Thesis

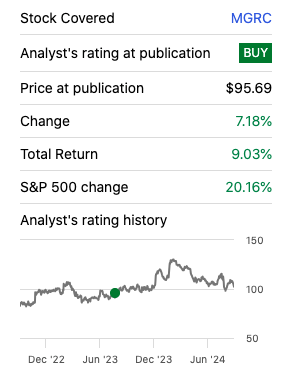

On July 28, 2023, I began coverage of McGrath RentCorp (NASDAQ:MGRC) with a ‘Buy’ rating and analysis discussing how Q2 earnings indicated the Mobile Modular segment and the Vesta acquisition were able to hit targets. While TRS-RenTelco had some weakness due to lower semiconductor demand, I thought that the revenue growth and increased EBITDA pointed to better things ahead, and the valuation metrics and financial health looked good.

At the time my article was published, MGRC was trading at $95.69 and hit a peak of $130.11, offering around a 36% return for anyone who sold at the top. For holders with a longer time horizon, the stock has only a total return of 9% versus the S&P 500’s 19.89% gain.

Grassroots Trading MGRC Performance (Seeking Alpha)

Today, I checked in with McGrath to see if it’s still a good investment, and my analysis shows that it has done well in areas like Mobile Modular, but I feel the investment is much shakier now with its merger problems and mixed valuation, so I would not be comfortable buying the stock today.

About McGrath RentCorp

McGrath RentCorp, started in 1979 and based in Livermore, California, rents out equipment through four divisions: Mobile Modular, Portable Storage, TRS-RenTelco, and Enviroplex.

Mobile Modular rents modular buildings for schools, offices, healthcare, and more. These buildings serve industries like education and construction, especially in places like California, Texas, and Florida.

Portable Storage handles renting steel containers, mainly for construction sites or other temporary storage needs.

The TRS-RenTelco division rents out electronic test equipment to aerospace, defense, and telecom firms, such as oscilloscopes and analyzers, vital for research and development work.

Enviroplex manufactures and sells portable classrooms-the kind you might see in school parking lots these days-primarily to state-funded public schools in California.

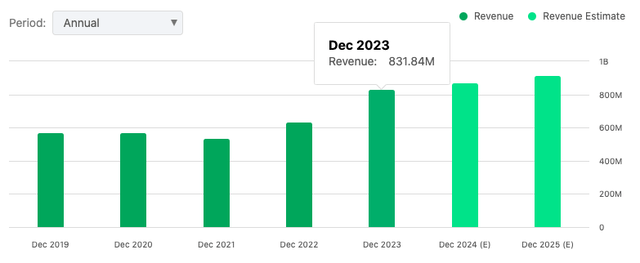

Seeking Alpha

In 2023 McGrath RentCorp pulled in around $832 million in revenue.

The McGrath/WillScot Mobile Deal

Earlier this year, WillScot Mobile Mini, which provides temporary space solutions, announced it’s buying McGrath RentCorp for $3.8 billion. The terms were 60% cash and 40% stock-meaning that, at the time the offer was made, McGrath shareholders would get $123 a share and wind up with about 12.6% of the newly combined entity.

The deal was expected to close by mid-2024, after getting approval from McGrath’s shareholders and regulators, but according to a 10-Q filing in July, the companies agreed not to close the transaction until Sept. 27 after a request from the Federal Trade Commission and civil investigative demands from three state attorneys general inquiring into the transaction. There have been no significant updates as of the time of this analysis.

Using this updated valuation, McGrath shareholders will receive their choice of either $123 in cash or 2.8211 shares of WillScot Mobile Mini, with the proviso that no more than 60% of the transaction can be cash. At the current stock price of WillScot, currently trading at the time of my research at $36.97, the stock component is $104.31 per McGrath share so, factoring in the 60% cash and 40% stock, the blended value is about $115.52 per share.

Stock component = 2.8211× 36.97 = 104.3

The blended price is calculated as (0.60 × 123 ) + ( 0.40 × 104.31 ) = 73.8 + 41.72 = 115.52

On synergies, SA Analyst Daniel Jones goes into a little more detail and is definitely worth reading in ‘McGrath RentCorp: Still In Play, Especially If Bullish On WillScot Mobile.’

Put simply, the two firms have a lot in common, with modular operations that complement each other, and the combo will have a healthy national footprint: $3.2 billion in annual revenue and 475,000 rental units. McGrath will bring strength in electronic test equipment, while WillScot is the storage leader.

The deal is projected to save $50 million a year via consolidation and cost-cutting, but it will also cost $35 million at the outset, and there’s no guarantee of success. Both companies are in good financial shape, but the deal adds $6.08 billion in debt that has spooked some investors. If the savings prove to be what is claimed, the combined company should provide good value.

McGrath RentCorp Stock Performance

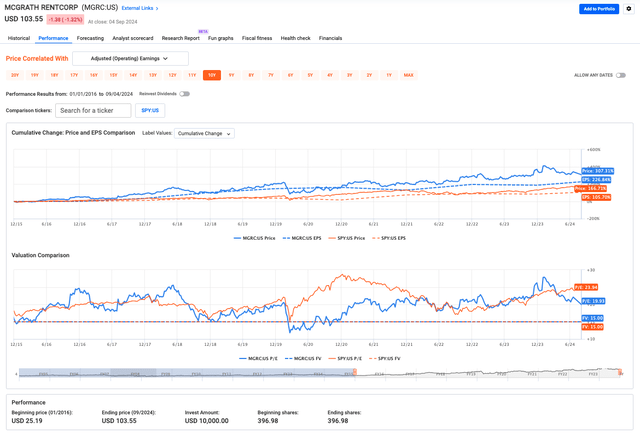

Fast Graphs

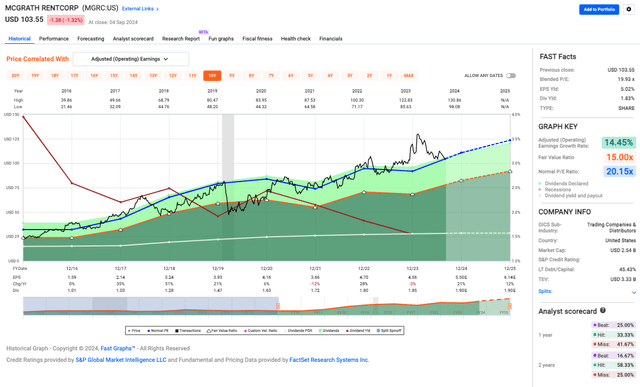

Since January 2016, MGRC has shown solid long-term growth in both stock price and dividends, making it a good bet for long-term players, especially when compared to the S&P 500 (SPY), with a 19.34% annual growth rate, beating the S&P 500’s 13.52%.

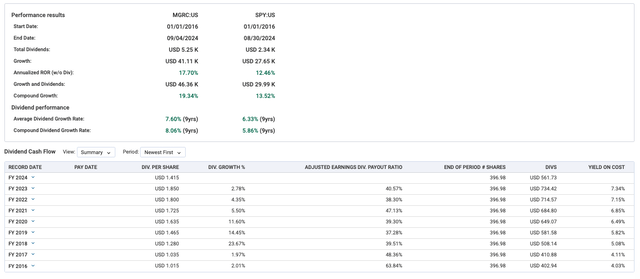

Fast Graphs

Over the last nine years, MGRC’s average dividend growth rate was 7.6%, with a compound rate of 8.06%, and dividends have climbed each year.

McGrath RentCorp’s Fundamentals

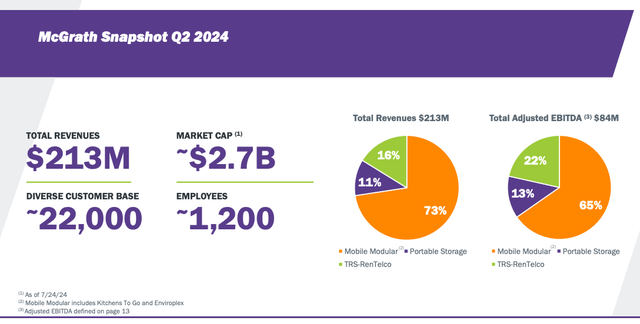

McGrath Investor Presentation

Examining the Q2 earnings announced in late July, McGrath RentCorp saw a 5% bump in total revenues, hitting $212.6 million. Rental revenues climbed 3%, while sales revenues jumped 14%, pushing adjusted EBITDA up 9% to $83.7 million.

McGrath Investor Presentation

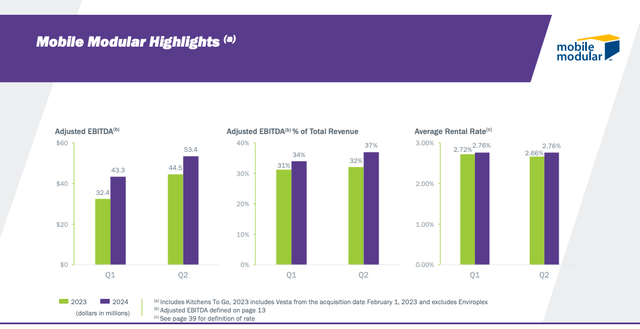

The Mobile Modular division led the charge, with rental revenues up 10% and adjusted EBITDA rising 20% to $53.4 million. Both education and commercial segments grew, with commercial up 14% and education up 6% year-over-year. Mobile Modular Plus also posted solid growth, with revenues up 12% to $7.5 million. Site-related services increased to $5.8 million.

In education, modernization and enrollment boosts led to a big backlog of deferred work, supported by strong funding. Rental backlog rose 24% year-over-year, showing steady demand for modular buildings. Monthly revenue per modular unit jumped 18% to $793, with new shipments up 13% to $1,124. Modular shipment pricing increased 13% over the past year (thanks to pricing hikes and added services from Mobile Modular Plus).

Operational efficiency remained strong, with rental margins for Mobile Modular increasing to 60% from 54% due to higher rental revenues and lower inventory expenses. Modular quoting activity was 14% higher year-over-year, signifying a strong pipeline of future shipments and revenue. Fleet utilization remained somewhat steady at 78.4%, compared with 79.3% a year ago. Also, according to management, local public education bonds are passing at high rates, reflecting strong community support for investment in school infrastructure, which is a positive for McGrath’s business.

And lastly, McGrath’s cash flow saw a big boost with net cash from operations nearly doubling to $139 million, up from $72 million last year, which allowed the company to keep paying $23 million in shareholder dividends.

McGrath RentCorp’s Valuation

(Potential) merger valuations aside, with MGRC’s blended P/E ratio of 19.93x, the stock is trading a bit above its fair value, which is around 15.00x. However, the 14.45% earnings growth rate is a solid sign as McGrath’s been consistently boosting its operating earnings, which is great news, especially in its cyclical industry.

Fast Graphs

One minor downside is the dividend yield at just 1.83%. It’s stable, but kind of weak, though in context, it’s not exactly what’s driving returns here. Bottom line: looking at the normal P/E of 20.15x, McGrath isn’t wildly overvalued, so there could still be some growth potential (if the merger doesn’t come to fruition).

McGrath RentCorp’s Risks & Headwinds

While there were some positives, McGrath also encountered some speed bumps. The Portable Storage segment saw revenues drop 6% to $24 million, with rental revenues down 4% to $17.8 million, and volumes lower due to exposure to the rate-sensitive commercial construction sector, resulting in increased returns and diminished revenues.

The TRS-RenTelco segment was also unsuccessful, with rental revenues down 11% and total revenues falling 14% to $32.7 million. TRS-RenTelco sales revenues dropped 22%, and gross profit in the division fell to $3.1 million, mostly because the whole industry for test and measurement equipment is struggling. According to management, almost all types of rental equipment, like general-purpose and communications gear, saw less demand, except for wired communication equipment. On the bright side, work related to data centers and the infrastructure needed for those projects did well. And since the market is slower, McGrath is cutting back on buying new equipment and started selling off inventory that wasn’t being rented out, with the main focus on getting more rental bookings and managing their current fleet.

Another mark of a soft year was TRS-RenTelco’s utilization, dropping from 58.2% in the first quarter of last year to 56.5%. The TRS segment, though, including much of the semiconductor activity and 5G businesses, remains “bouncing along the bottom,” the company stated. The slowdown in the 5G transition is seen as a long-term issue, not just a short-term dip.

Rising costs created some more challenges for McGrath as they already spent $12.4 million on transaction costs for the (pending) merger, cutting earnings per share by $0.36. Interest expenses rose by $3.1 million to $13 million due to higher debt and interest rates and selling and administrative expenses also jumped by $14.3 million to $61.4 million, partly because of the merger.

The debt continued to pile on for McGrath as net borrowings reached $794 million by the end of the quarter, which translated into a funded debt to adjusted EBITDA ratio of 2.43 to 1. All this comes on top of the weakness in the Portable Storage and TRS-RenTelco segments. All in all, McGrath expects steady demand for large infrastructure projects, especially if interest rates drop in the second half of the year.

McGrath RentCorp’s Rating

I’m downgrading my MGRC rating to a ‘Hold’ because, while the company has shown strong growth in the Mobile Modular segment and a solid backlog in education and commercial sectors, my concerns over weak performance in TRS-RenTelco and Portable Storage, coupled with the pending merger’s risks-such as regulatory scrutiny, increased debt, and the limited upside from the blended merger value-result in more uncertainty, and I believe that it makes more sense for existing shareholders to wait and see how the merger plays out than to recommend a ‘Buy’ for new investors.

Read the full article here