Investment Thesis

In today’s article, the main focus will be on two dividend growth companies. Both of the selected companies have shown strong dividend growth rates within recent years and I believe they will continue to do so over the next years. Therefore, I believe both can help you raise the Weighted Average Dividend Growth Rate of your investment portfolio and contribute to the additional income you can earn in the form of dividends that raise year over year at an attractive level.

Focusing on dividend income and dividend growth while having a long investment horizon instead of speculating over the short term will help you to be less dependent on the price fluctuations of the stock market.

To be part of a pre-selection of attractive dividend growth stocks, the companies needed to meet the following requirements:

- Market Capitalization > $10B

- Dividend Yield [FWD] > 0%

- Average Dividend Growth Rate over the past 5 years > 5%

- Payout Ratio < 60%

- P/E [FWD] Ratio < 50

- EBIT Margin [TTM] or Net Income Margin [TTM] > 5%

- Return on Equity > 5%

These are the dividend growth companies that I have selected for this month of June:

- The Goldman Sachs Group (NYSE:GS)

- Mastercard (NYSE:MA)

The Goldman Sachs Group

I believe that The Goldman Sachs Group is an appealing pick for investors seeking dividend growth. This is the case as investors can already benefit from an attractive additional income: the bank’s current Dividend Yield [FWD] stands at 2.98%.

I believe that The Goldman Sachs Group’s competitive advantages provide it with an economic moat over its competitors. The company’s strong brand image (it’s ranked 104th in the list of the most valuable brands in the world according to Brand Finance), its global network within the Investment Banking and Brokerage Industry, its strong focus on innovation and its expertise in the areas of risk management can be named among several of its competitive advantages.

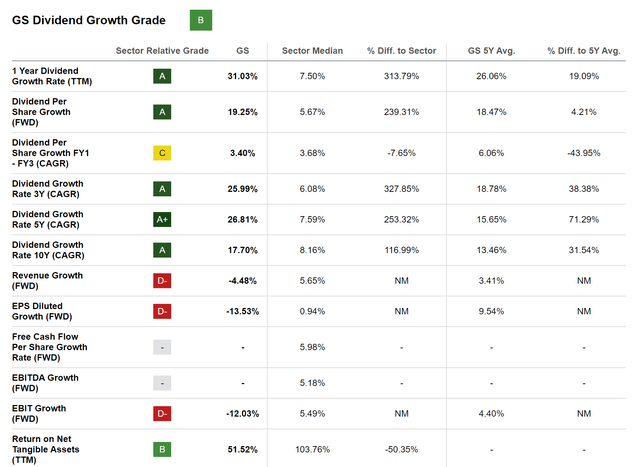

Moreover, it can be highlighted that The Goldman Sachs Group shows excellent metrics when it comes to dividend growth: the bank’s Dividend Per Share Growth Rate [FWD] stands at 19.25%, and its Dividend Growth Rate 5Y [CAGR] lies at 26.81%, strengthening my investment thesis that it’s an attractive choice for investors looking for dividend growth. It is further worth mentioning that the bank’s Dividend Growth Rate 5Y [CAGR] stands 253.32% above the Sector Median of 7.59%.

My theory that The Goldman Sachs Group is an attractive choice for dividend growth investors is further confirmed when we compare the banks Dividend Growth Rates with the one of its peer group: while The Goldman Sachs Group has shown a Dividend Growth Rate [CAGR] of 26.81% over the past 5 years, Morgan Stanley’s (NYSE:MS) is 25.39%, JPMorgan’s (NYSE:JPM) is 12.91%, Bank of America’s (NYSE:BAC) is 12.89% and Citigroup’s (NYSE:C) is 9.77%. These numbers confirm that The Goldman Sachs Group has delivered superior Dividend Growth Rates in recent years in comparison to its peer group.

Below you can find the Seeking Alpha Dividend Growth Grade, which once again confirms my investment thesis that the bank is an excellent choice for investors seeking dividend growth.

Source: Seeking Alpha

From my point of view, the bank is currently fairly valued. I believe this as its P/E [FWD] Ratio of 10.50 lies only slightly above its Average from over the past 5 years (which is 9.53). Moreover, its Price / Book [FWD] Ratio of 1.04 stands 2.75% below its Average from over the past 5 years (which is 1.07), further indicating that the bank is currently fairly valued.

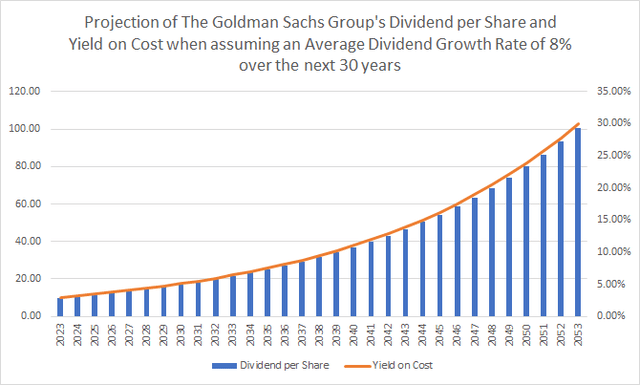

Projection of The Goldman Sachs Group’s Dividend and Yield on Cost

The graphic below illustrates a projection of The Goldman Sachs Group’s Dividend and Yield on Cost when assuming that the U.S. bank would be able to raise its Dividend by 8% on Average for the following 30 years (I have made a conservative assumption since its Dividend Growth Rate [CAGR] over the past 10 years stands at 17.70%).

Source: The Author

The graphic demonstrates that you could reach a Yield on Cost of 6.44% in 2033, of 13.91% in 2043, and of 30.04% in 2053. These numbers clearly show us that the U.S. bank can be an excellent choice if you would like to invest with the objective of combining dividend income with dividend growth.

Mastercard

I also consider Mastercard to currently be an excellent choice for dividend growth investors. There are numerous reasons which underline this thesis, which I will discuss in the following.

Even though the company only pays a Dividend Yield [FWD] of 0.62%, it has excellent metrics when it comes to dividend growth: its Dividend Growth Rate [CAGR] over the past 10 years stands at 30.32%, which is 268.19% above the Sector Median (8.24%).

It is also worth mentioning that its Dividend Growth Rate [CAGR] over the past 5 years lies at 17.66%, which is 132.82% above the Sector Median (7.59%). These metrics clearly indicate that Mastercard should contribute significantly to raise the Weighted Average Dividend Growth Rate of your investment portfolio. This theory is also underlined when having a look at the company’s Average EPS Diluted Growth Rate [FWD] over the past 5 years, which stands at an attractive level (18.98%).

As well as its strong competitive advantages over its opponents (to which I count the company’s high number of debit and credit cards, its worldwide network within the Transaction & Payment Processing Services Industry as well as its strong brand image and trustful relationships the company has established with financial institutions all over the world); the company also operates within an Industry which I believe still has a lot of growth potential. Due to these reasons, I suggest overweighting Mastercard in a long-term investment portfolio.

In regards to Growth, I also see Mastercard being on track: the company has shown a Revenue Growth Rate [YoY] of 14.49% and an EBITDA Growth Rate [YoY] of 16.31%. Both numbers support my investment thesis.

I also see Mastercard being ahead of its peer group when it comes to Growth: while Mastercard has shown an EPS Growth Rate Diluted [FWD] of 20.08%, PayPal’s (NASDAQ:PYPL) is 7.24%, Visa’s ((NYSE:V) is 18.23% and Block’s (NYSE:SQ) is 11.60%.

When it comes to Valuation, I believe that Mastercard is undervalued: at its current price level of $367, the company has a P/E GAAP [FWD] Ratio of 30.39, which lies 18.04% below its Average from over the past 5 years. But this is not the only metric indicating that Mastercard is currently undervalued.

The company’s Price / Sales [FWD] Ratio of 13.83 stands 16.80% below its Average from over the past 5 years, serving as an additional indicator that Mastercard is undervalued. This is also confirmed when looking at the company’s Price / Cash Flow [FWD] Ratio of 29.15, which stands 19.71% below its Average from over the past 5 years.

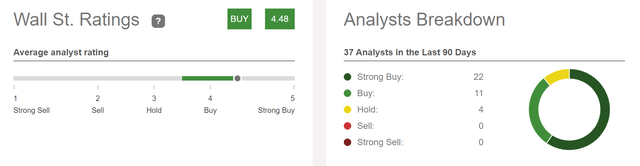

According to the Wall Street, 22 Analysts currently rate Mastercard as a strong buy while 11 Analysts rate the company as a buy. Only from 4 Analysts, the company receives a hold rating. The Wall Street Ratings further support my own strong buy rating for Mastercard.

Source: Seeking Alpha

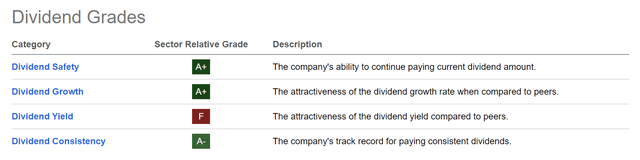

The confirmation of Mastercard’s appeal to dividend growth investors is reinforced by the Seeking Alpha Dividend Grades: Mastercard receives an A+ rating for Dividend Safety and for Dividend Growth. For Dividend Consistency, the company receives an A- rating. Only for Dividend Yield does Mastercard get a low rating (‘F’).

Source: Seeking Alpha

Risk Factors

I believe that an investment in The Goldman Sachs Group comes with slightly higher risk factors attached when compared to an investment in Mastercard.

The theory that an investment in The Goldman Sachs Group comes attached to a higher risk level is underlined through the companies 24M Beta Factors: while Mastercard’s 24M Beta Factor is 0.95, The Goldman Sachs Group’s lies at 1.12, thus indicating a higher risk level for The Goldman Sachs Group investors.

The same is confirmed when taking a look at the companies’ credit ratings: while Mastercard receives an Aa3 credit rating from Moody’s, The Goldman Sachs Group’s credit rating is A2, which further confirms that the risk level for The Goldman Sachs Group investors is slightly higher than for Mastercard investors.

In addition to the above, it can be highlighted that The Goldman Sachs Group is exposed to risk factors such as credit risks. Furthermore, inflation can have negative effects on the bank’s financial results, thus representing an additional risk factor for investors of the U.S. investment bank.

Considering the lower risk factors for Mastercard investors compared to those investing in The Goldman Sachs Group, I suggest allocating a higher proportion of the overall portfolio to Mastercard. With lower risks, I believe Mastercard investors have slightly higher chances of achieving excellent long-term investment results.

Conclusion

I believe that both The Goldman Sachs Group as well as Mastercard are excellent choices to enhance your investment portfolio and raise its Weighted Average Dividend Growth Rate. The companies’ have shown a Dividend Growth Rate [CAGR] of 26.81% and 17.66% respectively over the past 5 years.

In addition to that, both have a relatively low Payout Ratio (33.82% and 19.83% respectively), indicating that there is plenty of room to enhance the companies’ Dividend in the years ahead.

In addition, I believe that Mastercard is currently undervalued while The Goldman Sachs Group is fairly valued.

Furthermore, both are attractive picks in terms of Profitability: their Net Income Margin stands at 23.63% (The Goldman Sachs Group) and at 42.33% (Mastercard).

I believe that you can strongly benefit from both picks and their steadily raising dividends when having a long investment-horizon and therefore suggest including them in your investment portfolio.

Finally, I would like to reiterate that I recommend overweighting the Mastercard position in an investment portfolio, while underweighting The Goldman Sachs Group position.

Author’s Note: I would appreciate your opinion on this article! If you could only choose two dividend growth companies for this month of June, which would you select?

Read the full article here