Kiwetinohk Energy (OTCPK:KWTEF) (TSX:KEC:CA) is still concentrating on the natural gas business. Previous articles have noted that there is a long-term plan to develop a power business as well (and maybe a carbon hub business). However, right now, developing cash flow is likely important and rich gas has been the choice. Investors need to realize that this is a growth situation. Therefore, there is unlikely to be any significant income for years to come.

Founder

The company was founded by Pat Carlson. Long-time investors know that he was a founder of Seven Generations that was purchased by ARC Resources several years ago. He has experience with building companies before that as well. That experience gives this company a huge advantage in the beginning stages when someone with this level of experience is the CEO.

Second Quarter

This company, like many, is heading to the Montney, Duvernay, and other familiar names in Canada. The whole region is experiencing a revival as technology has made the area very cost competitive with other North American areas.

Some parts of this were originally known for natural gas production. But now other rich gas areas are becoming very profitable to produce. This has changed the industry in the area considerably.

A company like this that wants to build cash flow first to take on energy (primarily electricity) production projects later has a fantastic opportunity here.

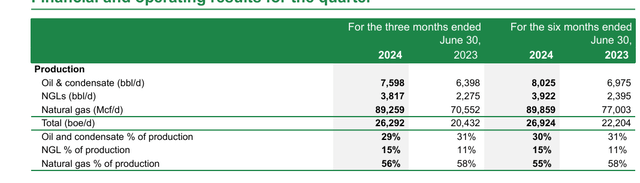

Kiwetinohk Energy Second Quarter Production Comparison (Kiwetinohk Energy Second Quarter 2024, Earnings Press Release)

This company, like many, is in a good position to benefit from the cyclical recovery anticipated for natural gas prices. But it has the advantage of liquids production in a market where oil and condensate prices are strong to get it to the point where it can benefit from better natural gas prices.

Those strong oil and condensate prices are helping to fund a fair amount of growth to get the production to the point where some economies of scale allow for further savings.

These wells are so profitable through that the debt ratio has remained fairly conservative despite the rapid growth of production.

(Note that Kiwetinohk Energy is a Canadian Company that reports using Canadian dollars unless otherwise noted.)

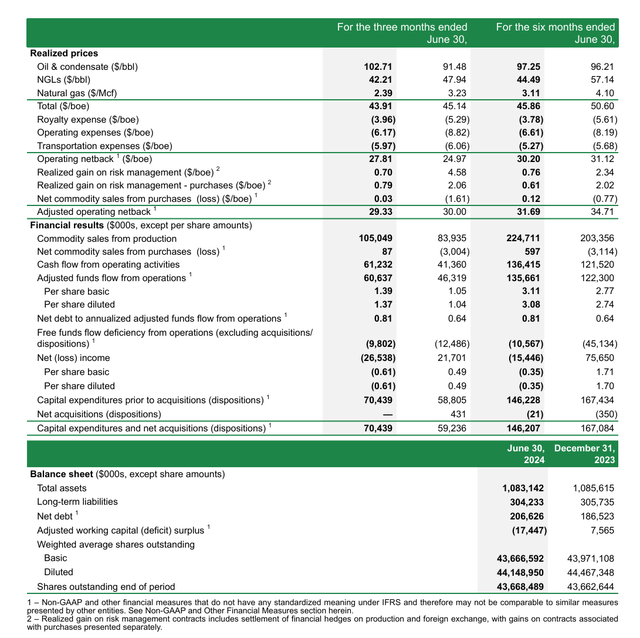

Kiwetinohk Energy Second Quarter 2024, Financial Summary And Netback (Kiwetinohk Energy Second Quarter 2024, Earnings Press Release)

Notice that the operating netback is roughly one-quarter of the sales price. That is a level of profitability seldom seen in any industry (let alone this one). Additionally, the reported cash flow, if annualized, easily handles the net debt figure. In fact, the total liabilities to annualized net cash flow is reasonable as well.

The major risk at this point is the fast growth of the company. This is where having an experienced CEO and likely other senior officials as well is absolutely critical.

The free funds flow shown above is negative, and it is likely to remain negative or close to zero because of the growth plans in place.

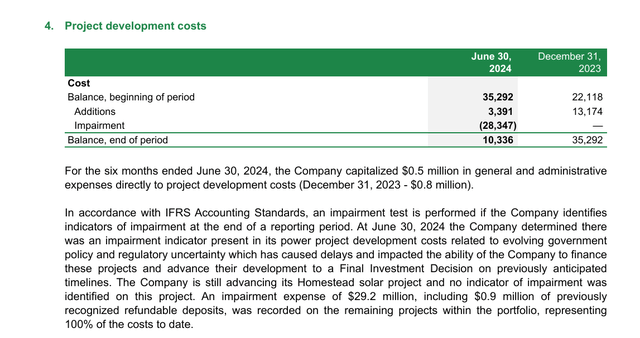

Impairment

One of the power plant projects has delays and other considerations that caused an impairment charge. This noncash charge resulted in a loss. Now it may or may not represent a future return loss as many of the power projects are in the early stages. It is probably best to be conservative, as management was about this “just in case”. This also points to the importance of a healthy upstream business until the power generation business gets going.

Kiwetinohk Energy Impairment Charge Description And Amount (Kiwetinohk Energy Second Quarterr 2024, Financial Statements Filed With Sedar)

There were also some hedging losses as well reported. So far, this year, the income statement has not been very cheerful. But that has not really affected cash flow growth at this point. If that changes, then investors would need to evaluate the cash flow growth and its effect on the future of the company.

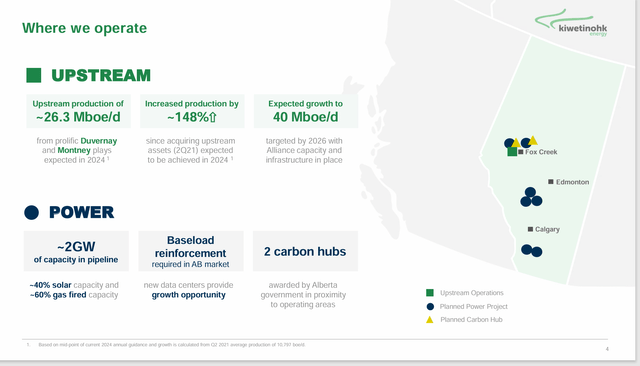

Business

Currently, the upstream business produces all the cash flow. However, the future could be quite a bit different, with power plant projects and carbon sequestering projects in the planning stages.

Kiwetinohk Energy Business Summary (Kiwetinohk Energy Second Quarter 2024, Corporate Presentation)

The upstream business is located in one of the main Canadian industry corridors, as shown above. The rest of the business is in the planning stages, with various levels of capital required.

Obviously, the better the upstream business, the easier financing some of these later projects will be. Nothing succeeds like cash flow.

This is an unusual way to integrate, but it is not unheard of. There are other power companies I have covered in the past that have upstream subsidiaries, from which they produce the needed natural gas for their power plants.

However, electricity is a regulated industry, whereas the upstream business is not. Sometimes, companies that have tried this have had to spin off the upstream business to obtain an adequate return that was free of regulation. Therefore, we will have to see how this idea works out in the future.

With an impairment charge already taken, that may be a sign of things to come. Now, the carbon hubs represent a relatively new industry. The profitability there is very hopeful, but there is no history because carbon sequestering was never a serious objective before. A lot of people are jumping into this area hoping to make a lot of money. That may not turn out to be a good thing.

Summary

The upstream business is very profitable and growing pretty much as planned. The power business is another matter, as already there is an impairment charge. This is an interesting start to a company by a businessman who has been very successful at building and selling companies in the past.

The stock price has not done much since the public beginning in fiscal year 2022. But that may be a reasonable situation given that the company has a lot of growth plans ahead. The profitability of those other areas is really nothing close to being calculated by the market.

Management feels that the stock is undervalued right now (what management does not?). However, the market generally values an upstream business on its free cash flow, dividends, and stock repurchases. But none of that appears to be a reasonable proposition until the other businesses are generating cash flow.

It is always hard to say how a stock should be valued in the early stages. It is even more challenging to say what the company will look like in the future when power plants are the future, and they are heavily regulated. The future needs to be a lot closer (at least before I have a clue).

This is a new company (elevated risk) strong buy recommendation based upon the history of Pat Carlson’s past successes at building and selling companies. More often than not, someone with his history can “roll with the punches” to come out showing a reasonable profit after 5 years. But as that initial impairment charge shows, that is far from guaranteed.

Risks

Any upstream business has the exposure to the volatility and low visibility of future commodity prices. Any severe and sustained downturn could materially change the future prospects of the company. In this case, such an event could require a capital infusion to complete the company’s plans to build the other businesses.

As the impairment charge demonstrates, building any power plant is never as simple as it looks. Adequate profitability from power generation is a specialty all by itself. There is no assurance that an upstream specialist like Pat Carlson can succeed in this venture.

Similarly, “everybody” is jumping into carbon hubs. But everybody may eventually turn out to be too many to make a decent profit.

As a result, this company could eventually end up being another successful upstream company to join the already substantial successes of the past.

The loss of key personnel, like Pat Carlson, could prove to be very consequential to the company’s future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here