Investing in growth stocks can be tricky, especially when it comes to some names that are trading at very high valuations. That’s when options traders take over the stock with heavy volume, as may be the case with NVIDIA (NVDA), making them more of a short-term trading vehicle than a long-term investment.

That’s when a GARP strategy comes into play. GARP stands for growth at a reasonable price, and can be great choices for investors who want to lessen their risk of overpaying for a stock, all while participating in secular trends.

This brings me to ABB Ltd (OTCPK:ABBNY), which is a leader in the utility and industrial electrification segment. In this article, I highlight ABB’s business performance and discuss whether ABB stock is worthy of a ‘Buy’ at its current price, so let’s get started!

Charged For Growth, But Is It Time to Buy?

ABB Ltd. is a leading global player in electrification, robotics, automation, and motion solutions. It has a presence in over 100 countries, and serves a wide range of industries, including utilities, manufacturing, transportation and energy sectors.

ABB is benefitting from strong growth in its Electrification and Motion Business segments, but that’s been offset by challenges in the machine automation market and headwinds in the E-mobility business. This is reflected by revenue growing by just 4% YoY in Q2 2024, lower than the 17% YoY growth in the prior year period.

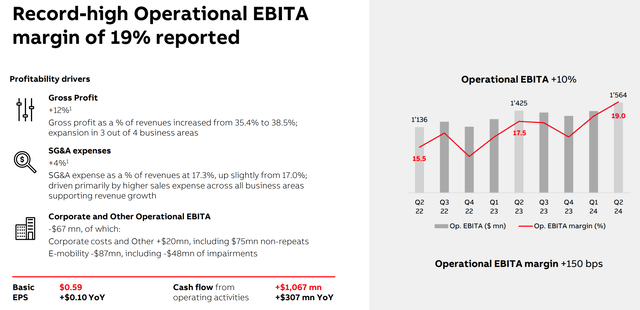

Despite slower top-line growth, ABB is seeing strong bottom-line growth, with EPS growing by 22% YoY during the second quarter. This was driven in large part by growth in EBITA margin by 150 basis points YoY to 19.0%. As shown below, this follows a 2-year trend of margin growth, which contributed to 9.8% YoY Op EBITA growth over the prior year period.

Investor Presentation

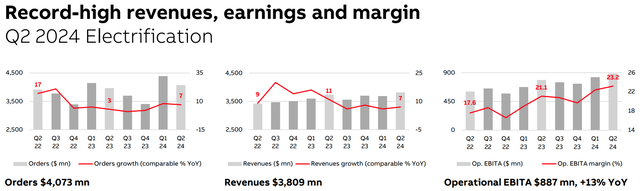

ABB’s growth story is driven by its electrification segment, which is seeing robust demand from infrastructure and data center projects. This is reflected by YoY revenue growth ranging from 7% to 11% over the past 3 years, including 7% growth during Q2 2024.

The main story behind ABB’s electrification segment is that it’s an economy of scale, in which higher volumes improve ABB’s cost absorption, particularly in the Smart Power and Distribution Solutions businesses. This reflects ABB’s high operating leverage with 13.8% return on total capital, earning it an A+ grade by Seeking Alpha for Profitability.

As shown below, Operational EBITA grew by 23% YoY during Q2 2024, following 21% growth last year, and 18% growth in 2022, far outpacing the rate of revenue growth.

Investor Presentation

Management is guiding for a sequential increase in revenue growth, but expects margin to be pressured down to 18.5% in Q3 (down from 19.0% in Q2). This is due to expected challenges in machine automation to persist due to weaker market conditions.

Moreover, E-mobility continues to be a weak spot due to delayed investments by customers and headwinds are expected to remain in place for the remainder of the year, as noted during the recent conference call:

Clearly this is a transformation year for E-Mobility. This means technology investments to a new best-in-class focused product portfolio for DC chargers. These investments and a weak market impacting sales of the old portfolio have burdened results so far this year more than expected, and unfortunately will continue to do so also during the second half of the year. Next year’s performance should be significantly helped by both better operations as well as by orders of the new upgraded products driving better gross margin.

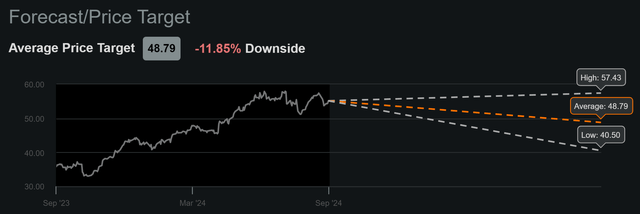

Considering the near-term headwinds, I view ABB as being overvalued at present, with the market seemingly over-focused on the electrification segment while not putting enough consideration into weakness in machine automation and e-mobility, especially with an economic slowdown in China. Analysts expect earnings growth to be tempered this year at 7% and 10-12% annual growth over the next two years.

This does not appear to justify ABB’s current $55.35 price and 25.7x forward PE. ABB also yields just 1.7% at the current price. The dividend is covered by a 50% payout ratio and comes with a 5-year CAGR of 5%.

I’d be more interested in ABB at a price of $43, which equates to a forward PE of 20x, and a PEGY ratio of 2.0x, which is derived by a forward PE of 20 divided by an estimated EPS growth rate of 10 (percent). For reference, a PEGY ratio of over 2.0x is generally considered to be overvalued territory. As such, investors may be well-served by waiting for a better entry point on this moat-worthy stock.

As shown below, my price target fits within sell-side analyst price target range of $40 to $57 over the next 12 months.

Seeking Alpha

Investor Takeaway

ABB Ltd is a global leader in electrification, robotics, and automation, benefiting from robust demand in its Electrification and Motion segments. However, near-term headwinds in machine automation and e-mobility, coupled with a tempered earnings growth outlook, make the stock appear overvalued at its current price of $55.35, trading at 25.7x forward PE.

While ABB shows strong profitability and operational leverage, particularly in its electrification segment, the market may be over-focused on these strengths without adequately accounting for challenges in weaker segments. Investors may find a better entry point at a lower price of around $43, where the stock would offer a more reasonable PEGY ratio of 2.0x.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here