“Low cost country” or “best cost country” sourcing has been a persistent trend in the American industrial and manufacturing sector for decades. Sending droves of jobs ranging from unskilled labor, skilled labor, and white collar jobs overseas in an effort to maintain competitiveness with the high cost of labor in the USA. Simply put: Americans cost too much. Why would I manufacture a part in the USA when I can do it cheaper across the sea or across the border? As this trend has progressed over the years it may come as a surprise that sending our industry overseas has presented drawbacks and in some cases, is less competitive than senior management’s original thesis. Companies that can position themselves to take advantage of reshoring trend in the USA stand to profit significantly over the next several decades.

The Case For Reshoring

Tema American Reshoring ETF (NYSEARCA:RSHO) seeks to invest in companies that are enabling and benefitting from manufacturing returning to America i.e. “reshoring” over the long-term. With $92M AUM, RSHO is certainly putting their money where their mouth is with this thematic ETF investment. I had a chance to sit down with Tema CEO Maurits Pot and RSHO Portfolio Manager Chris Semenuk to do a deep dive on the fund and learn more about their case for reshoring as a growth investment opportunity.

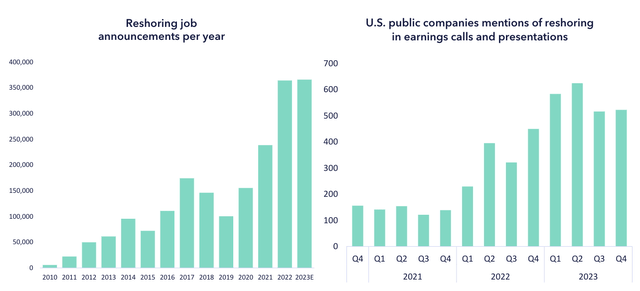

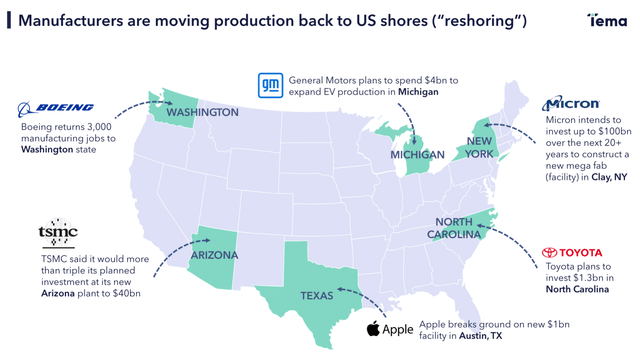

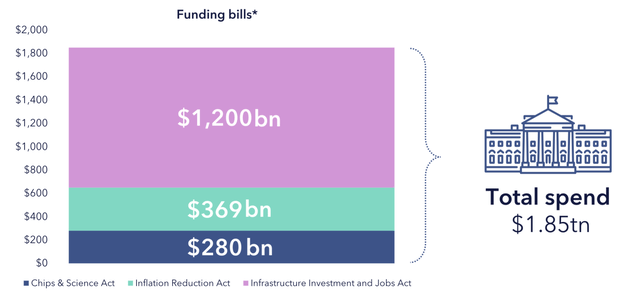

Much of the reshoring spark has been driven by supply chain insecurity, trade wars, deglobalization, and more recently $1.85tn bipartisan support to reindustrialize America. It’s not a fringe idea, several large companies have made announcements over the years to reshore significant production operations to America and the jobs announcements reflect this.

Reshoring Jobs (Tema ETF Trust) Reshoring Announcements (Tema ETF Trust)

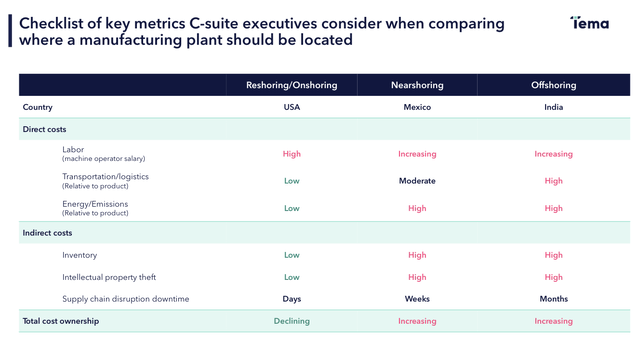

Why after so many decades of offshoring and nearshoring would a company revert to reshoring? Business has changed, driving what durable competitive advantages have changed. While labor costs are high in the USA, labor costs are increasing in nearshoring and offshoring countries such as Mexico and India respectively, withering away the only advantage they had. All the while, less talked about indirect costs such as transportation, supply chain downtime, inventory, and IP theft continue to run at significantly higher costs relative to USA based manufacturers. The directions these factors are moving cause reshoring’s total cost of ownership to continue to decline while offshoring and nearshoring’s total cost of ownership continues to increase. Below is a checklist of key metrics I found insightful to think like a C-suite when approaching the conversation of reshoring vs. nearshoring vs. offshoring.

Reshoring C-Suite Checklist (Tema ETF Trust)

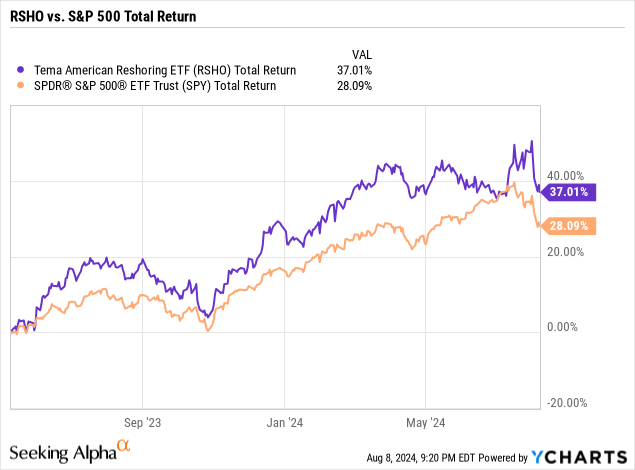

RSHO Performance

As an engineer & business professional, I’ve had roles ranging from supervising an offshore team, being a management consultant, and now currently working across 5 American manufacturing plants. I’ve experienced first-hand what offshoring, nearshoring, and legacy American manufacturing looks like in practice and what it’s sold as. So, when I heard about RSHO being a growth investment, “growth” by reshoring seemed counter-intuitive. However, since inception in May 10, 2023 RSHO has outperformed the S&P 500, posting a total return of 37% vs. 28%. Keep in mind: this is with almost no technology exposure.

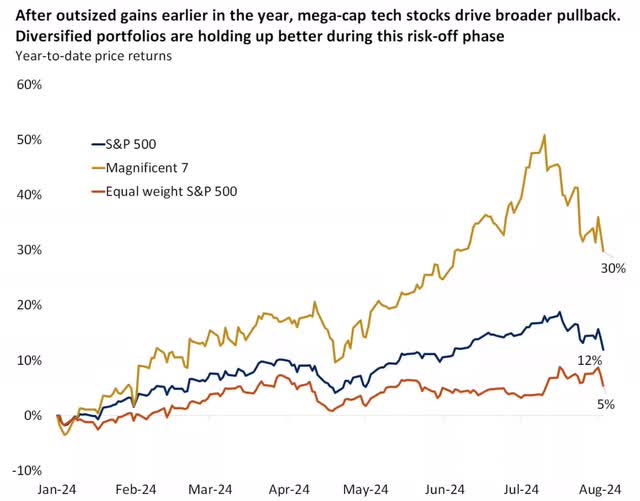

The Mag 7 has been propping up the S&P 500 the last few years, amplified by their every growing market cap exceeding a third of the US Large Cap Market at times. This trend is likely to continue into 2025 as forecasted by analysts from Goldman Sachs, with sales growth for example only estimated at 3% for the remainder of the S&P 500 compared to 11% for the Mag 7. This separation indicates that the large cap holdings, like Industrials and Basic Material sector holdings, may not generate alpha within the S&P 500. While these same sectors, which make up 90% of RSHO, are clearly generating growth in their respective sectors. This is the edge RSHO reveals through its thematic approach.

2024 Performance of the Mag 7 vs. Remainder of the S&P 500 (X)

Portfolio Strategy & Holdings

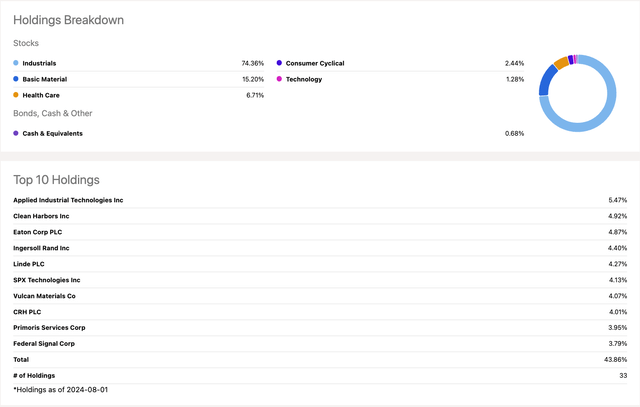

RSHO Holdings (Seeking Alpha)

RSHO predominantly invests in companies within sectors like industrials, transportation, infrastructure, materials, and semiconductors. RSHO is made up of mostly Industrials at 74% and Basic Material at 15%. There’s about a 10% spread across Health Care, Consumer Cyclical, and only 1.28% allocated in Technology. The companies making up their portfolio within these sectors could be reshoring manufacturers, suppliers/facilitators to reshoring manufacturers, or beneficiaries/aggregates like raw material suppliers or hazardous waste disposal companies. Interestingly, 75% of RSHO’s portfolio is invested in facilitators and beneficiaries vs. the manufacturers themselves, much like selling the “picks and shovels” to the gold rush miners in the 1800s.

Reshoring Category (Tema ETF Trust)

The top-down screening selection follows

- Debt/EBITDA < 4

- ROCE > 18%

- Net Free Cash Flow generation after an economic cycle

- Management owns shares of the company

The bottom-up screening is where the active management approach comes in, wherein the portfolio manager literally travels to factory floor to learn what a prospective company does, who supplies them, and if they or a company they do business with, stands to benefit from long-term reshoring activities. For example, when fund management is approaching a reshoring manufacturing facility they ask and observe things like

- How are we connecting to the energy grid? Primoris Services Corporation (PRIM)

- Where do the construction materials come from? Vulcan Materials Company (VMC) and CRH plc (CRH)

- Where do the bulldozers, dumptrucks, and other heavy machinery come from? Federal Signal Corporation (FSS)

- Where does the security equipment come from? Allegion plc (ALLE)

- Who’s supplying the transformers and high voltage equipment? ABB Ltd (OTCPK:ABBNY) and Eaton Corporation plc (ETN)

- Who’s providing the fire suppression system valves? APi Group Corporation (APG)

- Who’s doing the hazardous waste management? Clean Harbors Inc (CLH)

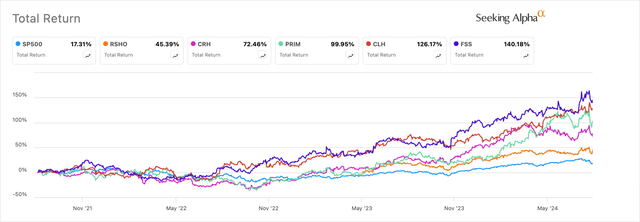

RSHO Holdings Performance Examples (Seeking Alpha)

These are all examples of companies which make up RSHO’s portfolio after referencing their top-down financial screening selection. Several of these companies have performed exceptionally well since before and after RSHO’s launch too. For example, in the last 3 years CRH is up 72%, PRIM is up 100%, CLH 126%, and FSS is up 140%. Overall, fund management tries to avoid “one hit wonders” such as pure EV Vehicle plays and focus on companies that can support the entire project lifecycle of reshoring an operation.

Risk Analysis

The key risk factors to RSHO are US economic growth, portfolio concentration i.e. industrials sector, and political policy. Economic cycles and portfolio concentration can be managed by rebalancing companies and verifying financial health, but the primary risk factor which is harder to control is policy effects. Particularly this election year, the view of the management team is that a republican victory skews more favorably for industrial spending. I tend to agree with this, both from a market perspective and my industry experience from 2016-2020 and 2020-2024. Even so, bipartisan support for an unprecedented $1.85T between the Chips & Sciences Act, Inflation Reduction Act (which actually benefits red states), and Infrastructure Investment and Jobs Act.

Industrial Spending Bills (Tema ETF Trust)

As a further risk mitigation domestically, foreign direct investment (FDI) in the United States has increased more than double in the last 20 years, from $1.26 trillion in 2000 to $5.39 trillion in 2023 at a rate of 6.52% compound annual growth, the highest of any other country. The manufacturing sector alone accounted for the largest share of new direct investment expenditures in the USA. Another point from my conversation with the portfolio manager is that many of the companies Tema invests in are already well established companies with strong balance sheets and positive free cash flow serving current production needs in the USA. These companies didn’t spawn into existence because of reshoring or bipartisan spending policies, rather they stand to benefit significantly from increased reshoring activity over the long-term.

Growth Outlook

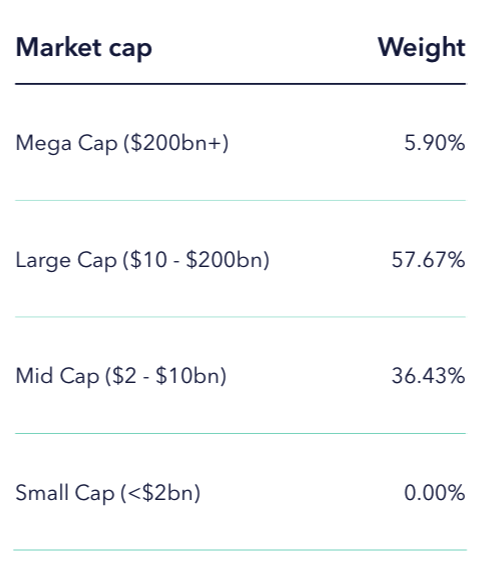

One of the competitive advantages RSHO has over the broader market is allocating a significant portion of their portfolio to quality mid-caps as contained in the S&P MidCap 400 Quality Index. Mid-caps tend to be underrepresented in portfolios at around 6% allocation based on Morningstar data. RSHO mid-cap allocation is around 36% and is considered a Medium Growth-to-Value investment valuation by Morningstar. Quality mid-cap stocks have a positive effect on risk-adjusted returns at about 0.5 compared to 0.2 for Large-caps.

RSHO Market Cap (Tema ETF Trust)

This differs from competing thematic funds such as Global X U.S. Infrastructure Development ETF (PAVE) which tilt toward large-cap stocks and have a strictly top-down screening approach. This doesn’t allow for significant investments in medium sized companies which have a niche market to capitalize on the reshoring trend. As the portfolio gets bigger, owning a piece of a medium sized company while maintaining a reasonable position size gets increasingly more difficult without taking minority interest in a company.

Q & A With Chris Semenuk, RSHO Fund Manager

I had the opportunity to do a Q & A with Chris Semenuk, RSHO Fund Manager, to get some tough questions answered which you can’t necessarily get out of reading static prospectus documents and flashy investor presentations. I hoped to close the gaps on relevant and timely topics facing the markets which can affect an investment in RSHO.

Nicholas Bratto: Are there any unique growth catalyst(s) on the horizon you think will drive and accelerate reshoring growth further?

Chris Semenuk:

In the very short term, low inventories across almost all manufacturing sub-industries, the ISM manufacturing PMI running at the sub 50 level (contraction) for one of the longest periods on record (19 consecutive months) and the eventual trend towards lower interest rates should certainly re-accelerate order growth and manufacturing activity later this year and at the latest early 2025. In the meantime, it is interesting to note that US manufacturers have remained very profitable throughout this slow down – recent Q2 results are testament to this.

I agree with this as someone working in the manufacturing industry, maintaining a lean inventory is an excellent cost save and risk management tool which can be reinvested into other areas to grow the business.

Nicholas Bratto: As a working engineer & business professional, I hear things like America doesn’t have the skills or knowledge anymore to support reindustrialization. Is this sentiment an actual risk and how does it affect RSHO’s portfolio?

Chris Semenuk:

The exporting of manufacturing jobs abroad over the last 20 years (since China entered WTO in the year 2000) has certainly resulted in a pinch point in terms of resources necessary for the US to re-build its industrial footprint and a more skilled labor base will take years to re-establish but the US is also home to the largest automation companies in the world, such as Rockwell and Emerson who are focused solely on optimizing and making US factory floors run more efficiently. It’s also important to recognize that low-cost labor countries are not nearly as low cost as they used to be (standards of living across the world are rising along with wages) and equally important, manufacturers are now more than ever focused on total cost of ownership. More specifically, when you add tariffs, taxes, high transportation costs, intellectual property protection, lower working capital needs, the ease of serving customers closer to where they live, etc…the cost of producing onshore become almost equal if not more advantageous than producing at a factory that is 7,000 miles away.

From my perspective, I’m still seeing an increase in offshore hiring in the automotive industry, so I’m not sure this is totally true across the board yet. I think if any one of these variables or better yet, several variables, increase in cost it will drive a larger shift in workforce and automation needs again.

Nicholas Bratto: Does reshoring energy to the USA play a role in RSHO now or in the future? If so what percentage of the portfolio is focused on energy?

Chris Semenuk:

Approximately 30% of the fund is power and energy related. US energy independence is a critical component of successful reshoring and more broadly the re-industrialization of the country. The US government is indeed aware of this and this is why it has essentially encouraged and allowed a massive consolidation of the US oil and gas sector in the last 24 months. Exxon Mobil , Chevron Corp and Occidental and several large independents have executed more than $130 Bn in acquisitions and Lena Khan has looked the other way. Energy and power do play a large role in the fund but more in the form of companies that sell the picks and shovels necessary to produce all that power and oil (Caterpillar, Terex, Emerson, Eaton, Fluor) all make or build things that allow oil and gas companies to run more efficiently. You may recall that when Biden introduced the IRA, IIJA and CHIPS, the first person he put in front of the press and the public to talk about it was Jake Sullivan, the US National Security Advisor which highlights the main impetus for these programs.

This was something I underestimated when thinking about reshoring and what the investment dollars need to power returns, but it makes sense. This allocation is certainly a secondary benefit and another sector to think about investing into alongside trends like AI. Manufacturing in the US is a lot cleaner environmentally than other countries as well due to stricter regulations for my environmentally consciousness readers.

Nicholas Bratto: Given the current concerns in the markets about a recession, to what extent is reshoring a mega trend that will continue?

Chris Semenuk:

Reshoring will make already great companies even better over time by making them more profitable and cushioning economic downturns, which we may already be witnessing as currently we have been in a slowdown and US manufacturers have continued to maintain high margins despite slower growth (see Caterpillar results a couple of days ago). Reshoring has in fact been underway off the radar for some years now and events like the pandemic and global conflicts have simply accelerated the trend. To reiterate, reshoring will make already great businesses even better over time and I think we will look back in 10-20 years’ time and re-industrializing the US will be viewed as one the biggest drivers of corporate earnings in our generation.

If the investment thesis is correct I somewhat agree, though during a recession unemployment goes up, so this may only help companies which have already or are already in the process of reshoring. Companies on the fence about it may have to wait until the cycle is over, depending on what factors drove the recession in the first place. I appreciate the fund manager answering my tough questions. I gather that if their thesis is correct, companies positioned to capitalize on this trend will do well as their suppliers, most of the companies RSHO invests in, stand to benefit. On the other hand, companies which will not adapt will see poor performance and therefore some volatility and rebalancing will occur in different sectors or indices depending on the companies contained in them.

All in all, I believe RSHO is strategically positioned to capitalize on the growing reshoring trend in the USA by investing in a highly curated collection of about 30 high-quality large and mid-cap companies. Being primarily in the industrial and materials sectors, these are essential to revitalizing the U.S. industrial footprint. Companies screened into RSHO have strong balance sheets with a proven track record as a profitable business, which are poised to benefit from both government support and the business advantages highlighted to support the case for reshoring in the USA.

Read the full article here