Summary

Following my coverage on Monster Beverage (NASDAQ:MNST) in March 2024, for which I recommended a buy rating due to my expectation that earnings growth will remain strong, with the potential to grow at >20%, this post is to provide an update on my thoughts on the business and stock. At a high level, MNST showed disappointing results since my last post, and that triggered a massive valuation re-rating, which combined together led to a sharp decline in share price. However, I don’t believe the growth will not recover given the historical trends, visible catalysts, and international performance. At the current valuation, I believe the recent weakness has already been priced in, and the upside is attractive.

Investment thesis

Unlike the past, where MNST was seen as a strong earnings compounder (EPS grew 15% CAGR from FY15 to FY23), the equity story has now switched to a “show me” story and one that is heavily hinged on 2H24 performance. Before I get to why I think the demand trend will improve in the coming periods, I give me thoughts on what really triggered this narrative switch.

There are two parts to the share price weakness. One is the poor 2Q24 earnings results, which saw revenue growth plummet from the low-teen percentage range to just 2.5%. This resulted in EPS growing by just 5% (down from 12% in 1Q24 and 52.8% in 2Q23). Two, and I think this is the key component, was that July global sales were up only by 5.9%, and this even included a benefit from the two additional selling days in the quarter (July this year had 23 weekdays vs. 21 weekdays last year = c.9.5 point impact). Adjusting for this implies July global sales to be down ~3% on a same-day basis. And this implies demand weakness has persisted into 3Q24 (a deceleration from the 2.5% growth since in 2Q24).

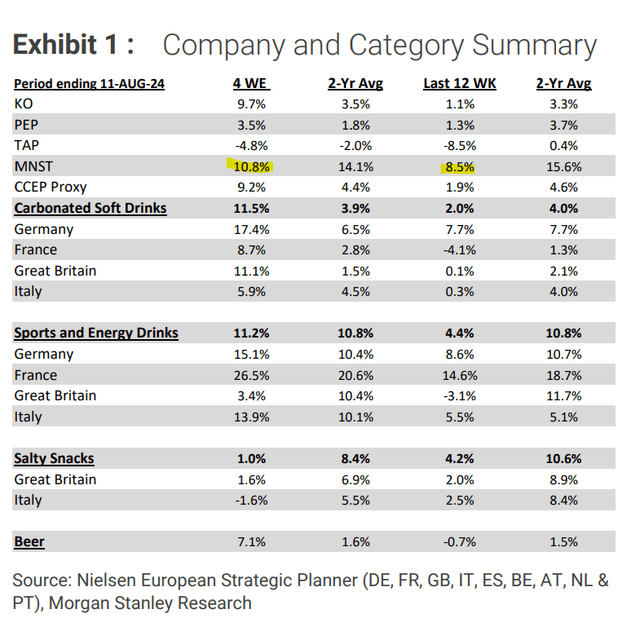

Here is why I think the demand trend will improve in the coming periods. The energy drink category in the US has experienced very strong growth over the past years, and the only time it saw a significant volume decline that MNST ever saw was during the subprime crisis and COVID. Given that the energy drink industry is not in a structural decline mode, I believe the current slowdown is mainly due to macro-related reasons. Specifically, the combination of high interest rates and the lingering impact of elevated inflation has caused consumers to pull back on discretionary spending and trade down to value purchases. When we look at international markets like Europe, growth has already rebounded, as per management comments in the call and Nielson’s data (refer to MS data below). Furthermore, Celsius Holdings (CELH) is still growing very strongly in the US (23% in 2Q24), and this tells me that there is still significant room for MNST to continue penetrating the market.

Morgan Stanley

Additionally, there are two other growth levers to take note of as well. Firstly, MNST is going to roll out a bunch of new products globally, including a big launch in October of Ultra Vice Guava, and these should help support strong shipment growth near term. Secondly, MNST is going to implement a 5% pricing in 2H24 (set for 1st November) on core brands (Bang, Reign, and Reign Storm). Using the last price increase (back in Sep’22) as a benchmark, there should be too much impact on volume, which means this 5% is likely to translate directly into revenue growth. Thirdly, MNST international growth is still robust (14% on local currency basis): (1) We know that Europe is performing well (~20% of the business) based on Nielsen’s data, and (2) we also know that MNST is doing very well in China due to the April roll-out of Predator Gold Strike in select provinces in China, which continues to be growth-accretive and in line with internal expectations. The plan is to roll out to additional provinces through FY24, which should be growth-accretive if the same trend holds.

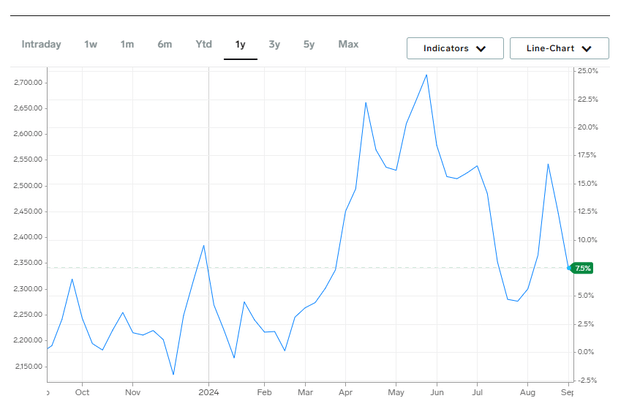

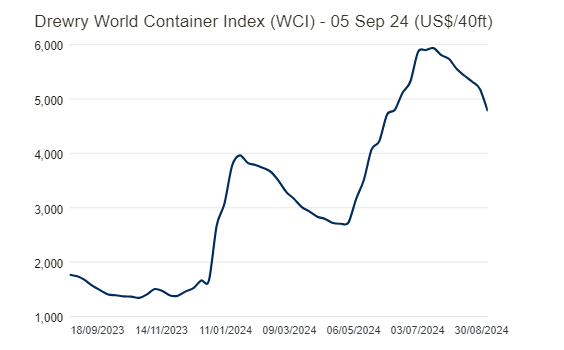

As such, for MNST’s topline, while I acknowledge the recent weakness, I don’t think this is a business that is seeing structural growth weakness. Moving down the income statement, there are also upside catalysts to margin improvements that support earnings growth. Firstly, gross margin should improve as the supply challenges in Germany are resolved and as production inefficiencies related to the start-up of the Norwalk and Phoenix facilities (acquired as part of the Bang transaction) improve (currently only producing Bang products, so it is fully utilized). While some production inefficiencies will continue to linger, they should go away eventually. Secondly, commodity prices should start to turn in favor of MNST as inflation tapers down. For instance, aluminum prices have started to decline, and freight costs are also continuing their streak of decline.

Business Insider

Drewry

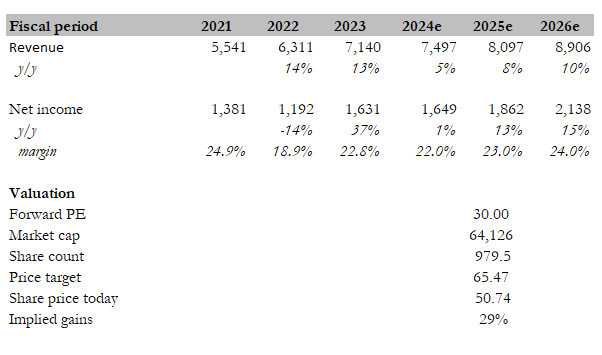

Valuation

Own calculation

With the stock now trading at 27x forward PE, I believe there is still attractive upside for investors to capture. While I stay bullish, it makes sense to adjust my estimates downwards to reflect the weak 2Q24 performance. I now expect growth of 5% in FY24 and a gradual improvement to 10% (still below the historical range of low teens) in FY26. I have also adjusted my net margin expectation downwards in FY24 to 22% and expected 100 bps of improvement over the next two years. Margin could inflect higher depending on how much commodity prices come down and how fast MNST can accelerate growth back to low teens. Given the lower growth and margin expectations today, I believe MNST is unlikely to trade back to 32x forward PE (which I expected previously). I think a more appropriate multiple would be ~30x (the midpoint between the low-end and average of the MNST historical trading range (28x to 32x).

Risk

The US dipping into a recession is going to be a big drag to growth given it is the largest part of the business. Commodity prices may flip to growth mode if geopolitical tension further worsens, and this will pressure MNST margin. Increasing competition internationally by new entrants such as Celsius may weigh on MNST international growth. Lastly, potential increased regulation for the energy drinks category is a permanent risk that MNST needs to deal with.

Conclusion

In conclusion, my rating for MNST is a buy rating. While recent results were weak, I expect a recovery in growth given the strong international performance, new product launches, and upcoming price increases. Importantly, the energy drink industry remained robust. At the current 27x forward PE, I believe the recent weakness has already been priced in, and the upside is attractive based on my model.

Read the full article here