This is a trader’s market. I don’t mean that everyone should be a trader. I mean that investors expecting something different than what we’ve had for the “average stock” should prepare for the possibility that the headwinds will be strong, for a while.

When I used to play golf (poorly), it seemed as if when the wind was blowing, it was always toward me, which naturally took some distance off of my shots. Even the few good ones. I can remember some rounds, usually at vacation destinations near an ocean, where every hole was a “wind in your face” hole, even though the course was designed such that the tee to green had the player go north, south, east or west on different holes.

But since I’m retired from both investment advisory and golf, let’s go to the one I am still actively involved in, albeit without the client base. My equity research is focused on a strategy I created years ago, but which I am now actively using for my own money more than ever. I’ve written about YARP™ which stands for “Yield At a Reasonable Price” multiple times here. And one of the things that following dividend stocks tells us these days, is that they often behave very differently than Nasdaq/Magnificent 7 names. I see 2 very different markets living together. One that is technology and related stocks, and the other that is the rest of the bunch.

Amcor plc (NYSE:AMCR) is one of the stocks I own and have tactically managed in my YARP portfolio for several months, and I have found it to be a very good example of the good news/bad news situation that the technician in me (44 years of charting to be specific) is noticing to be a distinct pattern. Too many stocks offer strong, but temporary price upside, but the moves are often stymied within months, if not weeks. That puts many of them in a trading range, which is good for my investment process, but not very good for long-term, buy and hold investors.

Before I get to AMCR, fundamentally and technically, I’ll just explain that my stock portfolio is about total return, but piling up as much dividend income as I can along the way. To do so, I establish a list of 30-40 stocks, which I commit to owning at least 1% of the portfolio at all times, as long as it is in the portfolio. But I can go up to 5% weighting, which allows me to stay invested “long-term” in the stocks, but manage around what I see (as a technician) as a market climate as difficult for the stock market mainstream as I can recall in more than 30 years of managing money professionally.

AMCR is one of very few stocks I consider for my portfolio that does not have a pristine dividend safety rating from either Seeking Alpha or the other sources I use. I stepped into it earlier this year cautiously, and understood that it was also one of the few stocks I follow that is not a US-based company. It was formed in 2019 when Bemis, a US company, merged into Amcor, a European firm.

About Amcor

As they describe themselves, Amcor plc develops, produces, and sells packaging products in Europe, North America, Latin America, and the Asia Pacific. The company operates in two segments, Flexibles and Rigid Packaging. The Flexibles segment offers flexible and film packaging products in the food and beverage, medical and pharmaceutical, fresh produce, snack food, personal care, and other industries. The Rigid Packaging segment provides rigid containers for various beverage and food products, including carbonated soft drinks, water, juices, sports drinks, milk-based beverages, spirits and beer, sauces, dressings, spreads, and personal care items; and plastic caps for various applications. It sells its products through its direct sales force. The company was incorporated in 1926 and is headquartered in Zurich, Switzerland.

So AMCR is a packaging company at its core. And that means that timber, the raw material that ultimately creates paper boxes and other packaging products, is a commodity whose price, supply and demand is critical to AMCR’s cost structure. While my regular followers know I’m not a fundamental analyst per se, in the case of this stock, since it is a bit different from many I follow, I tried to get up to speed on some of the fundamental nuances that might impact the stock down the line.

Fundamental overview and trends

One area of interest to me is what is happening to revolutionize the pulp and paper industry. Nanocellulose, derived from plant matter, is diverse in its applications. It offers lightweight, strong alternatives for packaging, enhancing durability and reducing transportation costs. There is abundant availability, it’s renewable and has an eco-friendly nature. It has been widely used as wet and dry strength agent and also as a coating to improve barrier properties of the paper.

The paper industry faces significant competition from digital media and electronic communication, leading to declining demand for traditional paper products like newspapers and office paper. But that is not an issue for the buyer, the packaging companies like AMCR, since their product inputs are items that cannot be easily replaced by digital alternatives, such as high-quality packaging and specialty papers. Furthermore, as sustainability needs to keep growing and regulations are ever-changing, nanocellulose offers a way to comply with these standards and meet consumer demand for greener products.

Paper and packaging companies contribute heavily to biodiversity loss through unsustainable forestry management in their supply chain. Biodiversity loss is not only a threat to nature but also to the economy. In fact, the World Economic Forum (WEF) estimates that nature and biodiversity loss could put $44 trillion, more than half of global GDP, at risk. This is important to consider for AMCR on the fundamental side of the analysis, since the company needs to adapt to making a better environmental impact without affecting operations.

Consolidation and restructuring have been major themes in this industry. Indeed, this company is a product of one of those, which caused a US-based company (Bemis) to merge into a non-US giant in Amcor. It makes sense that the combined company, a packaging conglomerate, will continue to seek growth via both bolt-on and larger acquisitions.

The risks to AMCR fundamentally include lower consumer demand globally due in part to digital replacement, higher raw material costs, and the company being forced to price their products more competitively. And, if future acquisitions end up being excessively dilutive, that can weigh on the stock price.

And that brings me to my more familiar territory: yield-hunting, technical and quantitative analysis, and the over-arching issue for investors in this and many other stocks: stagnating long-term returns and good tactical opportunities, co-existing. Again, this is a big help to my stock approach, but not to buy-and-hold investing.

AMCR: nice yield, but my eyes are wide open

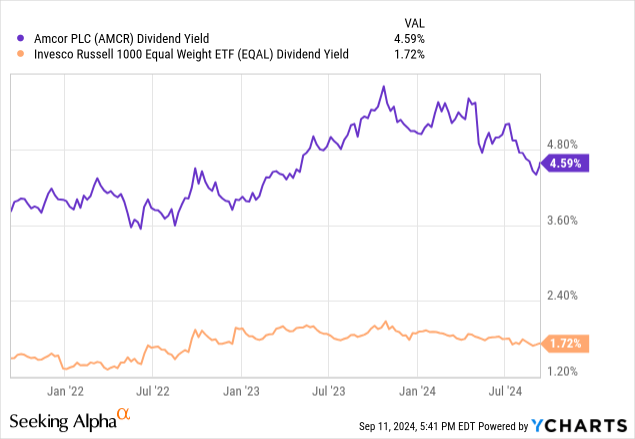

For my YARP stock portfolio, the dividend is an attraction point for sure. And as this chart shows, AMCR’s yield is consistently 2-3 times that of the average Russell 1000 stock, as depicted by the EQAL ETF. Still, that dividend is no good unless it can be sustained and grown, at least modestly.

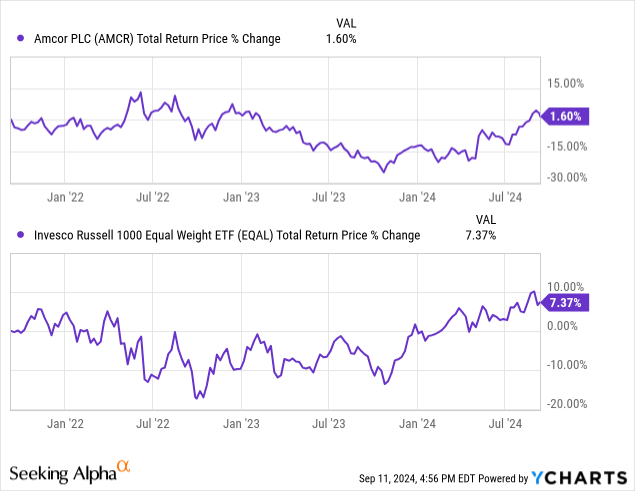

Below, we see that AMCR’s stock price has gone virtually nowhere across the past 3 years. Actually, it went a lot of places, up and down, but never truly broke to new higher ground versus where it stood in mid-2022.

I see this with one stock after another, and it is reflected in the weak performance of EQAL. That shows the average of the 1,000 largest US stocks with a 7.4% return in total (not annualized) the past 3 years, including dividends. And all of that came in the very recent summer rally.

Bull market? Not for many stocks

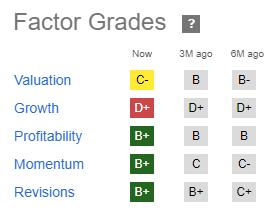

A look at Seeking Alpha’s quant factor grades for AMCR indicates that in the category I rely on most, profitability, AMCR qualifies for my portfolio. It grades out at a B+, and B or better is what I look for.

Seeking Alpha

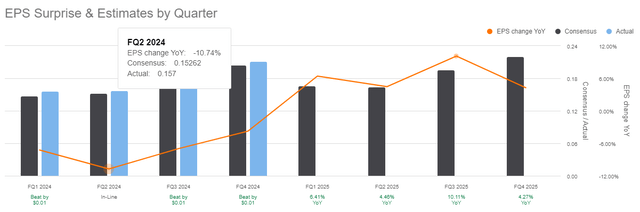

Quarterly earnings trends look a lot like they do for many stocks. With analysts habitually lowering the bar, earnings “beats” are easy for many companies. AMCR included, as we see, with 4 consecutive beats. So earnings drag is not why the stock can’t get out of its rangebound state.

Seeking Alpha

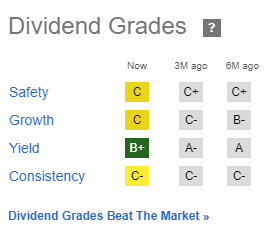

I also focus on dividend grades, and as noted earlier, this one is a rare exception I make. That safety score of C will likely force me to kick it out of the portfolio sooner rather than later, but the yield is high enough to offset some of that risk. And, ultimately, the chart price pattern is what “sells” me on a stock or prompts me to abandon it. But I suspect it won’t be long until I find something to replace AMCR.

Seeking Alpha

Price chart: a familiar pattern

I gave a charting educational session to my subscribers recently, and the main point was this: charts like the one below are better than most, but not because they indicate long-term upside. Rather, because they gyrate enough between ex-dividend dates, they provide an opportunity to try to earn that dividend with a 3-5% portfolio weighting most quarters, and produce price gains as well. And, via that tactical rotation process I use, the chart work helps keep me from being overinvested when the next intermediate-term price peak, occurs.

Below, I see a decent uptrend, but this is a chart of daily prices, so I’m looking ahead in months, not years here. And with AMCR backing down…again…from the top of the rising range, and the momentum indicator I use (bottom portion of chart) rolling over, this signals to me that

TC2000 (SungardenInvestment.com)

My recent trading and dividend history in AMCR

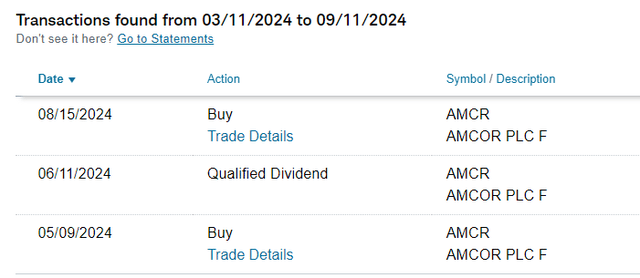

Straight from my brokerage account details, here is my path with AMCR, one of 40 stocks I bought last spring. I started with the “ante” so to speak, the minimum 1% position, collected the dividend on that the next months, added to the stock at $10.83 a share about a month ago, and qualified for the ex-dividend on September 6 with a 3% portfolio position.

Rob Isbitts (brokerage account)

But then the issue that is the running theme through this article appeared. The stock rallied up to near $11.50, then hit the wall again. That dropped AMCR down 5% from that peak as of this writing, but up about 5% in 4 months, including the 2 dividend payments I qualified for so far.

Ratings-wise, since I could consider a stock like this to be a buy, sell or hold, since I own it (buy), am probably close to reducing my position (sell) but continue to own at least some shares (hold), I’ll go with the one in the middle and officially call AMCR a hold for now.

There are a few ways investors can react after reading this. They can say, “just be a long-term investor,” and I get that. But this is how modern markets work. If your name is not Nvidia or a few dozen others (which pay little in dividend yield), this hamster wheel is more the norm than the exception. But remember, many stocks look like this, where gains can be had in weeks or months, but multi-year total return is more rare than it has been for a while. And this is all while we have not experienced a lasting recession in 15 years.

Conclusion

This is why I have fully embraced a more tactical approach to long-term dividend investing. I created the YARP approach several years ago and used it, but back then we did not have all of the influences that suppress stock prices or make them good for trading, but frustrating for buy and hold. And I think that it will be even more value-added to me in the months and years ahead, for all the reasons cited above.

I am going through my full watchlist and current holdings (stocks and ETFs) to identify additional cases in point. The goal is to add to the conversation around dividend investing in modern markets, which, I believe, is way too one-sided and has created a “herd mentality.”

Specifically, there are too many investors who have settled for 2-4% dividend yields and committed to being patient investors in a market that is not set up to reward them as it has through much of our investment lifetime. I look forward to continuing to report my progress, not only stock by stock, but in regard to my total YARP portfolio as this “new normal” for dividend investors continues to be recognized by my fellow Baby Boomers and others.

Read the full article here