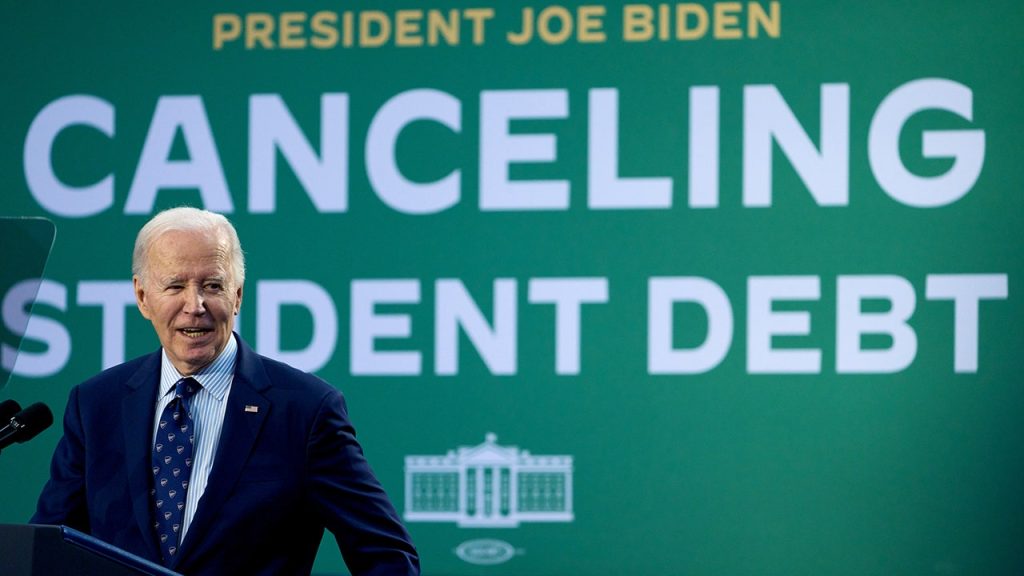

This is the latest legal challenge to President Biden’s efforts to fulfill a campaign pledge and provide debt relief to millions of Americans who paid for their costly higher education using federal student loans.

In a previous effort, Biden introduced SAVE after the Supreme Court struck down his proposed student loan forgiveness plan. The White House said that the SAVE plan could lower borrowers’ monthly payments to zero dollars, reduce monthly costs in half and save those who make payments at least $1,000 yearly. Additionally, borrowers with an original balance of $12,000 or less will receive forgiveness of any remaining balance after making 10 years of payments.

Legal challenges from Republican-led states resulted in a temporary block of the program until the litigation concluded. The 8th Circuit Court of Appeals issued a preliminary injunction blocking the SAVE student loan repayment plan.

The block prevents the DOE from offering the plan while litigation continues.

In the meantime, borrowers enrolled in the SAVE Plan are being moved into forbearance while the Biden administration defends the plan in court.

The appeal from the administration is separate from a lawsuit brought against the income-contingent SAVE Act by Alaska and other states in another appeals court.

An emergency request for an injunction to block the student loan forgiveness plan in that case is also pending at the Supreme Court.

Reuters contributed to this report.

Read the full article here